Source: Cointelegraph Original: "{title}"

Ethereum faces the risk of falling below $1,900 again, which could trigger significant investor demand and drive Ethereum out of its three-month downtrend.

TradingView data shows that after reaching a peak of over $4,100 on December 16, 2024, the price of Ethereum (ETH) has dropped more than 52% during its three-month downtrend.

Juan Pellicer, a senior research analyst at IntoTheBlock, stated that while it is becoming a reality for Ethereum's price to pull back below $1,900 again, this could trigger substantial buying pressure.

ETH/USD daily chart. Source: Cointelegraph/TradingView

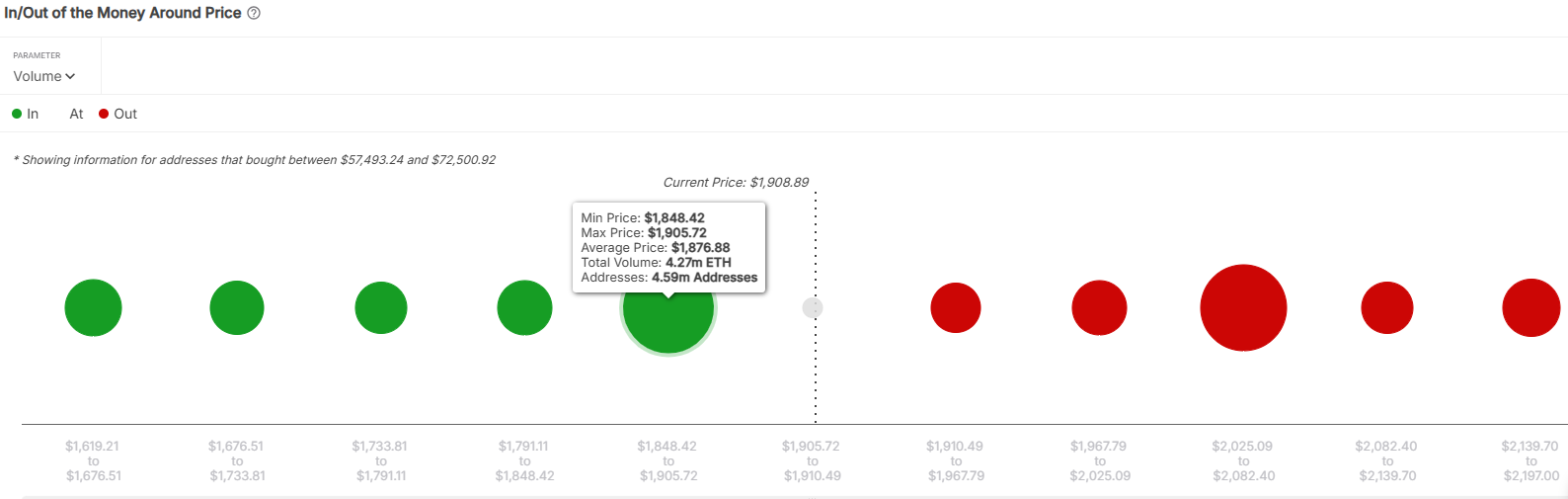

The analyst told Cointelegraph: "On-chain indicators show that there is a strong demand zone for Ethereum just below the $1,900 level." He added, "Historically, around 4.3 million Ethereum have been bought in the range of $1,848 to $1,905, indicating strong support in this range. If Ethereum's price falls below this level, the risk of panic selling among investors will increase, as demand outside this range is significantly weaker."

Capital inflow/outflow near the price. Source: IntoTheBlock

In financial markets, panic selling refers to investors selling their holdings in a state of panic, leading to a sharp decline in prices and signaling that the market bottom is approaching before a new upward trend begins.

Analysts say that with whale investors continuously increasing their holdings, it is unlikely that Ethereum's price will continue to decline significantly after falling below $1,900.

Nicolai Sondergaard, a research analyst at Nansen, stated that while Ethereum's price may temporarily pull back below $1,900, it is unlikely to drop significantly due to the continuous accumulation by whale investors.

The analyst told Cointelegraph: "If Ethereum cannot hold the $1,900 level, then further declines are indeed likely." He added, "Whale investors are said to be continuously accumulating, and WLFI also holds a large amount of Ethereum; regardless, the price trend has not been ideal."

The analyst also noted, "Recent options data reflects this situation, as large participants/institutions are positioning for bidirectional price fluctuations, indicating significant uncertainty in the market regarding Ethereum's direction."

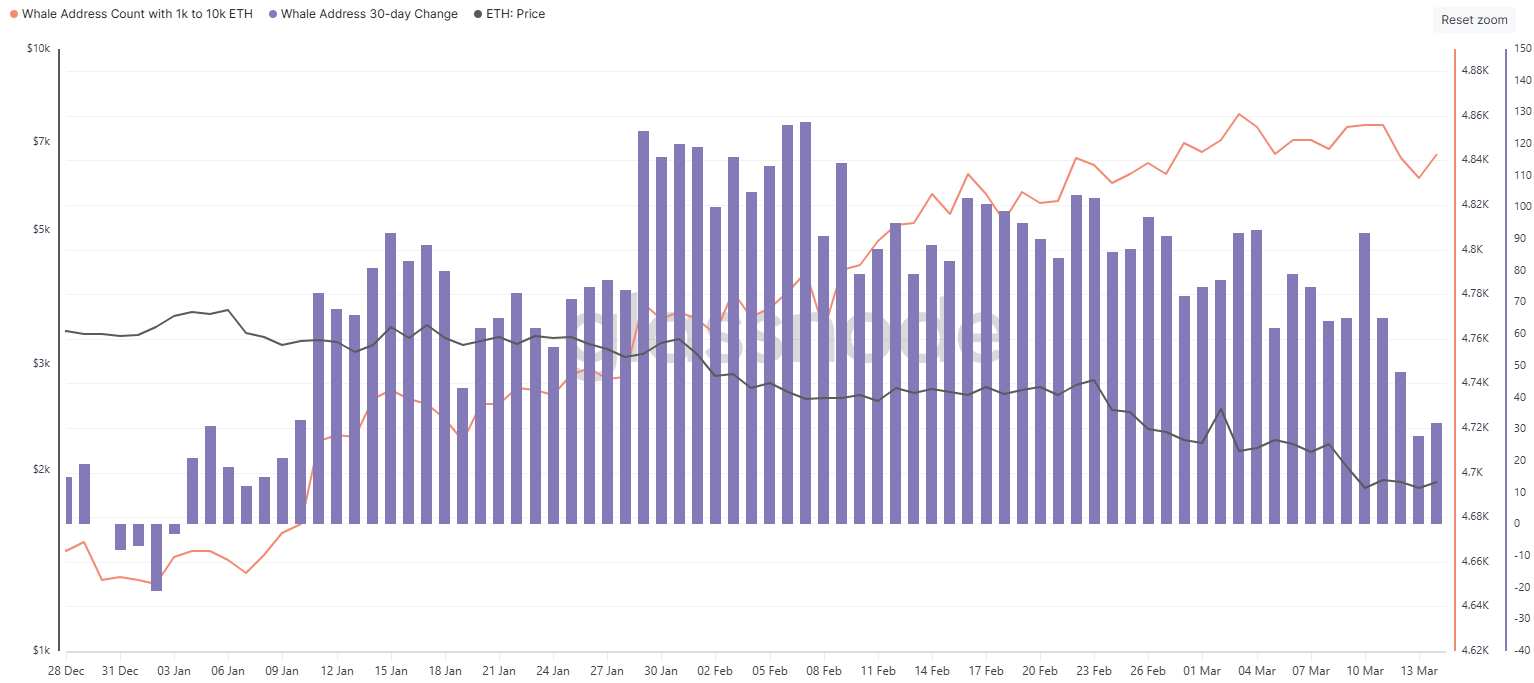

At the beginning of 2025, the number of whale addresses on Ethereum began to rise.

Ethereum: Number of whale addresses (balance > 1000 ETH). Source: Glassnode

Data from Glassnode shows that the number of whale addresses holding at least 1,000 Ethereum (worth $1.92 million) increased from 4,652 on January 1 to over 4,843 on March 14, marking an increase of over 4% year-to-date.

Related: Web3 Executives: A 20% drop in Ethereum could trigger $336 million in DeFi liquidations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。