Source: Cointelegraph Original: "{title}"

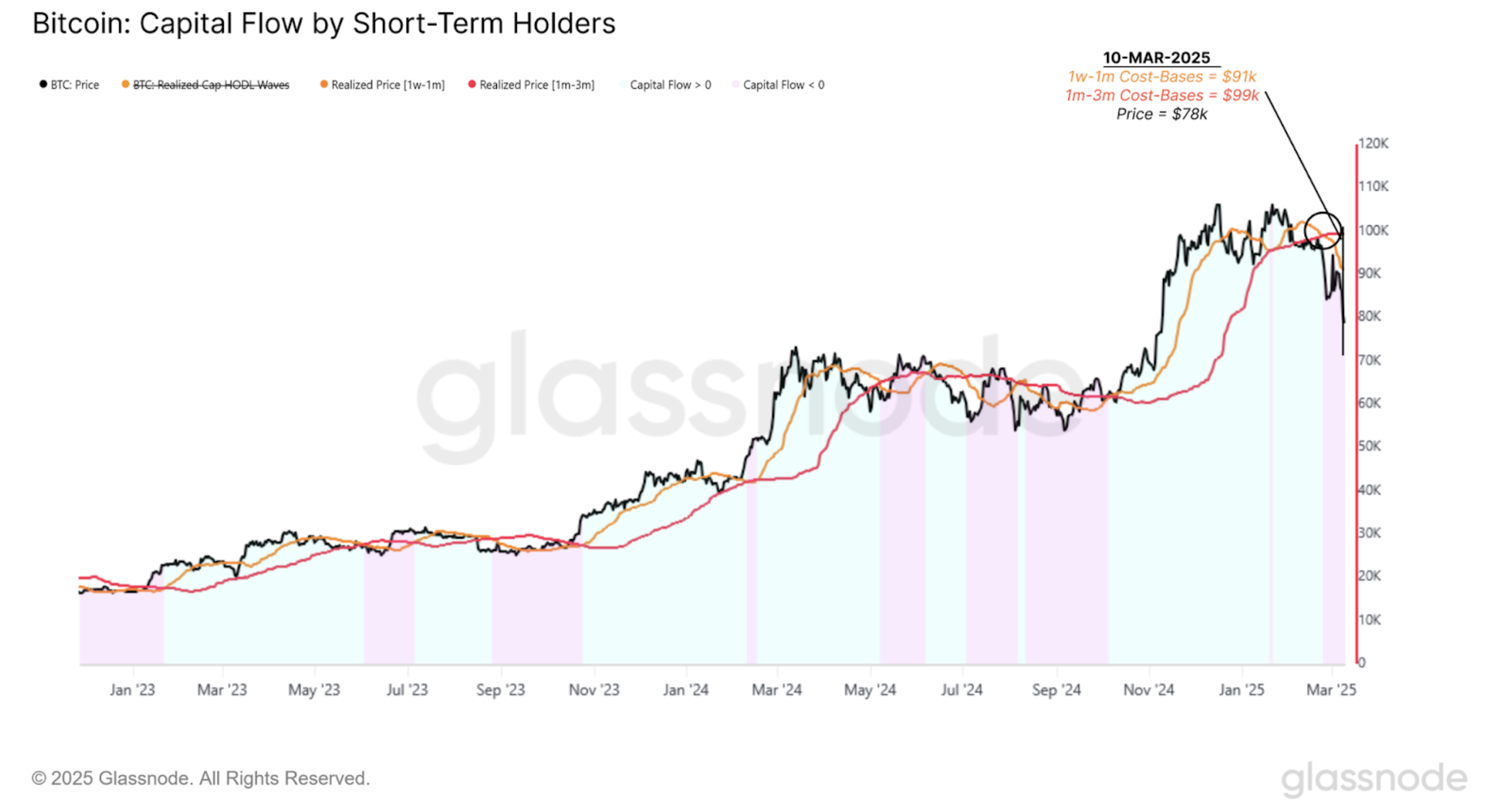

Analysts at the cryptocurrency exchange Bitfinex have stated that Bitcoin (BTC) has experienced the second-largest pullback in this bull market. From the historical high of $109,590 reached on January 20, to the low of $77,041 during the week of March 9 to 15, this pullback amounted to 30%, triggered by selling pressure from short-term holders.

In its report, Bitfinex defines short-term holders as those who bought Bitcoin within the past 7 to 30 days. According to the exchange, these short-term holders have suffered unrealized net losses and are often more likely to opt for capitulatory selling.

Bitfinex noted that Bitcoin exchange-traded funds (ETFs) have seen continued outflows, with approximately $920 million flowing out during the week of March 9 to 15, indicating that institutional buyers have not yet had enough strength to return and counter the selling pressure.

Capital flow of short-term Bitcoin holders. Source: Glassnode/Bitfinex

Bitcoin is currently trading at around $84,357, having rebounded 9.5% from its low. According to Bitfinex, a key factor moving forward will be whether institutional demand will recover at these lower price levels, which could lead to the absorption of Bitcoin supply and price stabilization.

Bitfinex analysts told Cointelegraph: “While the flow of institutional funds and the macroeconomic situation are crucial for the mid-term market direction, statistically, a 30% drop often marks a low point before continuing to rise. If Bitcoin stabilizes around this level, historical experience suggests that a strong rebound may follow.”

$5.4 billion has flowed out of Bitcoin ETPs in five weeks

Weekly outflows from cryptocurrency exchange-traded products (ETPs) have now occurred for five consecutive weeks, totaling $6.4 billion as of March 14. According to CoinShares, Bitcoin ETPs have borne the brunt of the outflows, losing $5.4 billion.

Bitfinex believes that the current macroeconomic environment may be putting pressure on the market. U.S. consumer confidence has fallen to its lowest level in two years, and the market expects inflation to rise amid economic uncertainty. On March 4, a model from the Federal Reserve predicted that the U.S. economy would shrink by 2.8% in the first quarter of 2025.

Meanwhile, discussions about trade wars continue to dominate the headlines, calling into question Bitcoin's status as a safe-haven asset and keeping miners on alert. Despite the White House recently announcing the U.S. Bitcoin strategic reserve and digital asset reserve plan, this may still pose risks to the bull market.

Related: From derivatives indicators, Bitcoin has a chance to return to $90,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。