Bitcoin ETFs Witness $939 Million Outflow As Ether ETFs Lose $178 Million

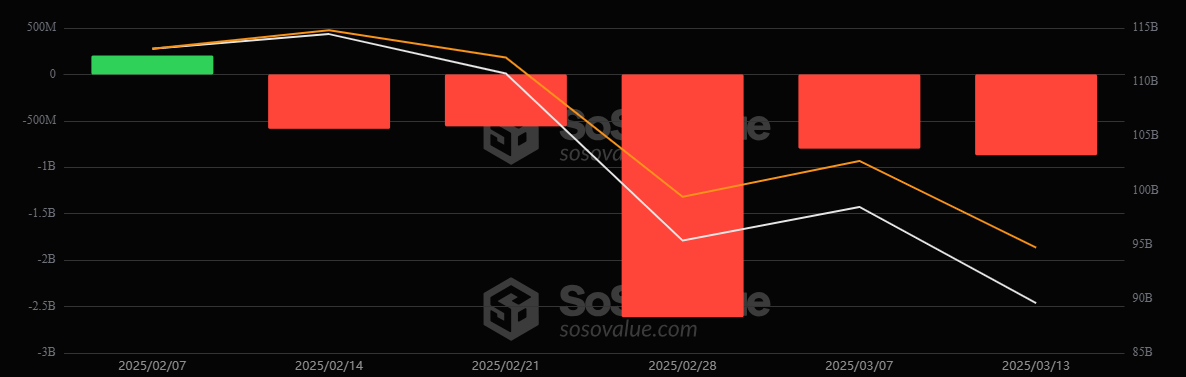

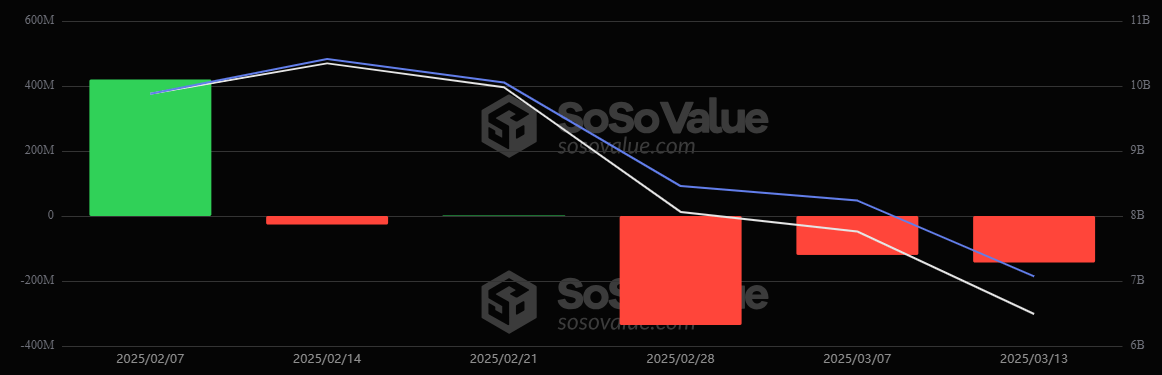

During the week of March 10 to March 14, bitcoin and ether exchange-traded funds (ETFs) continued to experience notable net outflows, underscoring a highly negative investor sentiment.

Bitcoin ETFs recorded a net outflow of $938.8 million, marking the fifth consecutive week of outflows. The most substantial single-day outflow occurred on Tuesday, March 11, with $371 million exiting the funds.

Blackrock‘s IBIT experienced the highest outflow with $338.05 million leaving the fund. Fidelity’s FBTC saw a net weekly outflow of $316.62 million while Grayscale’s GBTC reported an $80.57 million outflow.

Ark 21shares faced a $68.50 million net outflow with Franklin Templeton‘s EZBC experiencing a $54.37 million outflow. Invesco’s BCTO had a $41.54 million net outflow, Wisdomtree’s BTCW recorded a $33.46 million outflow, Valkyrie’s BRRR saw an $11.61 million outflow, and Bitwise’s BITB rounded up the outflows with a $3.8 million net outflow.

On the flip side, Grayscale’s Mini Bitcoin Trust: and Vaneck’s HODL both stood out with a $5.51 million and $4.2 million net inflow, respectively.

Ether ETFs were not immune to the trend, experiencing a net weekly outflow of $178.43 million, marking the third consecutive week of outflows. The largest single-day outflow occurred on Thursday, Mar. 13, with $73.63 million exiting these funds.

Blackrock’s ETHA led the net weekly outflows with $63.30 million while Fidelity’s FETH reported a $49.66 million net outflow. Grayscale’s ETHE experienced a $46.54 million outflow and 21shares’ CETH had a $5.68 million outflow.

There were modest net weekly inflows on Grayscale’s Mini Ether Trust ($12.65 million) and Bitwise’s ETHW ($1.60 million) but it wasn’t enough to stem the outflow tide.

At the end of the trading week, bitcoin ETFs closed with total net assets at $93.25 billion while ether ETFs closed with total net assets at $6.72 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。