Tether is exploring new solutions for electrification in Africa.

Author: Erik Hersman, Founder of the African off-grid power systems infrastructure company Gridless

Translation: Deep Tide TechFlow

Two days ago, Tether's CEO Paolo Ardoino announced their new plan on Twitter: to promote solar kiosks in Africa. Currently, hundreds of solar kiosks are in operation, providing monthly subscription services for high-performance batteries, with users able to pay using USDt and Bitcoin. Tether plans to expand this model to 100,000 solar kiosks, aiding in the electrification of the African continent.

My first reaction to this is that it is a very meaningful attempt. As I mentioned in a recent article about Africa's off-grid energy potential, innovative energy solutions are key to driving development in Africa. Electrification of the African continent is not a zero-sum game; there is no single solution that can completely address the electrification issues in Africa. Currently, up to 600 million people in Africa lack access to electricity, accounting for 83% of the world's un-electrified population. Therefore, exploring new off-grid energy models is an inevitable direction for the future.

I strongly agree with Paolo's view that Tether is a once-in-a-century company. In 2024 alone, Tether's profits reached as high as $13.7 billion. The usage of Tether continues to grow in the United States, the European Union, and China, while the demand for USDt in developing countries is also rapidly increasing. As local currencies depreciate in some regions, people are increasingly inclined to use stablecoins (digital tokens pegged to fiat currencies like the US dollar) to hedge against economic risks. For example, in Ethiopia (with a population of about 123 million), the currency birr depreciated by about 30% in mid-2023. Today, Ethiopia has become the fastest-growing stablecoin market in Africa, with retail stablecoin trading volume increasing by 180% year-on-year.

(Note: Due to the lack of detailed information currently available, some analyses of Tether's model in this article are based on speculation.)

Revisiting Solar Kiosks in Africa

Tether's plan in Africa combines off-grid solar kiosks with stablecoin-based financial services, which is a new highlight of this model. Before delving deeper, we need to understand the background of this field.

Over the past 15 years, many solar kiosk projects have emerged in Africa, provided by commercial companies and non-governmental organizations. The operational models and reasons for success or failure of these projects provide important references for evaluating Tether's plan. For example:

Solar Kiosk (2011-2019): Operated in Ethiopia, Kenya, Botswana, Tanzania, Rwanda, and Ghana, with a peak of 250 solar kiosks.

ARED “Shiriki Hubs” (Ongoing): Covering Uganda and Rwanda, currently with 60 solar kiosks.

Community Energy Kiosks: Part of the Malawi SOGERV project, smaller in scale, with only 4-10 solar kiosks.

Many solar kiosk projects in Africa face challenges in profitability and organic growth, often relying on funding from grants or impact investors. The current operational model of Tether remains uncertain. It is believed that Tether is likely to adopt a franchising model. However, regardless of which model Tether chooses, there are several key points to pay special attention to:

- Funding Sources Determine Success

Tether's plan is supported by a highly profitable for-profit company, which lays a solid foundation for the project's success. In contrast, funding models that rely on grants, especially in the "post-USAID era" of Africa, struggle to support long-term business expansion. Socially responsible investment can only provide initial assistance, but to achieve large-scale deployment, strong capital partners are still needed to invest substantial funds.

- Providing More Community Services is Key

If solar kiosks are merely used as low-margin battery charging stations, local operators often struggle to earn sufficient profits. For solar kiosks to achieve sustainable operations, they typically need to become social centers for the community, offering additional functions such as WiFi, mobile payment services, phone charging, and airtime sales. If they can also use solar energy to provide a venue for watching football matches in the evenings, they often attract more foot traffic, further enhancing profitability.

Tether's solar kiosk plan has good starting conditions: stable funding sources and guaranteed growth financing. Moreover, since franchisees are usually already mobile payment agents, they only need additional support for USDt stablecoin as a payment option to smoothly operate the subscription service model. At the same time, solar kiosks also come with WiFi deployment capabilities, providing more added value to the community, further enhancing the project's attractiveness and practicality.

However, expanding into rural markets in Africa is no easy task. The "last mile" market faces significant logistical and operational challenges, and competition in the off-grid solar sector is also exceptionally fierce. The pay-as-you-go household solar financing model has been developing for 13 years, but many companies have failed due to underestimating the competitive environment and logistical complexities of the African market. Additionally, the risks of theft and vandalism, as well as the difficulty of building brand trust in low-trust societies, are also critical issues that cannot be ignored.

The Rise of Stablecoins in Africa

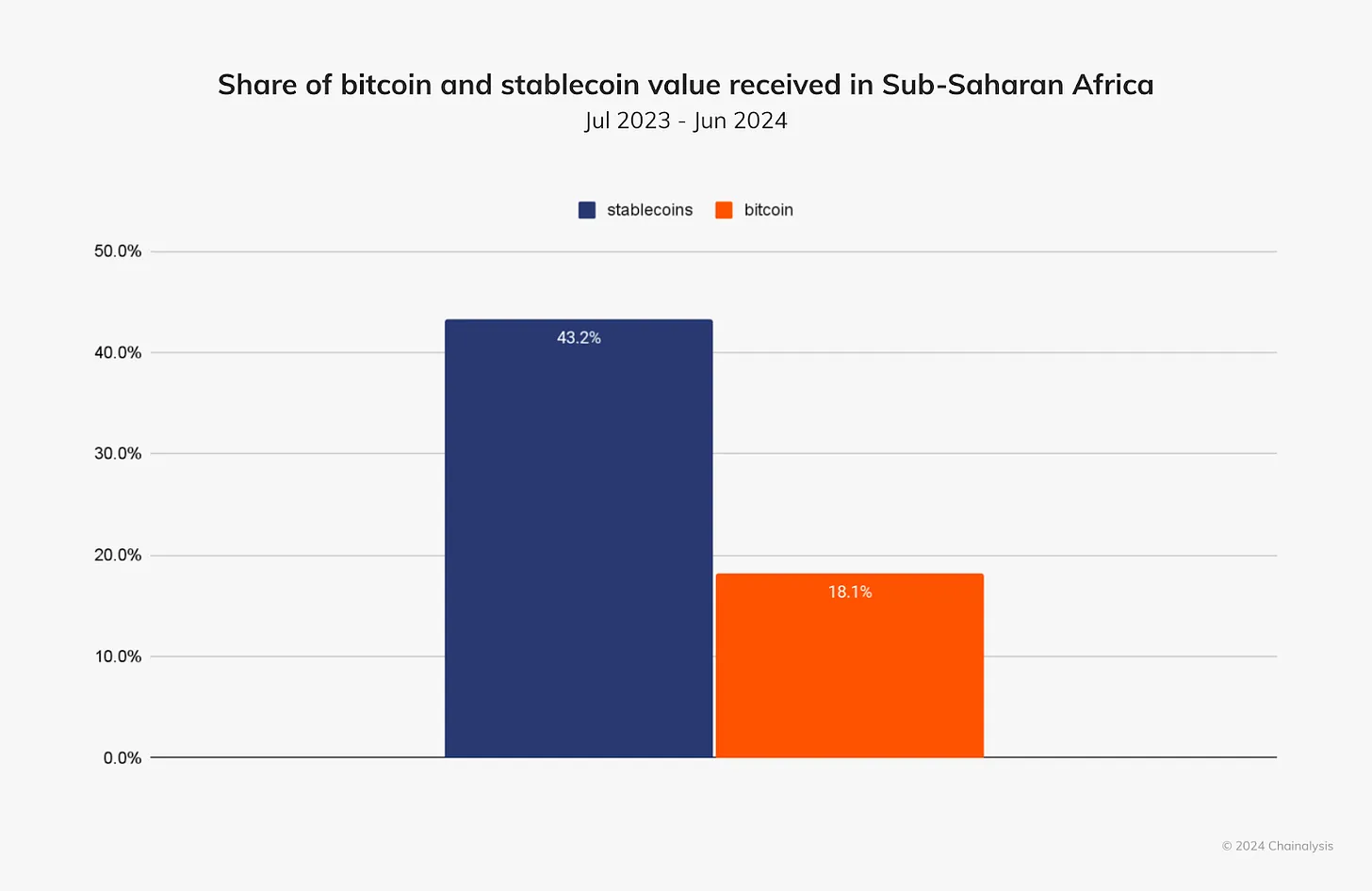

In recent years, Africa has become a major growth area for cryptocurrency usage, with stablecoins being particularly popular. As of mid-2024, approximately 43% of the total value of crypto transactions in sub-Saharan Africa comes from stablecoins. This rapid growth reflects concerns about the instability of local currencies. In fact, in Africa, stablecoins are even more popular than Bitcoin, becoming a primary tool for value transfer. This trend indicates that stablecoins are becoming an important part of Africa's financial ecosystem.

Stablecoins (such as USDt) have already demonstrated very practical use cases in the African economy. A typical application scenario is cross-border trade and payments. Many small and medium-sized enterprises choose stablecoins for cross-border payments due to difficulties in obtaining US dollar accounts. These businesses can exchange local currency for USDt and complete international transfers within minutes, while the recipient can quickly convert it into hard currency. This method greatly optimizes the traditional cross-border payment process. Compared to waiting weeks for high bank transfer fees or relying on the high risks of black market foreign exchange, the use of USDt bypasses traditional intermediaries and high remittance fees, becoming an indispensable tool for many import and export companies. Stablecoins are changing the trade landscape in Africa. Additionally, the practical role of stablecoins is also reflected in everyday transactions such as paying for overseas tuition and purchasing inventory. The widespread use of stablecoins addresses many pain points in traditional financial systems, such as high costs and delays in cross-border payments, thus performing well in the African market and becoming an important part of Africa's cryptocurrency ecosystem.

However, the popularity of stablecoins also faces challenges from government regulators. Some countries are concerned that the widespread use of USDt may lead to capital outflows and weaken the stability of local currencies. This is particularly evident in certain countries, such as Malawi and Nigeria. Due to severe depreciation of their currencies, many people prefer to choose USDt to meet domestic and international payment needs, further undermining the attractiveness of local currencies. Currently, stablecoins in Africa remain in a "gray area": they are widely used informally but have not yet received official recognition. This status poses obstacles to large-scale integration. Businesses may hesitate to use USDT openly due to concerns about future government penalties, while fintech startups face challenges due to the lack of a clear regulatory framework.

We have reason to believe that Tether can perform well in the African market. Tether's strong financial strength gives it a competitive edge in the African market. This financial support opens many doors of opportunity for it. Furthermore, Tether's strategy is to extend the use of stablecoins from urban traders to rural areas. For those merchants extending their supply chains into rural areas, they have already been using USDt in transactions with counterparts in China and other international markets, so replicating this model in local markets is a natural progression. In this way, Tether is expected to further promote the adoption of stablecoins in Africa while providing convenient financial services to users in more regions.

Tether's Solar Kiosk Project is Expected to Succeed

The most innovative part of Tether's plan lies in integrating stablecoin payments and related financial services into the operation model of solar kiosks. This model not only has the potential to change the industry landscape but may also face certain challenges.

On one hand, stablecoins have gradually gained popularity among grassroots users in Africa due to their ability to effectively address real financial issues. If Tether can expand the application of stablecoins to physical solar kiosks in rural areas, it will further promote financial inclusion. Imagine a farmer who can not only charge their phone at the solar kiosk but also convert part of their cash income into a digital USDt balance. This balance can help the farmer combat local currency inflation and provide a more stable means of value storage. They can use these balances to purchase agricultural supplies or receive remittances from relatives abroad within minutes.

Theoretically, these solar kiosks can serve not only as energy supply centers but also as "informal microbanks," supporting those who cannot access traditional banking services. By combining energy supply with fintech, this model could significantly enhance the overall development level of the community—addressing both electricity demand and providing safer savings and transaction methods. Compared to traditional solar kiosk projects, Tether's innovation lies in introducing financial service functions, rather than merely providing energy and connectivity services.

From a business perspective, this model has strong sustainability and is expected to achieve profitability. However, the project's goals may not be limited to merely pursuing profit. Tether's strategy seems to also include expanding the use of stablecoins while building brand influence and a good reputation in emerging markets. In the context of increasing regulatory pressure in the United States and the European Union, Tether is turning its attention to the Southern Hemisphere to explore new growth opportunities. This strategy suggests that Tether may be willing to incur some losses in the early stages of the solar kiosk project in order to gradually establish a complete ecosystem. This approach is similar to the development path of Mpesa in Kenya: through long-term investment and patient market cultivation, it ultimately achieves widespread user acceptance and commercial success.

Comparing Tether's Model with Gridless's Model

As another company dedicated to providing innovative financing models for Africa, developing off-grid energy, and achieving profitability, Gridless has significant differences from Tether's model. Here is a comparison of the two models:

Tether's plan is to deploy solar kiosks to provide flexible payment options and educational services for African communities. In contrast, Gridless focuses on building low-cost hydropower stations in areas with natural water resources while using excess electricity for Bitcoin mining, thereby providing stable financial support for the project.

Financing Methods

Gridless Model: Obtains financing by using Bitcoin as collateral to drive project expansion.

Tether Model: Relies on its large reserve funds to directly invest in projects for rapid growth.

Energy Sources

Gridless Model: Utilizes hydropower, relying on the low cost and sustainability of water resources.

Tether Model: Relies on solar power, fully utilizing abundant and low-cost solar resources.

Revenue Sources

Gridless Model: Achieves profitability through Bitcoin mining and meeting community electricity needs.

Tether Model: Profits from payment functions using USDt (or Bitcoin) and may earn returns by managing floating funds or attracting users to utilize other financial services provided by Tether.

Growth Potential

Gridless Model: Although limited by the geographical conditions for hydropower, it can provide localized and more stable energy solutions for communities while achieving inherent financial sustainability through Bitcoin mining.

Tether Model: With its strong financial strength and standardized solar kiosk design, it can expand the market more quickly. However, this model may face regulatory obstacles related to cryptocurrencies and has certain complexities in managing a large number of physical sites.

It is evident that both models demonstrate strong innovation in combining renewable energy with cryptocurrency, but their application scenarios are slightly different. Tether's solar kiosks can quickly cover underserved areas, particularly suitable for regions rich in solar resources but limited in traditional grid expansion. In contrast, Gridless's hydropower model, while having a longer deployment cycle, provides a solution that emphasizes infrastructure development. This model can offer communities a lasting and stable power supply, better supporting long-term community development and economic growth.

Ideally, a hybrid model could be adopted. For example, deploying solar kiosks in areas where hydropower is not feasible to fill the energy supply gap. This way, the overall impact of off-grid electrification in Africa can be maximized, providing reliable energy support to more communities while achieving sustainable development goals.

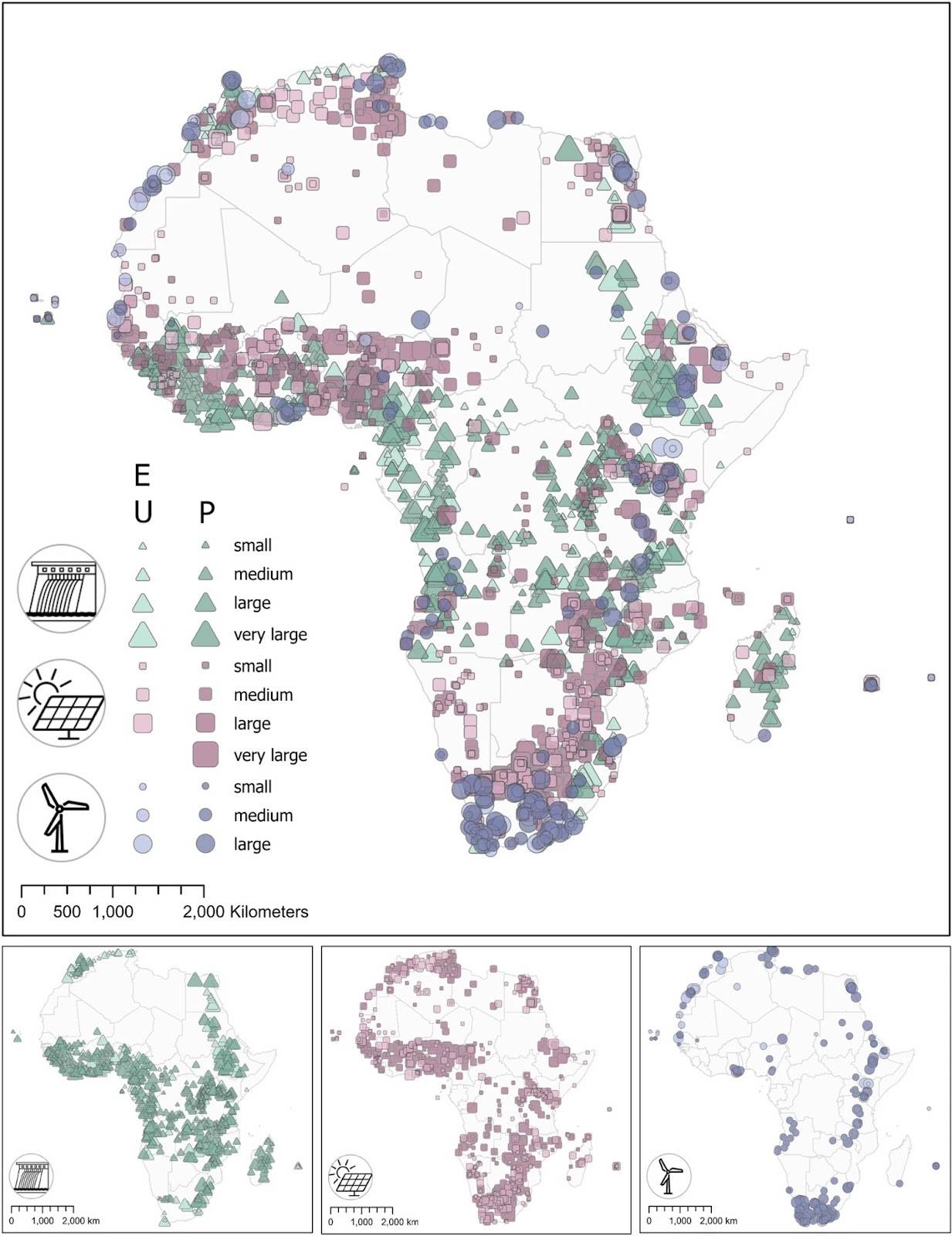

Distribution map of hydropower, solar power, and wind power in Africa

As shown in the above map, while there is some overlap between solar and hydropower in certain areas, there are also large areas more suitable for one form of energy. Tether's solar kiosks primarily target sunny regions with scarce grid access, such as the Sahel region and the Horn of Africa. These areas are characterized by high-intensity solar radiation and limited hydropower potential, making them very suitable for modular designs that can be quickly deployed. These kiosks not only provide electricity but also offer internet access and financial services to local residents. In contrast, Gridless focuses on water-rich areas in East and Southern Africa, building small hydropower stations. The rivers in these regions have stable flow rates, capable of supporting 24-hour uninterrupted power supply.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。