The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smokescreens!

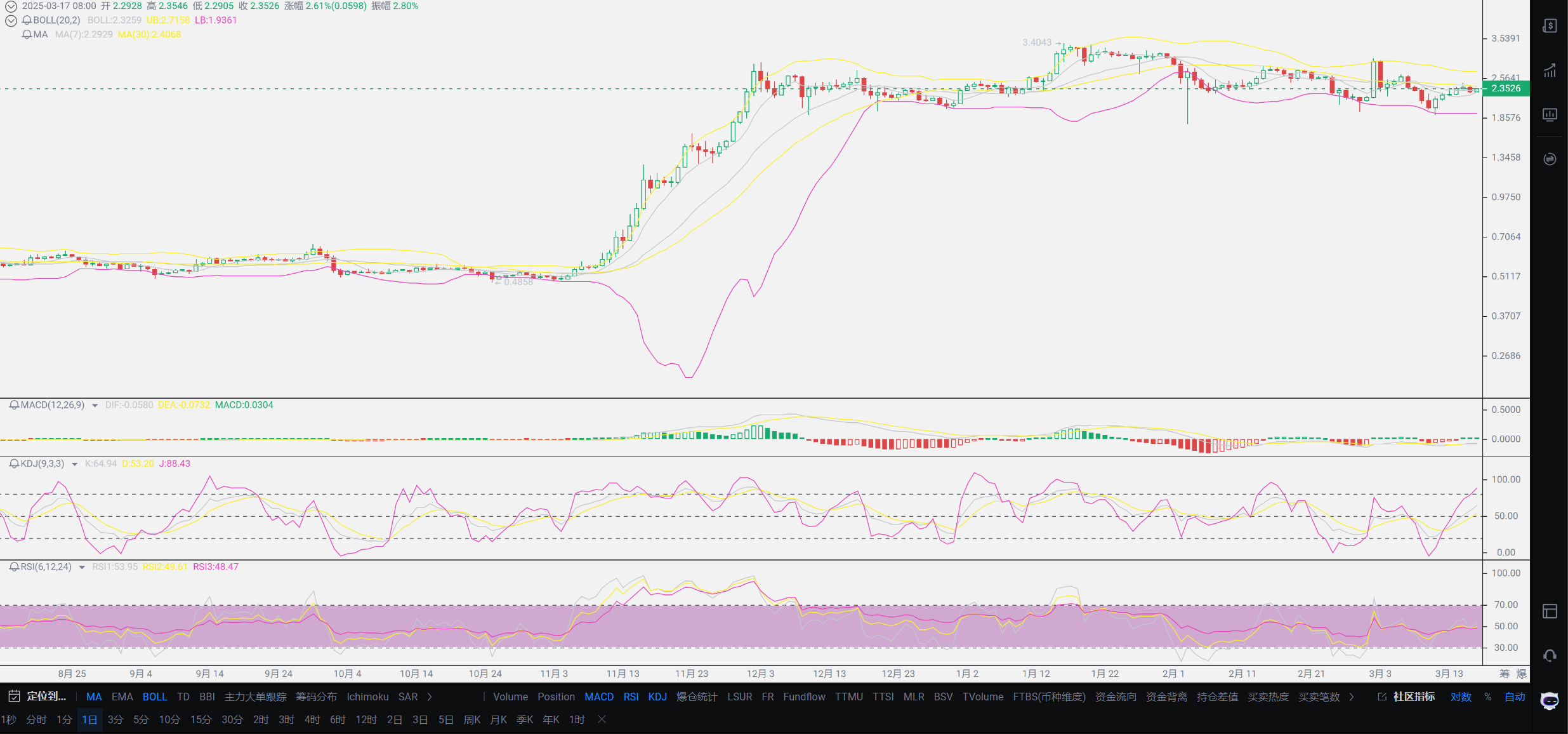

Unexpectedly, just after writing a bullish outlook, the market experienced a rapid increase. The reason for the increase was explained very clearly yesterday, which is simply the increased probability of interest rate cuts, driving short-term growth. This kind of speculative market sentiment will only appear as a fleeting moment for everyone. This also includes the much-anticipated upcoming Federal Reserve meeting, which is similar; it cannot solve the fundamental problems, and the influx of capital still requires time to catch up. However, among the recent rumors, one particular piece of news that caught Lao Cui's attention is Trump's interest in investing in a certain platform. For us ordinary people, once this news is confirmed, the platform tokens in your hands may realize their value. This is also what Lao Cui mentioned earlier, encouraging everyone to pay attention to platform tokens, with the idea being influenced by Trump. The largest platform in the U.S. is basically supported by them, and they have already tasted the sweetness and want to expand their influence globally. A certain platform is indeed the best choice, with a mature market and the largest trading system, the probability of attracting investment will greatly increase, so everyone can prepare in advance.

Returning to the familiar Bitcoin market, many friends saw that Lao Cui's article did not choose to lay out long positions but waited for the market to move before chasing the trend. Now, when asking Lao Cui for advice, Lao Cui does not recommend chasing the market. The current situation is that once it starts, it will basically end within 1-2 hours, and waiting for everyone to enter may lead to being trapped. If you did not choose to enter at that time, you can only give up on this trend later. The next opportunity for long positions will be the Federal Reserve meeting. With the performance of last month's data, it is highly likely that there will be favorable news released this time. There are still five days until the 20th, so do not lay out positions in advance; it is best to wait for the right moment. It is advisable not to have a mindset of entering early in speculative market sentiment. Speculative behavior in response to such events may yield better returns. Lao Cui has talked too much about the overall trend, whether long-term or short-term, and I believe everyone’s returns have significantly improved after reading Lao Cui's articles. Therefore, today’s article still wants to introduce Lao Cui himself; it is also because since predicting the start of this bull market last year, everyone has come to know Lao Cui.

However, some friends have known Lao Cui since 2015 through Penguin, weathering the storms together. From the time when Bitcoin was considered a fraudulent financial scheme to now being among the top ten global market capitalizations, we have been fortunate to witness this historic financial miracle together. Most friends primarily focus on contracts, and through this bull market, it can be said that they have developed a certain trust in Lao Cui. This also gives Lao Cui a great sense of satisfaction and pride. For an analyst, correctly judging the trend, especially when users can gain profits, is the greatest recognition and honor. Over the past year, every judgment on market movements has been very accurate, leading to some blind following. There has been a misunderstanding regarding Lao Cui's identity; it is important to emphasize that Lao Cui's articles do not constitute any investment advice, so everyone should not go in heavily. Previous high-accuracy predictions may lead to losses in your capital in the next misjudgment. In terms of trends, as long as something has not happened, it is a 50% probability for the future. Lao Cui is not a god and can also make mistakes in judgment. It is not because of Lao Cui's mistakes that everyone suffers losses. Moreover, do not think that Lao Cui can help everyone out of difficulties; more often, Lao Cui can only provide suggestions, and whether to adopt them is something everyone should consider.

This is also because too many users of small coin contracts have recently approached Lao Cui, and seeing the losing long positions in your hands, Lao Cui feels the same. Wanting to make a change, but due to being too deep in losses, Lao Cui suggests that everyone use Bitcoin as a benchmark to recover some losses, but everyone always finds it difficult to take that brave step. To this day, many users have already been liquidated and completely exited the market. More and more users convey to Lao Cui the thought that if only they had listened to him at that time. In Lao Cui's eyes, these words should not be directed at him; everyone should go confess to a priest! Of course, this example is not meant to mock users of small coin contracts; Lao Cui understands the psychology behind trading such small coin contracts very well. A more noble explanation is that they choose to take risks for a better life for their families, while a more base explanation is a lack of understanding and a heavy gambling mentality, always fantasizing that they are the chosen ones. Fate never favors gamblers, which is why Lao Cui does not work with users from certain professions—not out of discrimination against professions, but more based on everyone's ability to withstand risks. If you have trapped positions or losses, you can communicate with Lao Cui, and he will also provide his suggestions. However, the final decision-making power still lies in your hands. One thing is certain: Lao Cui will only give one opportunity. Regardless of whether you seize it, there will be no next chance.

Lao Cui's responsibility is primarily to reduce risks and increase profits, sharing trends with everyone, including helping everyone profit, which is just a part of life. Therefore, regarding the messages you send, Lao Cui tries to reply as much as possible, but these things are not Lao Cui's obligation, so many times, the things you send may not be checked in time. For example, many people will ask about the market on that day; Lao Cui may have other matters to attend to that day and overlook your messages. By the next day, it may no longer be necessary to reply. Therefore, if you have specific questions, it is best to use private messages; Lao Cui will provide you with contact channels. The same goes for peers; Lao Cui is open to communication with peers for mutual learning. However, if it is discovered that you are trying to extract Lao Cui's thoughts from a user's perspective, it will definitely end with being blocked; this is a matter of principle. Regarding platform parties and project parties, Lao Cui will publish requests for help when needed, but currently, there is no such demand, so you can look for other analysts to save time. Lao Cui understands your thoughts very well; there have already been enough leaks about the platform, so please do not provide Lao Cui with too much material.

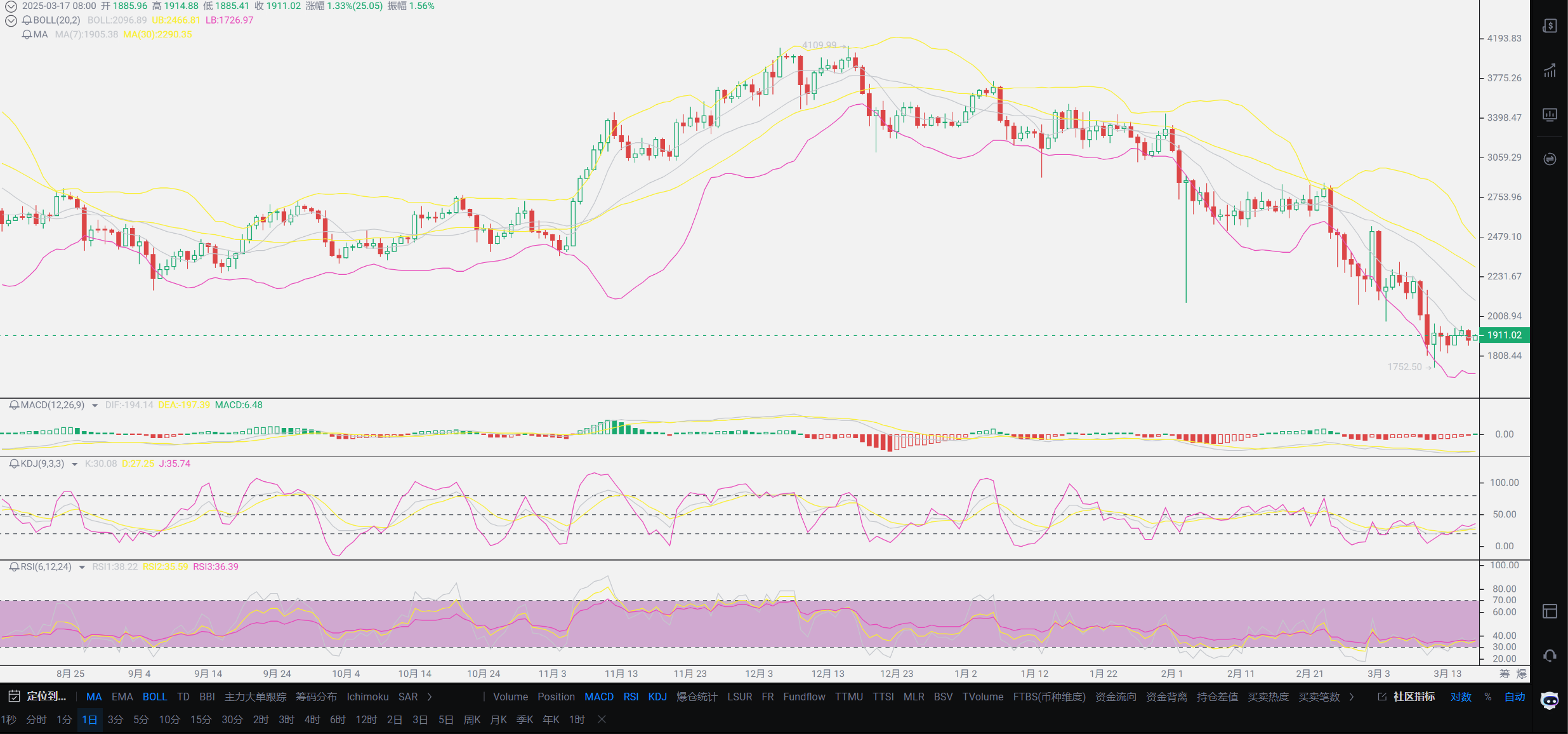

Lao Cui summarizes: Today's article is more of a detailed explanation of Lao Cui's profession. To summarize the future trends briefly, to avoid misunderstandings. In the previous article, Lao Cui called for long positions around Bitcoin 81900; the market had already moved that day, and everyone can ignore this trend. Today's explanation is that the article is time-sensitive; do not chase long positions after missing this market. The current stage is also a process of rising and then retracing. It has been clearly stated in the article that there is no possibility of breaking new highs. The current major trend is still primarily a downward fluctuation, and there is no chance for bulls to counterattack. The bottom-fishing for Ethereum and certain platform tokens needs to be prioritized, while SOL still has some waiting space, and Bitcoin is the same. Short-term contract users can choose to enter short positions after the rise, definitely focusing on shorts. Lao Cui will remind everyone about entering long positions. The overall thinking is no different from the previous text; as long as you do not enter heavily, both long and short will not incur significant losses. The reasons for the listings will not lead to a large-scale escape process. March to May will see the emergence of new lows, and from June to December, new highs will appear. The current bottom-fishing may take time to prove whether it is correct. Once you enter, you need to be prepared not to use this capital in the short term. If users have short-term capital needs, it is still best to focus on contracts. The profit target for Ethereum is around 50 points, and for Bitcoin, it is 1000-2000 points; do not let greed take over!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three. The master considers the overall situation and the big trend, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。