Article Author: Andrew Singer

Article Compilation: Block unicorn

A few years ago, many in the crypto community described Bitcoin as a "safe-haven" asset. Today, fewer and fewer people refer to it that way.

Safe-haven assets retain or increase their value during times of economic stress. They can include government bonds, currencies like the dollar, commodities like gold, or even blue-chip stocks.

The global tariff war initiated by the U.S. and unsettling economic reports have led to a stock market crash, and Bitcoin has followed suit—something that should not happen to a "safe-haven" asset.

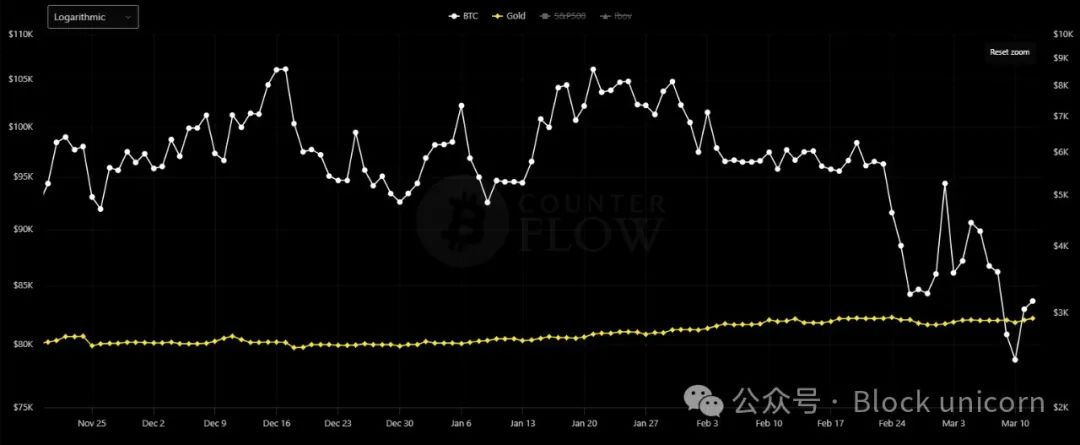

Compared to gold, Bitcoin has also underperformed. "Since January 1, gold prices have risen by +10%, while Bitcoin has fallen by -10%," noted the Kobeissi Letter on March 3. "Cryptocurrencies are no longer seen as safe-haven tools." (Bitcoin's decline was even greater last week.)

However, some market observers say this is not entirely unexpected.

Price charts of Bitcoin (white) and gold (yellow) from December 1 to March 13. Source: Bitcoin Counter Flow

Was Bitcoin Ever a Safe-Haven Asset?

"I never viewed Bitcoin as a 'safe-haven asset,'" Paul Schatz, founder and president of financial consulting firm Heritage Capital, told us. "Bitcoin's volatility is too great to classify it as a safe haven, although I do believe investors can and should allocate to this asset class overall."

"For me, Bitcoin is still a speculative tool, not a safe-haven asset," Jochen Stanzl, chief market analyst at CMC Markets (Germany), told us. "Safe-haven investments like gold have intrinsic value and will never go to zero. Bitcoin could drop 80% in a major correction. I don't think gold would do that."

Cryptocurrencies, including Bitcoin, "have never been a 'safe-haven tool' in my view," said Buvaneshwaran Venugopal, assistant professor of finance at the University of Central Florida.

But things are not always as clear as they initially seem, especially when it comes to cryptocurrencies.

One might think there are different types of safe-haven assets: one suitable for geopolitical events like wars, pandemics, and economic recessions, and another for strictly financial events like bank failures or a weakening dollar.

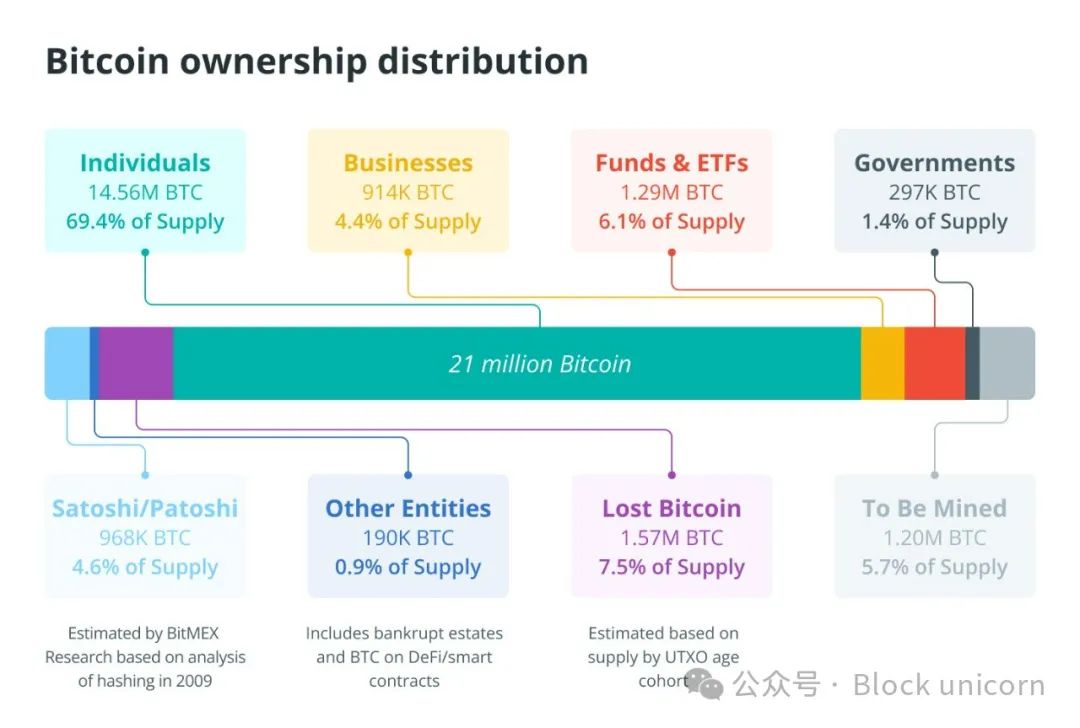

Perceptions of Bitcoin may be changing. In 2024, exchange-traded funds (ETFs) issued by major asset management firms like BlackRock and Fidelity will include it, broadening its ownership base but also potentially altering its "narrative."

Now, it is more widely viewed as a speculative or "risk-on" asset, similar to tech stocks.

"Bitcoin and the entire cryptocurrency market have become highly correlated with risk assets, and they often exhibit inverse volatility with safe-haven assets like gold," Adam Kobeissi, editor of the Kobeissi Letter, told us.

He continued, stating that with "more institutional participation and leverage," there is significant uncertainty about Bitcoin's future, and "the narrative has shifted from Bitcoin being seen as 'digital gold' to a more speculative asset."

One might think that the acceptance of Bitcoin by traditional financial giants like BlackRock and Fidelity would make its future more secure, enhancing its safe-haven narrative—but according to Venugopal, this is not the case:

"The influx of large companies into Bitcoin does not mean it becomes safer. In fact, it means Bitcoin is becoming more like any other asset that institutional investors prefer to invest in."

Venugopal continued, stating that it will be more influenced by conventional trading and withdrawal strategies used by institutional investors. "If anything, Bitcoin is now more correlated with risk assets in the market."

The Dual Nature of Bitcoin

Few deny that Bitcoin and other cryptocurrencies are still subject to significant price volatility, recently driven by increased retail adoption of cryptocurrencies, particularly fueled by the meme coin craze, "one of the largest cryptocurrency entry events in history," noted Kobeissi. But perhaps this is the wrong focus.

"Safe-haven assets are always long-term assets, meaning short-term volatility is not a characteristic factor," Noelle Acheson, author of Crypto is Macro Now, told us.

The biggest question is whether Bitcoin can maintain its value against fiat currencies in the long term, and it has been able to do so. "The data proves its effectiveness—over almost any four-year time frame, Bitcoin has outperformed gold and U.S. stocks," Acheson said, adding:

"Bitcoin has always had two key narratives: it is a short-term risk asset sensitive to liquidity expectations and overall sentiment. It is also a long-term store of value. It can be both, as we have seen."

Another possibility is that Bitcoin may serve as a safe-haven asset for certain events but not for others.

Gold can act as a hedge against geopolitical issues (like trade wars), while both Bitcoin and gold can serve as hedges against inflation. "Thus, both are useful hedging tools in a portfolio," Kendrick added.

Others, including Cathie Wood of Ark Investment, also agree that Bitcoin acted as a safe-haven asset during the bank runs of SVB and Signature Bank in March 2023. According to CoinGecko data, when SVB collapsed on March 10, 2023, Bitcoin's price was around $20,200. A week later, it was close to $27,400, up about 35%.

Bitcoin's price fell on March 10 and rebounded a week later. Source: CoinGecko

Schatz does not consider Bitcoin a tool for hedging inflation. Events in 2022, when FTX and other crypto companies collapsed, marking the start of the crypto winter, "greatly undermined that argument."

Perhaps it is a tool for hedging against the dollar and government bonds? "That's possible, but those scenarios are quite bleak and hard to imagine," Schatz added.

Don't Overreact

Kobeissi agrees that short-term volatility in asset classes "often has minimal correlation over the long term." Despite the current pullback, many fundamentals for Bitcoin remain positive: supportive U.S. government policies for crypto, announcements of U.S. Bitcoin reserves, and a surge in cryptocurrency adoption.

The biggest question facing market participants is: "What is the next major catalyst for a rally?" Kobeissi told us. "That's why the market is pulling back and consolidating: looking for the next major catalyst."

"Since macro investors began viewing Bitcoin as a high-volatility, liquidity-sensitive risk asset, it has behaved like a risk asset," Acheson added. Furthermore, "it is almost always short-term traders who set the final price, and if they are exiting risk assets, we will see Bitcoin weaken."

The market as a whole is struggling. "The re-emergence of the inflation ghost and economic slowdown has severely impacted expectations," which has also affected Bitcoin's price. Acheson further noted:

"Given this outlook, and Bitcoin's dual nature as a risk asset and long-term safe-haven asset, I am surprised it hasn't fallen further."

Venugopal stated that since 2017, Bitcoin has not been a short-term hedge or safe-haven asset. As for the long-term argument that Bitcoin is digital gold due to its supply cap of 21 million, this only holds if "most investors collectively expect Bitcoin to appreciate over time," which "may or may not be the case."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。