Source: Cointelegraph Original: "{title}"

On March 17, as the momentum for cryptocurrency acceptance in the mainstream market continues to grow, Solana (SOL) futures were traded for the first time on the U.S. derivatives exchange of the Chicago Mercantile Exchange (CME) Group.

In February of this year, CME announced plans to launch two types of Solana futures contracts: one is a standard contract representing 500 SOL, and the other is a "micro" contract aimed at retail investors, with each representing 25 SOL.

Following the launch of related products by Coinbase in February, these contracts became the first regulated Solana futures to enter the U.S. market. These contracts are cash-settled rather than settled in physical SOL.

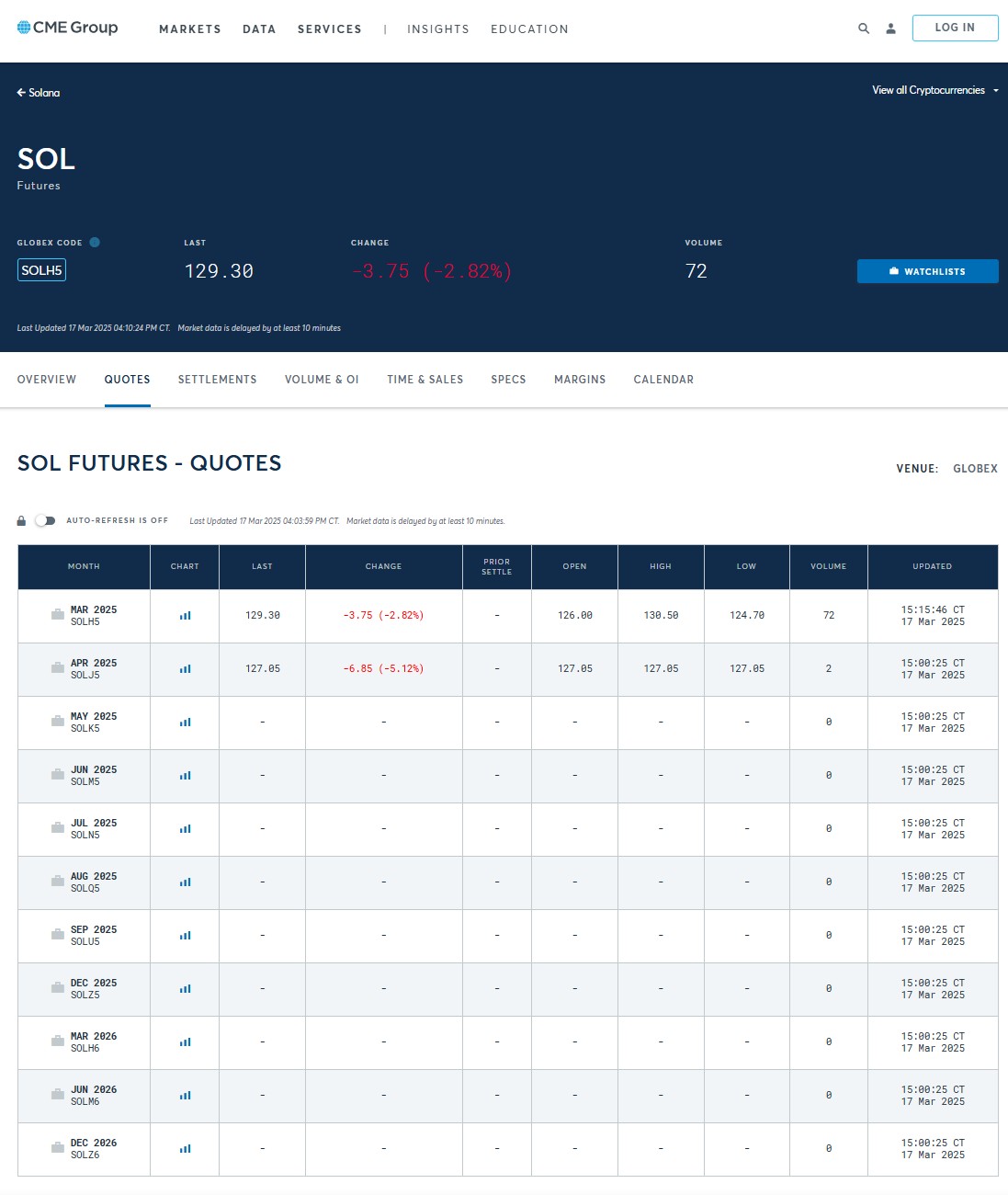

According to preliminary data from the CME website, on the first trading day of the contracts on March 17, nearly 40,000 SOL (approximately $5 million at current prices) in nominal value of Solana futures changed hands on the exchange.

Early pricing data suggests that traders may hold a bearish sentiment towards SOL. CME will not release the final daily trading volume data until the next business day.

CME's data shows that the trading price for Solana futures contracts expiring in April is $127 per SOL, which is $2 lower than the contracts expiring in March.

Trading firms FalconX and StoneX reported that on March 16, they completed the first-ever Solana futures trade on CME.

Chris Chung, founder of the Solana-based trading platform Titan, told Cointelegraph on March 17: "Solana has made significant progress over the past five years."

Chung stated, "With Solana futures launching today on CME, a Solana (exchange-traded fund) ETF will surely follow soon."

CME launched Solana futures on March 17. Source: CME

Possibility of ETF Approval

On March 13, Chung told Cointelegraph that he expects the U.S. Securities and Exchange Commission (SEC) to potentially approve the spot ETF applications for Solana submitted by asset management firms VanEck and Canary Capital as early as May.

At least five ETF issuers have submitted applications to the SEC for listing a Solana spot ETF. The regulatory agency must make a final decision on these applications by October 2025.

Bloomberg Intelligence estimates that the likelihood of Solana ETF approval is about 70%.

Futures contracts are standardized agreements to buy or sell an underlying asset at a future date.

Retail and institutional investors typically use futures for hedging and speculation. Futures play a crucial supporting role for cryptocurrency spot ETFs, as regulated futures markets provide a stable benchmark for measuring the performance of digital assets.

CME has launched futures contracts for Bitcoin (BTC) and Ethereum (ETH). Last year, U.S. regulators approved ETFs for both of these cryptocurrencies.

Related: Executives: Solana CME futures signal imminent approval of U.S. ETF

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。