Key Points

The total market capitalization of cryptocurrencies globally is $2.8 trillion, up from $2.78 trillion last week, with a weekly increase of 0.72%. As of the time of writing, the total net asset value of Bitcoin spot ETFs in the U.S. is $93.25 billion, with a cumulative net inflow of approximately $35.2 billion and a net outflow of $870 million this week; the total net asset value of Ethereum spot ETFs in the U.S. is $6.72 billion, with a cumulative net inflow of approximately $2.52 billion and a net outflow of $140 million this week.

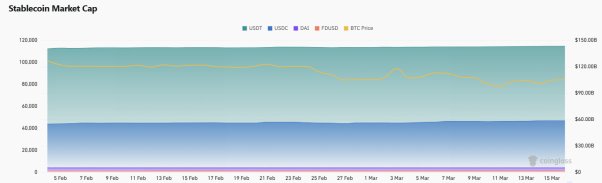

The total market capitalization of stablecoins is $236 billion, with USDT having a market cap of $143.5 billion, accounting for 60.8% of the total stablecoin market cap; USDC has a market cap of $58.7 billion, accounting for 24.87%; and DAI has a market cap of $5.37 billion, accounting for 2.28%.

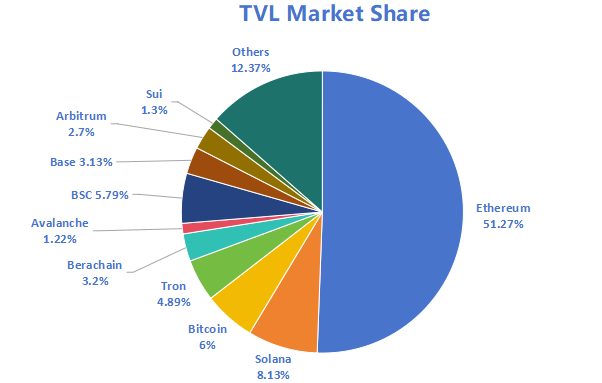

According to DeFiLlama data, the total TVL (Total Value Locked) in DeFi this week is $90.8 billion, an increase of 0.44% from last week. By public chain, the top three chains by TVL are Ethereum, accounting for 51.27%; Solana, accounting for 8.13%; and Bitcoin, accounting for 6%.

From on-chain data, the overall public chains, except for TON and BNB, are showing a downward trend in trading volume this week, with BNB showing significant growth, up 53.5% from last week. The overall change in trading fees this week is not significant. In terms of daily active addresses, ETH shows a significant downward trend, down 11% from last week; in terms of TVL, BNB shows significant growth, up 12.6% from last week. This week, the total TVL of Ethereum Layer 2 is $30.9 billion, with an overall decrease of 0.71% from last week.

Innovative projects to watch: Meridian: The native liquidity layer of Movement, aimed at secure scaling and achieving high-speed capital flow through Move; Extended: A self-custodial exchange with on-chain trade settlement and complete transparency, dedicated to providing a trading experience comparable to CEX; Rhei: A recently launched DeFi protocol on Sui, which will later support BTC lending, currently in the early stages of development but with some community interest.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Proportion 2

3. ETF Inflow and Outflow Data 4

4. ETH/BTC and ETH/USD Exchange Ratios 5

5. Decentralized Finance (DeFi) 6

7. Stablecoin Market Cap and Issuance Status 10

II. This Week's Hot Money Trends 11

1. Top Five VC Coins and Meme Coins by Growth This Week 11

1. Major Industry Events This Week 12

2. Major Events Coming Next Week 13

3. Important Investments and Financing from Last Week 14

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Ratio

The total global cryptocurrency market cap is $2.8 trillion, up from $2.78 trillion last week, with a growth rate of 0.72% this week.

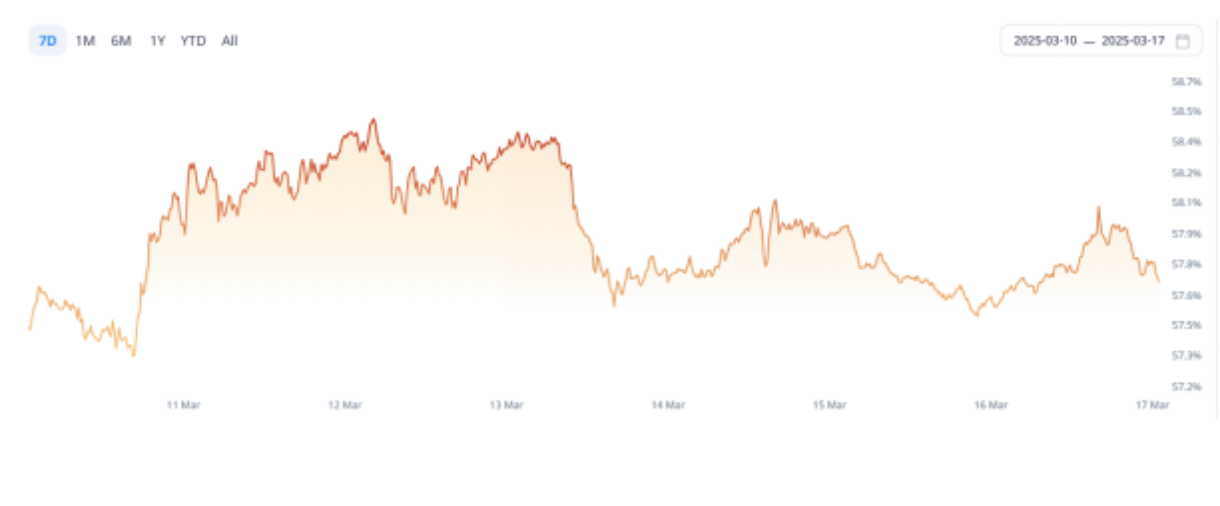

Data Source: cryptorank

As of the time of writing, Bitcoin's market cap is $1.64 trillion, accounting for 58.55% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $236 billion, accounting for 8.42% of the total cryptocurrency market cap.

Data Source: coingeck

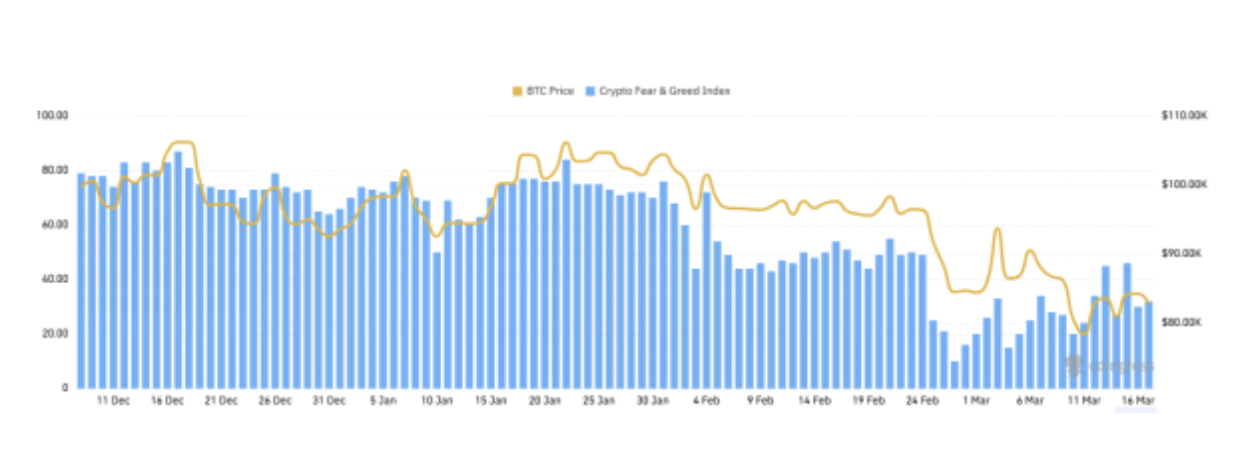

2. Fear Index

The cryptocurrency fear index is at 32, indicating fear.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the total net asset value of U.S. Bitcoin spot ETFs is $93.25 billion, with a cumulative net inflow of approximately $35.2 billion and a net outflow of $870 million this week; the total net asset value of U.S. Ethereum spot ETFs is $6.72 billion, with a cumulative net inflow of approximately $2.52 billion and a net outflow of $140 million this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $1,906, historical highest price $4,878, down approximately 61.04% from the highest price.

ETHBTC: Currently at 0.022875, historical highest at 0.1238.

Data Source: ratiogang

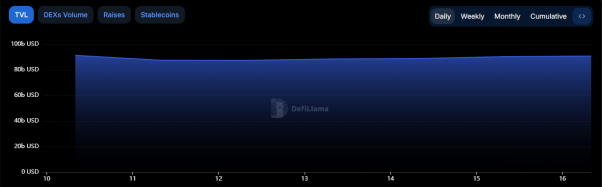

5. Decentralized Finance (DeFi)

According to DeFiLlama data, the total TVL of DeFi this week is $90.8 billion, with a growth rate of 0.44% compared to last week.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum chain at 51.27%; Solana chain at 8.13%; Bitcoin chain at 6%.

Data Source: CoinW Research Institute, defillama

Data as of March 16, 2025

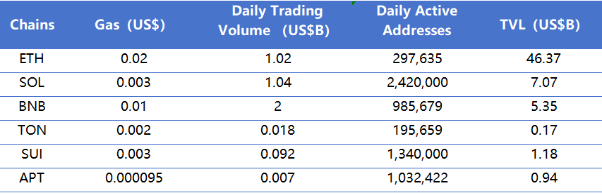

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current Layer 1 data including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of March 16, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, except for TON and BNB, the overall trend of public chains is downward, with BNB showing significant growth, up 53.5% from last week. The overall change in transaction fees this week is not significant.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. From the perspective of daily active addresses, ETH shows a significant downward trend, down 11% from last week; from the perspective of TVL, BNB shows significant growth, up 12.6% from last week.

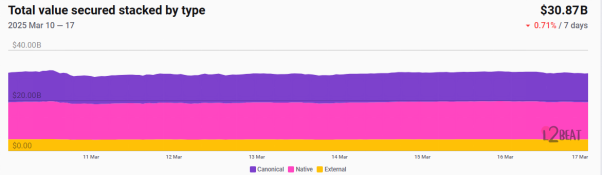

Layer 2 Related Data

● According to L2Beat data, the total TVL of Ethereum Layer 2 is $30.9 billion, with an overall decline of 0.71% compared to last week.

Data Source: L2Beat

Data as of March 16, 2025

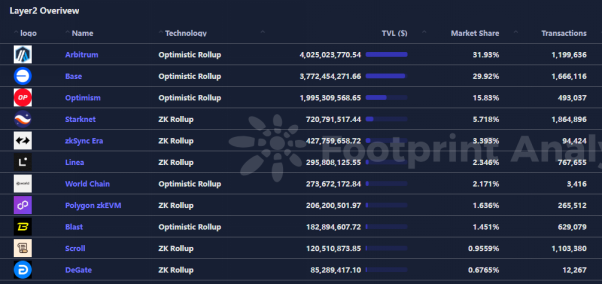

Arbitrum and Base occupy the top positions with market shares of 31.93% and 29.92%, respectively, but both have seen a decline in overall market share.

Data Source: footprint Data as of March 16, 2025

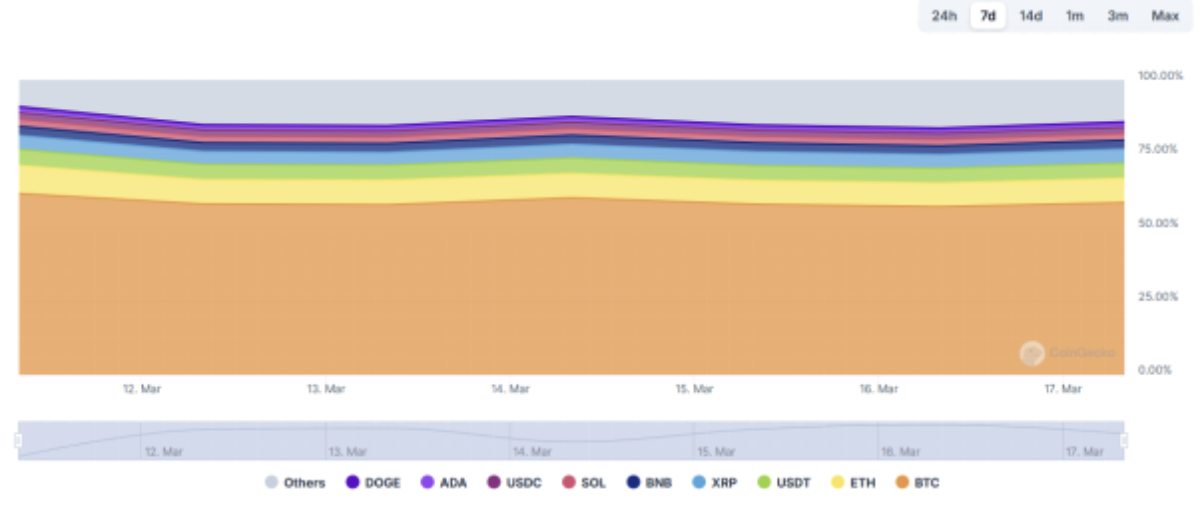

7. Stablecoin Market Cap and Issuance Situation

According to Coinglass data, the total market cap of stablecoins is $236 billion. Among them, USDT has a market cap of $143.5 billion, accounting for 60.8% of the total stablecoin market cap; followed by USDC with a market cap of $58.7 billion, accounting for 24.87%; and DAI with a market cap of $5.37 billion, accounting for 2.28%.

Data Source: CoinW Research Institute, Coinglass

Data as of March 16, 2025

According to Whale Alert data, the USDC Treasury issued a total of 800 million USDC this week, with the total issuance of stablecoins down 31.6% compared to last week.

Data Source: Whale Alert

Data as of March 16, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

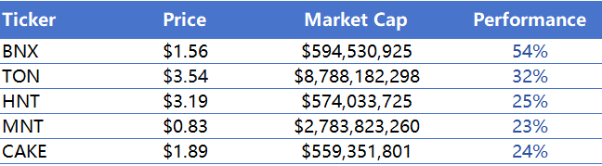

The top five VC coins by growth over the past week:

Data Source: CoinW Research Institute, coinmarketcap

Data as of March 16, 2025

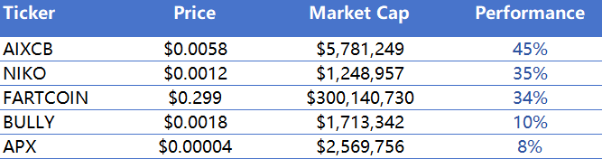

The top five Meme coins by growth over the past week:

Data Source: CoinW Research Institute, coinmarketcap

Data as of March 16, 2025

2. New Project Insights

Meridian: Meridian is the native liquidity layer of Movement, designed to securely scale and enable high-speed capital flows through Move.

Extended: Extended is a self-custodial exchange with on-chain trade settlement and complete transparency, committed to providing a trading experience comparable to CEX.

Rhei: A recently launched DeFi protocol on Sui, which will later support BTC lending and more. The project is still in its early development stage but has garnered some community attention.

III. Industry News

1. Major Industry Events This Week

The multi-asset liquidity re-staking protocol Bedrock launched the BR token airdrop check portal on March 16. Over 200,000 eligible addresses will be able to claim BR tokens. 5.5% of the total BR supply will be airdropped at TGE (Q1), and a points program will continue to provide future rewards. Additionally, pre-deposit claims have opened, and on-chain claims can be made within 7 days.

Kaito AI announced that Sophon is the next Pre-TGE project selected from the Yapper Launchpad, with the Yapper leaderboard to be announced soon.

Jupiter founder Meow stated that the team is advancing many technical details of Jupnet, with a comprehensive technical update expected in April. He looks forward to sharing recent development progress with the community; Jupnet is a full-chain network launched by Jupiter.

DeFi oracle RedStone announced the launch of the RedStone DRILL program, which will allocate 4.5% of the RED supply to RedStone's core users to reward early adopters of RedStone technology and incentivize rapid growth of the RedStone ecosystem.

The Bitcoin protocol Solv launched the Babylon points registration interface. Users only need to connect the address holding SolvBTC.BBN and enter the target receiving address to complete registration. SolvBTC.BBN is one of the Bitcoin yield assets provided by Solv, as an LST asset in the Babylon ecosystem, with a TVL of over 10,000 BTC, integrated into more than 40 public chains and DeFi protocols.

2. Major Events Coming Next Week

The KiloEx derivatives platform on the Manta ecosystem will conduct its TGE on March 17, with specific airdrop rules and eligibility information to be announced soon.

The Bitcoin staking infrastructure Babylon recently released an advertisement, stating that the airdrop registration deadline will be extended to March 19.

The Berachain Foundation announced that the airdrop is about to end, and eligible users must register their wallets by March 21; the airdrop claim portal will reopen on March 24.

The AI-based cryptocurrency data analysis platform Kaito AI announced that KAITO claims are now open, with a claim deadline of March 22.

Ethena Labs' third-quarter airdrop event will last for 6 months, with a deadline of March 23, 2025.

3. Important Investments and Financing from Last Week

Mesh, Series B financing, raised $82 million, with investors including Paradigm, ConsenSys, QuantumLight, Yolo Investments, Hike Ventures, and others. Mesh is a modern financial operating system that provides enterprise clients with the ability to transfer digital assets, make crypto payments, aggregate accounts, and register securities trading, all within its platform. By integrating with over 300 platforms such as Robinhood, Coinbase, and MetaMask, Mesh is creating a more open, interconnected, and secure embedded financial ecosystem for businesses and users. (March 11, 2025)

Axelar, raised $30 million, with investors including Arrington Capital, Electric Capital, Distributed Global, Laser Digital, and others. Axelar is a decentralized cross-chain communication network designed to enhance interoperability in Web3 by connecting heterogeneous blockchains and enabling asset mobility and programmability in an optimized manner for builders and end-users. (March 11, 2025)

RedotPay, Series A financing, raised $40 million, with investors including Lightspeed Venture, Sequoia China, Accel, Galaxy Ventures, and others. RedotPay is a blockchain technology company focused on digital currency wallets and payment solutions, with a vision not only to provide services but also to lead a global paradigm shift in payment methods by accelerating the acceptance of cryptocurrencies in everyday transactions and payments. (March 14, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。