What Can Binance Wallet's Generous Fee Waiver Bring?

Written by: ChandlerZ, Foresight News

On March 17, Binance Wallet announced a six-month zero-fee trading event, applicable to all trading pairs within Binance Wallet. The event will last until September 17, 2025, at 16:00. During the event, all transactions completed through the exchange and cross-chain bridge functions in Binance Wallet or the quick purchase feature of Binance Alpha will be exempt from trading fees, but users will still need to pay network gas fees. Additionally, transactions conducted through third-party dApps are not included in the event.

According to the market page on Binance's main site, a new Alpha section has been added, allowing users to purchase BNB Chain and Ethereum chain assets with USDT, and Solana and Base chain assets with USDC, with no other purchasing methods currently available.

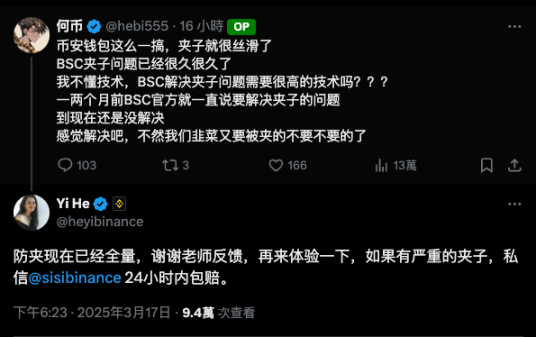

Furthermore, in response to the community's long-standing "sandwich" issue troubling users in the BSC ecosystem, Binance co-founder He Yi also replied on social media, stating, "Anti-sandwich measures have now been fully launched on BNB Chain, and if there are serious sandwich attacks, we will compensate within 24 hours."

BSC Ecosystem Tokens Surge

With the new excitement, the market reacted quickly and strongly. Among them, BSC ecosystem tokens surged, with the leading meme token MUBARAK on BNB Chain's market cap surpassing $200 million, reaching an all-time high, currently priced at 0.21 USDT.

BNX saw a 24-hour increase of 12.93%, currently priced at $1.7852; CAKE had a 24-hour increase of 23.98%, currently priced at $2.51; 1000Chems increased by 30.4% in 24 hours, currently priced at $0.0013; BAKE increased by 1.46% in 24 hours, currently priced at $0.1327;

In addition, the Binance Alpha section also experienced varying degrees of increase, with BMT rising 121.74% in 24 hours, currently priced at $0.20; JELLYJELLY increased by 40.28% in 24 hours, currently priced at $0.02; AVL rose by 4.64% in 24 hours, currently priced at $0.4496.

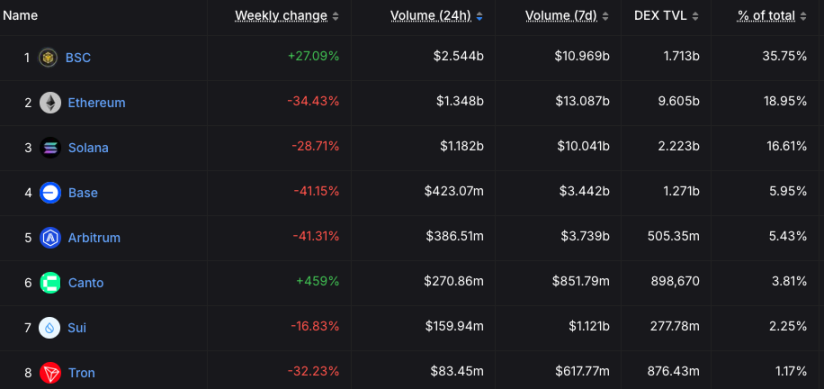

According to DeFiLlama data, the trading volume of BSC ecosystem DEX reached $2.544 billion in the past 24 hours, surpassing Solana to rank first, with a weekly growth of 27.09%. Additionally, PancakeSwap, the main DEX in the BSC ecosystem, became the DEX protocol with the highest trading volume in the past 24 hours, reflecting the market's positive expectations for the new BSC ecosystem, with funds flowing back into the BSC ecosystem.

Three-Pronged Approach Aimed at Revitalizing BNB Chain

As competition among Layer 1 public chains intensifies, the BSC ecosystem faces strong competition from Solana, Ethereum, and emerging public chains like Base. Data shows that BSC has previously seen declines in total DeFi TVL and daily trading volume. Additionally, issues like "sandwich trading" have long troubled BSC users, affecting user experience and ecosystem development. Recently, Binance has frequently appeared in public and actively showcased investment actions, such as purchasing 1 BNB of the mubarak token with its personal wallet. This series of actions symbolically guides market expectations and user enthusiasm, strategically promoting ecosystem recovery.

Binance has recently launched a series of strategies, with a three-pronged approach aimed at deeply revitalizing the BNB Chain ecosystem.

On one hand, the six-month zero-fee policy launched by Binance Wallet aims to activate user engagement in on-chain trading and increase capital circulation. In the interim while OKX Wallet temporarily suspends DEX aggregator services, the liquidity strategy targeting the BNB Chain ecosystem may bring positive market effects, promoting sustained increases in overall ecosystem activity.

On the other hand, to address the long-standing trading experience issues in the BNB Chain ecosystem, especially "sandwich trading," Binance has designed and implemented an "anti-sandwich full coverage + 24-hour compensation" mechanism. The core of this strategy is to strengthen the security guarantees for user transactions, reducing the psychological burden users face regarding trading risks, thereby rebuilding trust between users and the ecosystem.

It is noteworthy that the launch of the Binance Alpha asset section further broadens the channels for capital to enter the on-chain ecosystem. Centralized exchange users can directly invest in small-cap tokens on-chain using stablecoins, greatly simplifying user asset management and trading steps, creating an efficient on-chain and off-chain capital cycle. This innovative mechanism can effectively strengthen the capital flow between Binance's main site and the on-chain ecosystem, thereby enhancing the on-chain ecosystem's ability to absorb liquidity resources, ultimately achieving internal capital circulation and resource allocation efficiency, promoting sustainable ecosystem development.

Is BSC Summer Returning or Just a Wave?

Although Binance has effectively activated the market in the short term through the above strategies, whether the Binance ecosystem can sustain healthy development in the long term still needs further verification. The excitement brought by mere liquidity catalysis and marketing effects often carries the risk of cyclical decay. Once the excitement gradually fades, if the ecosystem lacks solid fundamental support, investor sentiment may quickly cool.

From the community and governance perspective, Binance has temporarily lowered user thresholds through innovative policies to boost user activity, but the long-term resilience and vitality of the ecosystem depend more on sustainable governance structures and community consensus. The possibility of a "BSC Summer" return ultimately requires Binance to shift from short-term marketing and liquidity orientation to more solid community governance, economic model iteration, and technological innovation in its long-term strategic layout. Whether the short-term excitement can be transformed into long-term ecological value will become an important topic for Binance's next phase of strategic planning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。