Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.65 trillion, with BTC accounting for 60.7%, which is $1.61 trillion. The market cap of stablecoins is $228.5 billion, with a 7-day increase of 1.02%, of which USDT accounts for 62.89%.

This week, BTC's price has shown range-bound fluctuations, currently priced at $84,300; ETH has shown a downward trend, currently priced at $1,916.

Among the top 200 projects on CoinMarketCap, most have declined while a few have increased, including: IP with a 7-day increase of 25.98%, AUCTION with a 7-day increase of 78.12%, and LAYER with a 7-day increase of 55.7%.

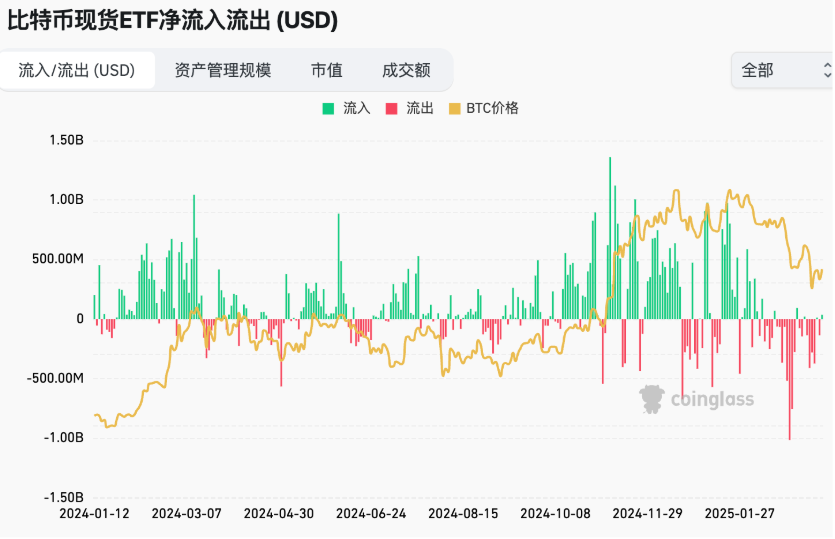

This week, there was a net outflow from the US Bitcoin spot ETF of $742.9 million; the US Ethereum spot ETF saw a net outflow of $143 million.

On March 15, the "Fear & Greed Index" was at 46 (higher than last week), with this week's sentiment: 1 day of extreme fear, 4 days of fear, and 2 days of neutrality.

Market Prediction: This week, the market has shown range-bound fluctuations, with market sentiment shifting from extreme fear to neutrality. On-chain stablecoins have seen a slight increase in issuance, while the US spot Bitcoin and Ethereum ETFs continue to experience net outflows. US stocks have also shown slight recovery this week. Gold futures have surpassed $3,000, indicating a deepening risk-averse sentiment in the market.

Positive news: This week's CPI and PPI data were all below expectations, but whether this will prompt the Federal Reserve to cut interest rates remains uncertain. The short-term market is expected to maintain range-bound fluctuations until a clear interest rate cut occurs, at which point liquidity will truly flow into the cryptocurrency sector.

Understanding Now

Review of Major Events of the Week

On March 10, US President Trump refused to rule out the possibility of the US economy contracting and entering a recession this year, acknowledging that his comprehensive economic agenda might cause short-term turmoil, but he believes it will lead to future prosperity;

On March 10, trader Eugene Ng Ah Sio stated in a TG group that he is currently not in a hurry to trade at the current price levels. Eugene reiterated that, as previously mentioned, the $75,000 level is the only level he is currently interested in;

On March 10, The Block reported that market tension has persisted since Bitcoin's price volatility reached its highest level of the year last Monday. According to The Block's dashboard data, since Bitcoin's annualized volatility reached 59.4% on Monday, it has stabilized at around 58%. The volatility experienced in the past week is the highest level since last December;

On March 11, BitMEX co-founder Arthur Hayes posted, "The plan is as follows: be patient, don’t rush. Bitcoin may bottom around $70,000, a 36% correction from the historical high of $110,000, which is very normal in a bull market. Then, we need a free-fall crash in US stocks, followed by the bankruptcy of major players in traditional finance. Then, the Federal Reserve and central banks will start to inject liquidity to save the market, and that’s when we should go all in. Traders will try to catch the bottom; if you are risk-averse, you can wait until the major central banks start injecting liquidity before increasing your position. You may not catch the bottom precisely, but you won’t have to suffer through a long consolidation period and potential unrealized losses."

On March 11, Musk stated that the X platform had suffered a "massive cyber attack. We are attacked every day, but this time a lot of resources were invested. It may involve a large coordinated organization or actions from a certain country. We are tracking it."

On March 11, in response to rumors that DeepSeek would release the next-generation R2 model on March 17, DeepSeek's official corporate consulting account stated in the user group, "Rumor refuted: R2 release is false news";

On March 12, cryptocurrency exchange Binance and Abu Dhabi-based AI and advanced technology investor MGX announced a $2 billion investment deal, marking Binance's first institutional investment to date. This is the largest single investment in a cryptocurrency company and the largest investment in cryptocurrency (stablecoins) ever;

On March 13, TechCrunch reported that Aleksej Besciokov, co-founder of the sanctioned Russian crypto exchange Garantex, was arrested while on vacation in India. Besciokov faces charges of conspiracy to launder money, conspiracy to violate sanctions, and operating an unlicensed money transmission business. Last week, an international law enforcement operation composed of the US, Germany, and Finland seized Garantex's servers and domain names and froze nearly $28 million in crypto assets, with assistance from stablecoin issuer Tether;

On March 14, data showed that with the end of Epoch 755, the Solana community's proposal to reduce SOL staking inflation, SIMD-0228, ended voting, receiving 43.6% in favor, 27.4% against, and 3.3% abstaining, failing to pass (total voting rate 74%);

On March 14, according to this Thursday's All Devs Call, Ethereum Foundation developers will launch a new test network called Hoodi, which will test the final Pectra deployment before mainnet activation. This new "long-term" test network is expected to launch on March 17;

On March 14, BlackRock's BUIDL tokenized fund surpassed $1 billion in assets today, becoming the largest on-chain national debt fund globally;

On March 14, Arkham monitoring reported that ARK Invest received over $80 million worth of Bitcoin from Coinbase today.

Macroeconomics

On March 12, the US Securities and Exchange Commission (SEC) announced this morning the postponement of several cryptocurrency spot ETF applications, including Grayscale's Cardano (ADA) and DOGE spot ETFs, Canary's XRP, Solana, Litecoin spot ETFs, and VanEck's Solana spot ETF;

On March 12, US February CPI data was significantly below expectations:

- The US February unadjusted CPI year-on-year rate recorded 2.8%, the lowest since last November;

- The US February seasonally adjusted CPI month-on-month rate recorded 0.2%, the lowest since last October;

- The US February unadjusted core CPI year-on-year rate recorded 3.1%, the lowest since April 2021;

- The US February seasonally adjusted core CPI month-on-month rate recorded 0.2%, the lowest since last December;

On March 12, Japanese listed company Metaplanet announced that it had purchased an additional 162 Bitcoins;

On March 13, according to CME's "FedWatch" data, the probability of the Federal Reserve cutting rates by 25 basis points in March is 2%, while the probability of maintaining rates is 98%.

ETF

According to statistics, from March 10 to March 14, the US Bitcoin spot ETF saw a net outflow of $742.9 million; as of March 14, GBTC (Grayscale) had a total outflow of $22.455 billion, currently holding $16.413 billion, while IBIT (BlackRock) currently holds $48.107 billion. The total market capitalization of US Bitcoin spot ETFs is $96.866 billion.

The US Ethereum spot ETF saw a net outflow of $14.3 million.

Envisioning the Future

Event Preview

The Digital Asset Summit 2025 will be held from March 18 to March 20, 2025, in New York, USA;

The Next Block Expo - Warsaw 2025 will be held from March 19 to March 20, 2025, in Warsaw, Poland;

The Southeast Asia Blockchain Week 2025 will be held from March 30 to April 5, 2025, in Bangkok, Thailand;

The 2025 Hong Kong Web3 Carnival will be held from April 6 to 9, 2025, at the Hong Kong Convention and Exhibition Centre, Hall 5BCDE.

Project Progress

The Manta ecosystem's derivatives platform KiloEx will conduct its TGE on March 17;

The Ronin mainnet will undergo the Cerastes upgrade on March 17, which will merge all EIPs from the Ethereum Shanghai and Cancun hard forks into the execution client;

Starknet v0.13.4 is planned to be deployed to the mainnet on March 17;

The BNB Chain mainnet will undergo the Pascal hard fork on March 20, introducing features such as gas abstraction, EOA wallet smart contract capabilities, and batch transactions, supporting EIP-7702;

The application deadline for Kaito AI's KAITO is March 22;

Ethena Labs' third quarter airdrop event will last for 6 months, until March 23, 2025.

Important Events

The Chicago Mercantile Exchange will launch Solana (SOL) futures on March 17, pending regulatory review, allowing market participants to choose between trading micro contracts (25 SOL) and large contracts (500 SOL);

The US Securities and Exchange Commission (SEC) will hold a roundtable on crypto assets on March 21 from 1 PM to 5 PM (Beijing time March 22, 4:00 AM to 8:00 AM) in Washington. The theme of the meeting is "How We Got Here and How to Get Out of It - Defining the Status of Securities." The team consists of twelve lawyers and scholars;

On March 19 at 2 AM (Beijing time), the Federal Reserve will announce its March interest rate decision;

On March 20 at 8 PM (Beijing time), the Bank of England will announce its interest rate decision.

Token Unlocking

SuperRare (RARE) will unlock 1,334 tokens on March 17, valued at approximately $1.36 million, accounting for 1.33% of the circulating supply;

Solv Protocol (SOLV) will unlock 117 million tokens on March 17, valued at approximately $5.12 million, accounting for 1.22% of the circulating supply;

Polyhedra Network (ZKJ) will unlock 15.5 million tokens on March 19, valued at approximately $31.61 million, accounting for 1.55% of the circulating supply;

Bittensor (TAO) will unlock 210,000 tokens on March 21, valued at approximately $55.70 million, accounting for 1.03% of the circulating supply;

SPACE ID (ID) will unlock 78.49 million tokens on March 22, valued at approximately $18.11 million, accounting for 3.92% of the circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and round-the-clock market volatility monitoring. Combined with our weekly live strategy broadcasts of "Hotcoin Selected" and daily news updates from "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。