It is expected that Hyperliquid will become the leading trading and liquidity center for all on-chain activities.

Author: Vikram Singh

Compiled by: Deep Tide TechFlow

Due to dangerous macroeconomic conditions, we are experiencing shocks in the stock and cryptocurrency markets. In this context, I believe it is necessary to take a step back and refocus on the fundamentals. The price drop has cleared out speculators from the market while providing an entry opportunity for new "first principles" investors. Particularly for assets like HYPE, a significant portion of its holders are perpetual contract traders (which relates to the nature of airdrop distribution). Therefore, the market downtrend leads these perpetual contract traders to sell HYPE due to margin calls, triggering a widespread sell-off of HYPE across the market. However, from another perspective, volatile markets typically bring higher trading volumes, resulting in higher trading fees, making HYPE more attractive to fundamental investors.

Here’s what we will explore:

Why am I excited about Hyperliquid today?

Long-term perspective on Hyperliquid

Potential obstacles

Comparative valuation model for HYPE

Why am I excited about Hyperliquid today?

I believe that an efficient on-chain order book can significantly improve existing trading models. The market should be a gathering place for investors on equal terms, but today’s market fundamentally caters to institutions and high-frequency trading (HFT) firms. The on-chain order book changes this, and Hyperliquid is the tool to achieve this transformation.

In traditional finance, high-frequency trading firms spend millions of dollars just to move their servers closer to stock market servers, while ordinary users need to spend thousands to set up and maintain their own servers. Similarly, centralized crypto exchanges create an unfair market environment through internal market-making agreements and prioritized server hosting. By providing access to order flow through the on-chain order book, Hyperliquid allows anyone to create their own "Citadel" or "Jane Street" at almost no cost. Additionally, Hyperliquid's powerful and user-friendly SDK offers a convenient way for non-crypto native users to experiment with trading strategies.

While ordinary users may not be able to outpace Wintermute in market-making, at least they have a fair chance, whereas the existing trading models do not even allow them to participate. Meanwhile, users can also leverage Hyperliquid's native market-making treasury HLP to earn approximately 10%-20% annual percentage yield (APY) in USD.

Through these measures, Hyperliquid creates a fair market. The following upcoming new features particularly excite me:

- Non-custodial BTC/SOL/ETH and related applications

Users need an on-chain platform to trade and collateralize BTC. Through @hyperunit, Hyperliquid provides a seamless way to bridge BTC to the on-chain platform. Hyperliquid supports trading strategies with low-latency settlement for spot and perpetual contracts, so I look forward to seeing use cases such as on-chain spot and futures arbitrage trading, spot hedging trades, and real-time settlement of options positions.

- Stocks and other real-world assets (RWAs) + Hyperliquid backend/traditional finance frontend

The Unit team is developing solutions to bring stocks and real-world assets into the Hyperliquid order book. I not only look forward to the on-chain demand for this but also to Hyperliquid serving as blockchain and liquidity infrastructure, providing previously hard-to-access financial opportunities for emerging markets (EMs). For example, through operations on Hyperliquid's order book backend, users from non-US markets may be able to acquire Apple (AAPL) stock in a seamless manner without directly dealing with the complexities of blockchain.

- BTC and HYPE as collateral

Currently, Hyperliquid only allows USDC as collateral for perpetual contracts. When BTC and HYPE are allowed as collateral, it will reduce the pressure to sell assets due to margin calls while improving capital efficiency.

- Native USDC support

Currently, Hyperliquid supports USDC bridged from Arbitrum, but because it is locked in a smart contract, this USDC cannot be directly exchanged for USD and must be bridged back to Arbitrum. Additionally, the bridged USDC is not compatible with the CCTP protocol. If native USDC is deployed, Hyperliquid will unlock more capital efficiency. For more information about Hyperliquid's native USDC or other native stablecoins, please read @0xBroz's post.

- Launch of lending markets

The launch of lending markets will increase market activity, as HYPE airdrop holders can use their HYPE for collateralized loans, thus participating more actively in the market. I look forward to seeing multiple lending protocols, including @felixprotocol, go live.

- Direct deposits and withdrawals

Through solutions like @HanaNetwork, users can make deposits and withdrawals directly via Apple Pay, PayPal, Wise, and debit cards. Reducing entry barriers will bring more market activity.

- Attracting non-crypto users on-chain

Hyperliquid is the first crypto application for many of my non-crypto friends. They were mostly attracted through trading competitions by @pvpdottrade, and even after the points program ended, they remain loyal users.

Long-term perspective: The future potential of Hyperliquid

Based on the above factors, I believe Hyperliquid has the potential to become a powerful liquidity magnet. As we have witnessed multiple times in the crypto space, liquidity attracts more liquidity. Therefore, I expect Hyperliquid to become the leading trading and liquidity center for all on-chain activities.

As discussed above, the introduction of native non-custodial BTC will unlock new opportunities at the intersection of an efficient Central Limit Order Book (CLOB) and BTC liquidity, including deeper CLOB liquidity, automated market makers (AMMs) on EVM, and lending pools. We may also see spot ETH/SOL and other altcoins migrate to Hyperliquid, which will capture market share from decentralized exchanges (DEXs) on other chains, leading to the drying up of those order books and liquidity pools.

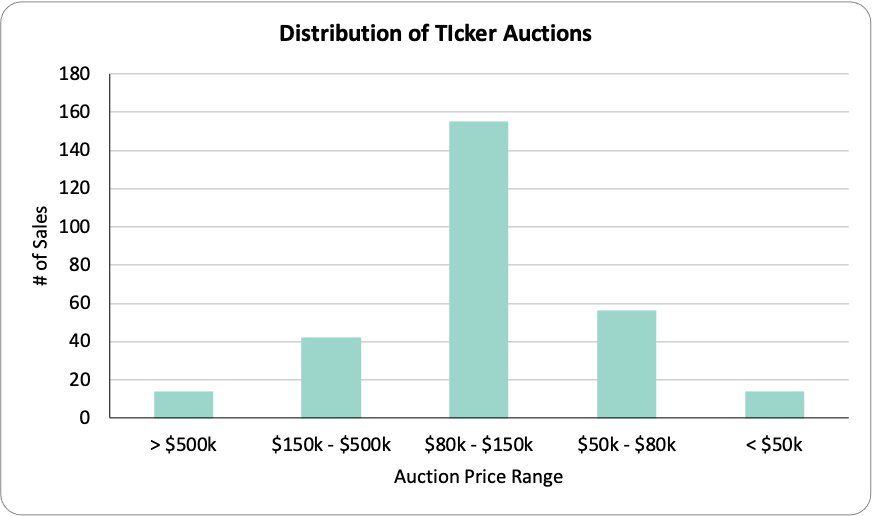

I believe Hyperliquid will compete with centralized exchanges (CEXs) in token listings. This has already been validated by the performance of projects like Swell and Plume, which purchased Hyperliquid's trading pair codes (tickers). Since the trading pair code auctions occur every 31 hours, there are only about 282 auctions per year. As Hyperliquid becomes the de facto on-chain trading venue, the "tickerspace" will become increasingly expensive, but it may still be cheaper than paying Binance a 5% token supply fee. If Hyperliquid successfully establishes itself as a liquidity center, I believe the average price for each trading pair code auction will reach around $500,000.

As mentioned earlier, Hyperliquid's backend and retail frontend applications will bring unprecedented financial opportunities to non-US markets while unlocking liquidity from user groups currently untouched by the crypto industry.

Potential obstacles

- Regulatory pressure

Hyperliquid has not aligned itself with the US political circle (MAGA), while other chains have gained support by catering to Washington politicians, as evidenced by the token purchases of World Liberty Finance. Additionally, many venture capitalists have invested in competing chains and DEXs, while Hyperliquid is siphoning liquidity and market attention from these projects, which have been critical of its regulatory legitimacy since Hyperliquid's inception. The lack of strong support for Hyperliquid in the US may lead to certain regulatory pressures.

- Deployment of EVM

The quality of Hyperliquid's EVM testnet release is not on par with HyperCore, with issues such as low gas limits, occasional block time delays, and lack of native USDC. These problems have slowed down the deployment speed of applications. If EVM applications cannot provide new features or if the total value locked (TVL) and trading volume are low, it may lead to a loss of market attention and TVL to other L1/L2s (like Monad, MegaETH). However, from my discussions with developers, the Hyperliquid team is actively collaborating with applications to gather feedback and make rapid improvements.

- Transparency of the validator network

Although Hyperliquid is transitioning to a permissionless validator system, the specific operations performed by validators remain obscured by opaque binary code. To become a secure liquidity center through true decentralization, Hyperliquid needs to gradually increase transparency regarding validator operations.

Comparative valuation model for HYPE

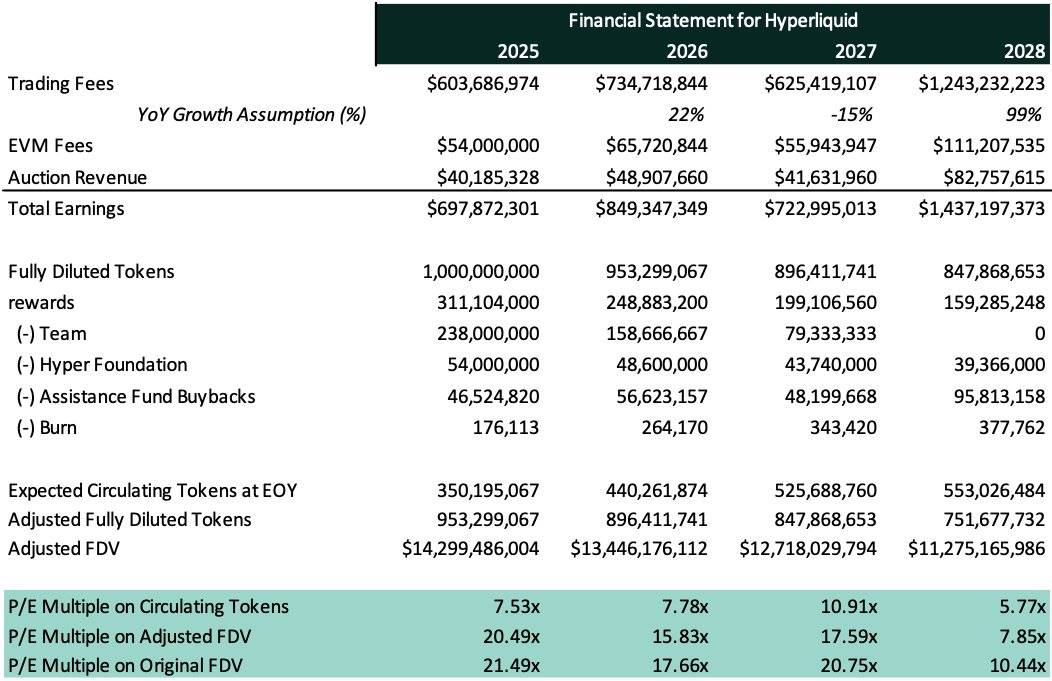

Here is my simple price-to-earnings (P/E) analysis of Hyperliquid's native token HYPE for the next four years.

I believe it is very important to study the impact of the Assistance Fund buyback in a larger context. Inspired by the analysis of @Keisan_Crypto, we introduced the concept of "Adjusted Fully Diluted Valuation" (Adjusted FDV), calculated as follows:

Adjusted FDV = Price × Adjusted Fully Diluted Supply.

Here, we define the adjusted fully diluted supply for the next year as:

Previous year's fully diluted supply - Assistance Fund buyback amount - Burn amount.

For those unfamiliar with the Assistance Fund, simply put, the fees collected by Hyperliquid will be directed into the Assistance Fund, which will use them to buy back HYPE from the open market, thereby reducing supply. In this analysis, we assume that the HYPE bought back by the Assistance Fund will never re-enter the market, effectively equivalent to a burn.

Hyperliquid's revenue sources can be broadly categorized into three main types: trading fees, EVM fees, and auction fees.

Note: The following calculations assume a HYPE token price of $15.

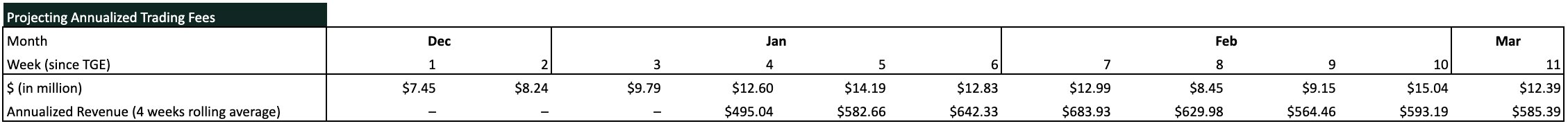

Trading fees are charged when users open or close perpetual contract (Perps) positions. To forecast Hyperliquid's annual trading fees, I first collected weekly revenue data from December 23, 2023, to March 10, 2024. Subsequently, we annualized the 4-week rolling average revenue and performed 8 annualized revenue calculations to obtain a balanced estimate of trading fees.

Therefore, I estimate that Hyperliquid's trading fee revenue in 2025 will be approximately $600 million.

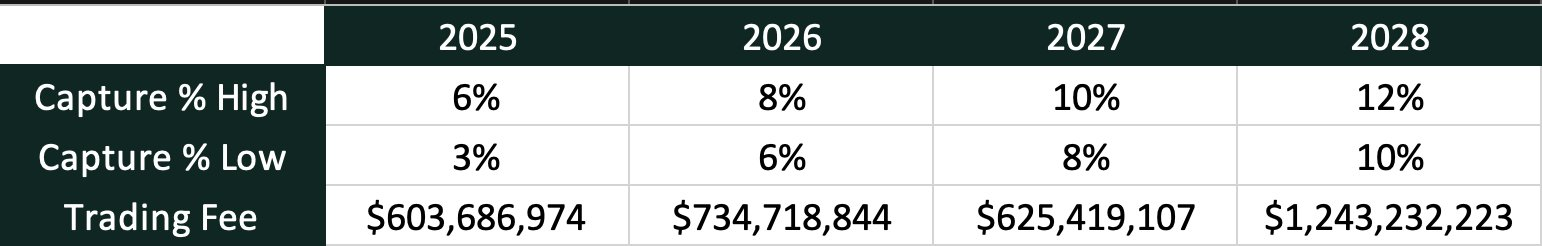

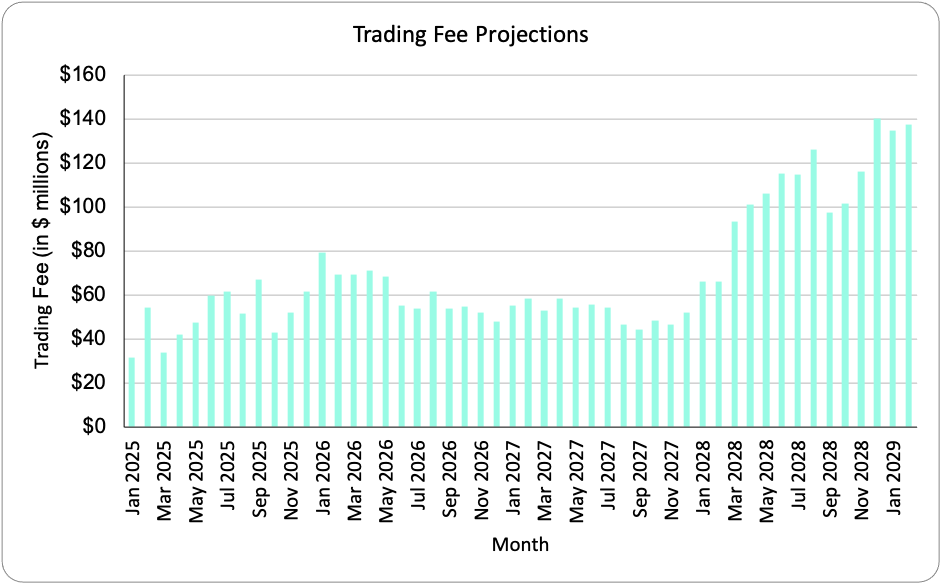

However, while the above method provides a reasonable reference for the 2025 forecast, it is challenging to infer the annual growth rate from 2025 to 2028 using this method. Thus, we turn to the smoothed historical data of perpetual contract trading volume from centralized exchanges (CEX) and assume that Hyperliquid will capture a certain percentage share of the total CEX trading volume. This method better reflects the cyclical fluctuations in crypto market trading volume. We further assume that Hyperliquid's market share will fall within a specific range each year. Directly assuming a fixed 5% market share for any given year may lead to overly generalized errors, so we assume that Hyperliquid's market share in 2025 will be between 3%-6%, and we randomize this range using the formula 3% + [(6%-3%) * RAND()]. This analysis based on a randomized range provides a more realistic monthly trading volume capture scenario. Additionally, assuming Hyperliquid's average trading fee is 0.025% of trading volume, we can conclude that Hyperliquid will earn approximately $600 million in trading fees in 2025. We note that this figure is close to our previous result obtained through the 4-week rolling average method, further validating our analysis.

Continuing with the trading volume capture analysis, we assume that Hyperliquid's market share will gradually increase over the next few years. Therefore, we assume that Hyperliquid will capture 3%-6% of the market share in 2025, 6%-8% in 2026, 8%-10% in 2027, and 10%-12% in 2028. The following will summarize our findings.

We view EVM fees as a function of the annual revenue of other Layer 2 networks (such as Base). Given the early development stage of HypeEVM and its inherently low gas fees, I expect HypeEVM to capture 50% of Base's annual revenue in 2024. Therefore, I estimate that Hyperliquid will earn approximately $54 million from EVM fees in 2025.

Finally, Hyperliquid holds auctions for trading pair tickers in the spot market. To estimate the revenue from trading pair code sales, we first need to analyze the distribution of trading pair code prices. By analyzing historical data and combining it with our previous theories about the trading pair space, I believe a normal distribution is sufficient to map the auction price distribution over a year. The following chart shows the price distribution and the revenue contribution from each price range. Therefore, I estimate that Hyperliquid will earn approximately $40 million from auction fees in 2025.

In summary, Hyperliquid's total revenue in 2025 is expected to be approximately $700 million. Given that most of the fees are expected to be injected into the Assistance Fund for the buyback of HYPE, this means that the Assistance Fund will create $700 million in buying pressure for HYPE in 2025.

Assuming that the HYPE held by the Assistance Fund is equivalent to being burned (i.e., never re-entering the market), along with the estimated 176,113 HYPE expected to be burned from HyperCore trading fees, approximately 4.6 million HYPE will be removed from circulation in 2025.

Therefore, as revenue grows and supply decreases, the price-to-earnings ratio (P/E) of HYPE will decline over the next few years, making it a more valuable asset over time. Additionally, this mechanism of periodically removing HYPE from supply also helps better absorb the token release pressure from the Hyper Foundation, the team, and future token unlocks and community reward programs.

We assume that the annual growth rates of EVM fees and auction fees will generally align with the annual growth rate of trading fees. This allows us to compile the final financial forecast table, with specific data as follows:

Finally, we will compare HYPE's price-to-earnings ratio (P/E) based on its fully diluted valuation (FDV P/E) and market cap (Market Cap P/E) with the following assets: competitors in the crypto space such as Solana and Ethereum; related stock assets: such as Coinbase and Robinhood; and traditional financial assets: such as Apple, Nvidia, and the S&P 500 index.

PS: A few thoughts on the Hyperliquid community

I have discussed the Hyperliquid community multiple times on Twitter, so I won't elaborate too much here to avoid deviating from the main goal of this article. However, I would like to share a passage from an earlier tweet describing the Hyperliquid community, which encapsulates my feelings about this community well:

"Whether making money or losing money, I have gained new friendships from it. Hyperliquid is the first crypto application that made me experience this—it's a very important feature for me."

If you are interested in more of my thoughts on the Hyperliquid community, you can click on Vikram Singh to read more.

Additionally, when mentioning community building, I must highlight @HypioHL, who has done an excellent job of creating a strong community around NFTs (I never thought I would praise NFTs this way one day).

Final words

Broaden your perspective, sit back, relax, and enjoy the journey (but don’t sell your HYPE due to forced liquidations).

Thanks to @KeisanCrypto for the inspiration for the valuation framework, and thanks to @0xBroze, @rpal, and @0xDuckworth for their suggestions and proofreading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。