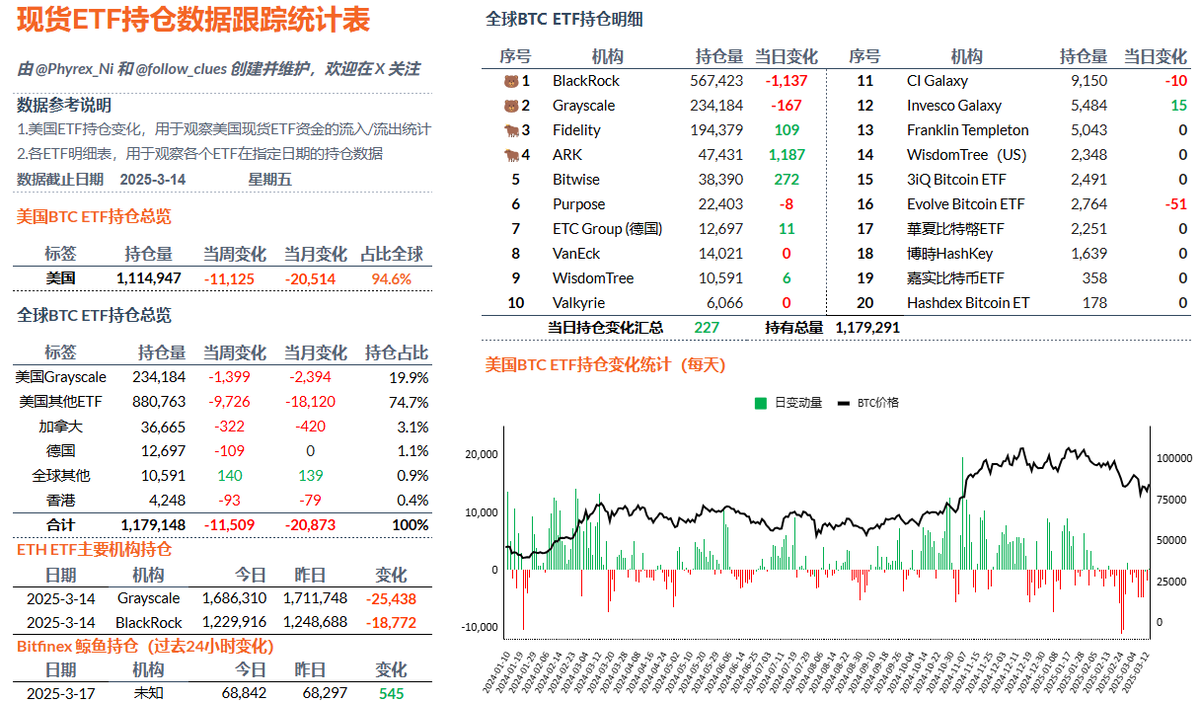

Last Friday, the long-awaited Bitcoin spot ETF saw positive inflows. Although it was just over 200 BTC, it is still a good sign. The largest buyer was Cathie Wood's ARK, which purchased nearly 1,200 BTC. However, the biggest seller remained BlackRock, with a selling volume not much lower than ARK's buying volume. Aside from BlackRock, the selling volume of U.S. ETFs was still quite low, with only GBTC selling 166 BTC.

Four institutions with spot ETFs experienced net inflows, indicating that prices have stabilized recently, and with potential market movements on the 20th, some investors began to buy. However, what specific data can be provided on the 20th is something even Powell might not know at this point.

From the weekly data perspective, the net outflow in week 61 is expected to increase by nearly 20% compared to week 60. Overall, investor sentiment remains unfriendly, with most investors being quite pessimistic about buying and not optimistic about the short-term future of BTC.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

Weekly data address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。