The rise and fall of Telegram mini-games is not an isolated phenomenon; it is merely an extreme "microcosm" of the entire Web3 industry.

Written by: Jaleel Jia Liu

Last week, the power struggle within the Yescoin team brought traffic back to the "TON ecosystem." After a long silence from the TON chain, we began to reminisce about this public chain backed by Telegram, which was on the "eve of takeoff" for three years but ultimately only thrived for a few months.

At its peak, trading platforms rushed to launch tokens for Telegram mini-games. In just over four months, Binance, the world's largest cryptocurrency exchange, consecutively listed five tokens from the TON ecosystem. Hundreds of mini-games emerged in a short time, with over 2,000 more in preparation for launch. Notcoin's monthly revenue exceeded $300,000, and Catizen achieved over $16 million in revenue. The TVL data of the TON chain grew by 70 times. The price of TON also rose from $2 to a peak of $8. The market's expectations for the TON ecosystem reached an all-time high, and both inside and outside the industry believed that the "traffic gold mine" of Web3 had finally found a new outlet for explosion.

However, this seemingly thriving ecosystem was merely a speculative game with a very short time window. In the summer of 2024, the market came to a sudden halt—trading platforms stopped listing TON ecosystem coins, the founder of Telegram was arrested, project teams fell silent, and player groups formed "ghost towns." Overnight, this track, once called a "traffic gold mine," turned into an emptied-out mine, leaving behind only data black boxes, an overdrawn market, and abandoned developers.

What exactly happened during this period? Rhythm BlockBeats interviewed three former Telegram mini-game project teams to analyze the true reasons behind the "flash in the pan" of the TON ecosystem.

False Prosperity; Black Box Traffic

The low customer acquisition cost of Telegram mini-games had long been a topic of discussion and was one of the reasons most Telegram mini-game project teams chose to enter the field. Today, it is also the root cause of the entire ecosystem's bubble.

"In Web3, a company, such as a trading platform or a large chain game, has a customer acquisition cost of around $10 to $15, but through Telegram mini-games, this cost can be far below $1, around $0.7." KinKin, a project team member who left Telegram mini-games six months ago, has now shifted her focus to research in the AI Agent field. She added to Rhythm BlockBeats, "In some regions, it's even more exaggerated; for example, in India, the acquisition cost can be as low as $0.002 to $0.05."

This extremely compressed customer acquisition cost created a paradise for project factories, while real users became a dispensable presence for them.

"Before the project, I didn't really need real users; the studio's volume was enough. In a very short time, we could achieve a scale of 200,000 to 300,000, which is a qualifying line for a Telegram mini-game, considered a light to medium scale." Xiaoguang, who has managed multiple token launches for Telegram mini-games, did not shy away from discussing the industry's operational model when questioned by Rhythm BlockBeats.

This approach has been standardized and streamlined within the industry. Several long-term cooperating studios are adept at it, even surviving longer than most Web3 projects. "The project team and the studio will agree on how much volume is needed in the early stages and how much needs to be supplemented before the TGE (Token Generation Event)," Xiaoguang explained. If merely inflating the volume is not enough, they will resort to "volume swapping" to amplify the data.

"After reaching a scale of 200,000 to 300,000, we would engage in volume swapping—where two games mutually drive traffic to each other to reach the next level." Xiaoguang added. Compared to traditional chain games, the data volume of Telegram mini-games has far exceeded that of most Web3 projects. However, everything has two sides; the low cost often means low quality, and the inflation of data obscures the true issues within the ecosystem.

"The data of the TON ecosystem has always been operated as a black box. In the past, those VC projects could have their data checked on platforms like Dune, where you could see how many addresses and transaction volumes there were, and investors would conduct some background checks. But the real data of Telegram mini-games is not public; only a few insiders know the approximate number of users and the real user ratio." In Xiaoguang's view, this is a natural soil environment for project factories.

"Do you know how many real users Notcoin has? You don't." Xiaoguang stated bluntly, "All the data that outsiders see is what the project team wants you to see."

The decline in the proportion of real users further exacerbated the market's false prosperity. "In the early games, like Hamster Kombat, it was considered relatively good, with about 60% being real people. But as the ecosystem expanded, this ratio continuously declined, and later on, having 40% was already considered impressive." Xiaoguang revealed to Rhythm BlockBeats.

Even among this 40%, the "airdrop tax" from professional airdrop hunters has not been excluded; their goal is not to play games but to obtain airdrop rewards. "When we tally the recharge users, among the remaining real users, 90% of the addresses are from the same group of people who specifically chase airdrops, playing briefly and then leaving."

This user structure directly determines the vicious cycle of the Telegram mini-game ecosystem—short-term, data inflation obscures the real situation, allowing investors and trading platforms to continue to pay; but in the long term, the overall user quality of the ecosystem is extremely poor, with very low stickiness.

In the eyes of trading platforms and investors, on the surface, the monthly active data of Telegram mini-games is astonishing, with massive traffic, but the actual user retention and conversion rates are pitifully low. "If the goal is merely to create monthly active data and wallet address numbers for trading platforms and investors to see, then this low-cost traffic is sufficient." The speaker is Sleepy, the founder of the Little Ghost NFT, who confirmed this month that they have decided to pause mini-game development on Telegram.

"But if you want truly active users, users who are willing to play your game and use your application, you absolutely cannot acquire them at such a low buying cost." Sleepy stated. "It still holds true— you get what you pay for."

"Our promotional methods still rely on Twitter, community promotion within the crypto circle, and crypto advertising channels, along with mutual volume swapping between projects." Sleepy said. "But no matter how much we swap, we have never been able to break out of this circle."

In other words, traffic merely flows from one project to another, but the entire pool of water remains stagnant, with no new fresh water being injected.

The TON ecosystem has never truly bridged the gap between Telegram's 900 million users and Web3; it seems that the TON Foundation and Telegram have not built a genuinely effective distribution channel that allows Crypto applications to reach a broader user base. Sleepy said, "Maybe they are trying hard, but I haven't seen any results yet."

TON and Telegram have never been the same thing.

TON Foundation: Vacuum Power and Uncontrolled Direction

In the past six months, when discussing the TON Foundation with industry insiders, they often mention the "factional struggles" within the foundation: the Russian team, the Taiwanese team, and the Dubai team after obtaining a financial license in Dubai. These three teams have not brought about a synergistic effect; instead, they have made the resource allocation within the TON ecosystem extremely unbalanced—whether one can gain support in the TON ecosystem often depends on their relationship with the Russian team.

The TON Foundation was initially founded by two core members: one is Steve Yun, the current chairman of the foundation who is still active in various online and offline events, and the other is Andrew Rogozov, the former CEO of VK (the predecessor of Telegram, the first social platform created by Telegram's founder, the Russian version of Facebook), who is considered a "core figure" by some.

However, at some point, the power structure of the TON Foundation underwent a subtle change—Andrew Rogozov seems to have faded from the core management of the foundation and established TOP (The Open Platform), which now resembles a true foundation more than the TON Foundation, or can be seen as the Consensys of the TON ecosystem, even leading the core ecological construction of TON.

"To be honest, as a foundation, we actually don't receive much information from Telegram. Pavel Durov and the others don't discuss anything with us; in fact, they only communicate with the wallet team because the wallet is the only real integration point. And that is not our team; it's a completely different company called TOP." This was stated by Jack Booth, the marketing director of the TON Foundation, in an interview in July 2024, indirectly confirming the influence of TOP.

The influence of TOP has gradually surpassed that of the TON Foundation, not only investing in and supporting the most critical projects on TON but also controlling the infrastructure within the ecosystem—they are responsible for running the official Telegram wallet TON Space, supporting the most active wallet in the TON ecosystem, Tonkeeper, and the DEX with the highest trading volume, Stonfi. Even the only staking protocol, Tonstakers, is also supported by TOP. From the perspective of key nodes in the TON ecosystem, TOP has become the de facto "core builder" of TON, while the TON Foundation resembles a promotional agency, with its power gradually being undermined.

Then, on January 14, 2025, the TON Foundation announced the appointment of board member and Kingsway Capital founder Manuel Stotz as the new president, while the former president Steve Yun will continue to serve on the board.

Under such "power disintegration," it is understandable why there are rumors that "the TON Foundation, led by the Taiwanese team, has almost no say in many matters."

The disadvantaged position of the Chinese members of the TON Foundation in resource allocation within the ecosystem has become more apparent. "The Taiwanese team has little say; core technical decisions are still in the hands of the Russian team," Xiaoguang pointed out. "If you can build a good relationship with the Russian team, you can get the most support. For example, Catizen has a very good relationship with Russia, securing investment and gaining a lot of resources."

Xiaoguang's statement is corroborated by TOP's investment list, which includes Pluto Studio, the game developer of Catizen.

The founder of another hit mini-game, Notcoin, Sasha Plotvinov, openly stated that his relationship with the TON Foundation is extremely close. This relationship not only gave Notcoin an advantage in the TON ecosystem but also made it a benchmark project in the Telegram mini-game sector. Notably, Sasha Plotvinov is also the CEO of Open Builders, whose products largely overlap with TOP and belong to the "core circle." "DOGS is also made by the Notcoin team; it's all controlled by the Russians," Xiaoguang said. "There are many similarities in their trends."

Looking at the price charts of the three coins from last August to now, their trends are indeed very similar. Additionally, on March 16, the news that "Telegram founder Pavel Durov was allowed to leave France" affected the prices of some tokens in the TON ecosystem, with TON rising 20.7% in 24 hours to a current price of $3.53; NOT rising 18.7% to $0.002543; and DOGS rising 10% to $0.0001475. (Prices are as of March 17.)

From top to bottom: TON, NOT, DOGS

The success of Catizen and Notcoin is, to some extent, not a success of the sector but rather a result of the highly centralized core resources of TON. These two projects launched over half a year earlier than most mini-games and received full support from the foundation. In other words, the prosperity of TON mini-games is not a true "open ecosystem" but a game of resource allocation.

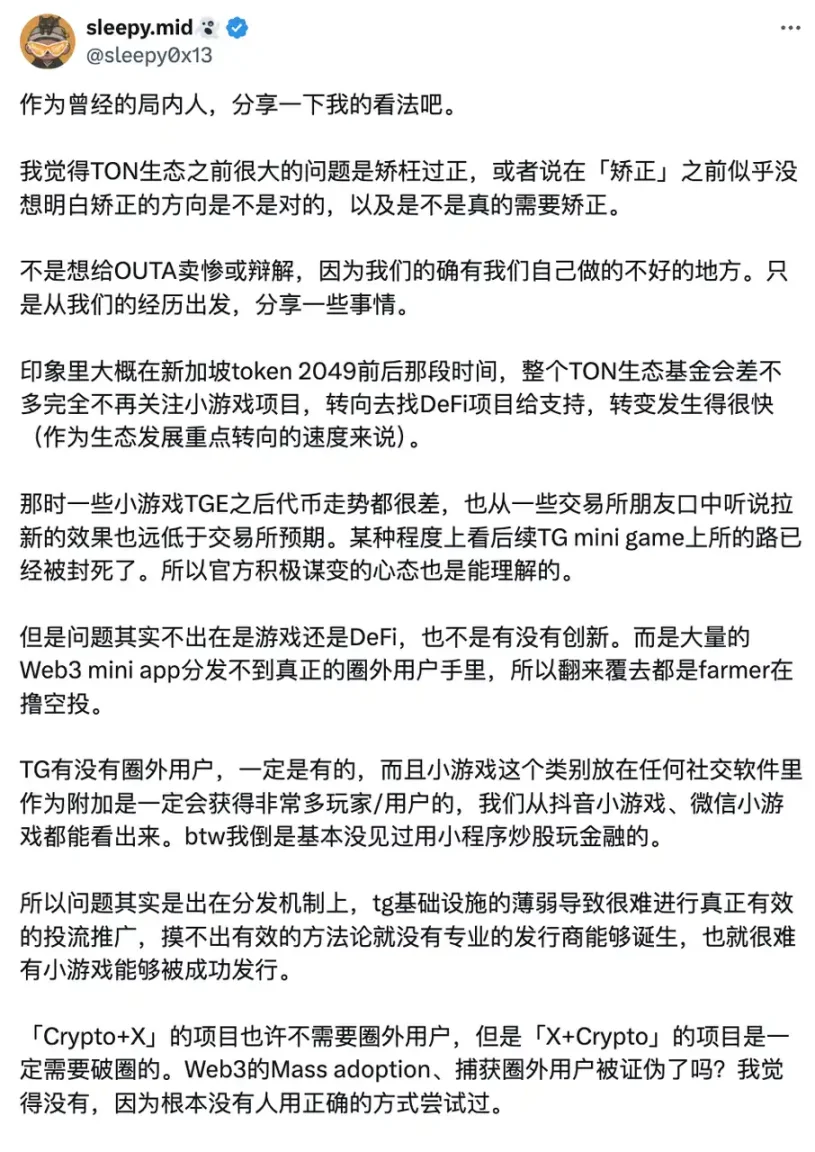

Another fatal issue in the TON ecosystem is the confusion and abrupt shifts in strategic direction—regarding resource support, the TON Foundation quickly shifted its focus from Telegram mini-games to DeFi, directly leading to many mini-game developers being forced to abandon their projects.

"When we contacted the foundation, we could clearly feel that after a certain point, they basically stopped paying attention to all game-related projects and started frantically searching for DeFi projects," Sleepy said. "This sudden shift was a huge blow to teams that were seriously developing products, resulting in a loss of many developers and users."

Sleepy strongly disagrees with the TON ecosystem's directional shift: "I think TON shouldn't just copy what other public chains are doing. Without relying on Telegram, TON cannot achieve the current user volume in terms of performance, language, and development difficulty. Therefore, TON's future development should be planned according to the characteristics of the social platform, rather than copying other public chains."

"Our initial judgment about TON was that its ecosystem would become part of the monetization of traffic on social platforms, like WeChat mini-games or Douyin mini-games." However, the decisions of the TON Foundation completely deviated from this direction. "They are making stablecoins and DeFi, which are huge mistakes, just like WeChat creating stock trading mini-programs. Would you use WeChat mini-programs to trade stocks?" Sleepy stated bluntly.

This strategic misstep by the TON Foundation not only caused the ecosystem to miss the correct narrative direction but also directly triggered a crisis—on August 2024, TON founder Pavel Durov was arrested in France. This incident dealt a significant blow to the TON ecosystem and plunged the foundation into chaos.

"The reason is actually that they added a function similar to fiat currency exchange for stablecoins, which involves compliance and political factors, especially in the context of the Russia-Ukraine war," Xiaoguang revealed to BlockBeats. Prior to this, BlockBeats had also heard similar viewpoints from other sources, indicating that a function related to stablecoins had attracted regulatory attention.

The original ecosystem of TON had already fallen into chaos due to strategic wavering and uneven power distribution, and the founder's sudden incident further stripped the ecosystem of its last support point.

"Death Accelerator": Project Factories and Trading Platforms

In addition to the black box of traffic, factional struggles within the TON Foundation, and the sudden shift in resource support, project factories and trading platforms are also key factors accelerating the demise of the Telegram mini-game sector. This ecological carnival is essentially a brief capital game, while real user growth has long stagnated.

In this sector, the development of games is extremely industrialized, with project factories producing various mini-games in bulk using an assembly line model, experimenting in the market, and inevitably having a few projects succeed. "For example, the game developer behind Catizen, Pluto Studio, initially ran a dozen games and eventually found that the cat life simulation model was the best, so they decided to focus on it," KinKin said.

In other words, Catizen's success is not accidental but a result of intensive project experimentation. This model is essentially characterized by high turnover, low cost, and rapid trial and error.

"This cost is actually very low," KinKin explained. "Many game developers directly look for verified games in the WeChat mini-program market, obtain the game code, change the H5 skin, and then integrate it with a Telegram IDK (integrated development kit) to go live. Moreover, as time goes on, the price of these mini-game codes has become increasingly cheap."

Low cost, short cycles, and quick launches give these game projects a high speculative nature. More critically, once a game model is validated by the market, it will be quickly copied and scaled, and the leading projects often possess "pricing power." KinKin mentioned, "Catizen was very strong in negotiations with trading platforms when discussing token listings, even leaning towards OKX and asking for $500,000."

Once a project succeeds, its bargaining power significantly increases. Catizen's strong negotiation ability stems from the market experience it accumulated after several project failures and its precise identification of a user group willing to recharge. "Mini-games like Catizen, validated through a dozen projects, are indeed products that are mature enough and have attracted a wave of genuine users willing to spend money," KinKin said.

The success of leading projects also brings another problem—highly concentrated resources. "The traffic of a single project like Hamster Kombat can almost match that of a medium-sized trading platform."

However, the ecosystem of Telegram mini-games has never had "fresh water" flowing in, lacking the entry of external incremental markets. The high-density "bombardment" from project factories leaves almost no survival space for other mini-games, let alone Web2 game developers—they hold a large number of abandoned, unlisted games with very low trial and error costs. In this competitive environment, the Telegram mini-game sector accelerates its decline.

Another driving factor is the competition among trading platforms. The traffic brought by TON mini-games made trading platforms see new growth points, leading to frequent token listings in the short term, which caused the market to be overdrawn too early. Looking back at Binance's token listing timeline, it is evident that the intervals between new projects are becoming shorter:

May 16: Notcoin listed;

84 days later: TON listed;

13 days later: DOGS listed;

23 days later: Catizen listed;

13 days later: Hamster Kombat listed.

"When DOGS was listed, all trading platforms were scrambling for this data, even offering rewards for activities like 'withdraw from my trading platform, and I'll give you a certain amount of DOGS.' Why did they know DOGS had traffic? Because NotCoin had already proven it once, and NotCoin and DOGS were made by the same team, just repackaging NotCoin's approach," KinKin told BlockBeats.

The deeper issue is that the user growth in this cycle has far lagged behind the previous cycle. At least before Trump issued his coin, the market's anxiety about user growth in Web3 was very evident, and this anxiety naturally transmitted to trading platforms. Although the user quality in the Telegram mini-game sector is uneven, at least in the early stages, the conversion of TON traffic could still bring some data growth to trading platforms. However, this data growth is essentially unsustainable.

Ultimately, the more projects the project factories have, and the faster the trading platforms list tokens, the quicker the sector cools down.

After several rounds, the incremental user base of trading platforms gradually dried up, losing the motivation to continue listing tokens. For latecomers, the first-mover advantage has been maximized, and the survival space for later projects and tokens is shrinking. All of this makes the collapse of the Telegram mini-game ecosystem inevitable.

TG + Web3, is it really a false proposition?

"Have you ever envied those projects that can get listed on Binance?" In response to BlockBeats' question, Sleepy answered quickly, clearly having thought about this issue long ago.

"It depends on how you define success. Many people think being listed on a trading platform is a form of industry recognition, but I don't feel that way. For me, issuing a token is not the end of a project. If you treat it as the endpoint, it can be very damaging—damaging to yourself, the community, and investors. Because everyone can see that these tokens perform poorly after listing, and the effect of attracting new users is far from the expectations of trading platforms," Sleepy said.

The "quick money logic" of the TON ecosystem has made everything simple and brutal—changing to a new project every three weeks, with the fast-money operators dominating the market's rhythm, while the teams that genuinely want to make games have become the eliminated "outliers." In this ecosystem, idealists ultimately have two choices: either abandon their beliefs and go with the flow or be eliminated.

Sleepy and his team ultimately chose the latter. He cut 80% of the team, and several core members decided not to take salaries for now, allocating some resources to do Web2 design outsourcing to sustain the team's survival.

"In addition, we are also discussing grants with some public chains, and we have already received our first Launch Grant. We will continue to do some development work to complete the remaining KPIs. We also applied for some hackathon competitions like Monad Madness to see if we can achieve some results. Currently, our income over the past few months has already exceeded what we earned from making games on TON," he joked.

After the collapse of the TON ecosystem, various individuals who were once active within it have found their own new paths.

KinKin has now turned to the AI Agent sector, and she is very optimistic about the future development of the BASE chain. Meanwhile, Xiaoguang, who is skilled at managing projects, is researching memes. He has long understood that "the business of Telegram mini-games is structural; it has never been a model of long-term stability, and the window period is only a few months." A former member who worked hard to promote the ecosystem at the TON Foundation has left to study the public chain Kaia, which merges WeChat in South Korea and Japan.

In an ecosystem where traffic reigns supreme, only the traffic itself remains. The TON ecosystem has not become "the future of crypto social," but rather another cyclical Web3 narrative—a market game that is shorter, faster, and yields more extreme returns than public chains or ZK tracks.

Looking back at this carnival today, for developers, the TON ecosystem once disguised itself as the hope of "social + Web3," attracting them into this market, only to turn them into producers of black box data; for players, airdrops created the illusion of "getting rich overnight," resulting in nothing more than a $0.99 game package becoming the "cyber incense money" of the new era.

When viewing the entire industry from a broader perspective, the rise and fall of Telegram mini-games is not an isolated phenomenon; it is merely an extreme "microcosm" of the entire Web3 industry. In fact, whether it is public chains, ZK Rollups, or Layer 2, the essence of many tracks is the same, just packaged in a more "grandiose" manner, with higher costs and longer cycles. Most Web3 projects are essentially creating a large-scale Telegram mini-game, with some having longer lifecycles and others shorter.

"Is 'Telegram + Web3' really a false proposition?"

Each interviewee provided their own answer, but I have decided not to write it down because, dear readers, this time, I want to hear your thoughts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。