Author: Weilin, PANews

Recently, ARK Invest has been active in adjusting its holdings in crypto companies: on March 10, it purchased 52,753 shares of Coinbase stock (worth $9.4 million) through the ARKK fund and 11,605 shares of Coinbase stock (worth $2.1 million) through the ARKF fund. On March 14, the company further increased its holdings in Coinbase stock worth approximately $5.2 million through the ARKK fund. In total, these three recent purchases of Coinbase amount to $16.7 million.

At the same time, it is noteworthy that ARK Invest has significantly reduced its holdings in the payment company Block, with reductions totaling approximately $30.35 million on March 11, March 12, and March 17.

Meanwhile, during this month's market fluctuations, it is memorable that on March 11, Bitcoin's price experienced a sharp decline, but ARK Invest founder Cathie Wood's bullish comments at that time attracted widespread attention in the market. This company, which manages $6 billion in assets, stated in a report to investors that ARK Invest remains optimistic about the long-term prospects of BTC. Why is ARK Invest so firmly bullish on Bitcoin?

Buying $16.7 million in Coinbase stock during a major decline in U.S. stocks, significantly reducing Block

On March 10, as Coinbase's stock price fell by 17.6%, ARK Invest purchased 64,358 shares of Coinbase stock, valued at $11.5 million. Specifically, the Ark Innovation ETF (ARKK) bought 52,753 shares of Coinbase stock (worth $9.4 million), and the Ark Fintech Innovation ETF (ARKF) bought 11,605 shares of Coinbase stock (worth $2.1 million). Additionally, according to trading documents, ARK Invest increased its holdings by 29,353 shares of Coinbase stock through its ARK Innovation ETF (ARKK) on March 13, valued at approximately $5.2 million, on a day when Coinbase's stock price fell by 7.43%, closing at $177.49. In total, these three recent purchases of Coinbase by ARK Invest amount to $16.7 million.

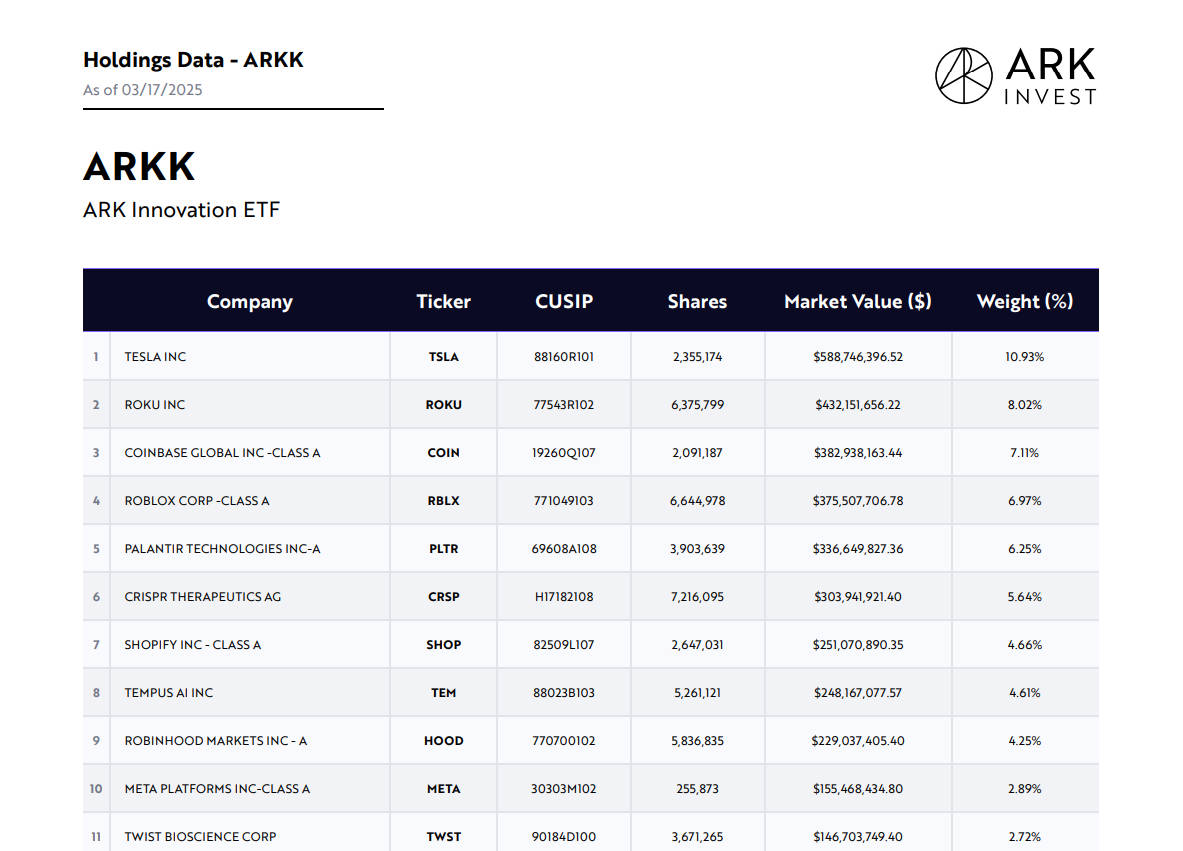

As of March 17, Coinbase stock is currently the third-largest holding in its ARKK fund, accounting for 7.11% of the portfolio, valued at approximately $383 million, second only to Tesla and Roku (an American streaming and network television company). ARK Invest previously stated that its goal is to ensure that no single stock holding exceeds 10% of the fund's portfolio.

As of March 17, Coinbase stock is the second-largest holding in the ARKF fund, accounting for 7.35% of the portfolio, valued at approximately $67.17 million, second only to Shopify. In the ARK Next Generation Internet ETF (ARKW), Coinbase ranks fifth, behind ARK BITCOIN ETF HOLDCO (ARKW), TESLA, Roku, and ROBLOX CORP, with a holding of approximately $86.55 million, accounting for 5.78%.

In terms of reductions, on March 17, ARKW sold 12,881 shares of Block stock. On March 12, Block announced that it would become the first company in North America to deploy NVIDIA DGX SuperPOD and DGX GB200 systems, marking significant progress in its open-source generative AI research, and predicted that its performance would improve significantly. CEO Jack Dorsey expects the system's computing power to increase by 30 times compared to current levels. However, Raymond James analyst John Davis believes that the company's fourth-quarter financial report was poor, indicating that Block stock "is not suitable for faint-hearted investors." The stock sold by ARK Invest on March 17 was priced at $58.65 per share, with a total transaction value of approximately $755,000. From March 11 to March 12, ARK Invest sold Block stock worth $29.6 million.

Why does ARK Invest maintain an optimistic long-term outlook on Bitcoin, which stands out during a major market decline?

In a recent report to investors, ARK Invest, which manages $6 billion in assets, remains optimistic about the long-term prospects of BTC. In the report, ARK Invest stated that Bitcoin is at an oversold level. Specifically, in February, Bitcoin's price fell by 17.6%, closing at $86,391 at the end of the month. As of March 3, Bitcoin's price was between the cost basis of short-term holders (STH) at $92,020 and the 200-day moving average at $82,005.

The Fear & Greed Index has reached an "extreme fear" level not seen since mid-2022. However, ARK Invest believes that the market is overreacting to the current macroeconomic and geopolitical sentiment, being overly pessimistic.

The Spent Output Profit Ratio (SOPR) of Bitcoin has fully retraced to 1. In a bull market, a SOPR of 1 indicates that the market is at a breakeven level, which usually coincides with local bottoms. SOPR tracks realized profits or losses and compares them to the relevant trading prices.

Additionally, Bitcoin's rolling four-year compound annual growth rate (CAGR) has dropped to a historical low of only 14%. While this has significant implications for Bitcoin as a long-term holding asset, a lower CAGR may also signal that Bitcoin is oversold.

Regarding the macro environment, ARK Invest stated that economic indicators (including a slowdown in money turnover growth and a decline in consumer confidence) indicate that businesses and households are becoming more cautious during this political transition. According to the University of Michigan Consumer Confidence Survey, consumer confidence has fallen below pre-election levels. Households seem to be becoming more cautious, delaying purchases until the impact of new policies becomes clear. Evidence of this cautious attitude includes a decline in real consumer spending in January and lower-than-expected performance guidance from companies like Walmart and Target.

Nearly one-third of the workforce, including federal, state, local, and quasi-government positions in education and healthcare, may be concerned about government spending cuts. Despite facing challenges in the short term, potential deregulation, tax cuts, and innovation incentives in areas like artificial intelligence (AI) and robotics may drive growth and enhance productivity over time. Researchers have previously predicted that the combination of AI and crypto technology could add $20 trillion to the global economy by 2030. Furthermore, ARK Invest previously stated in its “Big Ideas 2025” report that Bitcoin's price could range from $300,000 to $1.5 million by 2030, with a neutral expectation of $710,000.

In Cathie Wood's podcast "In the Know," she painted a bullish vision that technological innovation will drive real GDP growth to exceed historical growth rates by more than double, even as short-term economic indicators show signs of weakness. She stated, "We are nearing the end of a 'rolling recession,'" mentioning that she believes the economic recession has been unfolding since the Federal Reserve began raising interest rates in 2022. "The bad news is that we have to go through this process." A "rolling recession" refers to an economic phenomenon where different industries and sectors experience recessions in turn, while the overall economy and job market remain relatively stable.

She later stated on Twitter that the current crisis (the "process" she mentioned in her video) may open the door to a "deflationary boom" in the second half of 2025. Despite the current economic weakness, Cathie Wood seems to align with Trump's optimistic view of the future of the U.S. economy, especially with the rise of new technologies reshaping the economy. "We may be on the threshold of the most significant productivity growth in history," she said.

Cathie Wood discussed the fiscal policy proposals under the Trump administration, including the $4.5 trillion tax cut plan that has already passed the House Budget Committee. She believes that Trump's fiscal policies, combined with efforts to deregulate, could trigger a significant economic boom.

She noted the changes that have occurred in the cryptocurrency and digital asset space following the departure of SEC Chairman Gary Gensler, pointing out that the industry is celebrating a "digital asset revolution" at the White House.

For investors, Cathie Wood predicts that the market will shift from the "seven tech giants" to a broader range of innovative stocks. She pointed out that while the "seven tech" companies have seen their stock prices triple over the past five years, truly disruptive innovative stocks have only increased by about 30%.

Currently, ARK Invest's optimistic attitude towards Bitcoin and the U.S. economic outlook is not unfounded, as it has injected a dose of confidence into investors amid a generally negative market environment. However, the complexity of the market and the uncertainties in reality cannot be ignored. How to find growth momentum in the crypto and tech industries amidst these variables is worth contemplating.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。