With the continuous improvement and development of the RWA regulatory framework, more and more RWA projects are starting to land overseas. The core of RWA projects is the tokenization of real-world assets. Once it involves token issuance, due to the high compliance requirements of various countries' laws and regulations regarding token issuance, project parties must prioritize compliance when promoting RWA projects. The choice of the issuing entity is a fundamental yet crucial aspect of the compliance issue related to token issuance.

In recent years, due to an open regulatory attitude and a well-established institutional framework, Singapore has gradually become a "cryptocurrency paradise" sought after by entrepreneurs and investors in the cryptocurrency industry. Choosing a Singapore foundation as the issuing entity for RWA projects seems to have become a "natural choice."

What exactly is a foundation in the cryptocurrency industry, and how does it differ from a traditional fund?

Why do RWA projects usually choose a foundation as the issuing entity? Is a foundation the only choice?

Why do people choose Singapore foundations as the entity?

As of 2025, is the Singapore foundation still the optimal issuing entity for RWA projects, or are there other regions or types of entities available for selection?

The Crypto Law team has been deeply involved in the cryptocurrency industry for many years and has rich experience in handling complex cross-border compliance issues in the cryptocurrency sector. In this article, we will combine the legal frameworks of various countries and the practical experience of our team to clarify and answer the above questions from a professional lawyer's perspective.

1. What is a Foundation? How Does it Differ from a Traditional Fund?

Although different countries have their own definitions and structures for "foundations," most foundations possess at least the following characteristics:

Non-profit and Public Welfare: Foundations are established for public welfare purposes, and the income generated from operations is only used for reinvestment in the foundation, with no profits distributed to members. Unlike companies, foundations do not have shareholders but only members.

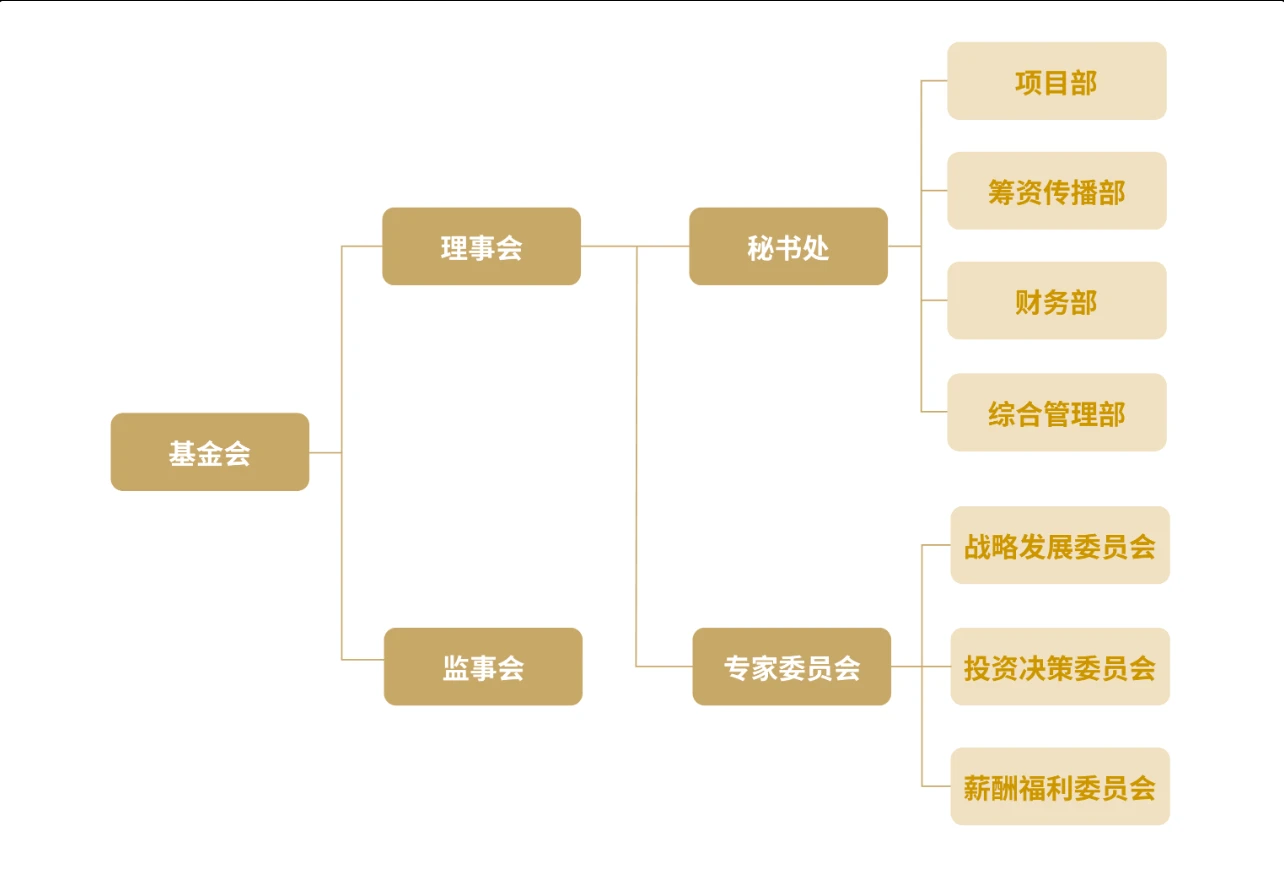

Independent Legal Entity: A foundation, as an independent legal entity, has its own assets and internal governance structure. For example, some foundations have a board of directors and a supervisory board responsible for managing the daily operations of the foundation.

(The above image shows the internal governance model of a certain foundation for reference only.)

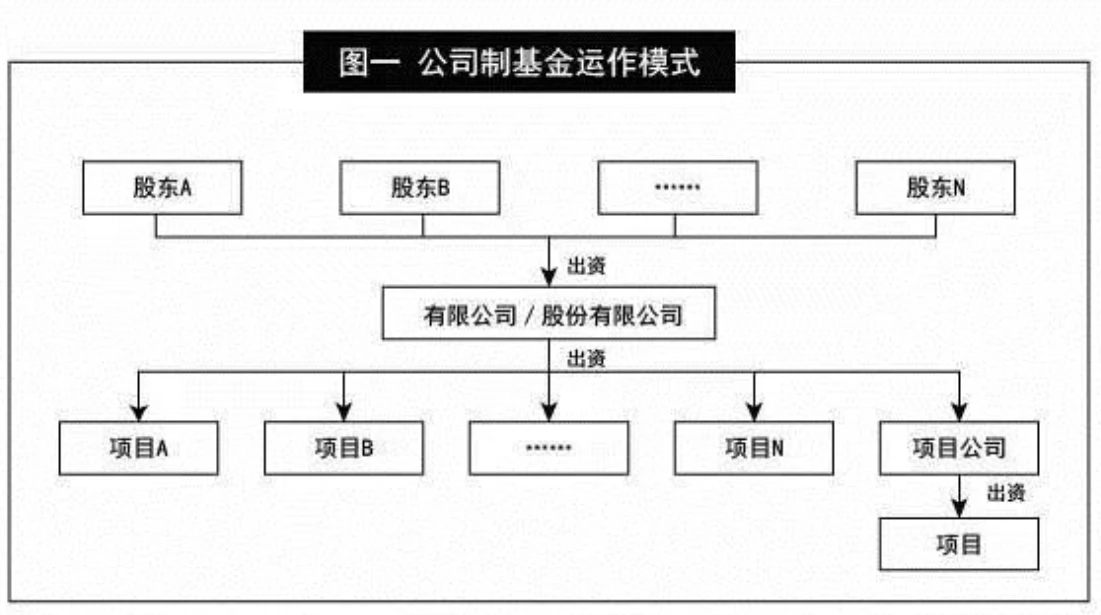

In contrast, a traditional "fund" essentially belongs to a type of investment tool or a pool of funds. The "fund management company" commonly seen in the financial industry is actually a type of "fund manager." Fund management companies raise investor funds by issuing "fund products" to form a fund pool and manage that pool to generate returns for investors, ultimately completing the "raising, investing, managing, and returning" of the fund while charging management fees.

(The above image shows the operational model and legal structure of a corporate fund.)

Thus, it can be seen that while "fund" and "foundation" may seem similar in everyday language, they express significantly different meanings in legal terms.

2. Why Does the Cryptocurrency Industry Favor Foundations?

Firstly, foundations typically have non-profit and public welfare characteristics, and their establishment aims to promote the development of social public welfare rather than maximizing the interests of centralized institutions or specific individuals. This aligns perfectly with the decentralized nature of the cryptocurrency industry. Additionally, foundations do not distribute profits to organizational members; members only participate in the governance of the foundation as managers. This characteristic also coincides with the community self-governance framework advocated in the cryptocurrency industry and Web3 field. Therefore, choosing a foundation as the entity not only benefits the project party in terms of packaging and promotion but also makes it easier to gain the trust of investors and community participants.

Secondly, an increasing number of project parties are choosing foundations as the entity for their projects, largely influenced by the well-known Ethereum Foundation. Ethereum (ETH), currently the second-largest cryptocurrency by market capitalization, also chose a foundation as its operating entity. Given Ethereum's significant position in the cryptocurrency industry, second only to Bitcoin, the Ethereum Foundation naturally wields considerable influence, thereby affecting many new entrepreneurs and players in the Web3 industry to choose foundations as their entities.

Finally, due to the non-profit nature of foundations, many countries' laws allow foundations to obtain tax exemptions or specific tax benefits after meeting certain conditions or obtaining specific approvals. Therefore, choosing a foundation as the issuing entity can enjoy tax reductions or benefits, thereby lowering the project's operational costs.

In summary, foundations have undergone long-term development abroad, and their institutional framework is already very well-established and mature. Moreover, the characteristics of foundations align closely with various practical needs of the cryptocurrency industry. Additionally, as practitioners and participants in the cryptocurrency industry tend to be significantly younger, they are also very interested in the foundation model, which is familiar to traditional "old money" and is relatively serious. Thus, this concept has gradually become a trend in the cryptocurrency space, attracting more and more attention.

However, it is important to note that from a legal perspective, it is not necessary to use a foundation as the issuing entity to complete token issuance. In fact, RWA project parties can also choose traditional profit-oriented entities such as private limited companies or joint-stock companies as the issuing entity. Most project parties choose foundations as the issuing entity, likely due to a comprehensive decision made from commercial perspectives such as project promotion, operational costs, and tax planning. Therefore, practitioners do not need to overly revere foundations; they are not the only issuing entity for RWA projects. Moreover, as a non-profit organization, while a foundation can accept cryptocurrency assets, it often cannot open accounts in commercial banks in many countries or regions. Therefore, if a foundation is used as the issuing entity, it usually requires the establishment of a private limited company to complement it.

3. Why Do RWA Project Parties Tend to Choose Singapore Foundations as Issuing Entities?

It is important to note that the term "Singapore foundation" is more of a customary term within the cryptocurrency industry. Legally speaking, there is no traditional concept of a foundation (Foundation) in Singapore law. What is commonly referred to as a "Singapore foundation" in the cryptocurrency industry actually refers to a legal entity recognized as a "Not-for-Profit Organization" under Singapore law. Many types of legal entities can be recognized as non-profit organizations, such as public companies limited by guarantee, associations, or charitable trusts. For RWA project parties, they typically choose a guarantee company as this legal entity. Therefore, the so-called "Singapore foundation" in the cryptocurrency industry is actually a guarantee company recognized as a "Not-for-Profit Organization."

The main reasons why the cryptocurrency industry often chooses Singapore foundations as issuing entities in the past few years are as follows:

Firstly, because in previous years, Singapore authorities held a relatively open and inclusive attitude towards the entry of the cryptocurrency industry into Singapore. This can be specifically reflected in the approval of registration applications for foundations as issuing entities. At that time, many cryptocurrency projects could easily pass the relevant approvals and complete token issuance in the form of Singapore foundations.

Secondly, because in previous years, the Singapore government actively supported the development of blockchain and cryptocurrency, providing a world-leading legal framework and regulatory environment for token issuance activities. Cryptocurrencies are recognized as legal in Singapore, and any contracts involving cryptocurrencies are not deemed illegal due to their involvement with cryptocurrencies. Additionally, Singapore has established a comprehensive legal framework for cryptocurrencies, covering various aspects such as ICOs (Initial Coin Offerings), taxation, anti-money laundering/anti-terrorism, and the purchase/trading of virtual assets.

Finally, Singapore has a very developed financial and legal infrastructure, which has long attracted significant attention from various international capital and has a good international reputation. Therefore, establishing an issuing entity in Singapore would lend the project higher credibility and professionalism. Moreover, Singapore and China are both in the same time zone (UTC+8), which is very friendly for the large number of Chinese players and project parties in the cryptocurrency space.

So, in 2025, can RWA projects still choose Singapore foundations as their issuing entities?

From a purely legal perspective, the Singapore authorities have not explicitly prohibited Singapore foundations from being used as issuing entities in Singapore. However, the Crypto Law team has learned through recent communications with local law firms, accountants, and company secretaries in Singapore that many compliance and regulatory issues have arisen in recent years for cryptocurrency companies established in the form of Singapore foundations. Following this, due to public opinion and regulatory pressure, Singapore authorities, led by ACRA (Accounting and Corporate Regulatory Authority), have begun to significantly tighten the approval process for foundations engaged in the cryptocurrency industry.

Based on corroborating information from multiple sources, it can be confirmed that ACRA will conduct detailed background checks on foundations during registration. If it finds any potential connection between the foundation and the cryptocurrency industry, it will generally not approve the registration application. Therefore, while choosing a Singapore foundation as the issuing entity for RWA projects still has legal feasibility, in practical terms, it has essentially been blocked.

4. So, besides Singapore foundations, what other issuing entities can RWA projects choose to land?

Based on years of relevant business experience and successful cases, the Crypto Law team recommends the following two options as issuing entities:

The first option is a U.S. foundation.

In fact, the logic of choosing a U.S. foundation as the issuing entity is fundamentally similar to that of choosing a Singapore foundation, with the main difference being that U.S. regulatory agencies currently have a relatively open attitude towards token issuance activities. Additionally, the new President Trump has a supportive stance towards the cryptocurrency industry as a whole.

Moreover, the registration cycle for U.S. foundations is relatively quick, with simple requirements and fewer restrictions. For example, in Colorado, registering a non-profit foundation can generally be completed within a week.

The second option to consider is a UAE foundation or DAO organization.

The overall structure of UAE foundations is also quite similar to that of Singapore foundations. However, it is important to note that Singapore and the UAE belong to different legal systems. Singapore is a common law country, while the UAE follows Islamic law, resulting in significant differences in legal applicability and judicial systems. This is crucial when dealing with complex compliance issues across jurisdictions.

A DAO (Decentralized Autonomous Organization) is an organizational form based on blockchain technology that achieves autonomy through smart contracts. In response to this novel organizational form, UAE authorities have established a complete set of regulations (the "DAO Association Regulations") and corresponding regulatory frameworks. According to the relevant regulations, UAE DAOs possess independent legal personality and also have non-profit characteristics.

Additionally, according to official information disclosed by Binance, it has officially reached a $2 billion investment deal with Abu Dhabi's investment institution MGX, marking the first time Binance has introduced external institutional investors since its establishment. One of the co-founders of MGX is from the Abu Dhabi sovereign fund. The collaboration between the UAE sovereign fund and the largest mainstream exchange in the cryptocurrency space is expected to further promote the development of the cryptocurrency industry in the UAE. Therefore, in the long term, the prospects for cryptocurrency development in the Middle East are indeed promising.

In summary, UAE foundations or DAO organizations are also viable options for issuing entities. However, the costs associated with registering a foundation or DAO in the UAE can be relatively high, making it more suitable for projects of a certain scale.

5. What Risks and Challenges Should Be Noted When Choosing a U.S. Foundation as the Issuing Entity for RWA Projects?

Firstly, issuing tokens in the U.S. in the form of a foundation requires obtaining the appropriate licenses, such as the MSB license issued by the Financial Crimes Enforcement Network (FinCEN).

Secondly, due to the tense geopolitical relationship between China and the U.S., the U.S. regulatory attitude and enforcement regarding offshore companies often change, which can create uncertainty for the long-term compliance operations of the company.

Moreover, U.S. financial and corporate commercial laws are exceptionally complex, requiring a systematic understanding of both federal and state laws, thus increasing the difficulty and complexity of achieving compliance.

Finally, the U.S. tax authority (IRS) has very strict tax audits. As the American saying goes: "In life, only death and taxes are inevitable." Therefore, establishing a foundation in the U.S. requires support from a professional tax planning team to handle related tax issues; otherwise, individuals associated with the business may be at risk of being affected by the U.S. long-arm jurisdiction.

6. Interpretation by Crypto Law

In the current uncertain regulatory landscape of the global cryptocurrency industry, Chinese project parties must adhere to the principle of "compliance first" when launching RWA projects. Therefore, RWA project parties need to actively collaborate closely with a professional cryptocurrency industry legal team to jointly promote the project's implementation.

This article is an original piece by the Crypto Law team and represents the personal views of the author. It does not constitute legal advice or consultation on specific matters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。