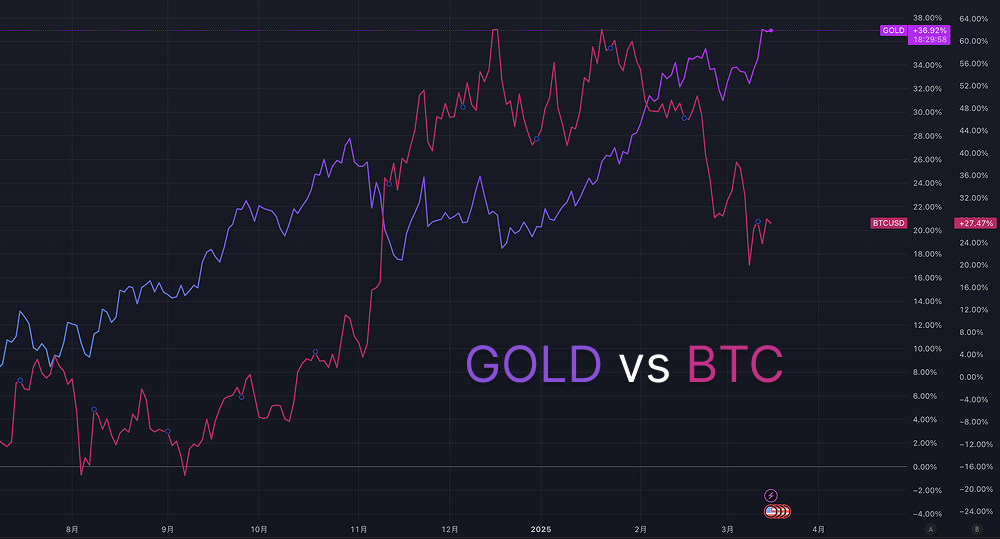

According to the latest report from Jinshi Data, the spot gold price strongly broke through the $3000/ounce mark over the weekend, once again setting a new historical high. Since the beginning of 2025, gold has accumulated an increase of over $370, with a rise of more than 14%. Meanwhile, Bitcoin has encountered an embarrassing decline in market value, falling out of the top ten in the global asset rankings. The stark contrast between these two assets has not only prompted investors to rethink their choices of safe-haven assets but has also made the competition between cryptocurrencies and traditional precious metals a hot topic in the market once again. In the context of increasing global economic uncertainty, does the surge in gold mean that Bitcoin's "digital gold" halo is fading? Would you give up your Bitcoin because of this?

The Return of Gold as the "King of Safe Havens"

Gold's breakthrough of $3000/ounce is not a coincidence. Since 2025, the global economic environment has been continuously turbulent, and the high tariff policies implemented by U.S. President Donald Trump upon his return to the White House have escalated global trade tensions. At the same time, geopolitical risks have frequently emerged, including potential turning points in the Russia-Ukraine conflict, ongoing instability in the Middle East, and policy uncertainties brought about by elections in multiple countries. These factors have collectively increased the market's demand for safe havens, and gold, as a traditional safe-haven asset, has naturally become the preferred direction for capital inflows.

According to market data, since the end of 2024, gold-backed exchange-traded funds (ETFs) have continuously recorded inflows, with a net inflow of about $10 billion in just the past 30 days. In stark contrast, Bitcoin ETFs have seen outflows of about $5 billion during the same period. The total market value of gold has now surpassed $22 trillion, approximately 13 times that of Bitcoin. This gap not only highlights gold's strong position in the current market but also raises questions about whether Bitcoin can continue to play the role of "digital gold."

Industry experts point out that the rise in gold is not merely driven by sentiment. The Federal Reserve's slowdown in interest rate cuts at the beginning of 2025 has led to rising bond yields, while gold, as a non-interest-paying asset, has risen against the trend, indicating that market trust in the U.S. dollar credit system is wavering. Analysts from China International Capital Corporation stated, "The sustained rise in gold is fundamentally driven by the collapse of global trust in the dollar system. In the context of uncontrolled U.S. debt, gold's status as hard currency has been further solidified." Meanwhile, central banks in emerging markets are accelerating their "de-dollarization" efforts and increasing their gold reserves, providing solid support for gold prices.

Bitcoin's "Disappointing Moment"

In contrast to gold's dazzling performance, Bitcoin's situation at the beginning of 2025 appears somewhat bleak. As of March 17, Bitcoin's price hovers around $83,259, with a market value of approximately $1.65 trillion, failing to maintain the upward momentum of 2024 and instead falling out of the top ten global asset market values. This decline is closely related to the overall sluggishness of the U.S. stock market and the cryptocurrency market. Since Trump announced the possibility of imposing a 25% tariff on imported goods such as automobiles, semiconductors, and pharmaceuticals, risk assets have generally come under pressure, and Bitcoin, as a highly volatile asset, has not been spared.

Discussions on platform X indicate that some cryptocurrency investors are losing confidence in Bitcoin. One user wrote, "Gold can increase by the market value of several Bitcoins in just half a year, while Bitcoin struggles between sideways movement and decline. When will its consensus value be realized?" Another user lamented, "In this wave of decline, Bitcoin fell by 23%, while Ethereum and Solana dropped over 50%, and gold rebounded strongly. Even the elderly are outperforming us." These voices reflect a divergence in market sentiment: on one side is gold's steady rise, while on the other is Bitcoin's short-term pressure.

However, Bitcoin's "disappointment" is not without reason. In 2024, Bitcoin experienced a surge due to the approval of the first Bitcoin spot ETF in the U.S., with an annual increase of over 120%, and was once seen as an important signal for institutional capital entry. But as 2025 began, with changes in the global macroeconomic environment, investors started to reassess its risk-reward ratio. HashKey Group previously predicted that Bitcoin's price could reach $300,000 in 2025, and the total market value of cryptocurrencies could exceed $10 trillion. However, this optimistic expectation now seems distant. Industry insiders point out that Bitcoin's high volatility makes it difficult to compete with gold in a market dominated by safe-haven demand, especially in the trend of short-term capital flowing towards conservative assets.

Gold vs. Bitcoin: The Ultimate Showdown of Safe-Haven Assets?

The ebb and flow between gold and Bitcoin is essentially a contest of two different safe-haven logics. Gold, as a physical asset with thousands of years of history, derives its value from scarcity, physical properties, and global consensus. In contrast, Bitcoin relies on decentralized blockchain technology, attempting to challenge the traditional financial system through "digital scarcity" and censorship resistance. Over the past few years, Bitcoin supporters have often referred to it as "digital gold," believing it can provide protection similar to gold in an environment of inflation and currency devaluation. However, the current situation seems to indicate that Bitcoin's safe-haven attributes still have limitations when facing systemic risks.

Historically, gold has shown far greater stability during crises than Bitcoin. During the 2011 European debt crisis and the 2020 COVID-19 pandemic, gold demonstrated strong resistance to declines. Although Bitcoin experienced a sharp drop at the beginning of the pandemic in 2020, it quickly rebounded due to global easing monetary policies, showing that it resembles a risk asset more than a pure safe-haven tool. The market environment in 2025 further validates this point: under the shadow of trade wars, gold has become a safe haven for capital, while Bitcoin has declined in tandem with the U.S. stock market.

But does this mean Bitcoin has lost its long-term value? Not necessarily. Bitcoin supporters argue that its market value decline is merely a short-term phenomenon, and in the long run, Bitcoin still holds immense potential. On one hand, Bitcoin's fixed supply (21 million coins) gives it a scarcity similar to gold; on the other hand, its decentralized nature provides unique advantages in combating currency overproduction and capital controls. A user named @BTCdayu on platform X commented, "Gold has been in a bull market for a long time, but Bitcoin just needs time and consensus; $1 million is not out of reach."

It is worth noting that recent news from the U.S. House of Representatives indicates that a congressman plans to submit a bill to ensure that the strategic Bitcoin reserve policy cannot be revoked by future presidents. This development suggests that despite short-term pressure, Bitcoin's institutionalization process is still advancing. If the Trump administration further promotes Bitcoin as a national reserve asset, its status may see a turnaround.

Would You Give Up Your Bitcoin?

For investors, the surge in gold and the slump in Bitcoin pose a practical question: should one continue to hold Bitcoin or turn to gold to hedge against risks? The answer may depend on your investment goals and time frame.

For short-term investors, gold's current momentum is undoubtedly more attractive. Analysts generally predict that gold prices still have room to rise in 2025, with Goldman Sachs raising its year-end gold price target to $3100/ounce, and Citibank even suggesting it could challenge $3300. In contrast, Bitcoin's short-term trajectory is filled with uncertainty, and technical indicators suggest it may further test support below $80,000. In a market dominated by risk aversion, gold is clearly the more prudent choice.

However, for long-term investors, Bitcoin's decline may represent a buying opportunity. Cryptocurrency analysts point out that Bitcoin's historical cycles indicate that each major drop is often followed by a more significant rebound. If the global economy continues to be turbulent in the coming years, Bitcoin's narrative as an anti-inflation asset may regain market favor. Additionally, as blockchain technology matures and institutional adoption deepens, Bitcoin's "digital gold" story still has the potential to be rewritten.

Conclusion: The Era of Diversified Allocation

The showdown between gold and Bitcoin is not a zero-sum game of either/or. In the current complex macro environment, diversified asset allocation may be a wiser choice. Gold can provide stability and hedge against short-term risks; Bitcoin represents a bet on the future financial system, containing high-risk, high-reward potential. As China Gold Network reminds investors, "The allocation value of gold is at the top of the pyramid, but when prices rise to historical highs, one must also be wary of the risk of a pullback. The idea of diversified investment should not be overlooked."

Returning to the initial question: with gold soaring, would you give up your Bitcoin? The answer may not lie in a simple yes or no, but in your judgment of the future. Gold's brilliance belongs to the present, while Bitcoin's dream points to the future. In this competition of safe-haven assets, your choice will determine whether you ride the waves or miss the opportunity.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。