In-depth analysis of the dTAO upgrade's impact on the Bittensor ecosystem, focusing on its architectural innovations, economic model, and overall ecological dynamics.

Author: Chloe Zheng

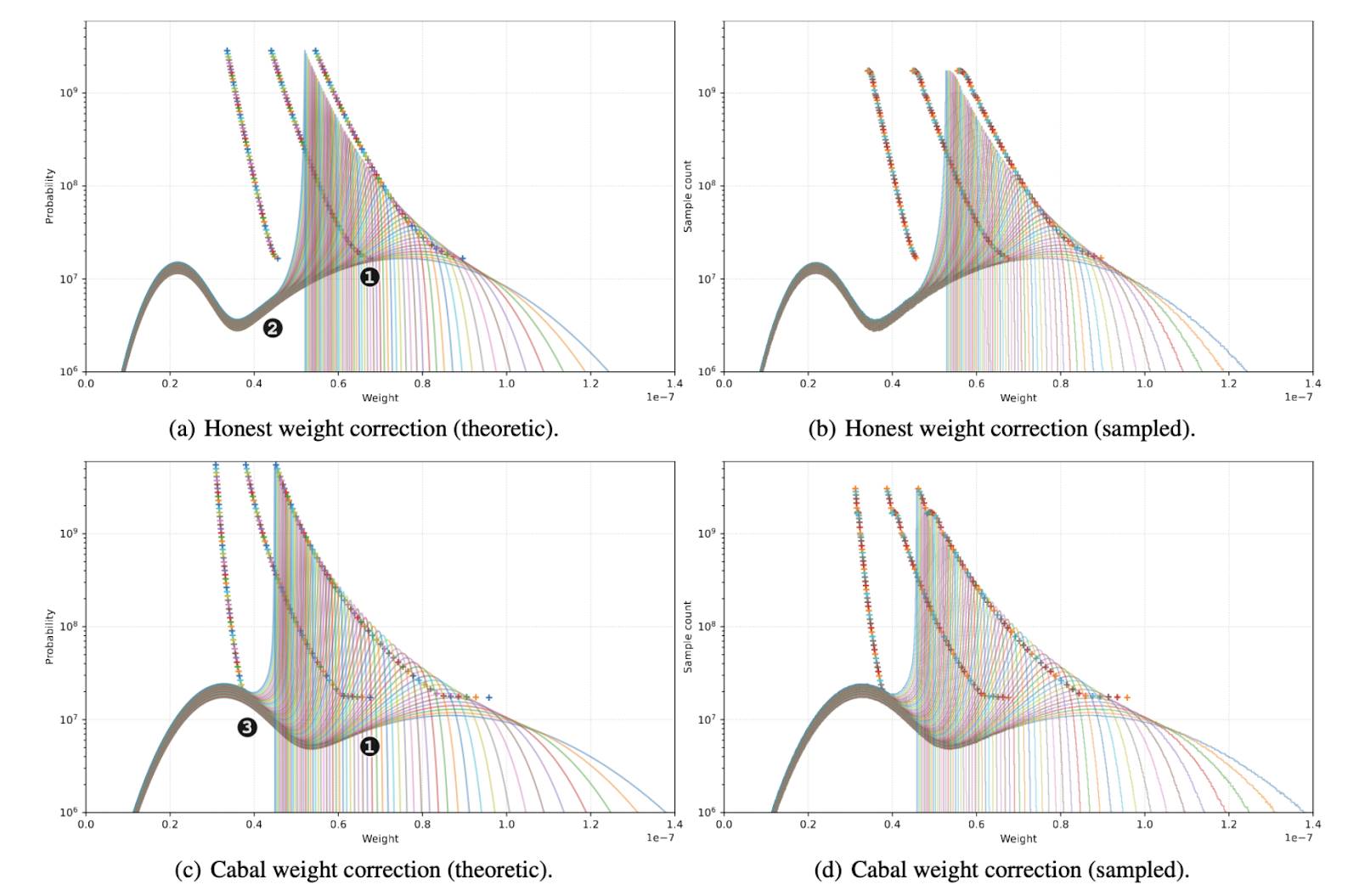

According to a 2023 study by Sequoia Capital, 85% of developers prefer to fine-tune existing models rather than train from scratch. Recent trends further validate this: DeepSeek has open-sourced its model and introduced model distillation technology, passing inference logic from a teacher model (large model) to a student model (small model) to optimize knowledge compression and performance retention. Similarly, OpenAI's ChatGPT O3 version emphasizes post-training and reinforcement learning. Bittensor provides an open, decentralized platform that supports collaboration and sharing of AI models. In July 2024, Bittensor and Cerebras released the BTLM-3b-8k open-source large language model (LLM), which garnered over 16,000 downloads on Hugging Face, showcasing Bittensor's technical capabilities.

Although Bittensor launched in 2021, it has barely made an appearance in the AI Agent boom of Q4 2024, and the token price has remained stagnant. On February 13, 2025, Bittensor launched the dTAO upgrade aimed at optimizing token issuance, enhancing fairness, and increasing liquidity. This change is akin to the Virtuals Protocol's launch of the AI Agent LaunchPad, which led to a 50-fold increase in the market cap of $VIRTUAL in 2024.

The report "dTAO and the Evolution of Bittensor: Reshaping the Open Source AI Ecosystem through Market-Driven Incentives" provides an in-depth analysis of the impact of the dTAO upgrade completed on February 13 on the Bittensor ecosystem, focusing on its architectural innovations, economic model, and overall ecological dynamics.

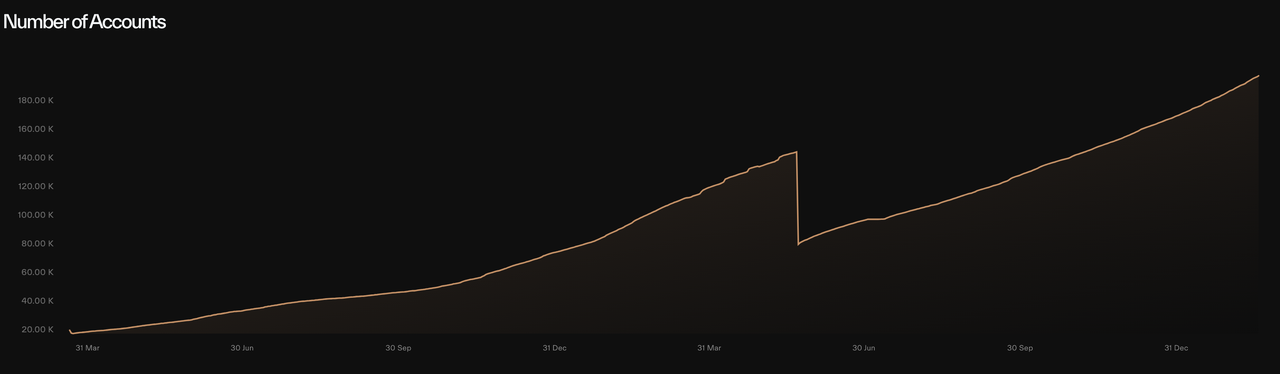

The number of accounts in the Bittensor system has increased by 100%, growing from 100,000 at the beginning of 2024 to nearly 200,000.

1. Bittensor's Basic Architecture

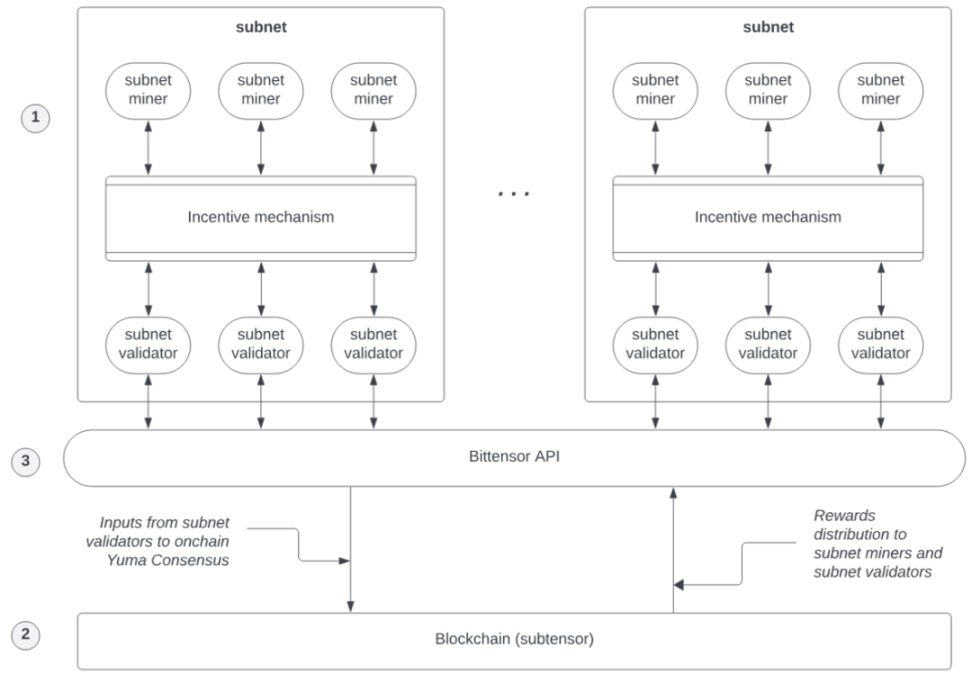

The Bittensor system consists of the following three main modules:

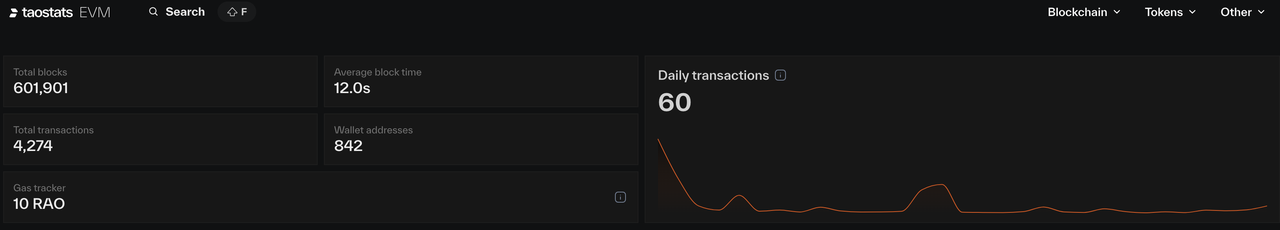

Subtensor parallel chain and its EVM-compatible layer (tao evm): Subtensor is a Layer 1 blockchain developed using the Polkadot Substrate SDK, responsible for managing the blockchain layer of the Bittensor network. Its EVM-compatible layer (tao evm) allows developers to deploy and run Ethereum smart contracts on the network, enhancing the system's scalability and compatibility. The Subtensor blockchain produces a block every 12 seconds, generating one TAO token per block. Additionally, Subtensor records key activities in the subnet, including the scoring weights of validators and the number of staked tokens. Every 360 blocks (approximately 72 minutes), the Yuma consensus algorithm calculates the tokens earned by 64 subnets (Emissions).

Subnets: The Bittensor network consists of 64 subnets, each focusing on specific types of AI models or application scenarios. This modular structure enhances the network's efficiency and performance, promoting the specialized development of different AI models. The incentive mechanism for each subnet is determined by the subnet owner, deciding how tokens are distributed between miners and validators. For example, Subnet 1 is operated by the Opentensor Foundation, tasked with text prompting. In this subnet, validators provide prompts similar to ChatGPT, miners respond to the prompts, and validators rank the miners based on the quality of their responses, regularly updating weights and uploading them to the Subtensor blockchain. The blockchain performs a Yuma consensus calculation every 360 blocks and allocates the token releases for the subnet.

Root Subnet: As the core of the network, the root subnet is responsible for coordinating and managing the operations of all subnets, ensuring overall coordination and stability of the network.

Additionally, the Bittensor API serves as a transmission and connection between subnet validators and the Yuma consensus on the Subtensor blockchain. Validators within the same subnet only connect to miners within the same subnet, and there is no communication or connection between validators and miners from different subnets.

This architectural design allows Bittensor to effectively integrate blockchain technology with artificial intelligence, creating a decentralized and efficient AI ecosystem.

The Subtensor EVM-compatible layer tao evm officially launched on December 30, 2024, allowing deployment and interaction on the Subtensor blockchain without modifying any Ethereum smart contracts, while all EVM operations are executed solely on the Subtensor blockchain without interaction with Ethereum. This means that smart contracts on Bittensor are limited to the Bittensor network and are unrelated to the Ethereum mainnet. Currently, tao evm is still in a relatively early stage, including the ecological project TaoFi, which plans to develop AI-based DeFi infrastructure, including the first TAO-backed stablecoin, decentralized exchanges, and a liquid staking version of the TAO token.

1.1 Account System

1.1.1 Coldkey-Hotkey Dual-Key System

The dTAO account system employs a Coldkey-Hotkey dual-key mechanism to ensure higher security and flexibility. When users create a wallet, they can choose to generate it via a Chrome extension or locally. Wallets created through the Chrome extension are used to store, send, and receive TAO, with the system generating a coldkey (48-character string, usually starting with 5) and a 12-word mnemonic. Wallets created locally will generate a hotkey in addition to the coldkey; the hotkey is used for operations such as creating subnets, mining, and validation.

The primary reason for adopting the Coldkey-Hotkey dual-key system is that the hotkey is frequently used in the daily operations of the subnet and faces potential security threats, while the coldkey is mainly used for storing and transferring TAO, effectively reducing the risk of TAO loss. This dual protection mechanism ensures the security and flexibility of account operations.

In terms of binding relationships, one hotkey can bind to one coldkey within the same subnet, but it can also bind to coldkeys from different subnets (not recommended). One coldkey can bind to multiple hotkeys.

1.1.2 Subnet UID System

1.1.2.1 Subnet UID Generation

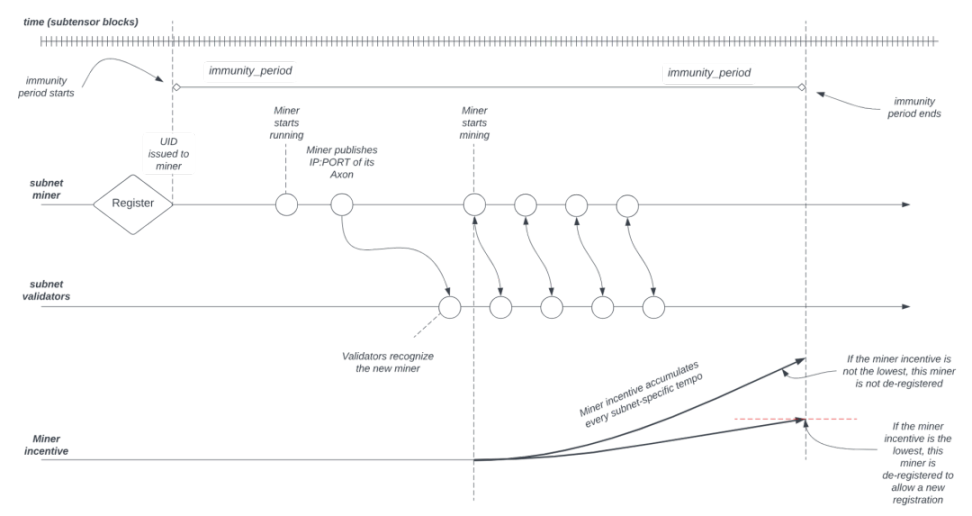

After paying a registration fee of at least 100 TAO, the system generates a subnet UID and binds it to your hotkey. This UID is a necessary credential for participating in subnet mining or validation. To become a miner, you only need a hotkey, coldkey, and subnet UID, then run Bittensor to participate in mining.

1.1.2.2 Requirements to Become a Validator

To become a subnet validator, you must stake at least 1000 TAO, and within each subnet, the staked amount must rank in the top 64. It is important to note that validators can hold multiple UID slots simultaneously, allowing them to validate in multiple subnets without needing to increase their staked amount (similar to the concept of restaking). This mechanism not only reduces the risk of validator misconduct but also increases the cost of wrongdoing, as staking a high amount of TAO (at least 1000 TAO) significantly raises the cost of misconduct. To enhance their competitiveness within the subnet, each validator strives to build a good reputation and performance record to attract more TAO delegated staking, ensuring they remain in the top 64.

1.1.2.3 Subnet Structure and Capacity Limits

Subnet 1: A total of 1024 UID slots, accommodating up to 128 validators; the total number of validators and miners is capped at 1024.

Other Subnets: Each subnet has 256 UID slots, accommodating up to 64 validators; the total number of validators and miners in each subnet does not exceed 256.

1.1.2.4 Subnet Competition and Incentive Mechanism

Within the subnet, validators assign tasks to miners, and once all miners complete their tasks, they submit the results to the corresponding validators. Validators evaluate and rank the quality of tasks submitted by each miner, and miners receive TAO rewards based on the quality of their work. At the same time, validators also receive incentive rewards for ensuring that high-quality miners receive better rewards, thereby promoting the continuous improvement of the overall quality of the subnet. This series of competitive processes is automatically executed by the incentive mechanism designed by the subnet creator, ensuring the system operates fairly and efficiently.

Each subnet has a 7-day protection period (immunity period), starting from the time a miner registers a subnet UID. During this period, miners will accumulate their rewards. If a new miner registers during the protection period and the current subnet's UID slots are full, the miner with the least accumulated rewards will be eliminated, and their UID will be reallocated to the newly registered miner.

1.2 Subnets Build a Multi-Layered Ecosystem

Bittensor subnets build a multi-layered ecosystem where miners, validators, subnet creators, and consumers each play their roles, collectively driving the generation of high-quality AI services.

Miners: As the core computing nodes of the network, miners host AI models, providing inference and training services. They compete to minimize loss functions and score point-to-point to earn TAO rewards. The success of miners depends on the quality and performance of the services they provide.

Validators: Validators are responsible for evaluating the task results submitted by miners, building a trust matrix to prevent collusion and cheating, and ensuring that high-quality miners receive higher rewards. They rank miners based on the quality of their responses, with more accurate and consistent rankings leading to greater rewards for the validators.

Subnet Creators: Subnet creators design customized subnets based on the needs of specific application domains (such as natural language processing, computer vision, etc.), establishing independent consensus mechanisms, task processes, and incentive structures. They act as network administrators, with the authority to allocate incentives through their respective subnets.

Consumers: Consumers are the end users or enterprises that access AI services provided by miners by paying with TAO tokens. This model allows consumers to leverage AI capabilities within the network without needing to own or maintain their own AI models, thereby reducing AI computing costs.

The overall process is as follows: Subnet validators generate questions and distribute them to all miners, who then generate answers based on the tasks and return them to the validators. Validators score the answers based on quality and update the miners' weights, which are then regularly uploaded to the blockchain. Through intense competition and a survival-of-the-fittest mechanism, the continuous advancement of AI models and ecological optimization within the subnet is promoted.

1.2.1 Miner Layer

Miners play a core computational role in the Bittensor network, with primary responsibilities including:

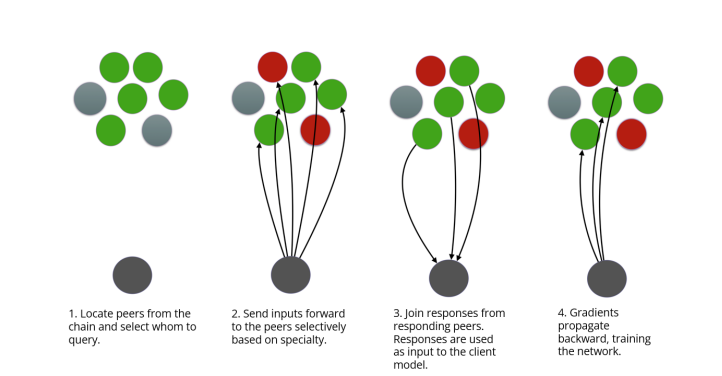

Hosting AI models and providing inference or training services: Miners host local machine learning models to provide prediction services for client applications. When a client needs a prediction, it sends a request to the Bittensor network, which routes it to miners registered as service providers. Miners process the request and return the prediction results to the client.

Competing in P2P rankings to earn TAO tokens as computational incentives: Miners compete in point-to-point rankings based on their model performance and contributions to the network to earn TAO token rewards. This incentive mechanism encourages miners to continuously optimize their model performance and provide high-quality AI services to the network.

Ensuring high-quality AI model contributions: Miners are committed to providing high-quality AI models to meet network demands and ensure service quality. This not only helps them achieve higher rankings and rewards within the network but also enhances the overall performance and reliability of the entire Bittensor network.

By fulfilling these responsibilities, miners make significant contributions to the efficient operation and development of the Bittensor network.

Each miner trains on dataset D to minimize the loss function Li=EDQfix

Where:

Qfix is the error function

ED represents the expectation over dataset D.

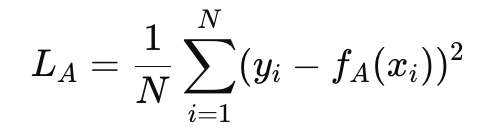

For example, if Miner A provides a speech recognition model fAx, its loss function might be:

A lower LA (i.e., better model performance) will lead to a higher ranking in P2P evaluations.

Each miner's contribution is measured by the Fisher Information Metric (FIM): Ri=WT⋅S

Where:

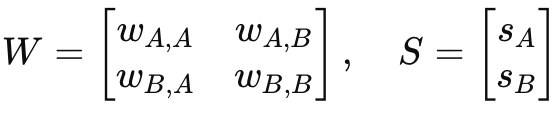

W is the weight matrix representing P2P scores among miners.

S is the amount of stake (holdings) of the miner in the network.

If Miner A and Miner B score each other, the weight matrix is:

Miner A's final ranking is:

If Miner A has a high-quality AI model, then wB,A will be high, resulting in a higher RA and thus more rewards.

Validator Layer

Validators ensure the fair evaluation of miners' AI models, preventing collusion and malicious behavior. They act as "referees" in the network, ensuring high-quality AI services.

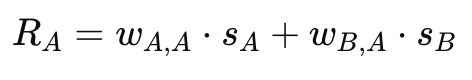

Validators rank miners by calculating the trust matrix:

ci is the trust score of miner i.

tj,i represents the trust level of miner j in miner i.

sj is the stake amount of miner j.

is the Sigmoid function used for smoothing scaling.

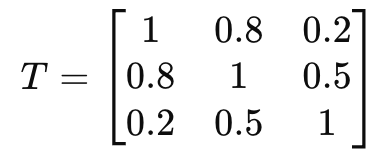

For example, suppose there are three miners A, B, and C in the network, and the trust matrix is:

If Miner A has a well-performing model, both Miners B and C highly trust A.

If Miner C's model is average, only Miner B slightly trusts C.

Thus, Miner A will receive a higher trust score cA, leading to more rewards, while Miner C will have a lower score.

1.2.2 Consumer Layer

In the Bittensor network, consumers refer to end users or enterprises that access AI services provided by miners by paying with TAO tokens. This model allows consumers to utilize AI capabilities within the network without needing to own or maintain their own AI models, reducing AI computing costs.

Specific application scenarios for consumers include:

Developers querying AI APIs: Developers can call the AI interfaces provided by Bittensor to obtain the necessary intelligent services for application development or feature integration.

Research institutions accessing AI training datasets: Research institutions can leverage resources within the network to access and analyze large AI training datasets, supporting research projects and experiments.

Enterprises utilizing Bittensor's computing resources for AI model training: Enterprises can use Bittensor's decentralized computing resources to train and optimize their own AI models, enhancing their business intelligence capabilities.

In this way, Bittensor provides consumers with flexible and efficient access to AI services, promoting the popularization and application of artificial intelligence.

1.2.3 Staking-Based Consensus Mechanism

Bittensor's staking-based consensus mechanism primarily addresses the following issues:

Preventing malicious score manipulation and ensuring fair scoring: Iteratively adjusting w==fw to correct any weights that deviate too much from consensus (i.e., the staked weighted average w), thereby reducing the impact of excessive self-scoring by adversaries.

Rewarding high-quality AI contributors: Validators who continuously contribute high-quality outputs maintain a high ranking even after weight adjustments, as their reported weights are close to the consensus value.

Staking-Based Game Model

We view the consensus model as a two-player game:

Honest party (protagonist) stakes: SH with 0.5SH ≤ 1

Adversarial party (opponent) stakes: 1-SH

Both parties compete for a fixed total reward: eH + eC = 1, where eH and eC are the rewards for the honest and adversarial parties, respectively.

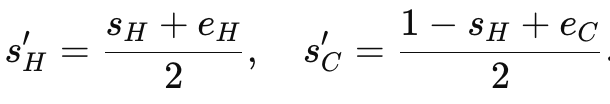

After reward distribution, the stake amounts are updated to:

The honest party allocates an objective weight wH for themselves and allocates 1-wH to the opponent.

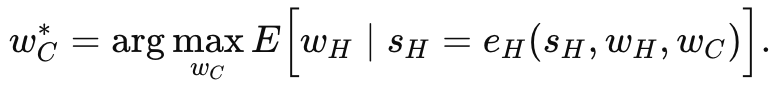

In contrast, the opponent can freely choose their self-allocated weight wC without cost, aiming to maximize the honest party's weight expenditure:

Imagine judges in a competition. Honest judges give fair scores, while malicious judges (the opponent) may give artificially high scores to their preferred contestants, forcing the honest party to exert more effort to remain competitive.

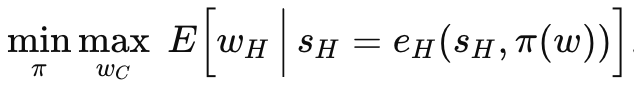

Since the honest party holds the majority of stakes (sH > 0.5), they can implement an anonymous consensus strategy π, adjusting all weights to optimize the Nash equilibrium without knowing the identities of the players:

The goal is to adjust the weights so that the corrected weights satisfy:

Thus correcting the error

The basic consensus strategy is defined as:

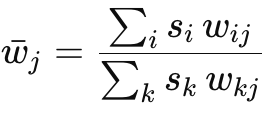

Where the consensus weight w is the equity-weighted average:

Then the strategy is iterated:

Where is the number of iterations.

This can be likened to a precisely calibrated balance scale. If one side's weight is too high, the system will repeatedly adjust until balance is restored. For example, when SH = 0.6 and the initial wH = 1, after multiple iterations, even if the opponent still reports a high wC (e.g., wC = 0.8), the honest party's effective expenditure will drop below 0.75,

1.2.3.1 Smoothing Treatment and Density Evolution

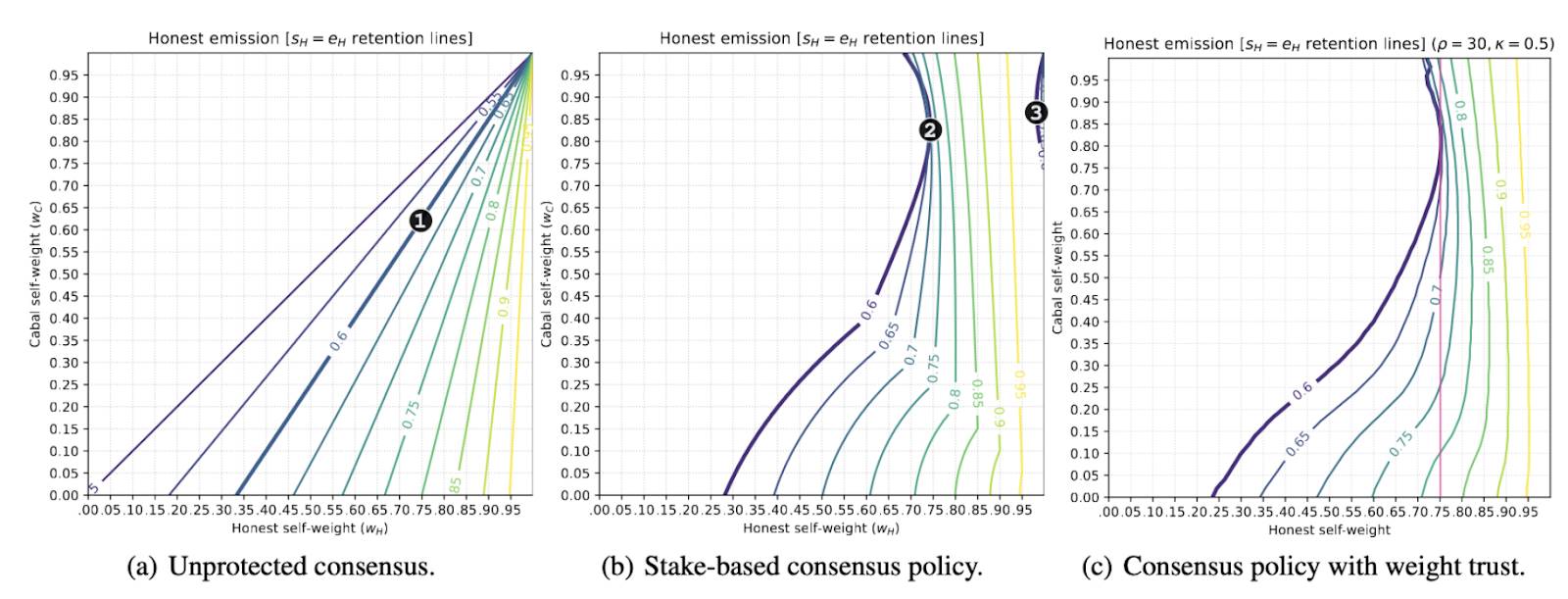

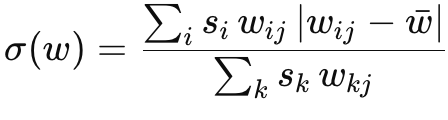

To avoid abrupt corrections that could lead to system instability, the correction function employs "smoothing treatment." We define the equity-weighted average absolute deviation as:

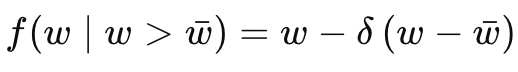

Then, the smoothing correction is given by the following formula:

Where (controlled by the parameter (0≤α1)) determines the degree of smoothing.

This smoothing adjustment is akin to a driver smoothly braking while turning, rather than suddenly slamming on the brakes. This gradual correction method ensures that small weight differences are gently adjusted, thereby maintaining the overall stability of the system.

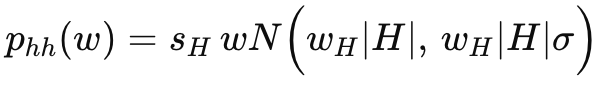

When extended to a two-team game (where |H| represents honest players and |C| represents adversarial players), the weight distribution of each team can be described using a density function pw. For example, for honest players, assume the weights follow a normal distribution:

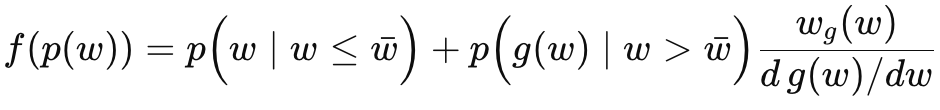

The distribution for adversarial players is similar. The overall density distribution for the honest and adversarial teams is:

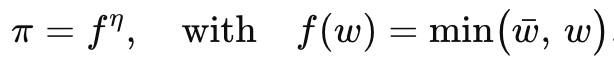

Then, the density evolution function is applied:

Where gw=f⁻¹w. After η iterations, the final ranking for each player is: ri = \int f^\eta\Bigl(pi(w)\Bigr)\, dw.

This process is similar to statistical smoothing of a large dataset. After multiple rounds of "smoothing," the true rankings of each participant become apparent. The key is that density evolution can compress anomalous weights (i.e., excessively high weights from malicious players) to a greater extent while having a smaller impact on honest players.

1.2.3.2 Weight Trust Mechanism and Zero Weight Vulnerability Prevention

To prevent adversarial players from reporting near-zero weights to evade penalties, a weight trust mechanism is introduced. The trust value Tas is defined as: T=(W〉0)S

This represents the total equity assigned to non-zero weights. Then, a smoothing threshold is applied:

C = \Bigl(1+\exp\bigl(-\rho (T-\kappa)\bigr)\Bigr)^{-1}.

This mechanism ensures that if the majority deem a node's weight to be zero, its rewards will be significantly reduced.

This is similar to a community reputation system—only when the majority of members recognize someone as trustworthy can that person receive full benefits; otherwise, attempts to manipulate the system by reporting zero weight will be penalized.

Current challenges include:

Zero weight vulnerability: Adversarial players may report extremely low or zero weights to exploit loopholes in reward distribution.

Correction imbalance: In some cases, corrections may be too aggressive or too mild, leading to consensus bias.

High computational complexity: Density evolution and multiple iterations involve O(n²) computational load, which may burden the blockchain environment.

The dtao upgrade addresses these issues with improvements, including:

Optimizing iterations and smoothing treatment: Increasing the number of iterations η, finely adjusting smoothing parameters α or δ to reduce zero weight vulnerabilities and prevent excessive corrections.

Enhancing the weight trust mechanism: More accurately detecting non-zero weights and applying stricter thresholds so that only nodes recognized by the majority can receive full rewards.

Reducing computational overhead: Minimizing computational costs through algorithm optimization to fit blockchain computing constraints without affecting theoretical accuracy.

Bittensor's staking-based consensus mechanism combines mathematical models and game theory tools, enabling the system to automatically calibrate anomalous weight deviations through updating formulas, weighted average consensus, iterative corrections, and density evolution, ensuring fair final reward distribution.

This process is akin to an intelligent balancing system or reputation mechanism that can continuously self-calibrate, ensuring fair scoring, incentivizing excellent contributors, and preventing malicious collusion and vote manipulation.

On this basis, the dtao upgrade employs more refined smoothing control and improved weight trust strategies, further enhancing the system's robustness and fairness. Thus, in adversarial environments, honest contributors can maintain a competitive advantage, while overall computational resource consumption is optimized and reduced.

2. Yuma Consensus: Dynamic Programmable Incentives and Consensus

Bitcoin has built the world's largest peer-to-peer computing power network, where anyone can maintain the global ledger by contributing local computing power. Its incentive rules were fixed at design time, leading to a relatively static development of the ecosystem.

In contrast, the Yuma Consensus (YC) is a dynamic, programmable incentive framework. Unlike Bitcoin's static incentive mechanism, YC directly integrates objective functions, staking rewards, and weight adjustment mechanisms into the consensus process. This means the system does not rely solely on fixed rules but dynamically adjusts based on the actual contributions and behaviors of nodes, achieving fairer and more efficient reward distribution.

The YC consensus algorithm runs continuously on the Subtensor blockchain and operates independently for each subnet. Its main workflow includes the following components:

Weight vector of subnet validators: Each subnet validator maintains a weight vector, where each element represents the scoring weight assigned by that validator to all subnet miners. This weight is based on the validator's historical performance and is used to rank miners. For example, if a validator's scoring vector is w=wn, the resulting ranking reflects that validator's evaluation of each miner's contribution level.

Impact of staking amounts: Each validator and miner on the chain stakes a certain amount of tokens. The YC consensus combines the weight vector and staking amounts to calculate reward distribution. That is, the final reward depends not only on scoring weights but also on the amount staked, forming a closed loop of "staking → weight → reward."

Dynamic subjective consensus: Each participant assigns local weights to their machine learning models. These local weights are adjusted through consensus strategies and then aggregated on the blockchain into global metrics. In other words, YC can achieve large-scale consensus even in adversarial environments and can dynamically adapt to changes in node behavior.

Reward calculation and distribution: Subnet validators collect their ranking results and submit them as collective input to the YC algorithm. Although the rankings from different validators may arrive at different times, Subtensor processes all ranking data approximately every 12 seconds. Based on this data, the system calculates rewards (in TAO) and deposits them into the wallets of subnet miners and validators.

This integrated mechanism allows YC to continuously and fairly distribute rewards in a decentralized network, dynamically adapting to the quality of contributions while maintaining the overall security and efficiency of the network.

2.1 Knowledge Distillation and Mixture of Experts (MoE): Collaborative Learning and Efficient Contribution Assessment

2.1.1 Knowledge Distillation (Digital Hivemind)

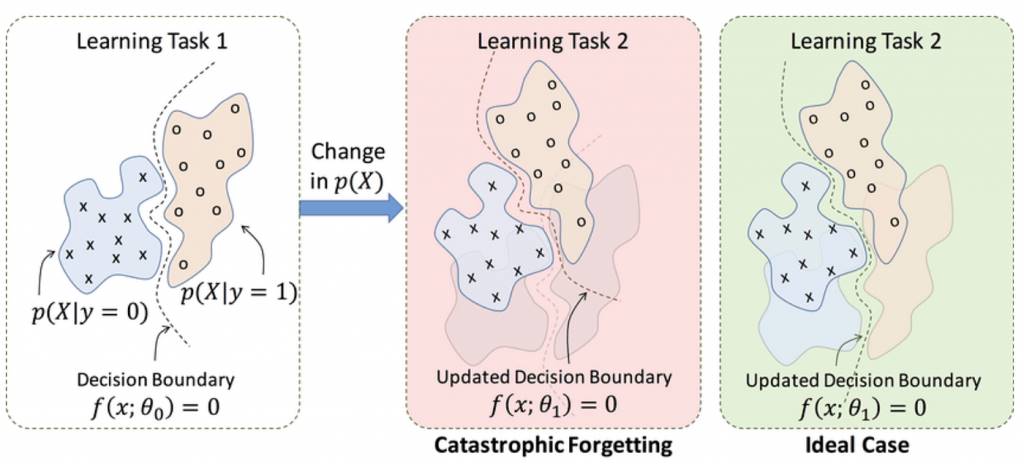

Bittensor introduces the concept of knowledge distillation, similar to the collaborative work of neurons in the human brain, where nodes collectively learn by sharing knowledge, exchanging data samples, and model parameters.

In this process, nodes continuously exchange data and model parameters, forming a self-optimizing network over time to achieve more accurate predictions. Each node contributes its knowledge to a shared pool, ultimately enhancing the overall performance of the network, making it faster and more suitable for real-time learning applications such as robotics and autonomous driving.

Crucially, this approach effectively mitigates the risk of catastrophic forgetting—a common challenge in machine learning. Nodes can integrate new insights while retaining and expanding their existing knowledge, thereby enhancing the robustness and adaptability of the network.

By distributing knowledge across multiple nodes, the Bittensor TAO network becomes more resilient to interference and potential data leaks. This robustness is particularly important for applications dealing with highly secure and privacy-sensitive data, such as financial and medical information.

2.1.2 Mixture of Experts (MoE)

Bittensor employs a distributed expert model (MoE) to optimize AI predictions, significantly enhancing the accuracy and efficiency of solving complex problems through the collaborative efforts of multiple specialized AI models. For example, when generating Python code with Spanish annotations, multilingual models can collaborate with code expertise models to produce high-quality results far superior to those of a single model.

The core of the Bittensor protocol consists of parameterized functions, commonly referred to as neurons, which are distributed in a peer-to-peer manner. Each neuron records zero or more network weights and trains the neural network by ranking neighboring nodes to assess their value, subsequently accumulating ranking scores onto a digital ledger. Higher-ranked nodes not only receive monetary rewards but also gain additional weight, thereby establishing a direct link between node contributions and rewards, enhancing the network's fairness and transparency. This mechanism creates a market where other intelligence systems can price information in a peer-to-peer manner over the internet, incentivizing each node to continuously improve its knowledge and expertise. To ensure fair distribution of rewards, Bittensor leverages the Shapley value from cooperative game theory, providing an efficient method for distributing rewards among parties based on node contributions. Under the YC consensus, validators score and rank each specialized model and fairly distribute rewards based on the Shapley value principle, further enhancing the network's security, efficiency, and capacity for continuous improvement.

3. dtao Upgrade

The Bittensor project has the following main issues in its resource allocation and economic model design:

Resource Overlap and Redundancy: Multiple subnets focus on similar tasks, such as text-to-image generation, text prompts, and price prediction, leading to duplication and waste in resource allocation.

Lack of Practical Use Cases: Some subnets (such as price prediction or sports event outcome prediction) have not yet proven their practicality in real-world scenarios, which may result in a mismatch between resource investment and actual demand.

"Bad Money Drives Out Good" Phenomenon: High-quality subnets may struggle to secure sufficient funding and development space. With only a seven-day protection period, subnets that fail to gain enough support from root validators may be prematurely eliminated.

Centralization of Validators and Insufficient Incentives for New Subnets:

Root validators may not fully represent all TAO holders, and their evaluation results may not reflect a broad range of opinions. Under the Yuma consensus, top validators dominate the final scoring, but their assessments are not always objective. Even if biases are discovered, they may not be corrected immediately.

Additionally, validators lack incentives to migrate to new subnets, as moving from a high-issuance old subnet to a low-issuance new subnet may result in immediate reward losses. The uncertainty of whether new subnets will eventually match the token issuance of established subnets further diminishes their willingness to migrate.

The main issues with the economic model:

A major problem in Bittensor's mechanism design is that although all participants receive TAO, no one is actually paying for TAO, leading to ongoing selling pressure. Currently, the questions answered by miners are not posed by real users but are provided by subnet owners—either simulating real user queries or based on historical user demand. Therefore, even if the miners' answers are valuable, this value is captured by the subnet owners. Whether the miners' answers help subnet owners improve their model algorithms or are directly used by subnet owners for model training to enhance their products, the value generated by the work of miners and validators is appropriated by the subnet owners. Theoretically, subnet owners should pay for this value.

Moreover, subnet owners not only bear no costs but also enjoy 18% of the subnet issuance. This means that the Bittensor ecosystem is not tightly connected—participants maintain loose ties based on development and collaboration. Projects on subnets can exit at any time without incurring any losses (as the subnet registration fee will be refunded). Currently, the main mechanism for token recovery in the Bittensor system is the registration fees paid by subnet miners and validators; however, these fees are minimal and insufficient to support effective value capture. Although staking has become the primary mechanism, the amount of TAO recovered through blockchain transaction fees and registration fees remains limited.

Staking is divided into two forms:

Validator Staking: Participants stake TAO to support network security and earn rewards, accounting for 75% of all issued TAO. Validators currently earn about 3,000 TAO per day, with an annualized return rate exceeding 15%. However, after the first halving, this allocation will drop to 1,500 TAO per day, reducing the attractiveness of staking and weakening its effect on balancing token supply and demand.

Subnet Registration Staking: The increase in new subnets significantly impacts TAO supply. This poses a challenge, as the total issuance of TAO is fixed; the increase in the number of subnets will dilute the rewards for all subnets, making it difficult for existing subnets to maintain operations, potentially leading to some subnets exiting the network.

These issues indicate that Bittensor's resource allocation and economic model design need further optimization to ensure the sustainable development of the network and fair incentives.

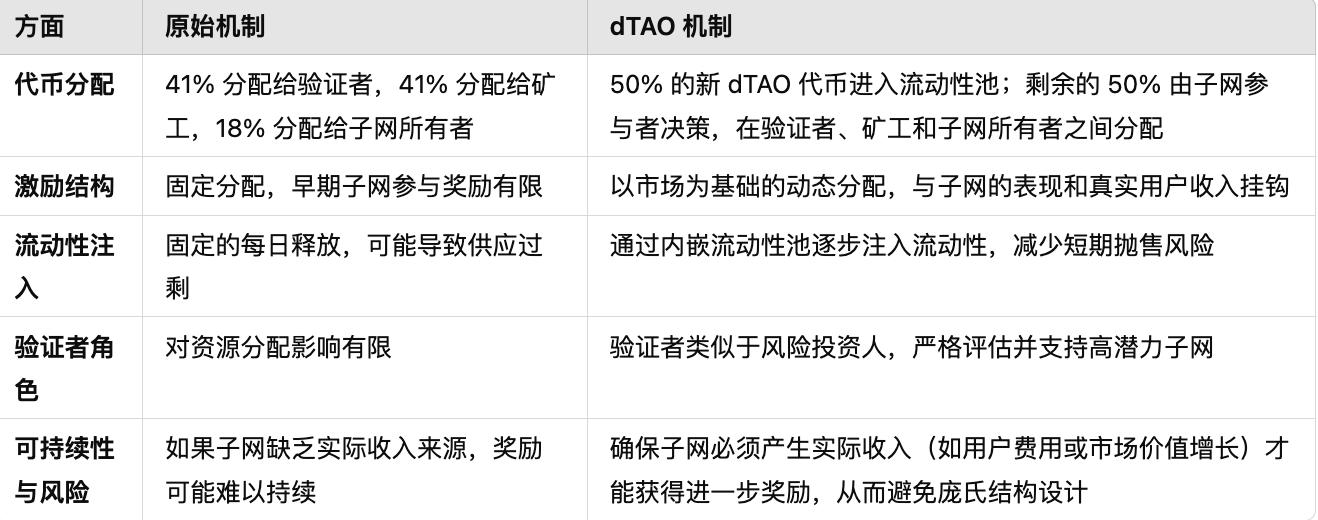

3.1 What is dTAO

dTAO is an innovative incentive mechanism proposed by the Bittensor network, aimed at addressing the inefficiencies in resource allocation within decentralized networks. It abandons the traditional method of resource allocation determined by manual voting by validators and instead introduces a mechanism that dynamically adjusts based on market conditions, linking the distribution of TAO issuance among subnets directly to the market performance of subnet tokens. By designing embedded liquidity pools, it encourages users to stake TAO in exchange for subnet tokens, thereby supporting high-performing subnets.

At the same time, a fair issuance model is adopted to ensure that subnet tokens are gradually distributed, prompting teams to earn token shares through long-term contributions and balancing the roles of validators and users. Validators act like venture capitalists, rigorously assessing the technical and market potential of teams, while users further drive the formation of subnet value through staking and market trading.

3.1.1 Core Mechanism of dTAO

3.1.1.1 Binding Validators and Teams Closely to the Ecosystem: To Earn Rewards, One Must First Invest in Subnet Tokens

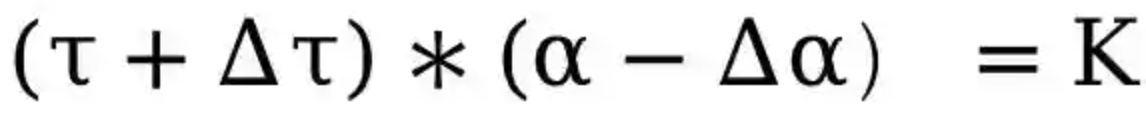

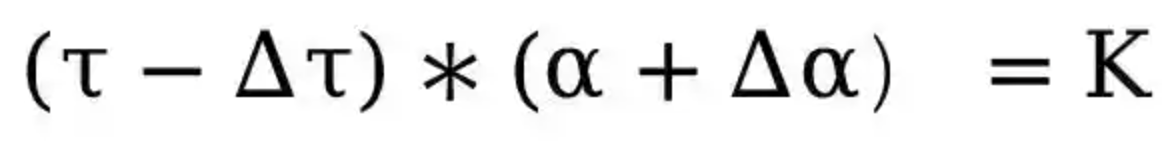

The design of dTAO is based on dual drivers of market and technology, with each subnet configured with a liquidity pool composed of TAO and subnet tokens. When $TAO holders (validators and subnet owners) perform staking operations, it is equivalent to using $TAO to purchase the corresponding $dTAO, and the amount of $dTAO that can be exchanged is calculated using the following formula:

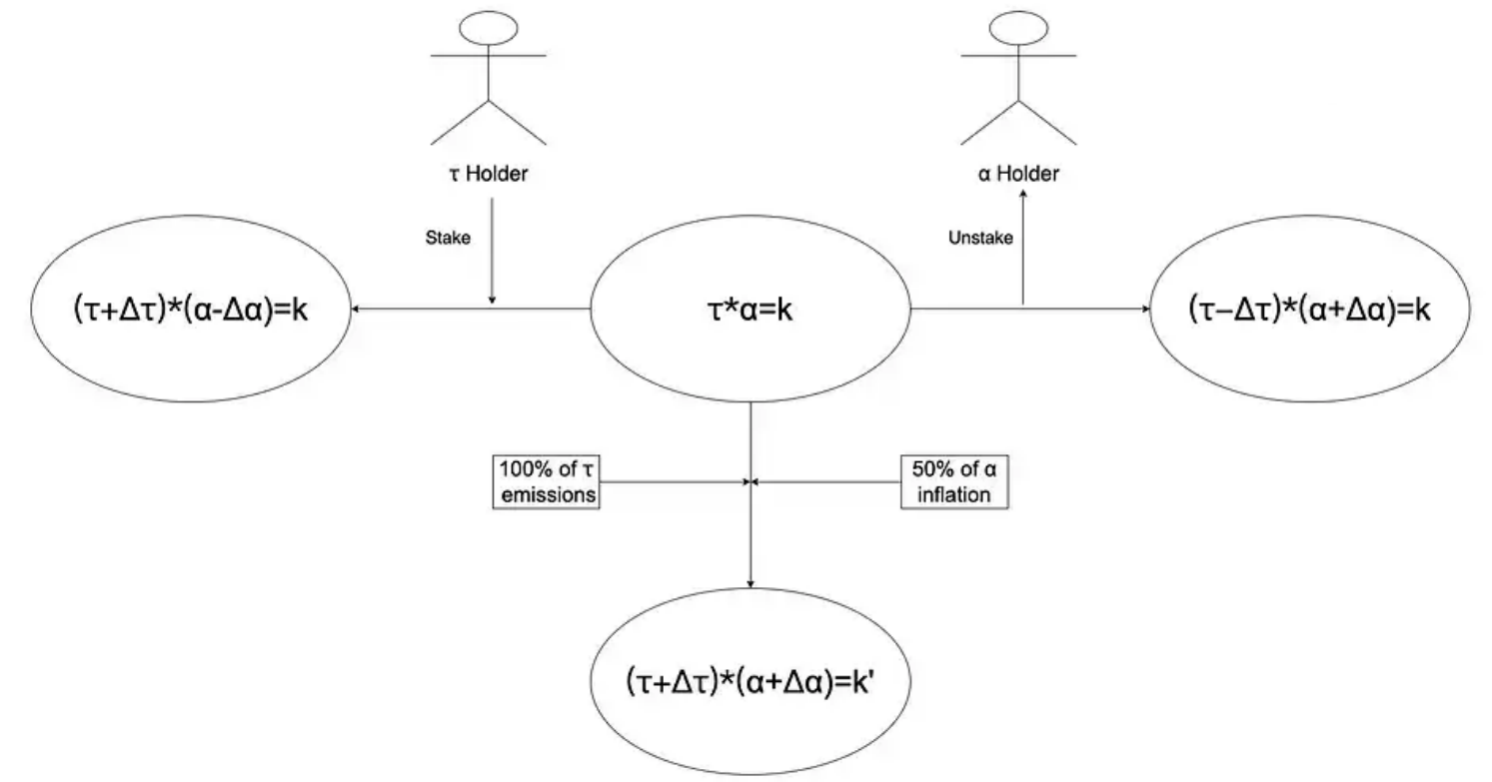

During the exchange, the pricing mechanism of $TAO and $dTAO follows the same constant product formula as Uniswap V2: τ*α=K

Where τ represents the amount of $TAO, and α represents the amount of $dTAO. Without additional liquidity injections, regardless of how much $TAO is used to exchange for $dTAO or how much $dTAO is exchanged for $TAO, the value of K will remain constant. Conversely, when $dTAO holders perform unstaking operations, it is equivalent to using $dTAO to purchase $TAO, and the amount of $TAO that can be exchanged is calculated using the following formula:

Unlike Uniswap V2, the liquidity pool of $dTAO does not allow for direct liquidity addition. Except when the Subnet Owner creates the Subnet, all newly injected liquidity comes entirely from the allocated $TAO and 50% of the total issuance of $dTAO. In other words, the newly allocated $TAO assigned to each Subnet is not directly distributed to that Subnet's Validator/Miner/Owner but is entirely injected into the liquidity pool for redemption; at the same time, 50% of the newly issued $dTAO is also injected into the liquidity pool, while the remaining 50% is distributed to the Validator/Miner/Owner according to the incentive mechanism agreed upon by the Subnet itself.

This prevents teams from quickly selling off large amounts of tokens through initial holdings, encouraging teams to continue contributing and iterating on technology; validators must play a role similar to that of venture capitalists, rigorously evaluating the technology, market potential, and actual performance of subnets.

Staking/Unstaking will not change the size of K, while liquidity injections will increase K to K'.

3.1.1.2 The Subnet Token with the Highest Market Price Will Receive the Most $TAO Emissions

In the previous scheme, the proportion of newly issued $TAO that each Subnet could receive was determined by the Root Network's Validators. This scheme exposed some potential issues. For example, due to the concentration of power in the Root Network among a few Validators, even if Validators collude to allocate newly issued $TAO to low-value Subnets, they would not face any penalties.

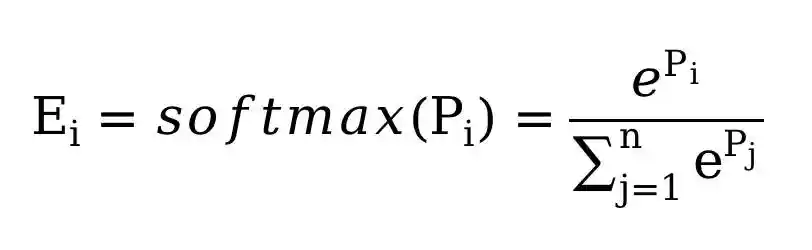

Dynamic TAO terminates the privileges of the Root Network and transfers the power to decide how newly issued $TAO should be allocated to all $TAO holders. The specific approach is to adopt a brand new Yuma Consensus V2, performing a softmax operation on the prices of each Subnet Token to obtain the corresponding release ratio, namely:

Softmax is a commonly used normalization function that can convert each element in a set of vectors into non-negative values while preserving the relative size relationships among the elements and ensuring that the sum of all elements after conversion equals 1.

Where P is the price of $dTAO relative to $TAO, calculated by dividing the amount of $TAO in the liquidity pool by the amount of $dTAO.

According to the formula, when the price of a Subnet Token relative to $TAO is higher, the release ratio of newly issued $TAO that can be obtained will also be higher.

3.1.1.3 Decentralizing the Power to Set Incentive Mechanisms to Each Subnet

Previously, the $TAO incentives received by each Subnet were distributed to Validators/Miners/Owners in a fixed ratio of 41%-41%-18%.

Dynamic TAO empowers each Subnet to issue its own "Subnet Token" and stipulates that, aside from 50% of the issuance that must be injected into the liquidity pool, the remaining 50% can be distributed to Validators/Miners/Owners according to a mechanism determined by the participants of the Subnet.

This mechanism ensures that only subnets that continuously improve their products and attract users can receive more incentives, preventing the emergence of short-term profit models driven by Ponzi schemes.

3.1.2 Example Analysis

After the upgrade to the Dynamic TAO network, all Subnets have now minted their corresponding $dTAO, with the genesis amount of $dTAO equal to the amount of $TAO that the Subnet Owner locked when creating the Subnet. Of this, 50% of $dTAO is injected into the liquidity pool of the Subnet, while the remaining 50% is allocated to the Subnet Owner.

Assuming that the Owner of Subnet #1 locked 1,000 $TAO, then the genesis amount of $dTAO would also be 1,000. Of this, 500 $dTAO and 1,000 $TAO are added as initial liquidity to the liquidity pool, while the remaining 500 $dTAO is allocated to the Owner.

Next, when a Validator registers in Subnet #1 and stakes 1,000 $TAO, that Validator will receive 250 $dTAO. At this point, the liquidity pool will have 2,000 $TAO and 250 $dTAO remaining.

Assuming Subnet #1 can earn 720 $TAO in block rewards each day, the liquidity pool will automatically receive an injection of 720 $TAO daily. The amount of $dTAO injected each day will depend on the issuance speed set by that Subnet.

3.2 Impact of dTAO

The introduction of dTAO fundamentally reshapes the distribution and staking mechanism of TAO. First, newly issued TAO is no longer unilaterally allocated by a few Validators but is indirectly determined by all TAO holders through market actions. This makes staking TAO more akin to "buying" a token of a particular Subnet rather than simply guaranteeing returns. Under this mechanism, the short-term impact of staking and unstaking on the price of $dTAO far exceeds the effect of the actual amount of TAO received by the Subnet, leading to uncertainty in staking returns.

The benefit is that the absolute control of top Validators over block reward distribution disappears, significantly increasing the cost for potential attackers to attack the network through staking amounts. At the same time, latecomer high-quality Subnets have a greater chance to stand out, and early Validators supporting high-quality Subnets have the potential for high returns, possibly achieving multiple times their principal. Furthermore, the intensified competition among Subnets will encourage stakers to become more rational investors, selecting the most promising Subnets through rigorous due diligence.

Overall, the implementation of the dTAO mechanism will drive the entire ecosystem towards a more efficient, competitive, and market-oriented direction.

3.3 How Will the Bittensor Ecosystem Evolve After the dTAO Upgrade?

To analyze the impact of the dTAO upgrade, we need to focus on two key questions:

How does Subnet demand translate into demand for Subnet tokens?

Can the introduction of Subnet tokens create a "Summer of TAO" and accelerate innovation within the TAO ecosystem?

3.3.1 How Does Subnet Demand Translate into Demand for Subnet Tokens?

Initially, all Subnet tokens have the same price, and each Subnet's liquidity pool contains only a small amount of TAO and $dTAO tokens. Therefore, any trading activity could trigger significant price fluctuations.

To participate in a Subnet and earn rewards, users must first purchase $dTAO Subnet tokens and stake them with Validators, which drives up the price of $dTAO within that Subnet. As the price of $dTAO rises, the total value of $dTAO in the liquidity pool increases, and the system automatically allocates more TAO rewards to that Subnet, allowing miners and stakers to earn higher returns.

This creates a positive feedback loop: users buy $dTAO, driving up the price ➔ price increase leads to more TAO issuance for the Subnet ➔ more rewards attract additional users ➔ further driving up the price of $dTAO.

Conversely, if users start to sell off $dTAO in large quantities, its price will drop, leading to a decrease in the TAO issuance for that Subnet, thereby reducing user participation. Overall, the price fluctuations of Subnet tokens are primarily influenced by market supply and demand, the size of the liquidity pool, and the system's automatic incentive mechanisms.

This mechanism is similar to the AI Agent Launchpad model, where users must first purchase platform tokens to invest in AI agent tokens. In the AI Agent Launchpad ecosystem, once a certain AI agent token's price rises rapidly and creates a wealth effect, a large number of users will flock in, further driving up the demand for platform tokens.

However, there are some key differences between the dTAO mechanism and the AI Agent Launchpad:

In the AI Agent Launchpad ecosystem, users typically only use platform tokens to purchase AI agent tokens when the market capitalization of those tokens is low (i.e., in the internal market of the project).

Once the AI agent tokens reach a certain valuation, users can sell them for ETH/SOL to realize profits, and new users can directly use ETH/SOL to purchase AI agent tokens.

In contrast, in the dTAO system:

When the price of $dTAO rises, users wishing to cash out or migrate to another Subnet with higher potential can only exchange $dTAO for TAO.

This process may lead to significant price fluctuations of $dTAO within the liquidity pool.

Currently, users can trade $dTAO tokens on Backprop Finance, providing secondary market liquidity for Subnet tokens.

3.3.2 Unique Issuance Mechanism of the dTAO Ecosystem

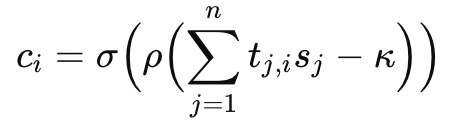

Another key aspect of the dTAO ecosystem is its unique token issuance mechanism. As shown in the figure below, after the dTAO upgrade, the issuance is highly concentrated among the top few Subnet projects. The top five Subnet projects currently receive 40% of the total issuance.

Currently, 7,200 TAO are distributed daily, which, based on the TAO price on February 18, 2025, means that the top five Subnet projects individually receive approximately $1 million worth of TAO each day.

If the development path of the dTAO ecosystem resembles that of the Virtual ecosystem, where certain projects gain significant market attention, then high-market-cap Subnets will capture the vast majority of the newly issued TAO.

For new projects to succeed in competition, they must demonstrate strong potential to attract stakers, miners, and Validators. This often means:

Participants need to migrate from other Subnets, exchanging their TAO for the new Subnet's $dTAO.

This may involve selling off Subnet tokens in existing liquidity pools, thereby increasing the market capitalization of the new Subnet.

This competitive model may encourage a more active market for Subnet tokens and further drive innovation and development within the entire TAO ecosystem.

3.4 Does dTAO Solve the Problems in the Bittensor Subnet Model?

3.4.1 Mechanism Issues Still Exist

The dTAO upgrade links the issuance of TAO to the market performance of Subnet tokens, shifting resource allocation decisions from a few root Validators to a market-driven approach, aiming to incentivize broader user participation and interaction. While this mechanism partially alleviates inefficiencies caused by resource overlap, ensuring that only high-performance Subnets with strong token price performance can receive more TAO rewards, it does not fundamentally address the following key issues:

Resource Overlap and Redundancy: If multiple Subnets focus on similar tasks (such as text generation, image generation, or price prediction), even with a market-driven adjustment approach, resource duplication and inefficient utilization remain unresolved.

Although all participants can earn TAO, there are no external users paying for the contributions of miners and Validators. This leads to ongoing selling pressure on TAO, as rewards are continuously issued without a sustainable demand mechanism to support the TAO price.

Some Subnets may have issues with fake models and inadequate evaluation standards: Bittensor is evolving into an "outsourcing layer" within the AI technology stack, where token incentives rapidly attract resources and drive the allocation of specific AI tasks. For example, Kaito AI outsources the development of a search engine to a Subnet, leveraging collective intelligence to reduce costs. However, while this incentive-driven model can attract developers in the short term, long-term success still depends on real demand and quality assurance. During testing of the Cortex.t Subnet, it was found that its responses came directly from the OpenAI API rather than being generated by Bittensor miners. This indicates that some Subnets are merely "packaged applications" and do not genuinely utilize Bittensor's decentralized AI computing power. Some Subnet Validators rely on OpenAI results for comparison, which may lead to centralization risks, while the accuracy of some price prediction Subnets is low, making practical application difficult.

Improvement Directions: Enhance Practicality and Transparency:

Miners should submit intermediate data or hash proofs to verify their model training and inference processes, ensuring that outputs indeed come from the Bittensor network rather than external APIs.

Standardized test datasets should be established for benchmarking different types of Subnets (such as predictive models and generative AI models).

Regularly publish benchmark rankings to promote healthy competition among Subnets and improve model quality.

3.4.2 dTAO Still Faces Adoption, Lack of Application Scenarios, and Declining Staking Rates

Currently, dTAO is primarily limited to the Bittensor network and has not gained sufficient adoption in the broader cryptocurrency market. Although dTAO introduces EVM compatibility, it has not generated the same buzz on social media as the AI Agent tokens in the Virtual ecosystem. Meanwhile, very few projects have incorporated dTAO into their core token economic models, resulting in a continued lack of real application demand for dTAO. At present, purchasing Subnet tokens resembles a one-time investment behavior, and when users choose to cash out, it may trigger significant price fluctuations. This issue is particularly evident in AI infrastructure outsourcing Subnets, where Kaito's $dTAO token is almost unrelated to its core business, leading to a lack of market value support for its token.

Nevertheless, dTAO still has certain advantages compared to the AI Agent Launchpad. According to the dTAO economic model, 50% of newly issued $dTAO must be injected into the liquidity pool, while the remaining 50% is allocated by Subnet participants (including Validators, miners, and Subnet owners). This mechanism ensures that only Subnets that continuously improve their products and attract users can receive more rewards, thereby avoiding the proliferation of low-quality AI agents and promoting technological innovation within the TAO ecosystem. However, as the dTAO ecosystem is still in its early stages, its audience has not yet expanded, and it lacks large-scale application scenarios, resulting in low market recognition.

Currently, the expansion speed of the Bittensor ecosystem has not matched the demand for token economic growth. According to the latest data, the staking rate of TAO has dropped from a peak of 90% to 71%. This indicates that some holders lack confidence in the network's long-term incentive mechanisms and may turn to other more attractive DeFi or AI ecosystem projects.

3.5 Focus on Subnet Projects Closely Integrated with the Bittensor Ecosystem and Having Practical Use Cases

The healthy development of the Bittensor ecosystem depends on its ability to attract and support high-quality Subnets. To assess the long-term potential of a Subnet, it is essential to focus on its application scenarios, incentive mechanisms, team background, and the actual use of its tokens.

First, the Subnet must have clear and practical application scenarios. A successful project not only needs to solve real-world problems but should also receive feedback from real users. The technical architecture needs to be robust and innovative, capable of supporting distributed AI model training and inference. Additionally, the Subnet should utilize on-chain data and adopt a transparent evaluation mechanism to demonstrate its contributions to the Bittensor ecosystem.

Second, a reasonable incentive mechanism is key to maintaining the long-term operation of the Subnet. The incentive structure should be fairly distributed among miners, Validators, and Subnet owners, avoiding market sell-off pressure due to a lack of sustained application demand. The Subnet needs to be able to generate its own revenue through its business model rather than solely relying on TAO issuance for incentives.

Moreover, a successful Subnet project often has a strong team background, ecosystem integration capabilities, and community support. Prioritizing Bittensor native Subnets over mere AI outsourcing Subnets can ensure the long-term stability of the entire ecosystem. For outsourcing projects, the key lies in whether their Subnet tokens are genuinely integrated into the core token economic model, rather than just being an incentive tool.

Finally, the actual use of Subnet tokens is central to determining their long-term value. Currently, very few projects truly incorporate Subnet tokens into their operational systems, and $dTAO is still in its early stages. If Subnet tokens can be used for payments, accessing AI services, participating in governance, or providing additional incentives, it can establish genuine market demand, ensuring long-term value and ecosystem health. Otherwise, Subnet tokens remain purely speculative assets, prone to market fluctuations, and ultimately struggle to attract long-term users and developers.

4. Economic Model

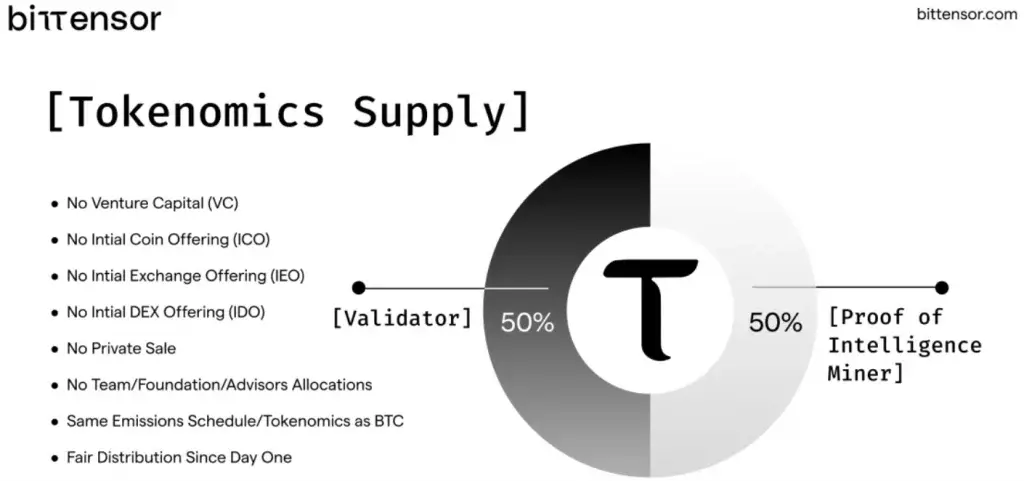

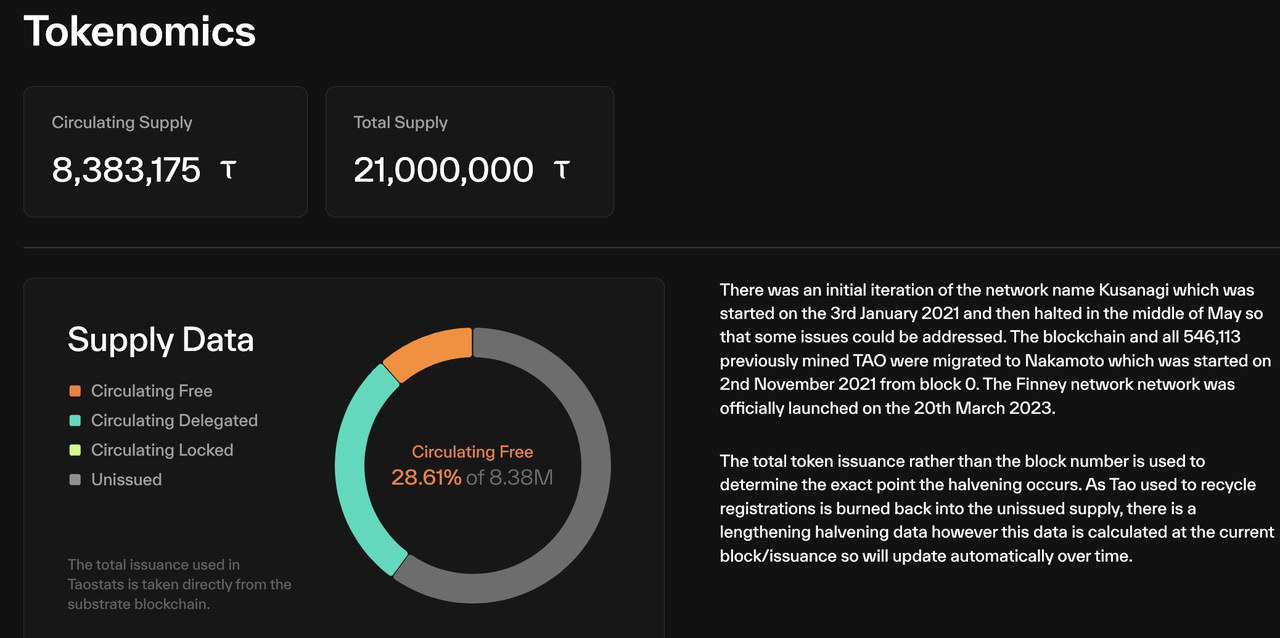

All TAO token rewards are newly minted. Similar to Bitcoin, Bittensor's TAO adopts the same token economics and issuance curve as Bitcoin, with a total supply cap of 21 million, halving every four years.

Bittensor employs a fair launch method, with no pre-mining or ICO; every circulating token must be earned through active participation in the network. Currently, the network generates 7,200 TAO daily (1 TAO per block, approximately every 12 seconds), following a programmatic issuance plan: once half of the total supply is distributed, the issuance rate is halved, a process that occurs approximately every four years and continues until all 21 million TAO are in circulation.

Although the issuance curve of TAO is similar to that of Bitcoin, the introduction of a recycling mechanism means that, according to taostats' token recycling data, the planned halving date for the Bittensor network (launched on January 3, 2021) is expected to be delayed until December 2025.

About HTX Research:

HTX Research is the dedicated research department under HTX Group, responsible for in-depth analysis across a wide range of areas, including cryptocurrencies, blockchain technology, and emerging market trends, as well as writing comprehensive reports and providing professional assessments. HTX Research is committed to providing data-driven insights and strategic foresight, playing a key role in shaping industry perspectives and supporting informed decision-making in the digital asset space. With rigorous research methodologies and cutting-edge data analysis, HTX Research consistently stands at the forefront of innovation, leading the development of industry thought and facilitating a deeper understanding of the ever-changing market dynamics.

References:

https://bittensor.com/content/consensus_v2

https://learnbittensor.org/subnets

https://taostats.io/subnets

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。