By providing clear structural advantages in five areas (tokenization, DeVin, DePin, payments, and speculation), the adoption of blockchain is merely a matter of time.

Author: Robbie Petersen

Translated by: Deep Tide TechFlow

Essentially, blockchain is an asset ledger. This indicates that it excels in the following three aspects:

Issuing assets

Transferring assets

Programming assets

Objectively, any cryptocurrency application scenario that can leverage the above functions will gain structural advantages by operating on-chain. Conversely, any scenario that fails to utilize these functions will not achieve such advantages. In most cases, the appeal of these scenarios is more about ideological alignment than functional unlocking.

While decentralization, privacy protection, and censorship resistance are undoubtedly worthy goals, these characteristics actually limit the potential market size (TAM) of programmable asset ledgers to a subset of idealists. It is becoming increasingly clear that the path to widespread adoption will be driven by pragmatism rather than pure idealism. Therefore, this article will focus on those application scenarios that would become inferior products without blockchain:

Asset tokenization

Decentralized virtual infrastructure networks (DeVin)

Decentralized physical infrastructure networks (DePin)

Stablecoins and payments

Speculation

Before delving deeper, I would like to emphasize two points:

First, the following arguments are derived from first principles. This means we are not simply forcing cryptographic technology onto a problem, but rather identifying issues that would persist regardless of the existence of cryptographic technology and actively assessing whether cryptographic technology can provide a structurally superior solution.

Second, this article strives to be as detailed as possible. As humans, our brains naturally tend to simplify complex issues and prefer answers that sound straightforward. However, reality is not simple; it is full of nuances.

Argument 1: Asset Tokenization

Financial assets can generally be divided into two categories:

Securitized assets

Non-securitized assets

While this may seem like a trivial distinction, it is crucial for understanding how existing financial ledgers operate. Securitized assets have two important characteristics compared to non-securitized assets:

First, they all have a CUSIP. A CUSIP is a unique 9-character alphanumeric code used to identify financial instruments such as stocks, bonds, and other securities. For example, the CUSIP for Apple Inc. common stock is 037833100. CUSIPs are used in North America, while ISINs (International Securities Identification Numbers) are used in other parts of the world, which include CUSIP information in a broader 12-character code. A key role of these codes is to establish trust through standardization. As long as an asset has a CUSIP, all parties involved can operate under the same standard.

Another notable feature of securitized assets is that they are almost always settled through an authoritative clearinghouse. In the United States (and to some extent globally), this institution is the Depository Trust & Clearing Corporation (DTCC). The DTCC and its subsidiaries are primarily responsible for ensuring that all transactions can be smoothly cleared and settled.

For example, when you purchase 10 shares of Tesla stock on Robinhood, the transaction is sent to an exchange or market maker to match with the seller. Then, the National Securities Clearing Corporation (NSCC) of the DTCC intervenes to clear the transaction, ensuring that both the buyer and seller fulfill their agreements. Finally, another subsidiary of the DTCC, the Depository Trust Company (DTC), completes the settlement the next day (T+1), transferring your $2,500 to the seller while moving the 10 shares of Tesla stock into Robinhood's account at the DTC. By the next day, your Robinhood app will show that you own these shares.

When people say that blockchain can replace existing financial infrastructure and achieve faster, cheaper settlements, they are actually referring to replacing the DTCC and its closed centralized asset ledger with blockchain. However, while blockchain offers some structural advantages due to its openness and programmability (such as eliminating batch processing and T+1 settlements, improving capital efficiency, and embedding compliance), it faces two main obstacles in replacing the DTCC:

Path Dependence: The existing securities standards (such as CUSIP/ISIN) and the bilateral network effects brought by the DTCC as an authoritative settlement layer make it nearly impossible to replace this existing model. The switching costs for the DTCC are extremely high.

Structural Incentives: The DTCC is a highly regulated clearing institution owned by its users—these users are major financial institutions in the securities industry, including banks, brokers, and other participants (such as JPMorgan, Goldman Sachs, etc.). In other words, those entities that need to collectively agree to adopt a new settlement system also have vested interests in the existing system.

Complexity of T+1 Settlements: Similar to payments (which we will discuss later), the existence of T+1 settlements is not solely due to outdated infrastructure; there are other reasons as well. On one hand, brokers do not always have sufficient liquidity to complete orders instantly. A one-day buffer allows them to raise funds through loans or bank transfers. Secondly, the net settlement process of the DTCC reduces the number of transactions that need to be executed. For example, 1,000 buy orders for Tesla and 800 sell orders can net to 200 transactions. Intuitively, the longer the time span, the more efficient this process becomes. Instant settlements would significantly increase the total volume of transactions—something that almost all current blockchains cannot handle. For reference, the DTCC's annual transaction volume reached $25 quadrillion in 2023.

In short, rather than saying that blockchain will replace existing financial infrastructure, it is more likely that the DTCC itself will upgrade its system. This means that any on-chain transaction is essentially a secondary issuance of assets. In other words, they still need to be settled through the DTCC in the background. This not only undermines any structural advantages that blockchain theoretically offers but also adds additional costs and complexities to tokenization, such as the need to synchronize price data through oracles.

Therefore, the value proposition of on-chain securities is weakened to a less attractive function: providing regulatory arbitrage channels for entities that have not undergone KYC (Know Your Customer) verification to access and use securities. While this demand does exist, especially in emerging markets, its scale is only a small fraction of the original issuance asset market.

This does not mean that blockchain has no role to play in the context of securities tokenization. While the current operations of domestic clearing institutions are "good enough" and will not be disrupted for structural reasons, the global interoperability between these clearing institutions is still not ideal (settlements often take T+3). Blockchain could serve as a unified coordination layer between global clearing institutions, leveraging its borderless open asset ledger characteristics to reduce the settlement time for international transactions from T+3 to nearly zero. More interestingly, this could become a powerful entry point that gradually erodes the domestic settlement market without facing the cold start problem. As we will further discuss in the payments sector, this logic seems equally applicable.

Unlocking Long-Tail Liquidity

Next, we discuss the second category of financial assets—non-securitized assets. By definition, these assets do not have a CUSIP identifier and do not rely on the DTCC or existing financial infrastructure. Most non-securitized assets are typically bought and sold through bilateral transactions (or not traded at all). Examples of non-securitized assets include: private credit, real estate, trade finance receivables, intellectual property, collectibles, and shares in private funds (such as private equity funds, venture capital funds, and hedge funds).

Currently, the reasons these assets have not been securitized are mainly as follows:

- Asset Heterogeneity

Securitization requires assets to be homogeneous so that they can be easily packaged and standardized. However, the aforementioned assets are mostly heterogeneous—each piece of real estate, each private loan, each receivable, each fund share, or each artwork has unique characteristics that make aggregation and standardization difficult.

- Lack of Active Secondary Markets

These assets also lack authoritative secondary markets like the New York Stock Exchange (NYSE). Therefore, even if they were securitized and settled through the DTCC, there would be a lack of exchanges connecting buyers and sellers.

- High Barriers to Entry

The process of securitizing assets typically takes more than six months, and issuers need to pay over $2 million in fees. While some of these steps are to ensure compliance and build trust, the entire process is overly lengthy and costly.

Returning to the core argument of this article, as a programmable asset ledger, blockchain excels in the following three areas—which happen to address the aforementioned pain points:

Asset Issuance

- While the barriers to asset securitization are high, the resistance to tokenizing these assets on-chain is much lower. Moreover, this does not necessarily come at the expense of regulatory compliance, as compliance logic can be directly embedded into the asset itself.

Asset Transfer

- Blockchain provides a shared asset ledger, offering backend infrastructure for building a unified liquidity market. Other markets (such as loans, derivatives, etc.) can also be built on this foundation, enhancing efficiency.

Asset Programming

- The DTCC still operates on systems from decades ago, including using languages like COBOL, while blockchain can directly embed logic into assets. This means that more complex logic can be embedded into products, simplifying or packaging heterogeneous assets into tokenized forms.

In short, while blockchain may only offer marginal improvements for existing securities markets (like the DTCC), it brings a qualitative leap for non-securitized assets. This indicates that a reasonable adoption path for programmable asset ledgers may begin with long-tail assets. This is not only intuitive but also consistent with the adoption patterns of most emerging technologies.

MBS Moment

One of my less consensus views is that mortgage-backed securities (MBS) are one of the most important technologies of the past 50 years. By transforming mortgages into standardized securities that can be traded in liquid secondary markets, MBS improved price discovery through a more competitive pool of investors while weakening the illiquidity premium historically embedded in mortgages. In other words, we are able to finance housing at significantly lower costs thanks to MBS.

In the next five years, I expect that almost all illiquid asset classes will experience their "Mortgage-Backed Securities (MBS) moment." Tokenization will bring about more liquid secondary markets, fiercer competition, better price discovery, and most importantly, more efficient capital allocation.

Argument 2: Decentralized Virtual Infrastructure Networks (DeVin)

Artificial Intelligence (AI) will surpass human intelligence for the first time in human history, covering almost all fields. More importantly, this intelligence will not stagnate—it will continuously improve, specialize, collaborate, and can be replicated almost infinitely. In other words, imagine the immense impact if we could infinitely replicate the most effective individuals in each field (limited only by computational power) and optimize them for ultra-efficient collaboration.

In short, the impact of AI will be enormous—greater than what our linear thinking patterns can intuitively foresee.

Thus, a natural question arises: Will blockchain, as a programmable asset ledger, play a role in this emerging agentic economy?

I anticipate that blockchain will enhance AI capabilities in two ways:

Resource Coordination

As the Economic Foundation for Agent Transactions

In this article, we will primarily explore the first application scenario. If you are interested in the second scenario, I wrote a dedicated article a few months ago (in short: blockchain could become the foundation of the agentic economy, but it will take time to realize).

Future "Commodities"

Fundamentally, AI (especially autonomous agents) requires five core inputs to operate:

Energy: Electricity powers AI hardware; without energy, there is no computational power, and thus no AI.

Compute: Computational power is the processing capability that drives AI reasoning and learning; without compute, AI cannot process inputs or perform functions.

Bandwidth: Bandwidth is the data transmission capacity that supports AI connectivity; without bandwidth, agents cannot collaborate or update in real-time.

Storage: Storage is the capacity to retain AI data and software; without storage, AI cannot retain knowledge or state.

Data: Data provides the context necessary for AI to learn and respond.

In this article, we will focus primarily on the first four. To understand a compelling application scenario for programmable asset ledgers in the context of AI, it is essential to grasp how compute, energy, bandwidth, and storage are currently procured and priced.

Unlike traditional commodity markets that adjust prices based on supply and demand dynamics, these markets typically operate through rigid bilateral agreements. For example: Compute is primarily procured through long-term cloud contracts with cloud giants (like AWS) or by purchasing GPUs directly from Nvidia. Energy procurement is similarly inefficient; data centers often secure energy through fixed-price Power Purchase Agreements (PPAs) with utility companies or energy wholesalers, usually signed years in advance. The storage and bandwidth markets exhibit similar structural inefficiencies, with storage typically purchased in predetermined blocks from cloud service providers, leading companies to over-provision to avoid capacity shortages. Similarly, bandwidth is acquired through rigid agreements with Internet Service Providers (ISPs) and Content Delivery Network (CDN) providers, forcing companies to prioritize peak demand over average utilization.

The commonality among these markets is the lack of granular real-time price discovery. By selling resources through rigid tiered pricing rather than continuous price curves, existing systems sacrifice efficiency for predictability, resulting in ineffective coordination between buyers and sellers. This situation typically leads to two outcomes: 1. Resource waste. 2. Enterprises face resource constraints. Ultimately resulting in suboptimal resource allocation.

Programmable asset ledgers offer a compelling solution to the above issues. Although these resources may never be securitized for the reasons mentioned earlier, they can still be easily tokenized. By providing a tokenized foundation for compute, energy, storage, and bandwidth, blockchain theoretically unlocks liquid markets and real-time dynamic pricing for these resources.

Importantly, this is not something existing ledgers can achieve. As a programmable asset ledger, blockchain has the following five structural advantages in this context:

Real-Time Settlement

- If an asset ledger takes days or even hours to settle resource exchanges, market efficiency will be undermined. Blockchain, due to its openness, borderlessness, 24/7 operation, and real-time capabilities, ensures that the market is not affected by delays.

Openness

- Unlike traditional resource markets controlled by existing oligopolies, blockchain-based resource markets have a naturally low barrier to entry on the supply side. By creating an open market, any infrastructure provider—from hyperscale data centers to small operators—can tokenize and offer their excess capacity. Contrary to popular belief, long-tail markets occupy a larger share within data centers.

Composability

- Blockchain allows for the construction of other derivative markets on top of these markets, facilitating higher market efficiency. Buyers and sellers can hedge risks just like in traditional commodity markets.

Programmability

- Smart contracts enable complex conditional logic to be directly embedded into resource allocation. For example, compute tokens can automatically adjust their execution priority based on network congestion, or storage tokens can programmatically replicate data across geographic regions to optimize latency and redundancy.

Transparency

- On-chain markets provide visibility into pricing trends and utilization patterns, allowing market participants to make more informed decisions while reducing information asymmetry.

While this idea may have faced resistance a few years ago, the rapid rise of autonomous AI agents will significantly accelerate the demand for tokenized resource markets. As agents become more prevalent, they will inherently require dynamic access to these resources.

For instance, envision an autonomous video processing agent responsible for analyzing security footage from thousands of locations. Its daily compute requirements may fluctuate by orders of magnitude—requiring minimal resources during normal activity but potentially needing thousands of GPU hours for deep analysis of multiple video streams when an anomalous event is triggered. In a traditional cloud model, this agent would either waste significant resources through over-provisioning or face critical performance bottlenecks during peak demand.

However, through a tokenized compute market, this agent can programmatically acquire the necessary resources on demand and purchase them at market clearing prices. When an anomalous event is detected, it can immediately bid for and acquire additional compute tokens to process the footage at maximum speed, then promptly release those resources back to the market once the analysis is complete—all without human intervention. Multiplying this economic efficiency across millions of autonomous agents, the improvements in resource allocation are unparalleled compared to traditional procurement models.

More interestingly, this could give rise to entirely new application scenarios that were previously impossible. Today's agents still rely on organized companies that pre-provision compute, energy, storage, and bandwidth for them. However, through blockchain-supported markets, agents can autonomously acquire these critical resources on demand. This disrupts the existing model, enabling agents to become independent economic entities.

This, in turn, may stimulate greater specialization and experimentation, as agents can optimize for increasingly narrow use cases without institutional constraints. The ultimate result is a fundamentally different paradigm—the emergence of next-generation breakthrough AI applications will no longer be top-down but will arise from autonomous interactions between agents. All of this is made possible by the unique capabilities of programmable asset ledgers.

Looking Ahead

This transition may initially be slow and gradual, but as the autonomy and economic significance of autonomous agents continue to grow, the structural advantages of on-chain resource markets will become increasingly apparent.

Just as yesterday's commodities (such as oil, agriculture, metals, and land) gradually formed efficient markets, the future commodities—compute, energy, bandwidth, and storage—will inevitably find their markets. And this time, they will be built on blockchain.

Argument 3: Decentralized Physical Infrastructure Networks (DePin)

In the previous argument, we explored how programmable asset ledgers serve as the digital foundation for these emerging resource markets, while in this argument, we will discuss how blockchain can simultaneously disrupt the operation of physical infrastructure. Although we will not delve into every specific vertical (as @PonderingDurian and I have conducted in-depth research on this), the following logic applies to any DePin vertical (such as telecommunications, GPUs, positioning, energy, storage, and data).

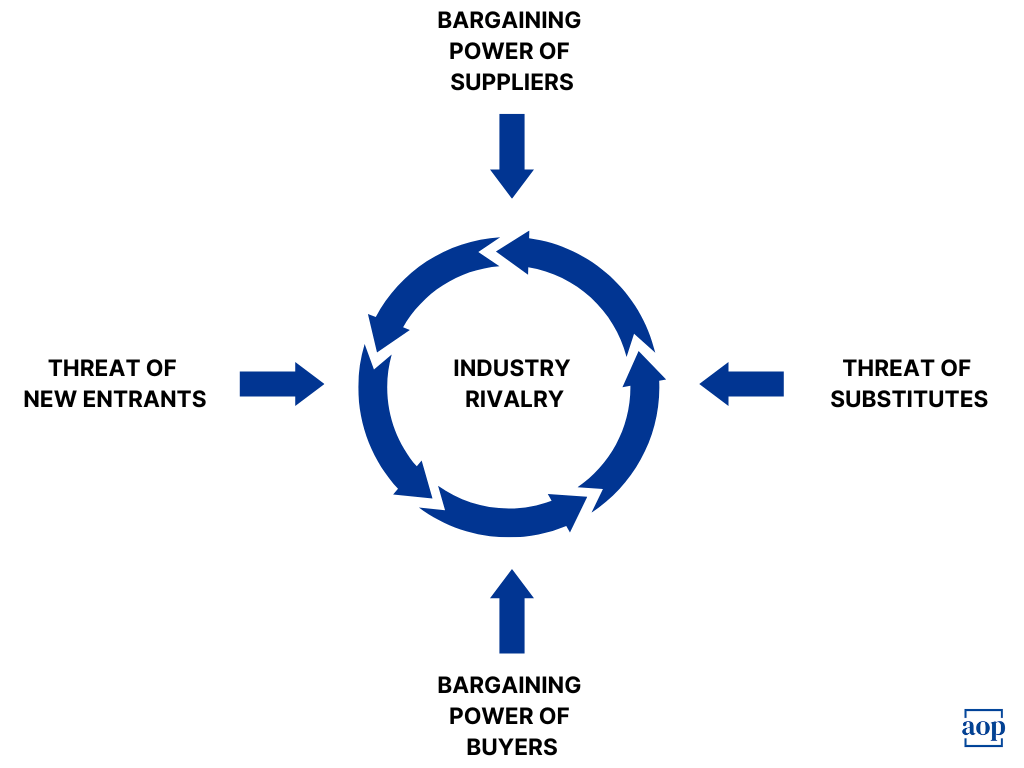

Porter's Five Forces Model

To understand the economics of physical infrastructure enterprises and how blockchain and the DePin model may disrupt them, one of the best frameworks is to analyze through Michael Porter's "Five Forces Model."

Porter's framework specifically describes the numerous forces that erode any company's profit margins in the absence of some structural moat. The five competitive forces are as follows:

Competition Among Existing Rivals

- Is there intense competition within the industry that could trigger price wars? Infrastructure giants typically operate as cooperative oligopolies, implicitly or explicitly maintaining high prices to sustain substantial profit margins.

Threat of New Entrants

- How easy is it for new competitors to enter the market? Capital intensity and economies of scale provide infrastructure giants with a degree of immunity from new entrants.

Threat of Substitutes

- Are there substitute products that weaken the value of existing products? Since infrastructure companies are essentially commoditized businesses, they typically do not face threats from substitutes.

Bargaining Power of Buyers

- A company's pricing power over its products is a key factor in the profit formula. Do buyers (customers or businesses) have the ability to demand lower prices or better terms, thereby squeezing suppliers' profits? Infrastructure giants often face low switching costs, indicating that in commodity markets, the lowest-cost producers tend to prevail.

Bargaining Power of Suppliers

- The costs that companies pay for their inputs are the denominator in the profit formula. Are companies able to exert influence over suppliers of key inputs to ensure that input costs remain moderate? The three main inputs for infrastructure giants are: (1) land, (2) labor, and (3) hardware. While suppliers do possess some bargaining power, large infrastructure companies typically mitigate these risks through fixed contracts and bulk transactions.

Clearly, this framework indicates that physical infrastructure giants are very defensive enterprises. This aligns with the fact that most existing companies have maintained their market positions over the past 30 years. However, the DePin model poses a powerful challenge for three significant reasons.

Structural Advantages of DePin

First, DePin leverages a novel capital formation model that outsources the upfront capital costs of building networks to individual contributors. In return, these individuals receive tokens representing future growth rights of the network. This model allows DePin projects to reach a critical scale where unit economics are effectively competitive without initially raising funds through centralized means. More importantly, it suggests that if executed properly, the DePin model can cultivate viable new entrants by breaking down the economies of scale barriers that existing enterprises rely on for protection.

Second, DePin fundamentally improves the fifth force in Porter's Five Forces Model: the bargaining power of suppliers. By utilizing a distributed network of individuals, the DePin model not only reduces costs but also completely avoids two (or possibly all three) of the major input costs for physical infrastructure companies:

Land: By accessing individual contributors (who own the land themselves), the DePin model entirely eliminates this cost.

Labor: Similarly, DePin avoids labor costs by outsourcing the setup and maintenance of nodes to network participants.

The third structural advantage of the DePin model lies in its ability to match supply and demand more precisely, thereby reducing deadweight loss. This advantage is particularly evident in geographically dependent networks (such as DeWi). These projects can first identify areas with the highest bandwidth demand and concentrate on releasing tokens to incentivize supply-side construction in those regions. Furthermore, if demand surges elsewhere, they can dynamically adjust incentives. This sharply contrasts with traditional infrastructure companies, which often build supply first, hoping demand will follow. If demand decreases, telecom companies still have to pay for maintaining infrastructure, leading to deadweight loss. In contrast, decentralized DePin networks can match supply and demand more accurately.

Looking Ahead

Looking forward, I expect the DePin model to continue shining in two key areas on the demand side:

B2B Applications: Businesses themselves are more cost-sensitive (e.g., compute, data, positioning, and storage).

Consumer Goods: Consumers also lack subjective preferences and primarily optimize for cost (e.g., bandwidth and energy).

Argument 4: Stablecoins and Global Payments

In 2023, the global GDP is approximately $100 trillion. In the same year, global transaction fee expenditures exceeded $2 trillion. In other words, for every $100 spent, an average of $2 goes towards transaction fees. As the world gradually breaks free from geographical constraints, this figure is expected to continue growing steadily at a compound annual growth rate (CAGR) of 7%. Against this backdrop, the demand for reducing global payment costs undoubtedly represents a significant opportunity.

Similar to domestic payments, the high transaction fees associated with cross-border capital flows are not an issue with the network infrastructure itself but are more driven by risk. Contrary to common belief, the messaging layer supporting global payments—SWIFT—is actually very inexpensive (@sytaylor). SWIFT's network fees typically amount to only $0.05 to $0.20 per transaction. The remaining costs—often reaching $40 to $120—primarily stem from two areas:

Risk and Compliance: The responsibility for ensuring that cross-border transactions comply with KYC (Know Your Customer), AML (Anti-Money Laundering) requirements, sanctions regulations, and other monetary restrictions is imposed on banks by regulatory authorities. If banks violate these rules, they may face fines of up to $9 billion. Therefore, it is crucial for banks handling cross-border payments to establish dedicated teams and infrastructure to ensure they do not inadvertently breach these regulations.

Correspondent Banking Relationships: To facilitate global capital flows, banks must establish correspondent banking relationships with other banks. Since different banks manage risk and compliance according to their respective jurisdictions, reconciling these differences incurs additional costs. Moreover, dedicated teams and infrastructure are needed to manage these correspondent banking relationships.

Ultimately, these costs are passed on to end users. Therefore, simply stating "we need cheaper global payments" does not address the issue. What is truly needed is a structurally superior way to audit and manage the risks associated with global payments.

Intuitively, this is precisely one of the areas where blockchain excels. Blockchain not only circumvents the reliance on correspondent banks but also provides an open ledger that allows all transactions to be audited in real-time, thereby offering a fundamentally superior asset ledger for managing risk.

Moreover, interestingly, the programmable nature of blockchain allows any necessary payment rules or compliance requirements to be directly embedded into the transactions themselves. The programmability of blockchain also enables the local yields from staked assets to be distributed to participants in cross-border payments (potentially including end users). This sharply contrasts with traditional money transfer institutions (like Western Union), where funds are locked in global prepaid accounts and cannot be used flexibly.

The end result is that the cost of underwriting risk will be compressed to the cost of programming an open ledger to handle compliance and risk management (plus necessary on-chain and off-chain conversion costs), minus the yields generated from staked stablecoin assets. This presents a significant structural advantage over existing correspondent banking solutions and modern cross-border payment solutions that rely on closed and centralized databases (such as Wise).

Perhaps most importantly, unlike domestic payments, governments around the world seem to lack the incentive to build globally interoperable payment infrastructure themselves, as this would undermine the value proposition of stablecoins. In fact, I believe that governments have a strong structural incentive not to build interoperable payment rails to ensure that value remains primarily within their national currencies.

This may be one of the most favorable driving factors for stablecoins—cross-border payments represent a unique public market problem, and the solutions need to rely on the private market. As long as governments have a structural incentive to maintain inefficient global payment infrastructure, stablecoins will continue to be well-positioned to facilitate global commerce and capture over $2 trillion in cross-border transaction fees annually.

Adoption Path of Stablecoins

Finally, we can speculate on the adoption path of stablecoins. The adoption of stablecoins will ultimately be determined by two key vectors:

Type of Payment (e.g., B2B, B2C, C2C, etc.)

Payment Channels (e.g., G7, G20 minor countries, long-tail markets)

Intuitively, those payment channels with the highest fees and the poorest banking/payment infrastructure are likely to adopt stablecoins first (e.g., the Global South, Latin America, Southeast Asia). Additionally, these regions are often the most severely affected by irresponsible monetary policies and historically volatile local currencies. Adopting stablecoins in these areas not only allows for lower transaction fees but also provides access to the dollar. The latter can be said to be the greatest driving force behind the demand for stablecoins in these regions and is likely to remain so in the future.

Secondly, since businesses are more cost-sensitive than consumers, B2B use cases will also be among the first to adopt stablecoins within the aforementioned vectors. Currently, over 90% of cross-border payments are B2B. In this vertical, small and medium-sized businesses (SMBs) seem best suited to adopt stablecoins, as they operate on thinner margins and are more willing to take on higher risks than larger enterprises. Those SMBs that may not have access to traditional banking infrastructure but need dollars appear to be the best entry point for stablecoin adoption. Other significant use cases for stablecoins in a global context include financial management, trade financing, international payments, and accounts receivable.

Looking ahead, as long-tail markets gradually adopt stablecoins as a structurally superior means of cross-border payments, the remaining markets will also follow suit, as these structural advantages will become too apparent to ignore.

Argument 5: Speculation

The final argument may be the most obvious and direct. Humans have an inherent desire for speculation and gambling. This desire has existed for thousands of years and will only continue into the future.

Moreover, it is becoming increasingly clear that blockchain has a unique advantage in fulfilling this demand. As a programmable asset ledger, blockchain lowers the barrier to issuing assets—here referring to speculative assets with nonlinear returns. This includes various forms ranging from perpetual contracts (perps) to prediction markets to memecoins.

Looking ahead, as users explore the risk curve and seek increasingly nonlinear outcomes, blockchain seems poised to meet this demand through ever more novel speculative avenues. This could include markets for athletes, musicians, songs, social trends, and even specific items like TikTok posts.

Humans will continue to pursue new speculative avenues, and blockchain is the best principled solution to serve this demand.

Looking Ahead

Throughout history, the adoption of new technologies often follows a similar trajectory:

A certain emerging technology provides structural advantages;

A small number of enterprises adopt the technology to improve their profit margins;

Existing enterprises either follow suit to remain competitive or lose market share;

As capitalism naturally selects winners, the adoption of new technology becomes the industry standard.

In my view, this is precisely why the adoption of blockchain as a programmable asset ledger is not only possible but inevitable. By providing clear structural advantages across five domains (tokenization, DeVin, DePin, payments, and speculation), the adoption of blockchain is merely a matter of time. While the specific timeline remains uncertain, it is certain that we have never been closer to this goal.

Finally, if you are building something in these frontier areas, feel free to DM me anytime!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。