Key Summary

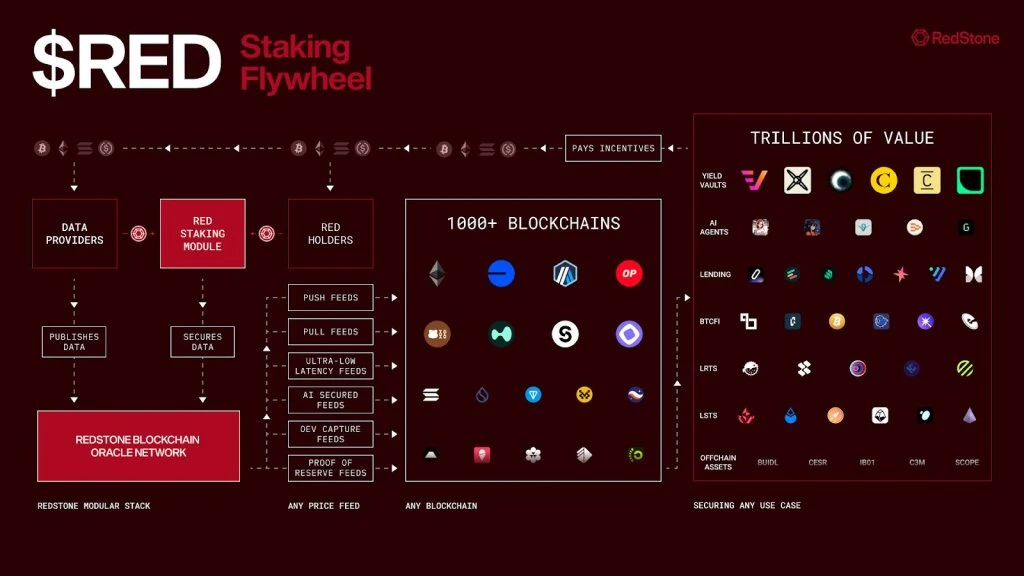

Modular architecture, lower costs: RedStone separates data collection and on-chain delivery, storing a large amount of data on Arweave and providing the latest data on demand, significantly reducing costs and latency.

Rapid updates, multi-chain compatibility: RedStone provides sub-second (approximately 300 milliseconds) price data, supporting over 70 blockchains and more than 130 projects, quickly expanding the Web3 ecosystem.

Challenging Chainlink and Pyth: Unlike Chainlink's push model, RedStone adopts a "pull" mechanism, potentially saving up to 70% on gas fees, while being more suitable for multi-chain scenarios than Pyth.

RED token and EigenLayer staking mechanism: The RED token employs a staking and penalty mechanism to ensure network security, combined with EigenLayer staking to enhance security and attract institutional users.

Expanding DeFi and real asset applications: RedStone plans to enter high-frequency trading, asset tokenization, and traditional finance integration, gradually shifting towards DAO governance to ensure long-term decentralized development.

In May 2022, an oracle failure caused a popular DeFi platform to lose millions of dollars, once again proving the importance of reliable data for decentralized finance. Today, RedStone is entering the market as a next-generation oracle service provider, redefining the acquisition, transmission, and security of on-chain data. With its modular architecture, Arweave storage technology, and on-demand data push mechanism, RedStone (RED/USDT) not only effectively reduces costs and latency but also seamlessly scales across multiple blockchains. Next, we will delve into this innovative oracle network and how it shapes the future of Web3.

In May 2022, an oracle failure caused a popular DeFi platform to lose millions of dollars, once again proving the importance of reliable data for decentralized finance. Today, RedStone is entering the market as a next-generation oracle service provider, redefining the acquisition, transmission, and security of on-chain data. With its modular architecture, Arweave storage technology, and on-demand data push mechanism, RedStone (RED/USDT) not only effectively reduces costs and latency but also seamlessly scales across multiple blockchains. Next, we will delve into this innovative oracle network and how it shapes the future of Web3.

Table of Contents

Problems with Traditional Oracles

Why does Web3 need oracles?

Risks and limitations of existing oracle models

RedStone's Modular Architecture

Decoupling data collection and transmission

How Arweave achieves efficient storage

Real-world case: How to help DeFi protocols reduce costs

Who can benefit from RedStone?

DeFi protocols: lending, derivatives, yield aggregation

NFTs and gaming: dynamic attributes, fair gaming mechanisms

Supply chain and insurance: real asset tracking

RedStone's Ecosystem and Growth

Supporting 70+ blockchains, integrating 130+ projects

Key partners: DeFi, traditional finance, institutional support

Venture capital and Binance Launchpad listing

Staking, penalty mechanisms, and network security

Fee distribution and participant incentives

Market performance and future applications

How to ensure security and long-term development?

Core team and background introduction

Community participation and developer ecosystem

Governance model: moving towards decentralized DAO

Problems with Traditional Oracles

Why are Oracles Important for Web3?

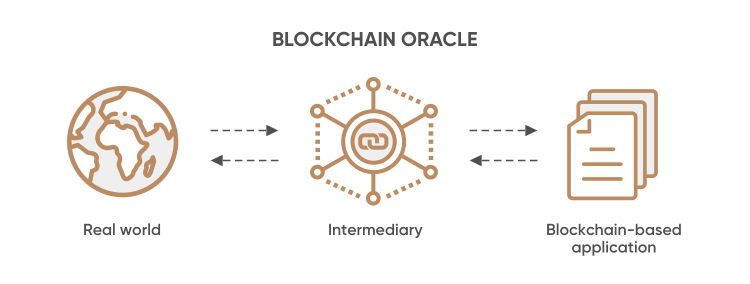

In decentralized finance (DeFi) and the broader Web3 ecosystem, smart contracts must rely on external data to function. This data may include cryptocurrency asset prices, weather forecasts, or even sports results. However, since blockchains are closed systems that cannot directly access external information, "oracles" are needed as a bridge to bring off-chain data on-chain.

If the data provided by oracles is incorrect or delayed, it can lead to significant financial losses. In the past, some well-known DeFi platforms have lost millions of dollars due to oracle failures, highlighting the importance of data accuracy and timeliness in the blockchain world.

Image Credit: Capital.com

Why is RedStone an Industry Innovator?

RedStone adopts a completely new modular architecture that fundamentally changes the way traditional oracles operate. Unlike traditional methods, RedStone separates data collection and on-chain delivery, optimizing costs and efficiency:

Oracles will store massive amounts of data on decentralized permanent storage networks like Arweave, ensuring data security and low storage costs.

Data will only be pushed on-chain on demand when a smart contract actually needs a specific data point, thereby reducing on-chain burden and saving gas fees.

This architecture not only significantly reduces costs but also accelerates data update speeds and allows developers to integrate external data more flexibly.

Image Credit: RedStone

RedStone's Modular Architecture

Decoupling Data Collection and Transmission

Traditional oracles typically handle data collection (off-chain) and data publishing (on-chain) within the same system, a model that is not only costly but also limits scalability. RedStone adopts a modular design that separates these two components, greatly improving efficiency and reducing costs:

Off-Chain Data Providers: Independent nodes collect information from various data sources (centralized exchanges CEX, decentralized exchanges DEX, data aggregators, institutional-grade data sources, etc.).

Data Validation and Signing: Data providers validate data using anomaly detection, cross-source comparison, etc., and ensure data integrity and credibility with cryptographic signatures.

Arweave Storage: Signed data is stored on Arweave, ensuring data is permanently available and tamper-proof, while costs are significantly lower than Ethereum.

On-Chain Data Delivery: Pull Model: DApps will only fetch the latest data from Arweave when executing transactions, embedding it into the transaction, reducing unnecessary on-chain writes, and greatly saving gas fees; Push Model: Data is regularly updated on-chain via relayers, suitable for applications requiring real-time data.

Image Credit: RedStone

Image Credit: RedStone

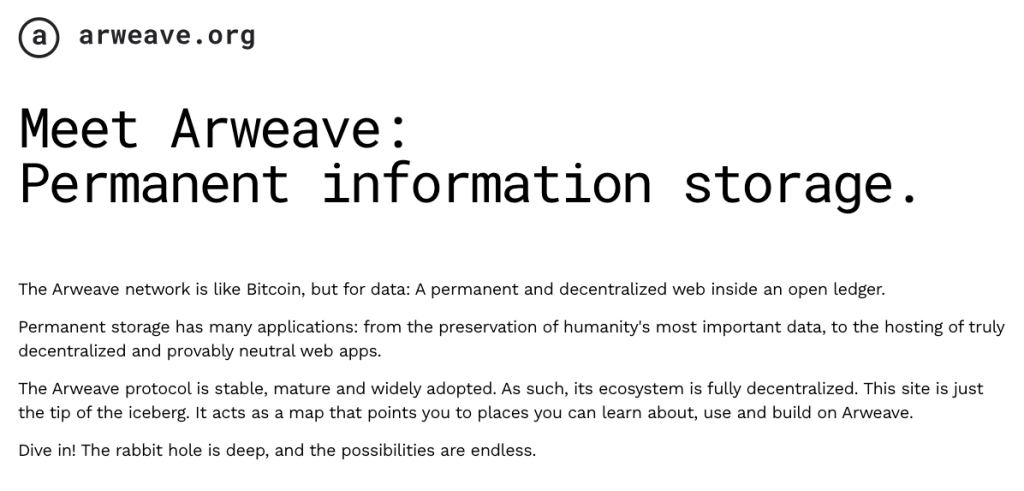

Why Choose Arweave?

Arweave is a decentralized network focused on permanent storage, where users only need to pay a one-time fee to ensure that data is "permanently available." This is crucial for oracles like RedStone that process massive amounts of real-time data every second.

For example, the cost of storing 1GB of data on Ethereum can reach millions of dollars, while on Arweave it only costs a few dozen dollars, significantly reducing data storage expenses.

Image Credit: Arweave

Real-World Case

- Lending protocol on Binance Smart Chain (BSC): Lending protocols typically only need to query the latest price data when user transactions occur, without requiring frequent on-chain writes. By utilizing RedStone's Pull Model, the protocol can directly embed the latest price data into the user's transaction process, eliminating the need to rely on traditional oracles for continuous updates and incurring high gas fees. This approach reduces operational costs for the lending protocol, speeds up data updates, and enhances user experience.

Who Can Benefit from RedStone's Oracle Solutions?

DeFi Protocols

Lending & Borrowing Markets: Real-time price data can accurately estimate the value of collateral assets. Projects like Venus (BSC) and Pendle have integrated RedStone to enhance security and market responsiveness with sub-second (~300 milliseconds) price updates.

Derivatives & High-Frequency Trading: RedStone provides low-latency (~300 milliseconds) price data, supporting perpetual contracts, options trading, and quantitative trading strategies, helping traders optimize profitability.

Yield Aggregation: Many DeFi protocols offer innovative investment opportunities through asset tokenization or yield splitting, which heavily rely on RedStone's precise valuations to ensure fair pricing of yield-bearing assets.

NFTs and Gaming

NFTs with Dynamic Attributes: Minted artworks or collectibles can obtain external data through RedStone for dynamic updates. For example, NFTs can change their appearance or rarity based on real-time sports results or weather conditions.

Game Mechanics: Role-playing (RPG) or fantasy sports games require reliable external data to ensure fairness. RedStone will also introduce VRF (Verifiable Random Function) in the future to provide true randomness for games, ensuring a fair and transparent competitive environment.

Image Credit: Pixelplex

Supply Chain & Insurance

Decentralized Insurance: For example, weather data or flight delay information can directly trigger smart contracts to automatically execute payouts, increasing transparency and operational efficiency in the insurance industry.

IoT & Real-World Assets: On-chain smart contracts can be updated in real-time through sensor data, supporting more complex asset tracking and tokenization applications. For instance, in logistics supply chain scenarios, RedStone allows real-time synchronization of shipping status to the blockchain, enhancing trust and efficiency.

RedStone's Expansion Landscape

Rapid Expansion and Ecosystem Growth

Since its mainnet launch in January 2023, RedStone has expanded to over 70 blockchains and integrated with more than 130 projects, protecting billions of dollars in on-chain assets.

The RedStone team's efficient execution capabilities enable rapid deployment to new blockchains within 1-2 weeks, making RedStone's expansion speed significantly faster compared to other oracle service providers, which is one of the reasons for its rapid rise.

Image Credit: RedStone

Key Partners and Funding Support

DeFi Integrations: RedStone has established partnerships with several well-known DeFi projects such as Lido, EtherFi, Pendle, and Venus, further solidifying its influence in the decentralized finance sector.

TradFi Collaborations: RedStone has become the exclusive oracle provider for the CoinDesk Index, achieving seamless integration of compliant financial data with the DeFi ecosystem, which is expected to drive more institutional applications.

Investor Support: RedStone has received approximately $40 million in venture capital from investment institutions such as Coinbase Ventures and CoinFund, accelerating product development and market expansion. Additionally, RedStone is set to launch on Binance Launchpad by the end of 2024, significantly enhancing market visibility and liquidity.

When Will RedStone Surpass Competitors?

Chainlink: Still the market leader in oracle services, benefiting from a push data model, extensive data coverage, and enterprise-level collaborations. However, RedStone's on-demand data model can reduce costs by up to 70% and provide faster update speeds, making it more competitive in terms of efficiency and cost control.

Pyth Network: Excels in sub-second data updates (especially within the Solana ecosystem) but lacks the multi-chain compatibility of RedStone, making it less competitive in cross-chain applications.

Band & API3: Focused on first-party data or data aggregation models, but still fall short compared to RedStone's ultra-fast data updates and flexible storage solutions.

Image Credit: CryptoKid

RED Token: The Core Driving Force of the RedStone Network

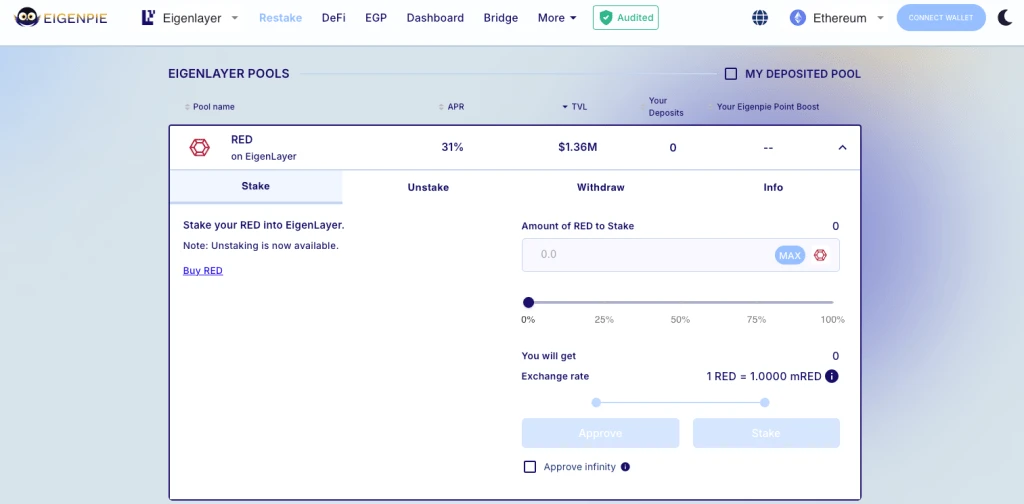

Staking Mechanism and Network Security

The RED token (RED/USDT) is officially launched in March 2025 and is the core of the RedStone economic model. Data providers must stake RED (and re-stake ETH through EigenLayer) to join the network.

If data providers submit incorrect or inaccurate data, the system will trigger a penalty mechanism (Slashing), deducting part or all of their staked funds. This mechanism ensures the credibility of all data providers, maintaining the security and stability of the network.

Image Credit: RedStone Staking

Rewards and Fee Distribution

Users: Protocol users need to pay fees to access data, with payment options including ETH, BTC, stablecoins (USDT, USDC), and other assets.

Stakers: A portion of the fees will be distributed to stakers of the RED token as an incentive for maintaining network security.

Token Supply: The total supply of RED tokens is 1 billion, with 28% released at issuance, and approximately 50% allocated for community growth and ecosystem incentives to promote long-term development.

Price and Market Performance

At the beginning of 2025, the RED token will officially launch on Binance Launchpool, with an initial price of approximately $0.86.

The market capitalization and price of the RED token fluctuate with the overall cryptocurrency market, but its strong fundamentals (multi-chain applications + high trading volume) may become a core driver of long-term demand.

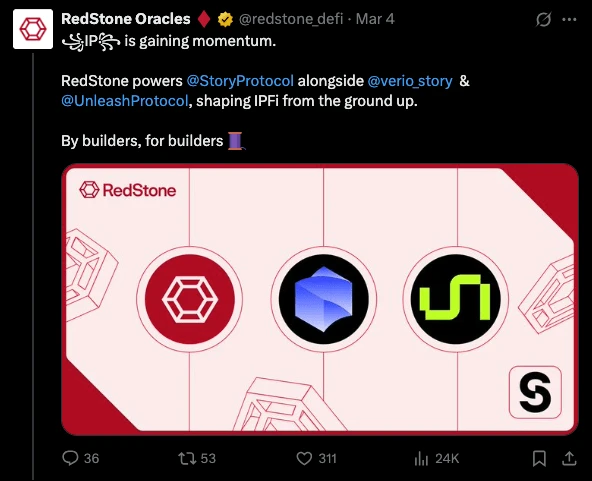

Image Credit: RedStone X (Twitter)

How does RedStone ensure security and long-term growth?

Leadership Team

RedStone was co-founded by Marcin Kaźmierczak (CEO) and Jakub Wojciechowski, originating from Marcin's in-depth research on blockchain oracles in 2017.

As of 2024, the core team of RedStone consists of fewer than 30 people, but they have successfully established a mainnet-level oracle and expanded to dozens of blockchains, demonstrating strong execution capabilities and market adaptability.

Image Credit: RedStone

Community Engagement

RedStone emphasizes deep interaction between developers and users, establishing close community ties through Discord, Twitter (X), and official documentation. Additionally, the team regularly publishes technical blogs to introduce new features (such as Active Validation Service, Push-Pull data model) and actively solicits community feedback to ensure continuous product optimization.

Image Credit: RedStone X (Twitter)

Image Credit: RedStone X (Twitter)

Moving Towards Decentralized Governance

RedStone Distributed Data Association: Responsible for token issuance and major decisions, aiming to gradually evolve into a DAO (Decentralized Autonomous Organization) to enhance the transparency and fairness of network governance.

Future On-Chain Governance: RED token holders will be able to propose governance proposals, approve data providers, and determine the long-term development direction of RedStone, ensuring that the entire network gradually achieves decentralized autonomy.

Challenges and Risks

Market Competition and Network Effects

Chainlink remains the industry leader, with many top DeFi protocols preset to use its data feed services, holding a very high market share.

Other oracle competitors (such as Pyth, Band, API3) have advantages in different niche markets, and RedStone needs to continuously optimize its technology and business model to maintain competitiveness.

Decentralization of Data Providers

If most nodes are controlled by a few large stakers, it may lead to concentration of computing power, which is detrimental to RedStone's decentralized development.

RedStone plans to launch a node reputation system to encourage more independent participants to join, increasing the network's decentralization and fairness.

Feasibility of the Economic Model

Staking rewards depend on fees paid by data users; if DeFi ecosystem activity decreases, it may lead to a decline in RED token staking yields, affecting long-term sustainability.

Offering various assets as rewards to stakers may reduce the direct demand for RED tokens but can also prevent the RED token from losing value due to high inflation.

Technical and Security Risks

Any oracle can become a target for vulnerabilities in DeFi; RedStone needs to continuously optimize its security defense mechanisms to reduce the likelihood of hacking attacks.

Relying on Arweave and EigenLayer, if these infrastructures fail or are attacked, it may cause a chain reaction for RedStone.

Governance and Community Challenges

Decentralized governance may lead to decreased decision-making efficiency, which may conflict with some enterprise users' needs for quick adjustments to data strategies.

If community proposals are inconsistent with the interests of large token holders, it may trigger governance disputes, necessitating an effective governance mechanism to balance various needs.

Regulatory Compliance Risks

Providing traditional financial data may involve data authorization, privacy protection, and legal compliance issues; RedStone needs to ensure compliance with regulatory requirements in different global markets.

Changes in the regulatory environment may affect RedStone's operations in certain regions, especially compliance requirements for cross-border data transmission, which may become one of the operational challenges.

Future Outlook

RedStone's development direction aligns closely with the overall trends of Web3, particularly in the expansion of modular blockchains and multi-chain ecosystems, where the role of oracles will become increasingly critical. As specialized Layer 1 (L1) and Layer 2 (L2) blockchains continue to emerge, these chains have a growing demand for fast, low-cost data updates, which is precisely RedStone's core competitive advantage.

Key Growth Drivers

High-Frequency DeFi Demand: Many DeFi protocols require sub-second price data or advanced data support (such as derivatives markets, AMM (Automated Market Maker) mechanisms). RedStone can provide near-real-time data solutions to help these protocols improve market efficiency.

EigenLayer Restaking: By connecting to the Ethereum validator network, RedStone enhances network security, making it an attractive choice for decentralized applications (dApps) that need to handle large-scale transactions.

Real-World Assets: RedStone plans to further integrate traditional financial data (such as mortgage rates, stocks, commodity markets) to open up broader markets for the DeFi ecosystem. However, these applications must comply with data authorization and regulatory requirements to truly enter the global financial system.

Decentralized Governance

As the RedStone Distributed Data Association gradually transitions to a DAO (Decentralized Autonomous Organization), community members will play a larger role in:

Adding Data Feeds

Optimizing Feed-Accuracy Protocols

Adjusting Fee Parameters

Striking a balance between decentralized governance and enterprise-level reliability will determine RedStone's long-term positioning in the Web3 ecosystem and influence its future development landscape.

Conclusion

RedStone has quickly gained a competitive advantage in the market through a new oracle operating model:

Off-chain storage of data, provided only when needed, reduces the burden on the blockchain and lowers gas fees.

Utilizing economic incentives and cryptographic signatures to ensure data security, enhancing data accuracy and credibility.

Supporting flexible deployment across multiple blockchains, making it easier for developers to integrate.

Although Chainlink still dominates, the market's demand for more specialized, lower-cost, and faster oracles is growing, and RedStone is carving out a niche in this segment.

As the role of the RED token (RED/USDT) increases in network security and potential cross-chain governance, RedStone is not just a substitute for Chainlink but may become a core part of Web3's data infrastructure.

If RedStone can:

Maintain a record of zero pricing errors to ensure data accuracy

Efficiently scale its business model and optimize its fee structure

Find a balance between community governance and enterprise-level needs

Then, RedStone is expected to become the efficient, flexible, and truly decentralized "preferred oracle," providing stable and sustainable data support for applications in DeFi, NFTs, supply chains, financial markets, and more.

Quick Links

March Global Economic Dynamics: A Must-Read for Crypto Investors

Top 9 Cryptocurrency Trends for 2025: AI, DeFi, Tokenization, and More Innovations

Beyond Candlestick Charts: How On-Chain Data and Macro Trends Drive Bitcoin Growth

Monad vs. Ethereum: Can This Emerging L1 Disrupt the Market?

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and over 40 million user traffic within the ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options including spot trading, margin trading, and futures trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。