The DOGE led by Musk has not effectively played its role, and the U.S. government is heading towards an economic crisis due to debt.

Author: NOAH SMITH

Translated by: Tim, PANews

I know you all have many concerns about the Trump administration. Trump's tariff policies are causing stock market crashes and consumer confidence to plummet. To appease Putin, Trump has betrayed European allies. Musk's Department of Government Efficiency is recklessly targeting U.S. government agencies in an attempt to eradicate leftist ideology. Meanwhile, Trump is significantly expanding presidential powers, trying to imprison opponents and deport illegal immigrants.

But unfortunately, I have to give you one more thing to worry about, because this issue is indeed crucial. With the current scale of national debt becoming increasingly unsustainable, Trump and his Republican Party are planning to significantly increase borrowing.

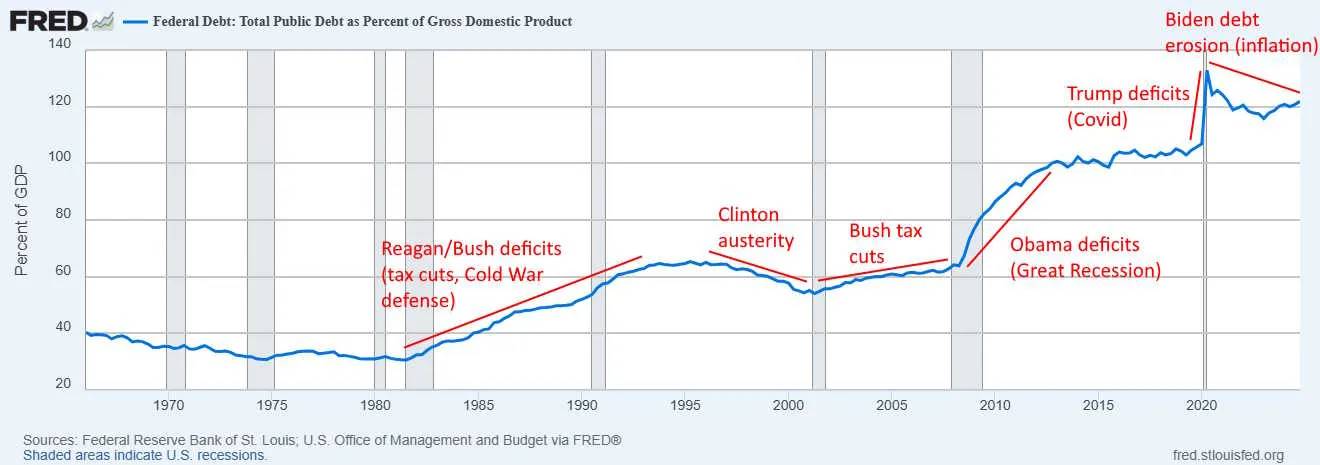

Before I explain why this crisis is so urgent, an important note: most of the responsibility for the existing debt problem does not lie with Trump; both the Democrats and Republicans share almost equal blame. Here is a brief history of the rise in U.S. federal government debt since 1980.

You can see that the growth of U.S. national debt is mainly concentrated in three significant jumps: the first occurred during the Reagan and George H.W. Bush administrations in the 1980s and early 1990s, the second during the Obama administration in response to the Great Recession (subprime mortgage crisis), and the third during Trump's first term amid the COVID-19 pandemic. Overall, the long-term rise in U.S. government debt can be attributed to two main reasons:

Major challenges that the U.S. government has borrowed to address (Cold War, Great Recession, and COVID-19)

Republican administrations cutting taxes without reducing spending

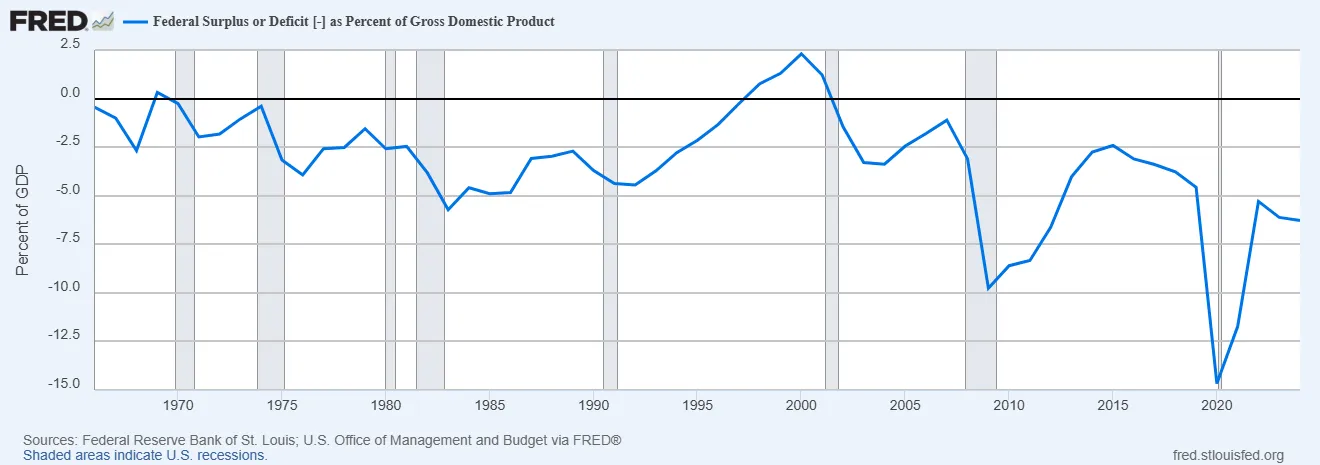

In the 1990s and early 2000s, the Democrats were the more fiscally responsible party, but this pattern was broken during the Biden administration. The federal debt burden decreased during Biden's term, but this was merely due to soaring inflation. Biden has engaged in massive spending: first with the pandemic relief plan, then with student loan forgiveness and healthcare subsidies. Although pandemic relief spending has ended, other expenditures continue, and Biden has not even attempted to cover these costs through tax increases. As a result, even as the U.S. economy strongly recovers and the threat of COVID-19 diminishes, Biden continues to borrow at an unprecedented rate not seen in non-pandemic or economic recession periods:

This is clearly very unwise. From 2021 to 2022, I was insufficiently concerned about the debt issue for three reasons: A) Inflation was eroding the value of debt B) I expected interest rates to decline C) I believed that government deficits would be controlled after pandemic relief spending ended. Most concerning is that the core philosophy of the Democratic Party's fiscal policy has undergone a significant shift: they have transformed from a party advocating for tax increases to one promoting unfunded spending plans. It was only later that I began to realize the severity of the problem and started calling for the government to implement fiscal tightening policies.

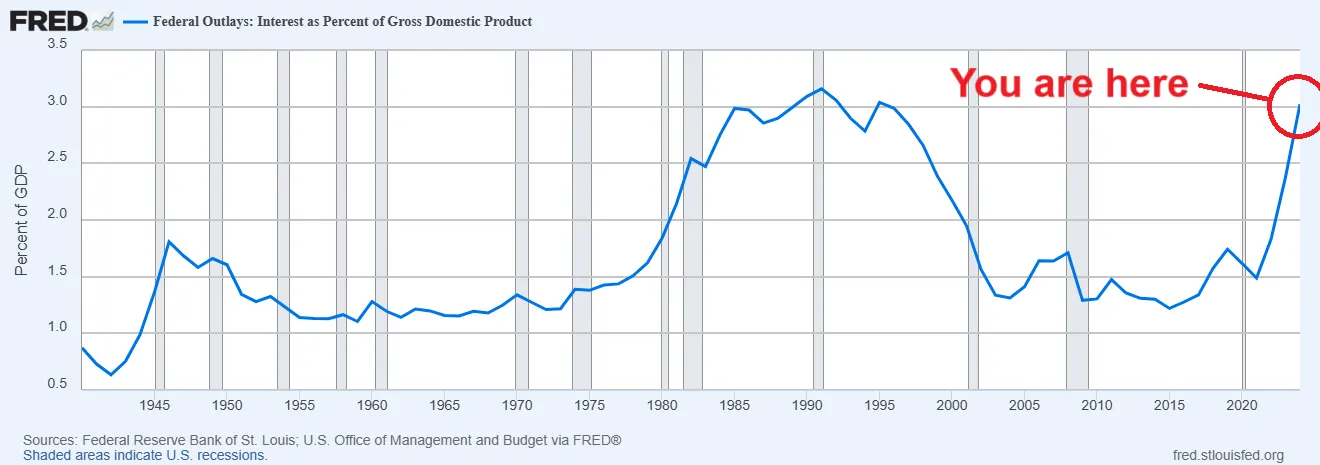

But as the chart at the top of this article shows, rising interest rates are the direct reason for the current debt problem becoming prominent. As the scale of bonds issued by the government continues to grow, these debts are forced to refinance at higher interest rates, leading to a sharp increase in the proportion of interest costs relative to GDP. This proportion of interest expenditures is about to break the historical record set in the early 1990s.

This is already bad enough. But the bigger problem is that the Republican Party is preparing for massive tax cuts, which will exacerbate the issue—while Musk's Department of Government Efficiency (DOGE) has not taken any effective measures to control spending. The Democrats have become fiscally irresponsible, and more incredibly, the Republicans have not only failed to implement fiscal tightening to address the problem but have become even more extravagant. As a result, the U.S. economy is heading towards trouble.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。