Source: Cointelegraph Original: "{title}"

The dominance of Bitcoin (BTC), which refers to Bitcoin's overall market share in the cryptocurrency market, has been steadily increasing since 2023, amidst a surge of new cryptocurrencies and tokens.

Currently, Bitcoin's market dominance is approximately 61.6%, down from a local peak of 64.3% reached on February 3.

On February 2, due to widespread market concerns about the ongoing trade war between the U.S. and its trading partners, the overall market declined, causing Bitcoin's market dominance to rise back above 60%.

Macroeconomic uncertainty typically impacts risk assets, and the recent market downturn has affected altcoins more than Bitcoin, as altcoins tend to have lower liquidity and higher risk.

Bitcoin's market dominance has been on the rise since 2023. Source: TradingView

The current market cycle is also characterized by Bitcoin exchange-traded funds (ETFs), which concentrate liquidity in these financial instruments, thereby preventing funds from flowing into altcoins, a pattern that cryptocurrency traders and investors have been accustomed to.

In previous market cycles, investors would gradually shift profits from lower-risk assets like Bitcoin into higher-risk investments, first flowing into large-cap altcoins and eventually into smaller-cap tokens.

The liquidity absorbed by traditional investment tools, combined with the continuous emergence of new tokens competing for limited investor attention and funds, has led some analysts to believe that "altcoin season" has become a thing of the past and will not be a feature of the current or future market cycles.

An Overabundance of Tokens in the Market

As of February 8, the total number of cryptocurrency tokens and coins listed on CoinMarketCap was less than 11 million different assets, while by March 15, the number of digital assets listed on the site had surged to over 12.7 million.

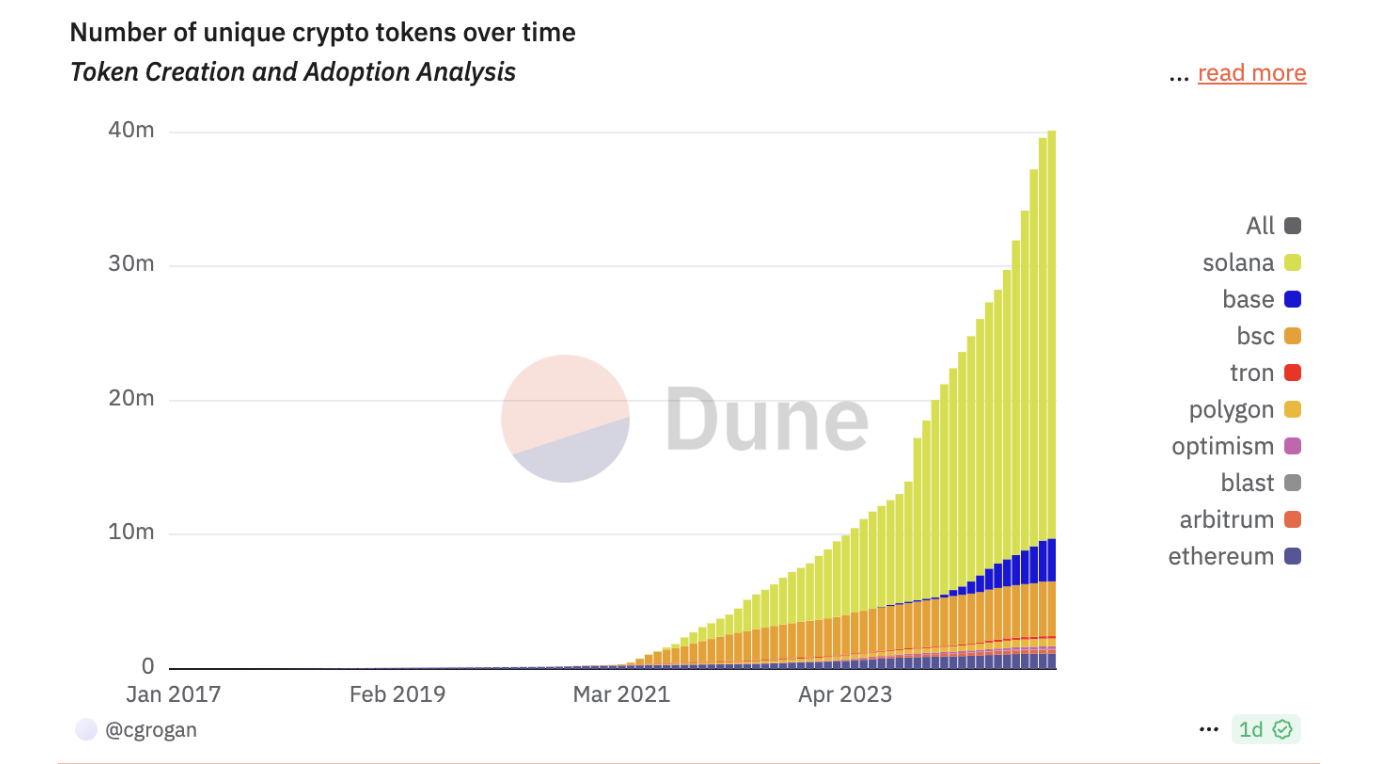

Today, there are tens of millions of different digital assets in circulation. Source: Dune

Over 600,000 tokens were launched in January 2025 alone. The vast majority of these assets are meme coins created on fair distribution platforms, as well as low-market-cap altcoins.

According to market analyst Jesse Myers, when these tokens fail, their prices do not drop to zero. Instead, their market values tend to remain between $10,000 and $100,000, which traps funds in illiquid pools indefinitely.

The massive influx of new tokens and digital assets has prompted Coinbase CEO Brian Armstrong to reassess the token listing process on the exchange to better meet consumer demand.

Related: Data Predicts Bull Market Return, Bitcoin Aiming for $126,000 Target by June

This article does not contain investment advice or recommendations. Every investment and trading operation carries risks, and readers should conduct their own research when making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。