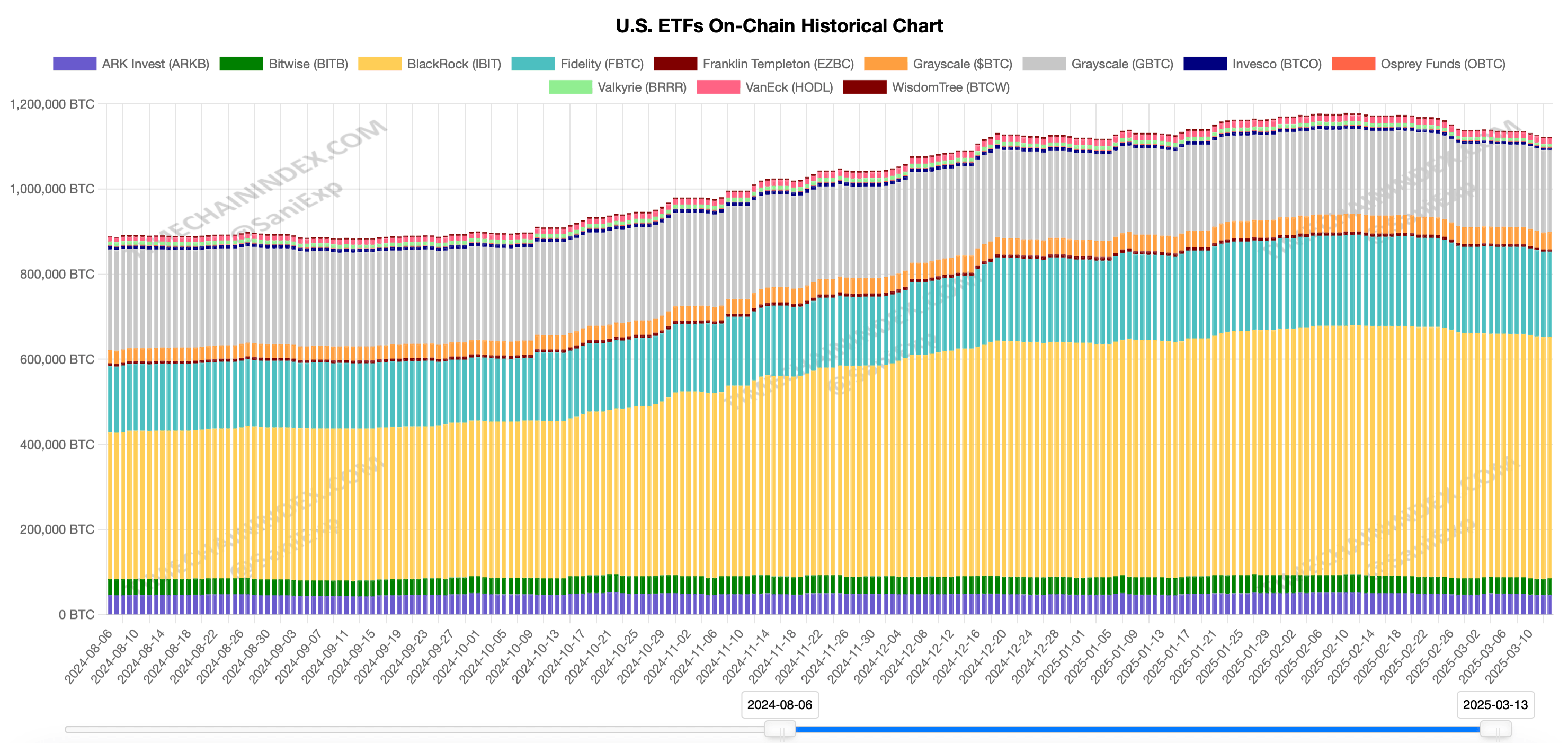

Current data shows U.S. spot bitcoin (BTC) ETFs soaked up 56,802.86 BTC between Jan. 1 and Feb. 6, climbing from 1.120 million to a peak of 1.177 million BTC—hit 35 days back on Feb. 6. But since that high, roughly 55,348 BTC (worth $4.58 billion) have vanished from their vaults.

As of March 14, these funds hold steady at $93.25 billion worth of BTC, accounting for about 5.6% of the leading cryptocurrency’s total market cap. Blackrock’s IBIT has solidified its top-dog status with $39.24 billion in net inflows and a stash of 568,559.37 BTC.

Fidelity’s FBTC trails closely in second, having snapped up $11.25 billion in total inflows and parking 194,269.83 BTC in its portfolio. Grayscale’s GBTC, meanwhile, sits in third despite logging $22.5 billion in net outflows—it still clings to 193,870.05 BTC as of March 14.

Combined, these three heavyweights—IBIT, FBTC, and GBTC—account for 85.26% of the entire group’s 1.121 million BTC holdings. While 12 spot bitcoin ETFs are already in the game, a potential 13th contender might crash the party.

Osprey Funds filed a draft registration statement on Form S-1 with the U.S. Securities and Exchange Commission (SEC) on Feb. 14, 2025, for its Osprey Bitcoin Trust (OBTC). As of March 16, 2025, OBTC hasn’t yet secured the SEC’s thumbs-up, but timechainindex.com reports the fund is already sitting on roughly 1,934 BTC—valued at a cool $160 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。