This past Friday, all ten leading bitcoin mining companies listed publicly climbed higher, with Applied Digital stealing the spotlight thanks to an 11.46% jump. Moreover, theminermag.com, a Blocksbridge Consulting news, data, and research platform, published a report this week on the current state of bitcoin miners.

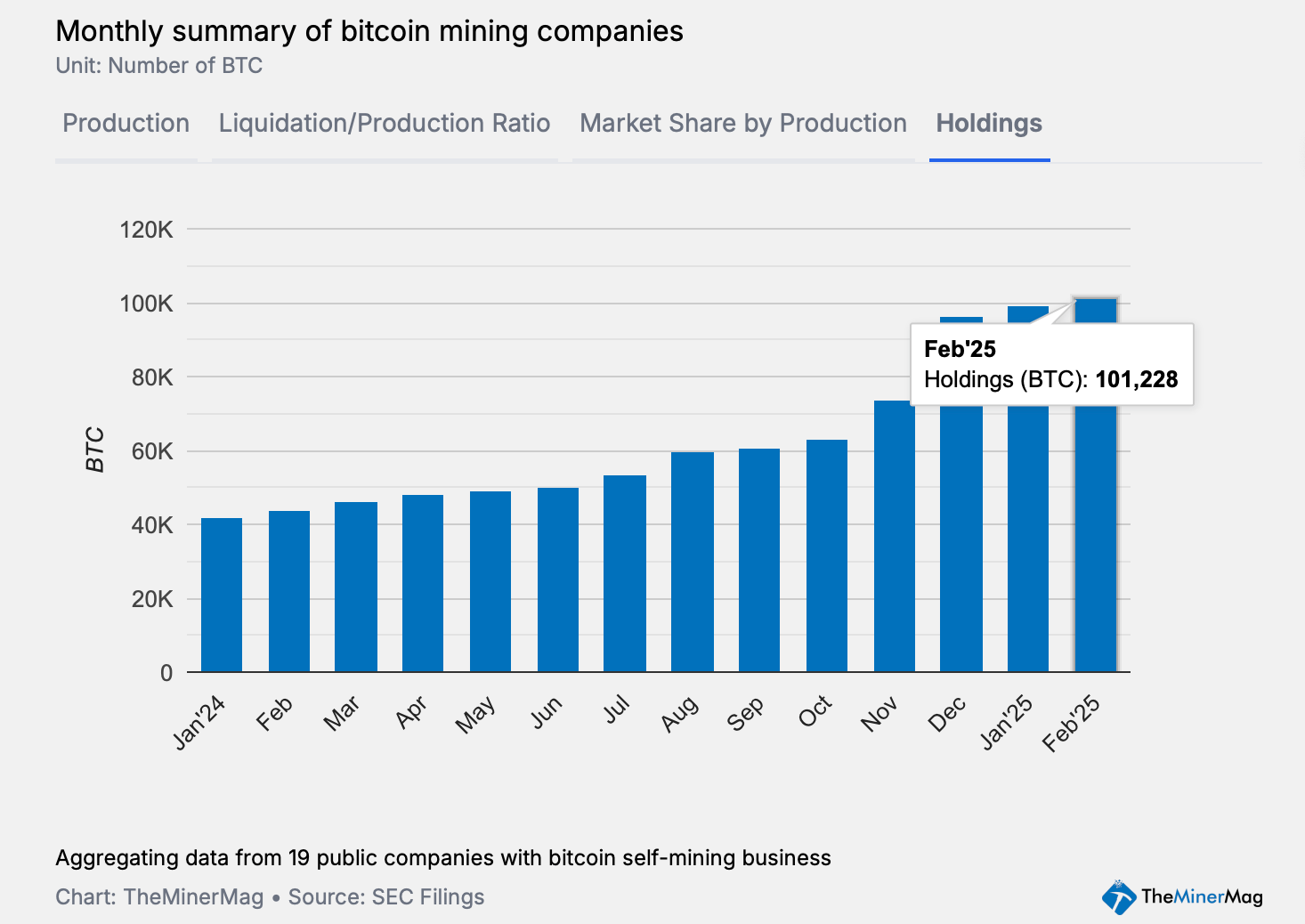

The analysis highlights that among 14 firms spanning private and public sectors, all closed out February with a combined 101,000 BTC. According to theminermag.com’s findings, companies like Cango, Core Scientific, Hut 8, Riot, Cleanspark, and MARA have all faced double-digit declines since January.

Source: theminermag.com

This collective BTC stash now holds a value of $8.51 billion based on current exchange rates. Meanwhile, the report also reveals that publicly traded bitcoin miners have racked up $4.6 billion in debt financing.

“With Bitcoin’s hashprice—daily revenue per unit of computing power—falling below $50/PH/s again, hitting $45/PH/s during the recent market downturn, it will be interesting to see how these dynamics shift, particularly for companies colocating their equipment,” theminermag.com analysis states.

Bitcoin’s hashprice? Think of it as the estimated daily earnings a miner can pocket from one petahash per second (PH/s) of SHA256 hashing power. Flashing forward to March 15, 2025, the hashprice clocked in at $47.85 per PH/s. Since Feb. 15, the hashprice has slid 11.84% over the last 30 days.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。