Many people find stop-loss painful; cutting losses means a loss, while holding on still offers hope. But the reality is that the pain of stopping losses is temporary, while the pain of not stopping losses is permanent.

At first, it’s just a floating loss, and you comfort yourself: “Just wait a bit longer; it might bounce back.”

As the losses increase, you start thinking: “If it drops another 5%, I will definitely cut my losses.”

Then it really drops 5%, and you say: “It’s already dropped this much; I might as well hold on a bit longer.”

And then? If you don’t cut your losses, the market will do it for you, leading to a total loss, sparing you the trouble of stopping losses.

The fairest aspect of the market is that it won’t force you to stop losses, but it will definitely give you the punishment you deserve.

Hoping for luck will surely lead to failure!

There’s basically no need to review yesterday’s market situation, including our operations. Looking back now, it’s just a small range of fluctuations, with little market movement, and our long positions have not been entered. According to current discussions, the market seems to be waiting for the key results of the Federal Reserve's interest rate decision and Powell's remarks on the economic situation and future policies, so market funds are also choosing to adopt a wait-and-see attitude.

This week, the world will welcome a significant central bank week, with the Federal Reserve, Bank of Japan, Bank of England, and Swiss and Swedish central banks all adjusting interest rates. In particular, the Federal Reserve's upcoming interest rate policy will greatly influence the trend of the cryptocurrency market. Currently, the U.S. economy is slowly falling into a state of stagflation, and expectations of an economic recession are particularly important. Recent consumer confidence indices and the Atlanta Fed's GDP turning negative show that after experiencing constantly changing policies, consumers in the U.S. seem to be losing their purchasing power. To make matters worse, U.S. stocks have dropped by as much as 10% in the past two weeks, with the Nasdaq entering a technical adjustment, causing great panic among American residents regarding their wealth. Whether the Federal Reserve will release dovish expectations to save the market is what the market is most looking forward to!

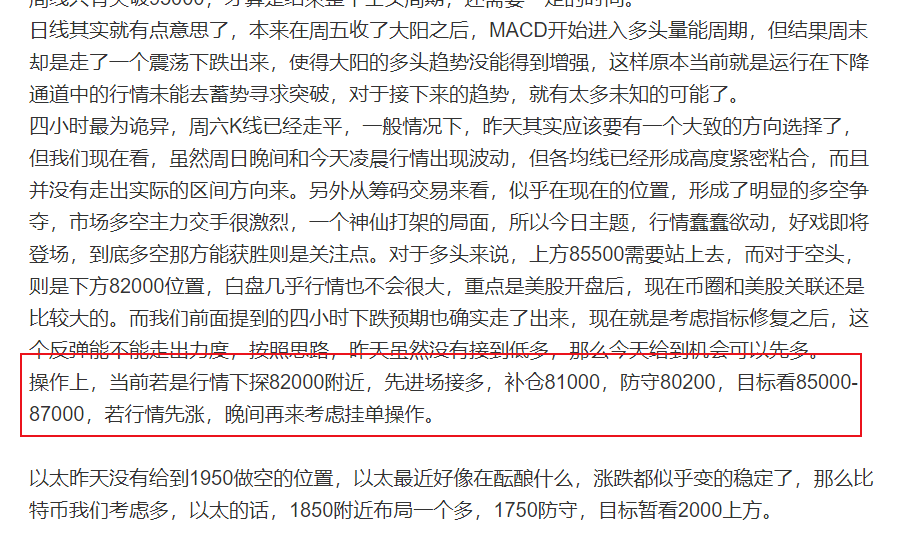

The market remains in a state of fluctuation, but it seems that some differences have occurred. Originally, in the four-hour timeframe, the bullish cycle failed to show strong performance and did not form an effective breakthrough, but is now under pressure and falling back. The anticipated bullish momentum is too weak. Technical indicators are once again showing signs of bearishness. On the moving averages, all the moving averages, which were tightly bound, are starting to turn downwards, and the MACD has entered the early stages of bearishness. Similarly, there likely won’t be much market fluctuation during the day; the focus remains on the evening session, especially since the recent performance of the cryptocurrency market and U.S. stocks seems to be more of a follow-the-drop rather than a follow-the-rise, which is somewhat fatal for the cryptocurrency market. Another interesting point is that the insider on Hypr, claiming to be a bearish whale, continues to openly increase short positions, currently holding over $500 million in short positions, with a leverage of 50X, and an average price of 83,567. If Bitcoin rises to 85,600 in the short term, it could trigger a liquidation, but it seems the sniper's action hasn’t arrived yet?

In terms of operations, yesterday’s long plan is paused. It is recommended to short first and then look to go long for a rebound. In the short term, a short position can be considered around 84,000, controlling the position; if more aggressive, a short can be laid out around 83,500, with 85,000 for adding to the position, 85,600 as a stop-loss, and a target of 81,000-79,000. For going long, consider positions around 78,400 and 77,000.

Ethereum is really uninteresting, with low volatility. For intraday shorts, consider around 1,940, targeting 1,800-1,700.

Currently, the altcoin market on the BSC chain is relatively hot due to CZ's involvement, but to be honest, I have a respectful caution towards the BSC chain. Some MEME projects are indeed experiencing significant losses, and the risks are still high. For those interested, a small investment in Jin Doge could be a decent idea; good luck! I am also researching and playing around with a little.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies. Feel free to contact and discuss the market.】

Scan to follow

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。