Yesterday, Binance just updated to Binance Alpha 2.0, allowing CEX users to purchase any DEX tokens directly from CEX without withdrawal. CZ also commented, "I believe other CEXs will follow suit, and DEX trading volume will also increase." Following that, Coinbase's actions also came.

Last night, Coinbase announced the launch of "Verified Pools," a set of rigorously vetted liquidity pools. Users holding Coinbase Verifications certification can seamlessly conduct on-chain transactions by connecting their Prime Onchain wallet, Coinbase wallet, or other third-party wallets with Coinbase verification credentials, addressing the transparency issues of traditional liquidity pools.

The "Verified Pools" are based on the Uniswap v4 protocol on the Base network, utilizing the hooks mechanism to achieve customizable smart contract functionality. Additionally, they have partnered with DeFi research and risk management company Gauntlet to optimize the configuration of liquidity pools, ensuring the overall health of the liquidity pools.

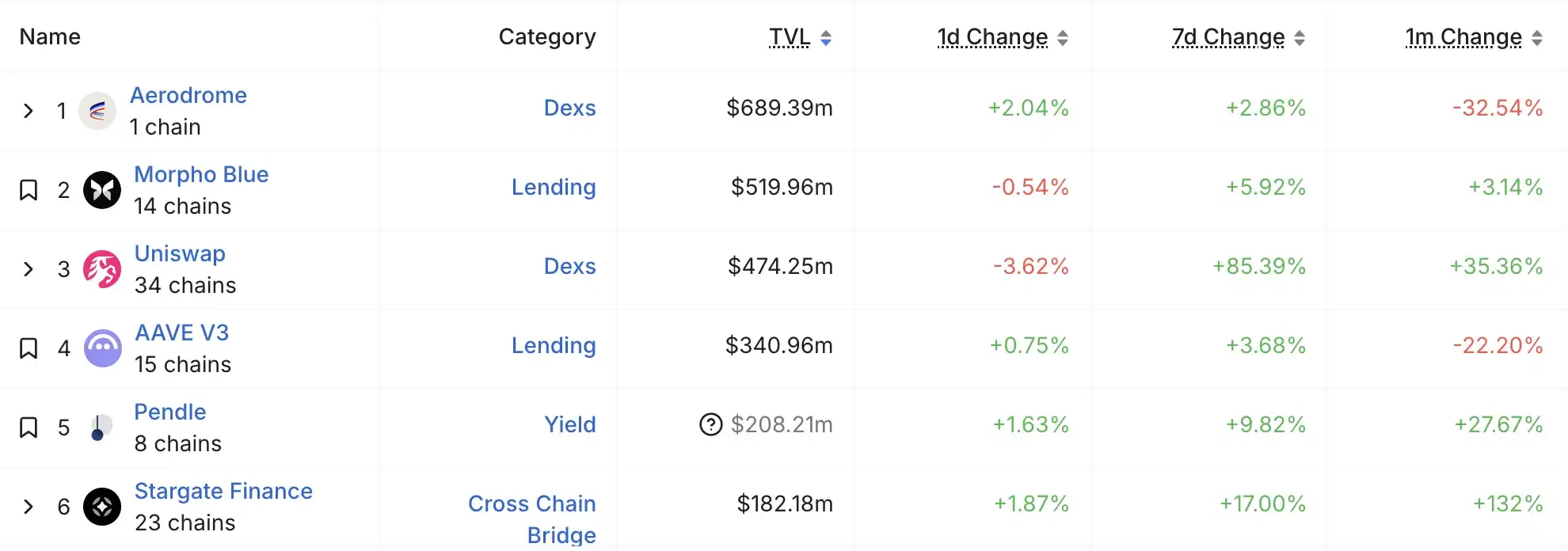

In the official announcement, the verified pools were characterized as another important initiative by Coinbase to promote the adoption of on-chain applications. However, users focused on the Base community were quite surprised that the verified pools are based on Uniswap V4 rather than Aerodrome, the largest DEX application on the Base chain, with some even calling this behavior a "backstab" to Aerodrome.

Aerodrome ranks first in TVL on Base; Image source: DeFiLlama

So why did Coinbase choose Uniswap for its verified pools instead of Aerodrome?

Compliance First, Uniswap is a More Cost-Effective Choice

Many people do not understand Coinbase's approach, including Sonic founder Andre Cronje, who asked, "I'm really a bit confused. Aerodrome and Alex have always been the most steadfast supporters of Base. This could have been built on Aerodrome. Isn't supporting your builders just a slogan?"

In response to these doubts, Aerodrome co-founder Alexander Cutler stated, "We talked to them during the early development phase and were fully capable of adding the same features — it just wasn't a priority at the time. We will definitely pay attention to its adoption."

He mentioned that Coinbase approached Aerodrome last summer to collaborate on the verified pools, but the PMF of the verified pools still had many unresolved issues, so Aerodrome chose to prioritize larger opportunities at that time.

The core of Coinbase's verified pools lies in its on-chain credential system linked with KYC certification. The hooks mechanism of Uniswap V4 can be customized to allow only LPs who have passed Coinbase's KYC certification to participate, directly addressing regulatory compliance issues.

The hooks of Uniswap V4 essentially serve as a "plugin system" for smart contracts, allowing developers to customize the creation rules, fee structures, and permission management of liquidity pools. This flexibility enables Coinbase to quickly deploy a whitelist access mechanism that aligns with its compliance framework and achieve a strong binding of LP identities through the on-chain credential system.

Related Reading: "When Binance Launchpool Meets Uniswap V4, Who Has the Bigger Ace?"

As the native DEX on the Base chain, Aerodrome is positioned as a "liquidity hub," but its underlying codebase does not natively support such complex permission layering designs. Even if this could be achieved in the future through forking or modification, the development cycle and testing costs would be significantly higher than directly adopting Uniswap's mature solution.

As a publicly traded company, Coinbase has a very low tolerance for compliance risks. Although Aerodrome is the native DEX of the Base chain, its permissionless and highly autonomous protocol characteristics fundamentally conflict with Coinbase's regulatory framework. If Coinbase were to directly integrate Aerodrome, it would have to bear the joint responsibility for protocol vulnerabilities, money laundering risks, and even regulatory scrutiny. In contrast, the modular design of Uniswap V4 allows Coinbase to gradually test the waters through a controlled KYC-isolated pool, avoiding regulatory pitfalls while leveraging Uniswap's brand credibility and liquidity network.

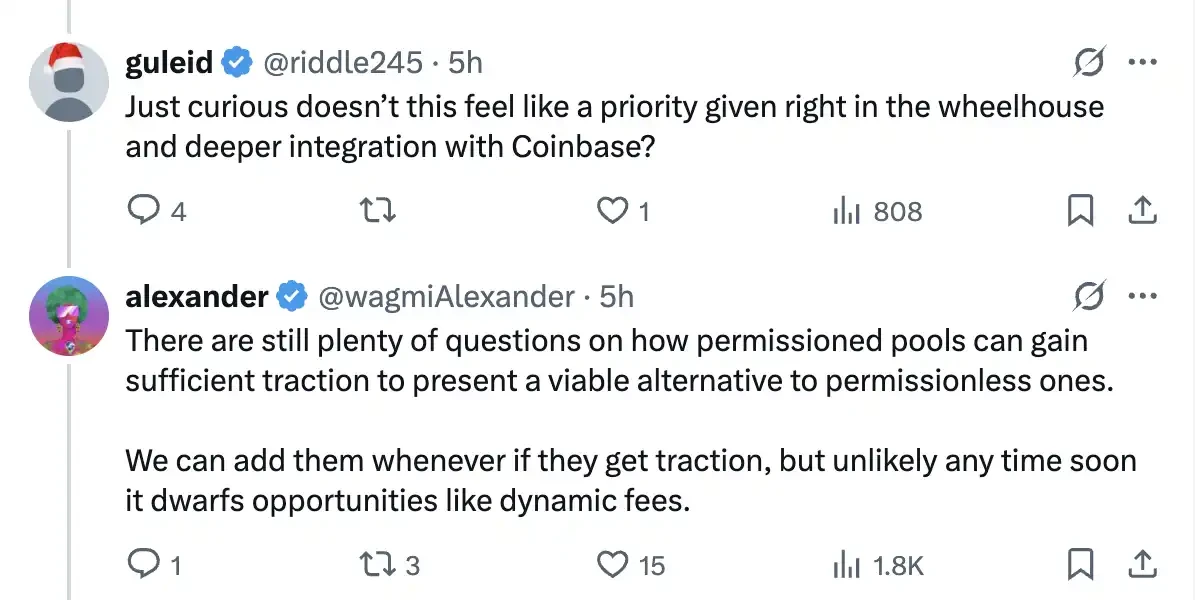

Alexander Cutler also acknowledged that "technically feasible," but clearly stated that features like dynamic fee optimization and permissionless pool functionalities are prioritized higher.

In response to others' tweets, he wrote, "There are still many questions about how permissioned pools can gain enough appeal to become a viable alternative to permissionless pools. If it really gains market recognition, we can support it at any time. But in the short term, it is unlikely to surpass opportunities like dynamic fees."

This choice reflects that Aerodrome is more inclined to serve existing DeFi native users rather than cater to Coinbase's compliance experiments. In contrast, Coinbase aims to explore on-chain compliant trading scenarios through verified pools and gradually migrate CEX users to on-chain — a path that requires immediate availability and low compliance risk, which Uniswap V4 conveniently provides with ready-made technical interfaces.

The Experimental Nature Exceeds PMF

Some view the whitelist liquidity pool as one of the anticipated application scenarios of Uniswap V4, and Coinbase's verified pools are merely a practical implementation of this concept. The most direct contradiction lies in the high overlap of target users — institutional LPs and compliant buyers on Coinbase's order book are already accustomed to the low-friction environment of centralized trading platforms.

If on-chain concentrated liquidity merely replicates the order book functionality of CEX, users lack the motivation to migrate — the gas costs, price slippage, and operational complexity of on-chain trading are still higher than those of CEX, while traditional users rely more on CEX's instant settlement, fiat channels, and customer support. Even if the verified pools can offer slightly higher market-making returns, the fragmentation of liquidity may reduce capital efficiency, creating a dilemma where "compliance premiums cannot cover migration costs."

A deeper challenge arises from the paradox of liquidity distribution. If the verified pools focus on assets not listed on Coinbase, they will fall into a "chicken and egg" cycle: the high-risk attributes of unreviewed assets conflict with the conservative positioning of compliance pools, while funds seeking Alpha often prefer early assets in permissionless pools. This could lead to verified pools becoming a "compliance buffer zone" for market makers — earning fees by providing liquidity rather than capturing asset appreciation dividends.

Even if unlisted assets are allowed into the pool, whether they can become a "listing transition channel" remains uncertain. As a publicly traded company, Coinbase's strict standards for asset review will not relax due to the existence of on-chain pools; rather, they may tighten further due to compliance pressures.

Although Coinbase binds KYC identities through on-chain credentials, ZachXBT has revealed a systemic vulnerability: the risk of black market actors injecting laundered funds by purchasing/stealing KYC information to forge "compliant identities" always exists. If hackers sell illegal ETH to the verified pools through market makers, the gap between on-chain anonymity and CEX's risk control capabilities may lead to the entire pool being marked as a "contaminated asset pool," triggering regulatory scrutiny. More subtly, arbitrage bots still need to rely on market maker channels to balance prices, but the risk control capabilities of market makers are far inferior to those of centralized systems in CEX, potentially transferring risks to ordinary users.

In the short term, the verified pools resemble a "feasibility study report for on-chain" — utilizing Uniswap V4's hooks mechanism to build a minimal viable model, testing regulatory tolerance and user behavior data; in the medium term, they plan to iterate the interactive interface developed for this into a standard tool for on-chain trading, paving the way for future integration of permissionless pools; the long-term goal remains to blur the boundaries between CEX and DEX, gradually realizing Brian Armstrong's vision of "unified on-chain and off-chain liquidity."

However, whether this experiment can bridge the gap between "sandbox and implementation" depends on two key variables: first, whether the U.S. SEC views such pools as "de facto securities trading platforms," and second, whether the speed of CEX users migrating to on-chain can support liquidity density. At the current stage, it is still too early to assert its success or failure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。