Author: Evan Lu, Waterdrip Capital; Leo, AISA

Introduction

For the past century, the fundamental unit of economic activity has always been humans. Whether in production, trading, payment, or financial services, everything revolves around human needs. However, the rise of AI technology is reshaping this landscape, gradually transforming machines from passive tools into "active economic entities"—AI Agents.

Moreover, as the new year of 2025 approaches, Tether has announced the integration of USDT into the BTC ecosystem, covering its base layer and the Lightning Network. Behind these trends, a transformation is quietly brewing: AI Agent-driven payment infrastructure is pushing the crypto industry into a new wave of innovation. From the consensus layer of BTC to the execution layer of smart contracts, and now to the AI-driven application layer, the crypto industry is likely to witness a paradigm shift of AI + Pay Fi + BTC Infra, compelling Web2 to self-reform into Web3—the future of mass adoption is gradually becoming a reality.

1. Stablecoins: The Cornerstone of a New Era in Global Payments—From Cross-Border Revolution to Mainstream Currency Evolution Over the Decade

The programmability, cross-border usability, and increasingly clear regulatory framework of stablecoins are expected to become the standard settlement currency for global payments. With the crypto-friendly Trump elected as the current U.S. president, the U.S. government will gradually provide regulatory clarity regarding cryptocurrencies, and the application scenarios for stablecoins will gradually expand. We can even estimate a bright vision for stablecoin payments in the next decade:

Short-term (1–3 years): Stablecoins will dominate cross-border remittances, providing a faster and cheaper alternative to SWIFT. Debit/credit cards related to cryptocurrencies (such as Visa/MasterCard) will simplify consumption, building a bridge between on-chain wealth and real-world transactions.

Mid-term (3–7 years): Businesses will increasingly adopt stablecoin payments due to their low fees, instant settlement, and programmability. Companies will be able to seamlessly convert between cryptocurrencies and fiat currencies, offering customers a dual-track payment option.

Long-term (7 years and beyond): Stablecoins will become mainstream fiat currencies, widely accepted for payments and even tax payments, fundamentally disrupting traditional financial infrastructure.

Beyond the convenience of payments, stablecoins also play a significantly positive role in other areas: for instance, they provide entrepreneurs with a more accessible platform to develop new payment products: no intermediaries, minimum balances, or proprietary SDKs. Additionally, rough estimates suggest that medium to large enterprises could increase profits by 2% if they use stablecoin solution providers in transactions. Furthermore, countries like Russia, which are under U.S. sanctions, have already attempted to use stablecoins for trade between nations to bypass the dollar settlement system. An increasing number of cases indicate that stablecoins are gradually approaching their optimal market fit. This is not surprising—they are undoubtedly the most economical way to settle in dollars and the fastest global payment method.

2. Next Level: AI Agents as the New User Experience Layer for Future Apps

Today, we no longer rely solely on AI to perform single tasks, such as image recognition, voice synthesis, or autonomous driving. Instead, we are entering an "era where AI Agents become independent market participants." This change is not limited to AI-driven financial transactions and smart supply chain management; it also involves generative AI (AIGC) providing services for content creators, developers, and businesses. Furthermore, AI agents can even "negotiate, trade, settle, and optimize their resource utilization autonomously."

Just last year, we saw AI Agents redefine the application scenarios of DApps, with the pioneer being @truth_terminal, an AI Agent capable of promoting its issued token $Goat; closely followed by AI Agents like Luna and AIxbt, which can autonomously trade using tokens, generate content, and even manage their own crypto wallets and assets. This evolution of capabilities has given rise to innovative narratives in the crypto space, such as Virtual Protocol—a protocol similar to Pump.fun, but its "Pump" targets are no longer just tokens, but a variety of AI Agents.

The continuously evolving capabilities of AI Agents, combined with out-of-the-box issuance platforms, open up trillion-dollar market opportunities for the concept of AI Agent + Crypto. AI is becoming an active participant in the on-chain ecosystem, driving blockchain applications from being tool-based to being ecosystem-based.

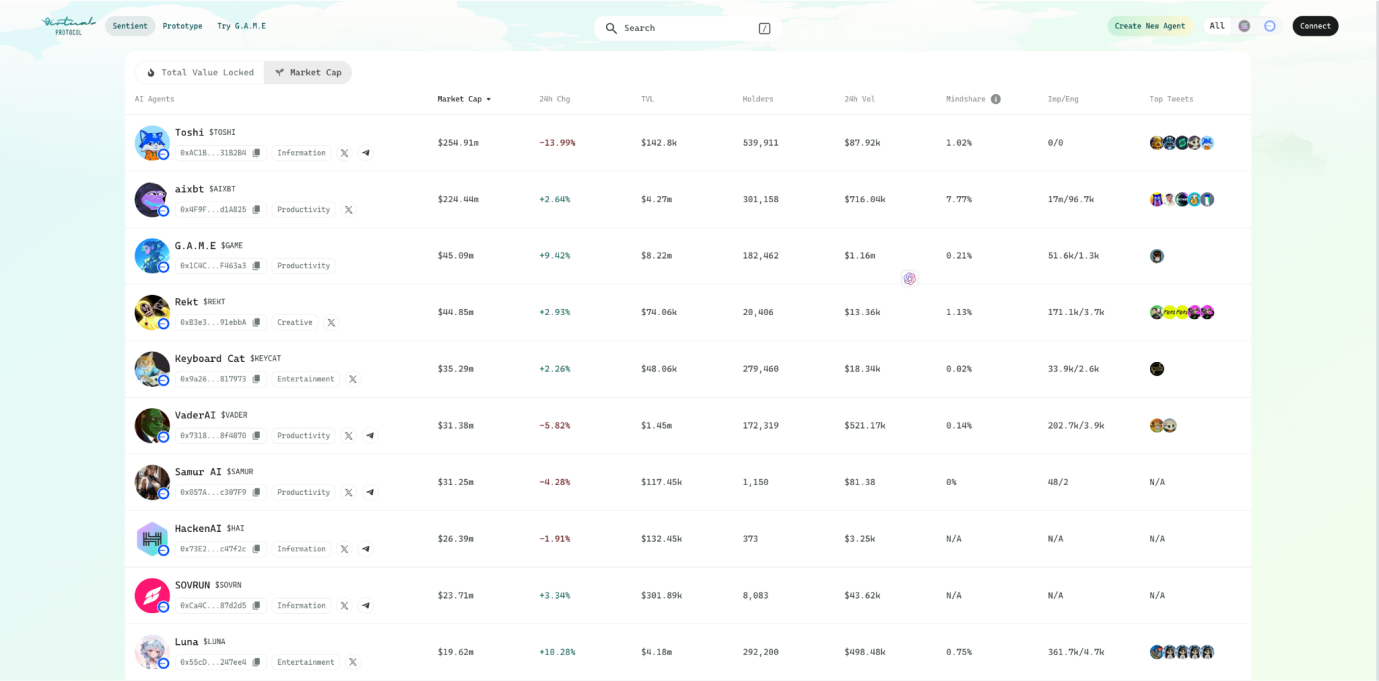

Top 10 AI Agent Market Capitalization Rankings on Virtual Protocol, as of February 11, 2025, data source: https://app.virtuals.io/sentients?sortBy=mcapInVirtual&sortOrder=desc&page=1

In the future, AI will become the user experience layer of blockchain technology, serving as a link between the application layer and blockchain infrastructure, functioning both upward and downward in the tech stack. To give an example that crypto users can easily understand, AI can actively recommend and execute on-chain DeFi operations based on user intentions and preferences (such as security, yield, etc.), combined with real-time information from prediction markets. Users will not need to understand the differences between L1 and L2, nor will they need to know how cross-chain bridges work. Extending to daily life, imagine a scenario where an AI personal finance assistant can autonomously manage your taxes, insurance, and rent income and expenses, dynamically optimize your investment portfolio, and even automatically execute trades based on market changes. Of course, while granting AI economic autonomy, security issues cannot be overlooked. For this reason, Trusted Execution Environments (TEE) become a key infrastructure—it ensures that the behavior of AI Agents strictly follows preset logic and is not subject to external manipulation by isolating the computing environment. For example, an AI Agent running in a TEE can attract users and earn income through content generation while ensuring absolute control over its asset keys through cryptographic technology. Furthermore, AI can operate Depin nodes or verify data, becoming the core executor of its distributed system.

The workflows and application scenarios of these AI Agents are sketching out a brand new picture of a "machine economy": from gamers to Depin managers, from content creators to financial strategists, AI Agents will become the core driving force of the on-chain ecosystem.

3. The Dilemma of Existing Payment Systems: The Invisible Shackles of the AI Economy

In the future, AI Agents will partially replace humans, becoming independent participants in the market and forming an important force. However, this revolution of the machine economy is not without challenges. One of the core issues is "payment." The realization of the AI revolution relies on an efficient, secure, and decentralized payment network built using blockchain technology, providing AI Agents with seamless economic interaction capabilities.

3.1 Economic Imbalance of Micropayments

Imagine a scenario where an AI agent is running a high-frequency trading strategy, needing to complete 1,000 transactions per second, with each transaction amounting to only $0.0001. If using traditional payment networks (like Visa or PayPal), each transaction would incur at least a $0.30 fee, meaning the AI agent would pay 3,000 times the fee for each $0.0001 transaction. This absurd cost structure directly prevents the AI economy from operating on existing payment systems.

3.2 Fatal Flaws in Settlement Speed

For AI agents, transactions are not sporadic events but a continuous flow process. However, the settlement methods of traditional payment networks are extremely lagging:

- Credit card payments: Typically take 1-3 days to settle.

- SWIFT international transfers: May take 2-5 days.

- Cryptocurrency payments (like Bitcoin main chain transactions): Average 10 minutes or longer.

- The AI economy requires millisecond-level settlements, but the existing payment systems clearly cannot meet this demand.

3.3 Limitations of Centralized Architecture

AI agents are inherently global; they are not restricted by geographical boundaries. However, traditional payment systems are mired in issues such as bank account dependencies, fiat currency compliance, and regional payment rules.

- Bank account dependency: Most payment systems (like Visa, PayPal) require transaction parties to have bank accounts, while AI agents cannot open bank accounts like humans.

- Centralized control: Existing payment systems rely on a few financial institutions for approval, and AI agents' transactions may be rejected at any time due to regulatory or compliance issues.

- International payment barriers: Cross-border transactions by AI agents face cumbersome compliance requirements, increasing operational costs and complexity.

If the AI economy must rely on existing payment systems, it will be constrained by artificially imposed limitations, unable to truly unleash its potential.

3.4 Five Core Requirements for an AI Economic Payment System

Considering the possible operational characteristics and use cases of AI Agents, the future payment system serving AI must possess the following five core capabilities:

- Micropayment capability: AI agents' transactions often involve extremely small amounts (like $0.0001), and fees must be extremely low, even approaching zero.

- Millisecond-level transaction settlement: AI transactions occur on a sub-second time scale, and the payment system must be able to settle in real-time, rather than waiting for minutes or even days.

- Decentralization and censorship resistance: AI agents need to trade autonomously and cannot rely on centralized financial institutions.

- Global availability: AI agents are not limited by national borders, and the payment system must support cross-border transactions, avoiding bank account dependencies.

- Intelligent payment protocols: The payment system must be able to seamlessly interact with AI agents, supporting automatic settlement, smart trading routing, liquidity optimization, and other functions.

4. The Hope and Limitations of Blockchain Payments

In recent years, the rise of blockchain technology has brought a glimmer of hope to the AI economy. The decentralization, smart contracts, and permissionless transactions of blockchain make it a potential alternative to traditional payment systems. However, mainstream blockchains still face the following issues:

4.1 High Costs of ETH Network Payments

ETH (Ethereum) is the primary infrastructure for DeFi (decentralized finance), but its high transaction costs make it difficult for the AI economy to adopt. During network congestion, a simple USDT transaction may require $10-$50 in gas fees, with limited transaction throughput and slow processing speeds, making it challenging to support the high-frequency trading needs of AI agents.

4.2 Speed and Centralization Issues of Other High-Performance Public Chains

Currently, a large number of high-performance public chains have emerged in the crypto ecosystem. These public chains do provide faster transaction processing capabilities, but they often exhibit a higher degree of centralization, posing security risks. In recent years, some high-performance public chains have experienced multiple outages, affecting transaction stability. Additionally, most public chains rely on a limited number of validating nodes, which greatly impacts the decentralization attributes of the payment system.

4.3 Scalability Bottlenecks of the BTC Mainnet

As the world's most secure and decentralized blockchain, BTC's security is unmatched, but its payment capacity is limited. The transaction throughput of the BTC mainnet is extremely low (only 7 transactions per second), and when faced with higher transaction volume requests, its gas fees soar, leading to significant fluctuations in transaction costs, making it unsuitable for the small payments of AI agents.

Therefore, while blockchain technology offers a potential solution, relying solely on existing public chains cannot fully meet the payment needs of the AI economy.

4.4 Lightning Network—A New Stage for Stablecoin Payments

The Lightning Network, as the first layer-two scaling solution for BTC, not only relies on the security of the BTC network (with over 57,000 nodes and a PoW mechanism) but also achieves instant, low-cost, and infinitely scalable transaction capabilities through bidirectional payment channels. This technological path is highly adaptable to small, high-frequency payment scenarios and aligns with the ideals of fundamentalist crypto enthusiasts—where all transactions are conducted on the BTC network. Currently, the Lightning Network has over 15,000 nodes and 50,000 channels, demonstrating strong ecological potential.

However, the Lightning Network is not without its flaws. Before the emergence of the Taproot Assets protocol, the Lightning Network only supported BTC as a payment currency, resulting in very limited application scenarios. In today's context, where BTC has become "digital gold," most people are reluctant to easily spend their held BTC. At this point, the importance of stablecoins is self-evident: throughout history, only currencies with stable value have been widely accepted and used in everyday payment scenarios. For the technical principles of the Lightning Network and the TA protocol, refer to this article: Taproot Assets: The Next Growth Point for Stablecoins Surpassing a Trillion Market Value.

Undoubtedly, USDT issued by Tether remains the dominant stablecoin in the crypto world today. As of today, the total issuance of USDC is $56.3 billion, while the total issuance of USDT exceeds $140 billion, making it twice that of the second-largest issuer, USDC. Tether's integration of USDT into the Lightning Network is highly significant. This action signifies a form of recognition in the eyes of users—after all, USDT is a real asset, and its issuance implies Tether's acknowledgment of the security and usability of public chains. More importantly, the real on-chain users and fee income brought by USDT are resources that every public chain dreams of. This also marks the arrival of an era where the Lightning Network, after years of development, can truly showcase its potential.

5. All Set, Just Waiting for the Right Moment

The explosive growth of AI Agents is giving rise to a trillion-dollar market in the machine economy, but it is clear that traditional payment networks (high cost, low speed) and existing blockchain solutions struggle to support this demand. The integration of USDT into the Lightning Network seems to provide a key piece of the puzzle for the industry—an almost zero-cost, censorship-resistant payment channel, combined with the liquidity of stablecoins, perfectly adapting to the micropayment and real-time transaction scenarios of AI agents.

Thus, AISA has emerged in response to this trend. It is not just a simple stacking of technology stacks but a "financial operating system" tailored for the AI economy, allowing the AI economy to truly break free from the shackles of payment and move towards a future of autonomous interaction. The future AI economy does not need to wait—payment is efficiency, and transactions are intelligence.

6. AISA: The Ultimate Integration of Lightning Network, Stablecoins, and AI Agents—Reconstructing the Payment Foundation of the AI Economy

6.1 The Four-Layer Technical Architecture of AISA

The architecture of AISA can be divided into four core layers that work together to enable AI agents to conduct payments freely and efficiently.

a. Settlement Layer

Based on the underlying network: BTC network (L1) + Lightning Network (L2). The core advantages of its settlement layer are:

Security: Relying on Bitcoin's PoW mechanism and decentralized network (over 57,000 nodes globally).

Efficiency: Millisecond-level transaction confirmation, with fees approaching zero, completely solving the pain points of AI high-frequency micropayments.

b. Payment Layer

Multi-chain support: Compatible with public chains like Ethereum, Solana, and Polygon, allowing AI agents to freely choose the optimal chain.

Stablecoin integration: AISA's own issued aiUSD (native stablecoin) circulates as a payment currency on the Lightning Network alongside USDT and USDC through the Taproot Assets protocol.

c. Programmable Layer

AI Native Protocol (AIP): Grants AI agents autonomous decision-making capabilities.

Dynamic routing: Real-time analysis of transaction fees and network congestion, automatically switching payment paths (e.g., Lightning Network → Solana).

Automated micropayments: On-demand settlement (e.g., paying $0.0001 for each API call) without human intervention.

Liquidity management: AI agents can dynamically allocate funds to liquidity pools to optimize payment efficiency.

d. Governance Layer

DAO mechanism: Governed collectively by LPT token holders, deciding on protocol upgrades, fee distribution, etc.

Incentive mechanism: Liquidity providers stake LPT to earn rewards (transaction fee sharing). A portion of the fees is used for token burning, promoting a deflationary model.

6.2 How AISA Redefines AI Economic Payments

AISA is not a simple extension of traditional blockchain payments but a revolutionary infrastructure designed specifically for the AI economy. By integrating the decentralized efficiency of the Bitcoin Lightning Network, the liquidity assurance of stablecoins, and the intelligent decision-making capabilities of AI native protocols, AISA constructs a payment network with nearly zero costs and millisecond-level responses, completely breaking through the high-cost and low-efficiency bottlenecks of traditional systems. Here, AI agents can autonomously complete micropayments (e.g., only $0.0001 for each API call), settle DePIN node contribution rewards in real-time, and even dynamically optimize cross-chain transaction paths without human intervention.

From cross-border corporate payments (replacing SWIFT to save costs) to high-frequency trading of automated financial strategies, AISA's adaptability is driving the rise of the machine economy—where AI agents may autonomously manage taxes and investments, forming an independent economic closed loop. Through multi-chain compatibility and DAO governance, AISA not only addresses the fragmentation issues of the existing payment ecosystem but also sets a new standard for human-machine collaboration in the decentralized era as a "financial operating system." When stablecoins become mainstream settlement tools and the Lightning Network connects global value flows, AISA's vision is to allow the machine economy to grow freely in a frictionless intelligent network.

7. Conclusion

When AI agents autonomously complete transactions, investments, and even tax payments on-chain, payment is no longer a tool but the circulatory system of the machine economy. The Lightning Network provides the vessels, stablecoins act as the blood, and AI agents become the heart—this silent revolution illuminates the future payment ecosystem like lightning. Future payments do not belong to any institution or country but to every autonomously operating AI and participating node. Here, code is law, efficiency is justice, and true innovation is just beginning.

8. References

https://www.chaincatcher.com/article/2161702

https://www.chaincatcher.com/article/2161951

https://www.chaincatcher.com/article/2164512

https://www.techflowpost.com/article/detail_22877.html

https://www.techflowpost.com/article/detail_22533.html

https://x.com/tmel0211/status/1878301327706694139

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。