Source: Cointelegraph Original: "{title}"

The New York Supreme Court will review the Libra token scandal following a newly submitted class-action lawsuit accusing the creators of the Libra token of misleading investors and withdrawing over $100 million from a one-sided liquidity pool.

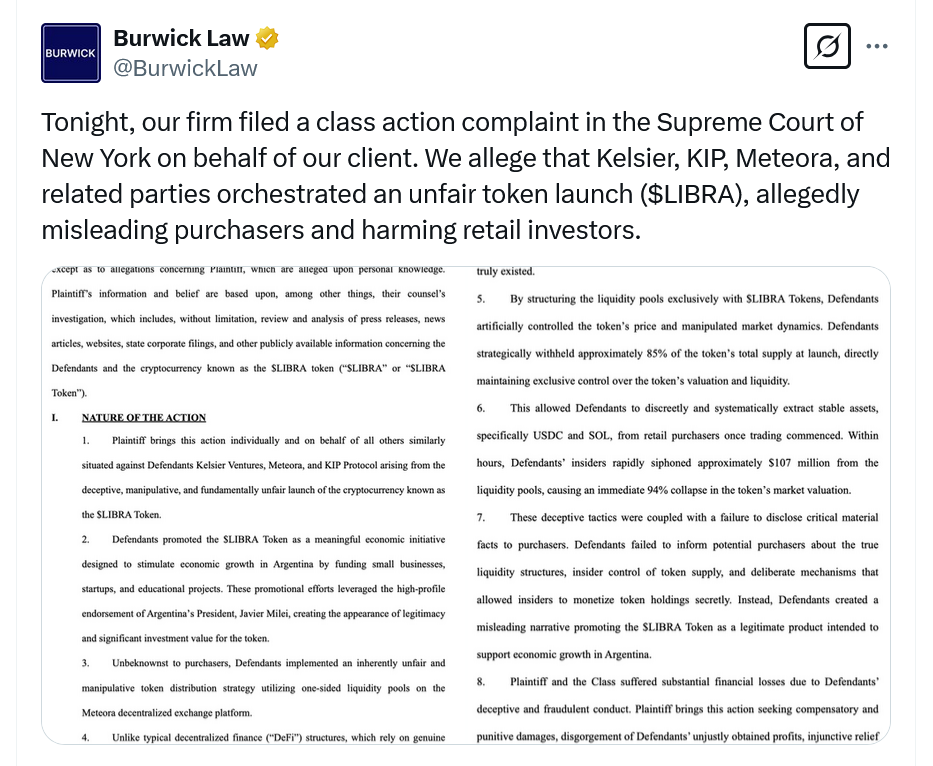

Burwick Law filed a lawsuit on March 17 on behalf of its clients against Kelsier Ventures, KIP Protocol, and Meteora, claiming they launched the LIBRA token in a "fraudulent, manipulative, and fundamentally unfair" manner. Subsequently, Argentine President Javier Milei promoted the token on the X platform as an economic initiative to stimulate financing in Argentina's private sector.

The law firm criticized the two cryptocurrency infrastructure and token issuance platform companies behind the LIBRA token—KIP and Meteora—stating that they artificially inflated the price of this meme coin using "predatory" one-sided liquidity pools, allowing insiders to profit while "ordinary buyers bore the losses."

In a document released by Burwick Law on March 17 on the X platform, it was stated that insiders "quickly withdrew approximately $107 million from the liquidity pool within just a few hours," leading to a 94% drop in the market value of the LIBRA token.

Source: Burwick Law

President Milei was mentioned in the lawsuit but was not named as a defendant.

Burwick accused the defendants of leveraging Milei's influence to heavily promote the token, deliberately creating a false sense of legitimacy and misleading investors regarding the token's economic potential.

Burwick stated that at the time of the LIBRA token's launch, approximately 85% of the tokens were withheld, and the so-called "predatory infrastructure means" used by the defendants were not disclosed to investors.

"These means, combined with the concealment of the true liquidity structure, prevented investors from obtaining critical information."

Burwick is seeking compensatory and punitive damages, demanding that the defendants surrender the "improperly obtained" profits and requesting an injunction to prevent further fraudulent token issuance activities.

Data from blockchain research firm Nansen found that among the 15,430 largest Libra wallets studied, over 86% of the wallets sold at a loss, totaling a loss of $251 million.

Nansen noted in a report on February 19 that only 2,101 profitable wallets managed to gain a total profit of $180 million.

Kelsier Ventures, the venture capital firm behind the LIBRA token, and its CEO Hayden Davis, are evidently two of the biggest beneficiaries of the token issuance. They claimed to have netted approximately $100 million.

Davis is currently facing the possibility of an Interpol red notice after a request was made by an Argentine lawyer. He stated on February 17 that he does not directly hold these tokens and will not sell them.

Meanwhile, Milei has distanced himself from this meme coin, stating that he did not "promote" the LIBRA token as alleged in the fraud lawsuit against him, but merely "advertised" it.

The Argentine opposition has called for Milei's impeachment, but so far, the efforts have been minimal.

Related: Reports indicate that an Argentine lawyer has requested Interpol to issue a red notice for the LIBRA founders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。