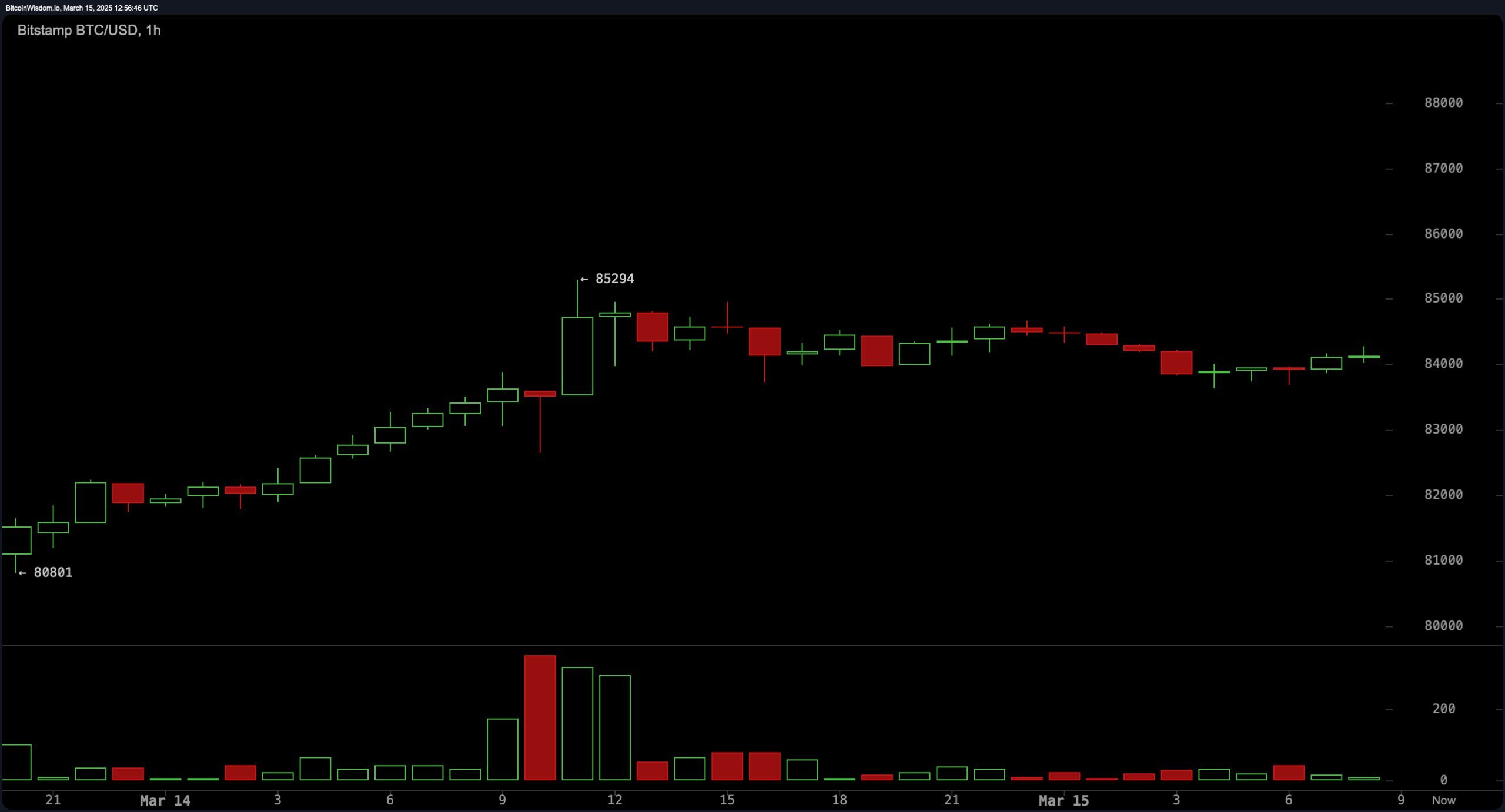

On the 1-hour chart, bitcoin‘s recent momentum stalled after reaching $85,294, suggesting a short-term pullback. Immediate support lies near $83,500, with resistance forming at $85,000. A series of small red candlesticks indicate profit-taking, while the drop in buying volume implies market participants are waiting for more favorable entry points. If bitcoin breaks below $82,500, further downside toward $80,000 may occur, while a successful defense of $83,500 could trigger another upward test of resistance levels.

BTC/USD 1H chart on March 15, 2025.

The 4-hour chart presents a slightly more optimistic outlook, as bitcoin has rebounded from a local bottom of $76,600 and briefly peaked at $85,294. The support level at $80,000 remains crucial for maintaining bullish momentum, while resistance near $85,000 must be surpassed for continued upside. However, declining volume following the bounce suggests waning bullish conviction. If bitcoin retraces to the $82,000–$83,000 range and shows renewed buying strength, it could provide a viable long entry opportunity, while another rejection at $85,000 could lead to a larger corrective move.

BTC/USD 4H chart on March 15, 2025.

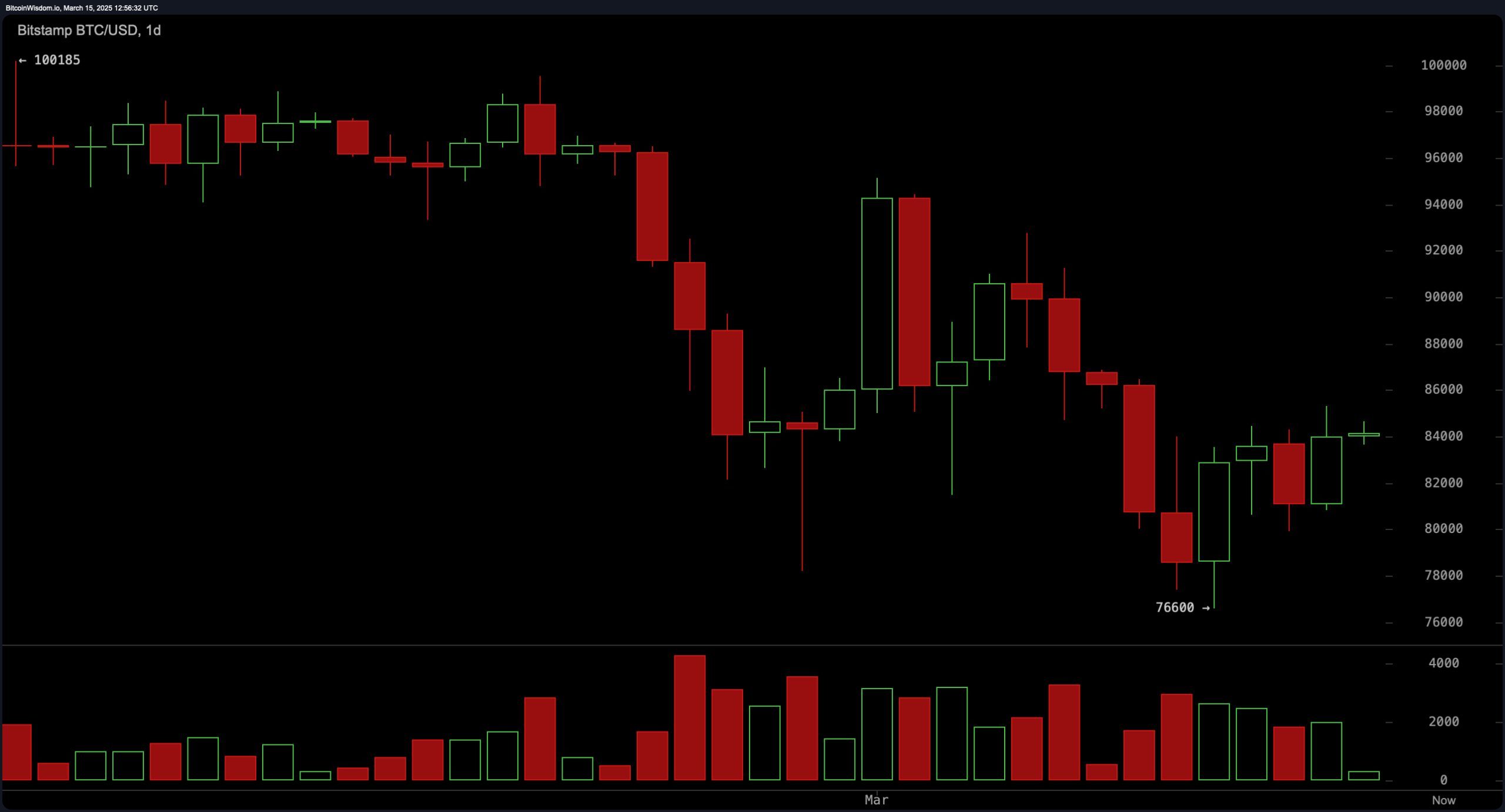

On the daily chart, bitcoin is consolidating after a significant drop from its recent high of $100,185 to a low of $76,600. Key resistance sits near $90,000, with major support established at $76,600. Candlestick patterns suggest a stabilization phase, but buying pressure needs to increase to sustain a recovery. The market has seen a mix of bullish and bearish activity, with the potential for another leg down if bitcoin fails to hold the $80,000 level.

BTC/USD 1D chart on March 15, 2025.

Oscillators remain neutral overall, with the relative strength index (RSI) at 44, Stochastic at 35, and the commodity channel index (CCI) at -36, indicating a lack of strong directional momentum. However, momentum (10) sits at -6,483, signaling a bearish bias, while the moving average convergence divergence (MACD) level (12,26) at -3,104 presents a buy signal. Moving averages (MAs) show mixed signals, with short-term exponential moving averages (EMA) and simple moving averages (SMA) favoring buying, while longer-term indicators, such as the 50-day, 100-day, and 200-day EMAs and SMAs, remain bearish.

Fibonacci retracement levels indicate that $85,609 (38.2% level) is acting as immediate resistance, while $82,166 (23.6% level) serves as minor support. A break above $85,609 could lead to a move toward $88,392 (50% level), with $91,176 (61.8% level) representing a stronger resistance point. Conversely, if bitcoin drops below $82,000, a retest of $76,600 is likely. The overall market outlook suggests a need for bitcoin to hold above $80,000 to maintain its bullish structure, while traders should watch for breakouts above $85,609 to confirm a potential trend reversal.

Bull Verdict:

Bitcoin’s ability to maintain support above $82,000–$83,000, coupled with bullish signals from the MACD and short-term moving averages, suggests a potential rebound. If bitcoin successfully breaks through the $85,609 resistance level, it could trigger a rally toward $88,392 and beyond. A close above $90,000 would confirm renewed bullish momentum, making higher price targets, including $95,138, achievable in the coming days.

Bear Verdict:

With declining volume, bearish momentum readings, and longer-term moving averages signaling a downtrend, bitcoin remains vulnerable to a deeper correction. A failure to hold above $82,000 could accelerate losses, with a drop below $80,000 opening the door for a retest of the $76,600 support zone. If selling pressure intensifies, further downside toward lower Fibonacci levels and psychological barriers could materialize.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。