The SUI blockchain, developed by Mysten Labs—founded by former Meta engineers—is a layer one (L1) platform designed for fast, secure digital asset transactions using the Move programming language. SUI tokens facilitate network governance, staking, and transaction fees, with prices fluctuating between $2.25 and $2.30 following the filing announcement.

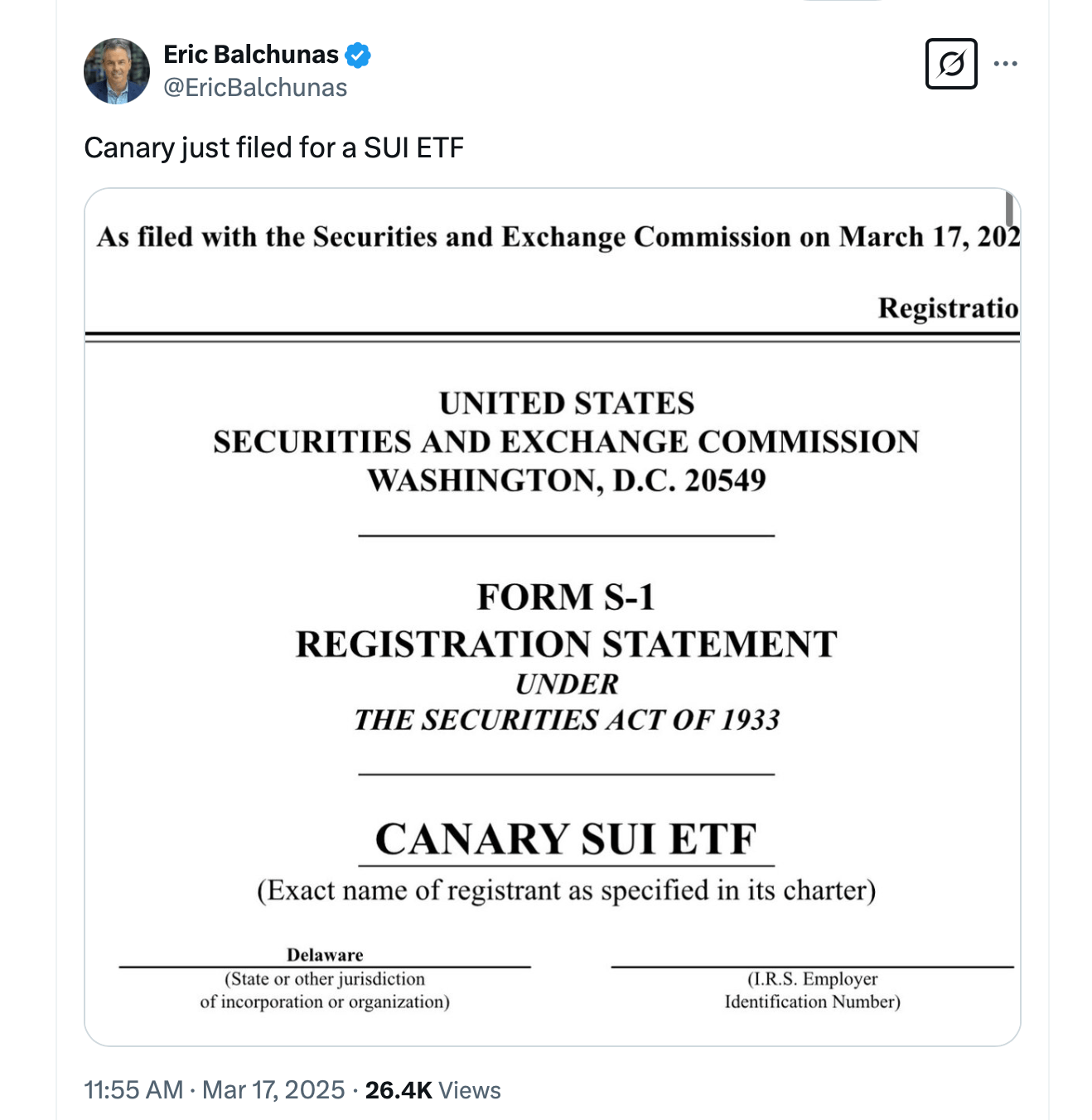

An ETF would allow investors to gain exposure to SUI’s price movements without directly holding the token. The filing includes an S-1 registration statement, a critical step in the SEC’s approval process. If greenlit, the ETF could enhance SUI’s liquidity and attract institutional capital, though approval timelines remain uncertain. Historical precedents, such as bitcoin and ethereum ETFs, suggest the process could take months.

Approval may partly hinge on SUI’s regulatory classification. While bitcoin ( BTC) and ethereum ( ETH) are treated as commodities, SUI’s status remains unclear. Analysts speculate its decentralized structure may align with commodity definitions, but the SEC has not ruled definitively on a wide array of tokens associated with new ETF filings in 2025.

The filing follows Canary Capital’s registration of a SUI ETF trust in Delaware on March 6, part of a broader push for altcoin ETFs. Competitors like Grayscale have pursued similar products, signaling rising institutional interest in crypto investment vehicles.

Despite bullish projections—including price targets up to $7—SUI faces hurdles. Market volatility and regulatory ambiguity could delay or derail approval. The SEC may require amendments to the filing, extending the review period. Stakeholders await further developments as the agency evaluates compliance and investor risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。