The Converge network is designed specifically for TradFi, supporting on-chain interactions through iUSDe, USDe, and Securitize-supported assets.

Author: Ethena Labs

Compiled by: Deep Tide TechFlow

We proudly introduce Converge on Chain, a settlement network for traditional finance and digital dollars supported by @ethena_labs and @Securitize. Our goal is to provide the first purpose-built settlement layer that deeply integrates traditional finance (TradFi) with decentralized finance (DeFi), centered around USDe and USDtb stablecoins, secured by the ENA token.

We believe there are two core application scenarios for blockchain:

Settlement of permissionless spot and leveraged DeFi speculation.

Storage and settlement of stablecoins and tokenized assets.

While speculation remains an important part of the crypto industry, we see a broader and relatively less competitive opportunity to dominate the second scenario over the next decade.

To this end, Ethena and Securitize have emerged.

We firmly believe that the biggest theme of this cycle and the coming years will be the large-scale entry of institutional capital.

Currently, the total value locked (TVL) in DeFi is about $100 billion, which is still insignificant compared to global capital markets.

The lack of infrastructure specifically designed for large-scale capital pools is one of the main barriers preventing traditional finance from entering the crypto space.

The unique advantages of Ethena and Securitize position them at the forefront of capturing this opportunity.

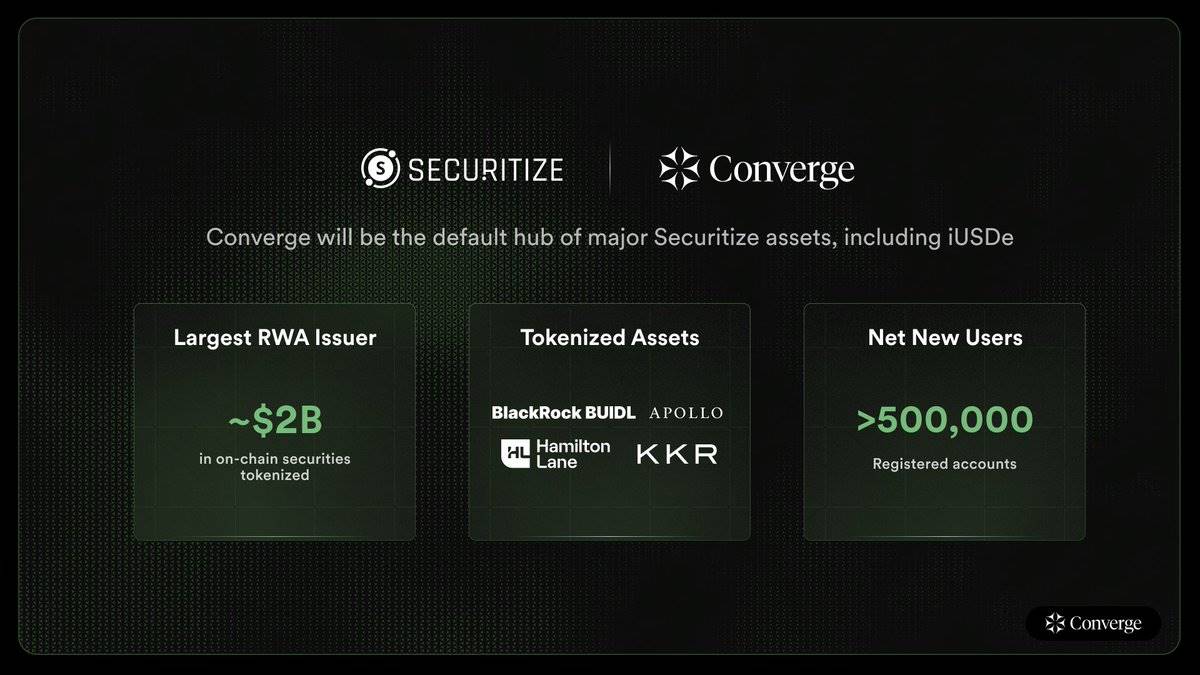

Securitize is a market leader in tokenized products, having issued approximately $2 billion in securities on-chain, including the Blackrock BUIDL fund and funds from Apollo, Hamilton Lane, and KKR, with over 500,000 user accounts.

Notably, Securitize will serve as the core issuance layer for future tokenized assets on the Converge network. This deployment will not be limited to tokenized government bond products and funds but will expand to cover securities across all asset classes.

This initiative further deepens our partnership with Securitize—Securitize is also a partner of USDtb, the stablecoin supported by Blackrock BUIDL.

Ethena is one of the most influential protocols on-chain, with its core products USDe, USDtb, and iUSDe being natively issued on Converge, aimed at providing a format for interactive crypto assets for traditional finance.

These native crypto assets and foundational components will be exported to traditional finance (TradFi) in a proprietary format, enabling underwriting and interaction, thus bringing billions of dollars in new capital inflows on-chain.

As one of the most influential protocols on-chain, Ethena has achieved deep integration with almost all major DeFi protocols and most centralized trading platforms. While existing applications based on USDe have already seen significant success, there remains vast design space on-chain for building new financial building blocks based on USDe.

The US dollar remains the structural core of capital flows on-chain, whether for settlement, payments, or core DeFi scenarios such as trading, lending, derivatives, and leverage.

Every DeFi protocol related to the US dollar today can be redesigned around Ethena, achieving natural optimization in economic structure.

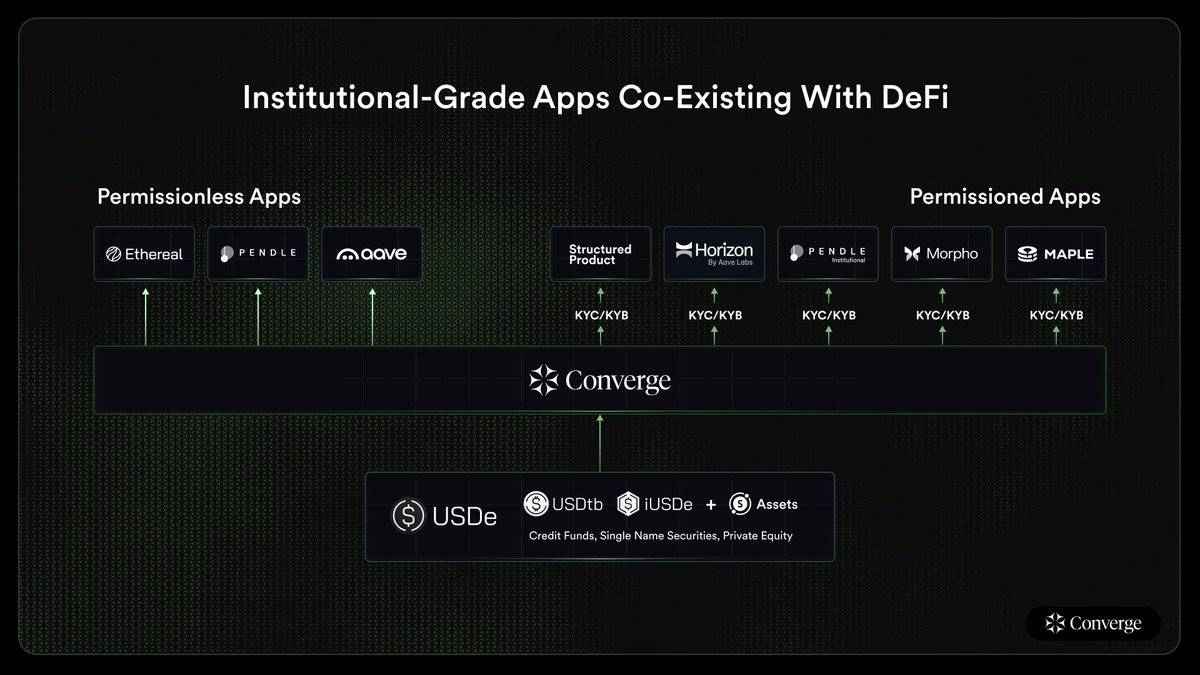

The Converge network is designed for traditional finance (TradFi), supporting on-chain interactions through iUSDe, USDe, and Securitize-supported assets. Currently, five top protocols have committed to building and distributing institutional-grade DeFi products on Converge, driving institutional capital into the on-chain ecosystem:

Horizon by Aave Labs: Creating a dedicated market for Securitize tokenized assets (including Ethena's institutional-grade iUSDe), connecting TradFi with DeFi.

@Pendle_fi Institutional: Providing infrastructure for interest rate speculation, creating scalable institutional opportunities for assets like iUSDe.

@MorphoLabs is building a modular money market to support Ethena and Securitize's assets.

@maplefinance / @syrupfi: Developing verifiable on-chain institutional yield and credit products based on USDe and real-world assets (RWAs).

@etherealdex provides high-performance derivatives and spot trading for Ethena liquidity, using USDe as collateral.

We look forward to closely collaborating with these top partners to build cutting-edge products that pave the way for institutional capital's entry into the on-chain space.

This is the first time traditional finance and internet finance coexist in the same execution environment, and they will work together on-chain to usher in a new era of finance.

In addition to a range of permissioned applications, Converge will also facilitate permissionless on-chain finance within the same block space.

The ecosystem will operate with three unique pillars in parallel:

- Completely permissionless user access

Users can access the DeFi ecosystem and applications built on USDe without barriers, which have already validated their market demand. At the same time, Ethena supports and accelerates the growth of innovative projects like Ethereal DEX.

- Permissioned applications: Providing compliant interactions for TradFi

Traditional financial institutions can interact with counterparties that have completed KYC through permissioned applications, using assets like Ethena's iUSDe and USDtb. These applications are specifically designed for TradFi, aiming to meet their needs for compliance and transparency.

- New permissioned financial applications based on Securitize tokenized assets

Building new financial scenarios, including leveraged operations based on credit and fixed-income assets, as well as trading single stocks through spot or perpetual swaps. These applications will further expand the depth and breadth of on-chain financial products.

Converge will launch a high-performance EVM network compatible with the Ethereum mainnet, providing developers with a development experience comparable to that of the Ethereum mainnet.

Ethena and Securitize plan to release more detailed information about the tech stack and developer documentation in the coming weeks, followed by the launch of an official developer testnet.

The mainnet is expected to go live in Q2 2025.

We sincerely invite developers to join us in building products that can attract institutional capital into the crypto space while exporting unique crypto primitives to traditional finance.

From day one, the Converge network will integrate major infrastructure providers and development tools, including @LayerZeroCore (providing cross-chain interoperability support for Ethena assets), @PythNetwork, @wormhole, and @redstonedefi have all committed to providing support. @Anchorage, @CopperHQ, @FireblocksHQ, @KomainuCustody, and @ZodiaCustody will provide institutional-grade custody services and key management for @convergeonchain.

USDe, USDtb, and sENA will become the core assets of the network.

The Converge network will be built by a group of permissioned institutional validators, who will need to stake ENA tokens to ensure the security of the network.

At the same time, USDe and USDtb will serve as the native fuel (gas token) of the network, allowing users to complete transactions with lower friction costs.

It’s time to embrace the era of convergence!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。