In March 2025, the competition intensity in the blockchain industry reached a new high. As the dual giants of smart contract platforms, Binance Smart Chain (BSC) and Solana (SOL) engaged in a hardcore showdown in terms of ecological expansion, technical performance, and market performance. BSC, backed by Binance's resource advantages, is steadily making progress; Solana, on the other hand, continues to seize opportunities with its ultra-high throughput and community-driven approach.

Technical Background: The Balancing Act of Efficiency and Decentralization

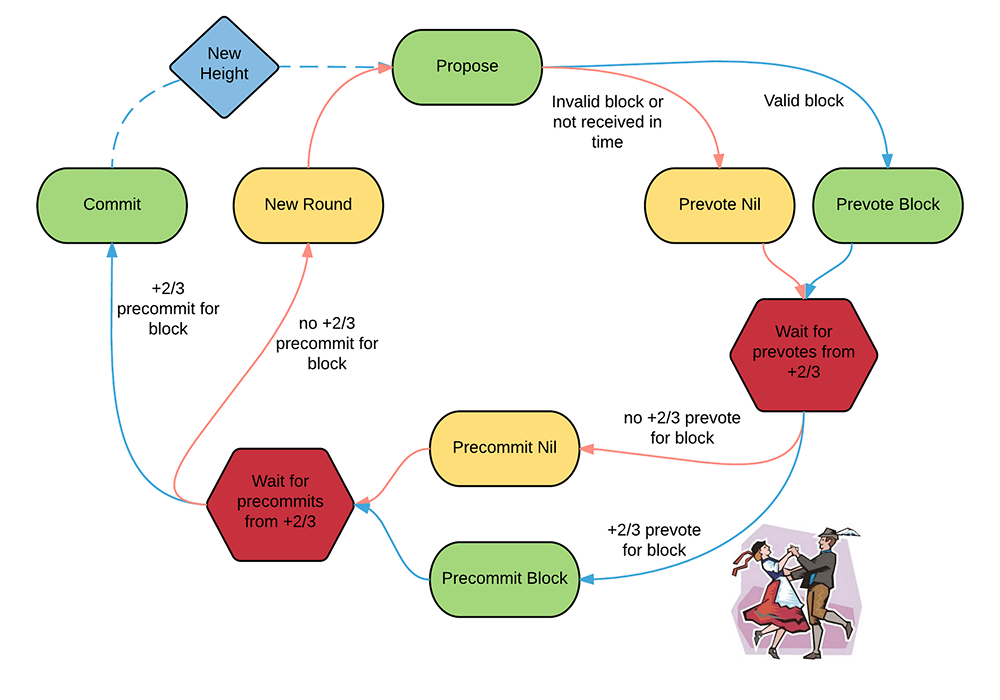

BSC's technical background remains synonymous with "high efficiency and low cost." Data from March 2025 shows that its average transaction fee stabilizes around $0.01, with a transaction processing capability (TPS) maintained at around 200 transactions per second. This is thanks to its Tendermint consensus mechanism, which achieves rapid confirmation through 21 validator nodes. However, this centralized design has been frequently scrutinized this year. Information across the network indicates that BSC's front-running issue remains a hot topic in the community, and even with the implementation of anti-front-running mechanisms, traders still struggle to escape the fate of being "eaten" by others. More critically, BSC's capacity to support large-scale liquidity seems to have hit a ceiling, showing some strain in high-frequency trading scenarios.

In contrast, Solana's label as a "performance monster" remains dazzling. Data from March shows its theoretical TPS reaching as high as 65,000; although it has not reached peak performance in actual applications, it has performed impressively in DeFi and meme coin trading, with median transaction fees as low as 0.00064 SOL (approximately $0.0001). Behind this is a combination of Proof of History (PoH) and Proof of Stake (PoS), along with the number of validator nodes increasing to about 2,000, significantly enhancing its level of decentralization. However, Solana is not without flaws, as cases of node malfeasance have risen in early 2025, increasing the complexity of network coordination.

The technical routes of the two are clearly differentiated: BSC sacrifices some decentralization for stability and low cost, while Solana seeks a dynamic balance between high performance and decentralization. Although BSC's multi-chain expansion plan is underway, progress is slow; Solana, through proposals like the Atlas architecture, has compressed block time from 400 milliseconds to 50 milliseconds, showing a clear advantage in the speed of technological iteration.

Ecological Landscape: The Battle for Traffic in Private and Public Domains

BSC's ecosystem remains Binance's "private domain empire." In March 2025, the number of active addresses on-chain surpassed 150 million, with an average daily transaction volume of about 5 million, focusing on core applications in DeFi and GameFi. PancakeSwap continues to be the traffic leader among DEXs, while the Four platform plays an important role in meme coin issuance. However, feedback from the network indicates that the commission model and liquidity management of the Four platform have been heavily criticized, with user experience described as "unpleasant." More critically, BSC is highly dependent on Binance's Launchpool and incubator; while private domain traffic is stable, it appears to lack momentum in global market expansion, especially with slow penetration in European and American markets.

Solana, on the other hand, has taken a completely different public domain route. In March 2025, its share of global investor interest continued at 38.8% from 2024, with on-chain activity remaining high due to the popularity of meme coins like BOME. In terms of application scenarios, Solana not only dominates in DeFi (with liquidity staking projects like Jito) and meme coins (like Pump.fun) but is also making continuous efforts in DePIN (Helium, Hivemapper) and mobile payments. Data across the network confirms that Solana's developer ecosystem is exceptionally active, with open-source tools and documentation attracting a large number of new projects. Unlike BSC's "centralized traffic diversion," Solana's community-driven model gives its ecosystem more vitality and aligns more closely with the decentralized spirit of blockchain.

The competition in ecosystems is essentially a clash of traffic models. BSC's private domain strategy allowed it to accumulate a user base in the early stages, but it now faces sluggish growth; Solana's public domain strategy has put it far ahead in globalization and diversity. The divergence between the two also reflects the evolution of blockchain ecosystems from "enclosure" to "breaking the enclosure."

Market Performance and Investor Sentiment: The Capital Game of Hot and Cold

Market data is a direct reflection of this showdown. In March 2025, BSC's TVL stabilized around $5.3 billion. According to DefiLlama's historical trends and network information, TVL had dropped to $4.7 billion in early February but rebounded to this level in March due to increased meme coin trading volume. The price of BNB remained around $630 in March, with a market cap of about $65.3 billion, firmly in the top five. In terms of community sentiment, BSC experienced a brief surge in popularity as its trading volume surpassed Solana's, with some believing its "slower pace is more suitable for beginners and long-term players." However, others pointed out that the excitement is merely a game of existing funds, and without new gameplay, it may just be a fleeting moment. Overall, BSC's market performance is steadily rising but lacks explosive potential.

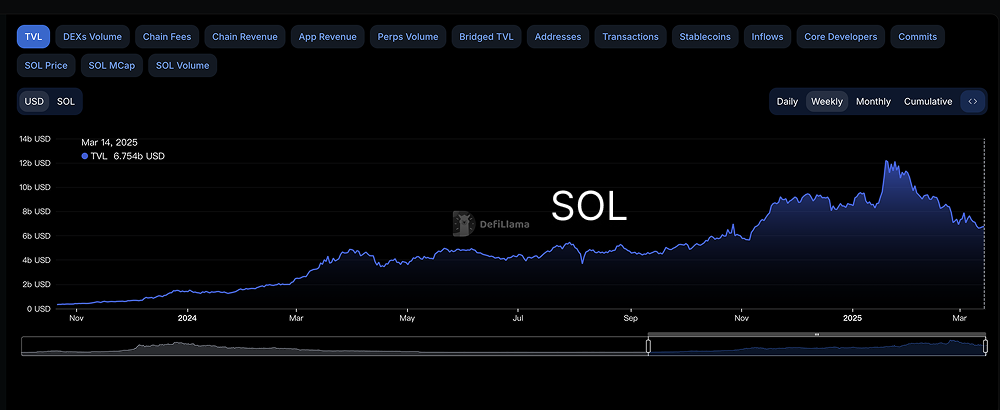

Solana's market performance resembles a roller coaster. In March, its TVL fluctuated between $6.5 billion and $6.7 billion, with Jito locking over 16.65 million SOL (approximately $3 billion) on the 18th, which may boost overall network data. The price of SOL dropped to $124 on the 18th, with a market cap of about $45.8 billion. Investor sentiment is polarized: some complain that "SOL is being drained by BSC, with too much short-term selling pressure," noting a 35% drop this month; yet the impressive performance of projects like Jito gives some hope. Data across the network shows that the number of active wallets on Solana has decreased by 12%, but its global attention and technical narrative still inject confidence into the market.

In comparison, Solana's TVL leads BSC, showing stronger ecological potential and capital attraction. However, BSC has made gains in trading volume and market cap, occupying 5 out of the top 10 spots in the past 24 hours, slightly ahead of Solana's 4 spots. Investor attitudes towards BSC are "short-term optimistic, long-term cautious," while for Solana, it is "confidence shaken but not collapsed." This capital game is intertwined with hot and cold sentiments, and the outcome remains uncertain.

Future Trends: The Crossroads of Breaking Through and Leading

BSC's future lies in breaking through. Currently, its core challenge is how to break free from its dependence on Binance while enhancing its technical competitiveness. Multi-chain expansion and decentralized governance are potential directions, but execution and community response remain unknowns. If it cannot make substantial progress in innovation, BSC may become a "low-cost backup chain," gradually being marginalized.

Solana stands at the starting line of leadership. High performance and ecological diversity are its trump cards, but the stability of nodes and the concentration risk of validators cannot be ignored. If it can find a better solution between decentralization and efficiency, Solana even has the potential to challenge Ethereum's dominance in the next five years. However, in the short term, the adjustment pressure following the retreat of the meme craze will still require time to digest.

Conclusion: The Keys to Victory for the Dual Giants on the Chain

The battle between BSC and SOL in March 2025 is not only a hard clash of technology and ecology but also a touchstone for market sentiment and capital flow. BSC maintains its position with low costs and stability, but its lag in innovation makes it appear somewhat fatigued; Solana, propelled by high performance and community vitality, is at the forefront but must face the cooling period after the excitement. There is no absolute winner in the competition between the two, but trends are emerging: Solana's leading advantages in technology and ecology are more apparent, while BSC needs to seek new paths in breaking through.

In this duel of dual giants on the chain, the ultimate key to victory may not lie in who is stronger, but in who can adapt more quickly to the next wave of the blockchain industry. Whether it is BSC's pursuit of change while maintaining stability or Solana's quest for stability amid rapid growth, the data from March 2025 is sufficient to illustrate: the future of blockchain requires both the hard support of efficiency and the soft empowerment of ecology.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。