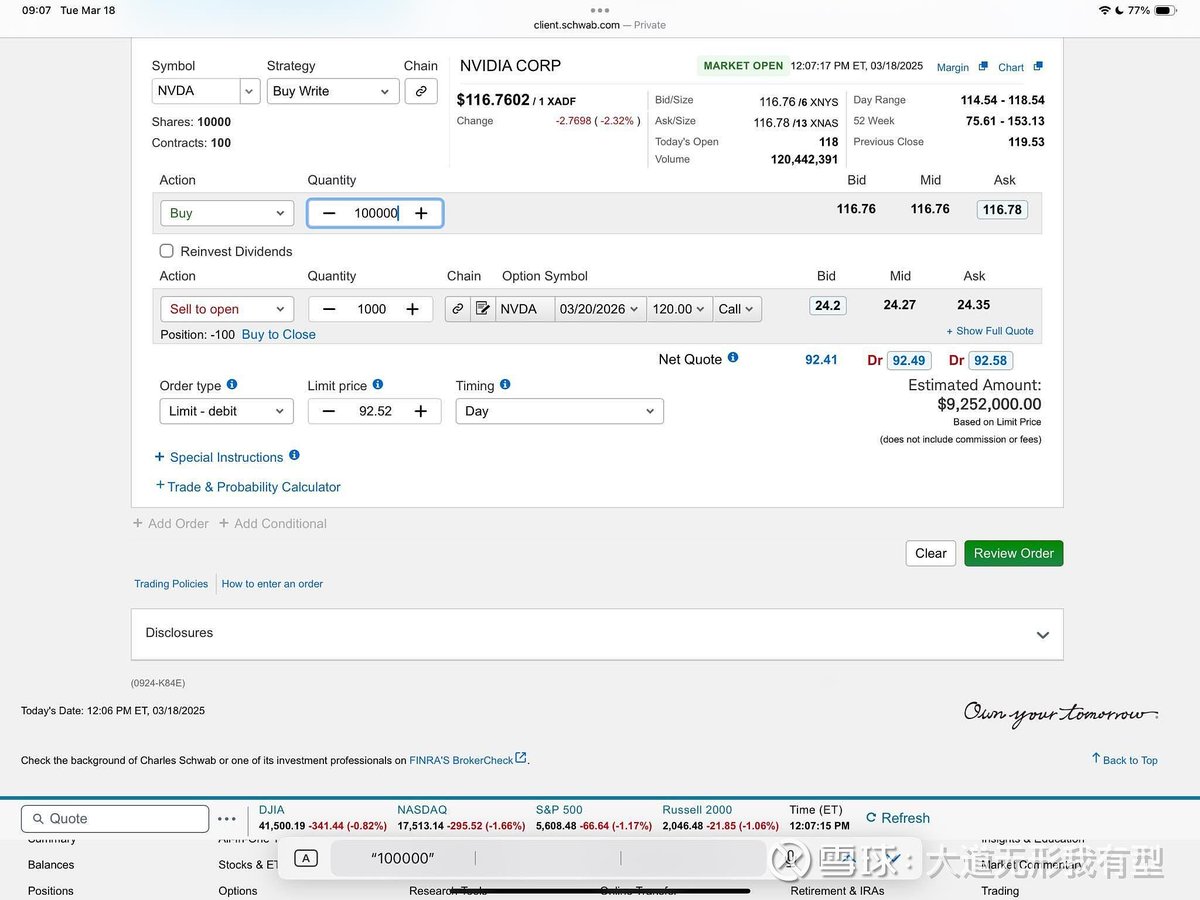

Classic Teaching: Experts play the U.S. stock market differently from ordinary investors. Let's take a look at the strategy of the great Duan Yongping when buying Nvidia stock:

1️⃣ Stock Price Rises (> $120)

• The stock appreciates, and the portion above $120 is exercised (because the buyer will purchase the stock at $120).

• The investor earns a price difference of $120 - $116.76 = $3.24 per share (totaling $3.24 × 100,000 = $324,000).

• Adding the option premium of $2,427,000, the total profit is $2,751,000.

2️⃣ Stock Price Stays Flat (Not Exceeding $120)

• The stock remains unchanged, earning the option premium of $2,427,000 as passive income.

3️⃣ Stock Price Falls

• The stock price declines, and the investor incurs a loss, but since they have already received an option premium of $24.27, it effectively reduces the cost per share to $92.52, somewhat cushioning the loss.

This indicates that Duan Yongping's current strategy is still conservative, showing long-term confidence in Nvidia stock, but there is uncertainty in the short term, and no significant rise is expected. This strategy effectively lowers the holding cost through the option premium.

However, there are also two potential risks: first, if Nvidia surges (for example, to $150), Mr. Duan can only sell at $120, missing out on greater profits. Additionally, if Nvidia's stock price plummets, there will still be a certain level of loss.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。