1. Market Observation

Keywords: FOMC, ETH, BTC

Yesterday, YZi Labs announced an investment in Plume Network, driving a rebound in the RWA sector. QCP Capital's latest analysis shows that despite ongoing market noise, Bitcoin remains stable above $80,000, demonstrating strong resilience. Standard Chartered Bank stated that if Trump's proposed "crypto reserve" plan is successfully implemented by 2025, combined with the Bitcoin halving effect, it could drive Bitcoin prices to soar to $500,000.

CryptoQuant founder Ki Young Ju believes the Bitcoin bull market cycle has ended, expecting prices to show a bearish or sideways trend for 6-12 months, pointing out that every on-chain indicator signals the arrival of a bear market. Meanwhile, LMAX Group strategist Joel Kruger holds a cautious outlook on the market, warning that global trade tensions and concerns over a slowing U.S. economy may lead to continued adjustments in U.S. stocks, dragging Bitcoin down to the $73,000-$74,000 range. In contrast, Coinbase Institutional research director David Duong is relatively optimistic, believing that the current market sell-off is mainly influenced by macro factors and liquidity, and expects conditions to improve in the next quarter. He specifically noted that as bank reserve levels approach 10-11% of GDP, the Federal Reserve may adjust its quantitative tightening (QT) plan to maintain financial stability, which would support asset prices.

From a technical perspective, Glassnode data shows a significant supply gap for Bitcoin in the $70,000 to $80,000 range, where trading time is short, and open interest is low, indicating weak support. Currently, about 20% of Bitcoin supply is in a loss state, with the holding cost above the current price of $83,000. If the $80,000 support level is breached, $73,000 will become a key support level.

In the Ethereum market, Standard Chartered Bank recently significantly lowered its ETH price forecast for the end of 2025 from $10,000 to $4,000. This adjustment mainly considers factors such as the weakening of ETH's market value due to Layer 2 scaling solutions and the potential continued decline of the ETH/BTC ratio. Notably, the Ethereum Foundation is actively listening to community feedback and exploring operational changes to adapt to market changes.

In terms of regulation and policy, QCP Capital stated that last week's U.S. CPI data, which was lower than expected, provided temporary relief, but the likelihood of the Federal Reserve turning dovish remains limited amid ongoing tariff risks and inflation concerns. The market generally expects the Federal Reserve to keep interest rates unchanged at this Wednesday's FOMC meeting, but under policy uncertainty, market volatility may remain high.

Macquarie Bank's latest report warns of the overall market, pointing out that Trump's economic policies could trigger a significant adjustment in the stock market. Unless trade policies shift to a more moderate stance and spending is cut, U.S. real consumer spending may significantly slow down. Currently, the S&P 500 index has fallen nearly 8% from last month's peak, and the Nasdaq index has retraced nearly 12% from its December peak last year. Against this backdrop, the market is closely watching the results of this week's Federal Reserve FOMC meeting, especially regarding potential adjustments to the quantitative tightening plan, which could have a significant impact on the cryptocurrency market.

2. Key Data (as of March 18, 13:30 HKT)

Bitcoin: $82,671.90 (Year-to-date -11.31%), Daily Spot Trading Volume $24.471 billion

Ethereum: $1,894.96 (Year-to-date -42.82%), Daily Spot Trading Volume $11.089 billion

Fear and Greed Index: 34 (Fear)

Average GAS: BTC 2 sat/vB, ETH 0.4 Gwei

Market Share: BTC 60.7%, ETH 8.5%

Upbit 24-hour Trading Volume Ranking: XRP, UXLINK, AUCTION, BTC, CARV

24-hour BTC Long/Short Ratio: 0.9681

Sector Performance: RWA sector up 9%, BSC ecosystem up 2.68%

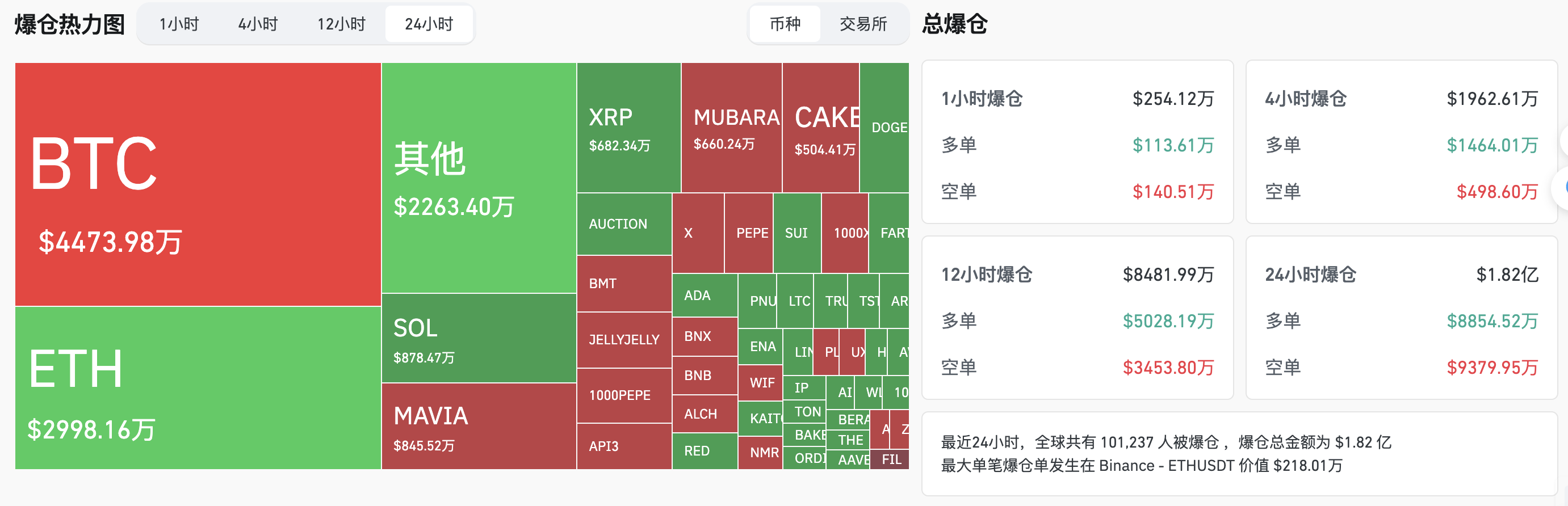

24-hour Liquidation Data: A total of 101,237 people were liquidated globally, with a total liquidation amount of $182 million, including $44.73 million in BTC and $29.98 million in ETH.

3. ETF Flows (as of March 17 EST)

Bitcoin ETF: $275 million

Ethereum ETF: -$7.29 million

4. Today's Outlook

Binance will launch trading pairs DF/USDC, EPIC/USDC, GMX/USDC, MKR/USDC, and RPL/USDC

Binance will support Kadena (KDA) network upgrade and hard fork

Sui Foundation SuiNS RFP program application deadline is March 18 at 15:59

Binance supports BinaryX (BNX) renaming and token exchange for Four (FORM)

Babylon will extend the registration deadline for airdrop to March 19

Fasttoken (FTN) unlocks 20 million tokens, accounting for 4.65% of the current circulation, valued at approximately $79.8 million;

QuantixAI (QAI) unlocks approximately 566,000 tokens, accounting for 3960.24% of the current circulation, valued at approximately $41.4 million;

Melania Meme (MELANIA) unlocks 26.25 million tokens, accounting for 17.50% of the current circulation, valued at approximately $17.6 million;

NVIDIA CEO Jensen Huang will deliver a keynote speech on March 19 at 1:00 AM

Top 500 Market Cap Gainers Today: X Empire (X) up 118.14%, Mubarak (MUBARAK) up 66.48%; Bubblemaps (BMT) up 58.14%, API3 (API3) up 37.31%; Cheems (CHEEMS) up 27.86%

5. Hot News

Spot gold rises above $3,010 per ounce, setting a new historical high

Blur, which unlocks once a month, unlocked 21.69 million BLUR four hours ago

Vitalik sold 5,000 DHN for 65.19 ETH

Bithumb will list BMT token in the Korean won market

NVIDIA GTC conference is coming up, focusing on AI computing power iteration

Metaplanet announces issuance of 2 billion yen zero-interest ordinary bonds to purchase more Bitcoin

CryptoQuant CEO believes the Bitcoin bull market cycle has ended

WLFI announces it has included BTC, ETH, TRX, LINK, SUI, ONDO in its strategic token reserves

Canary has submitted S-1 filing to apply for the launch of Canary SUI ETF

YZi Labs announces investment in Plume Network

MicroStrategy increases its Bitcoin holdings by 130 BTC, with an average purchase price of $82,981

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。