1. Ecosystem Project Categories

2. Overview of BNBCHAIN Ecosystem Data

3. Why BNBCHAIN, which Laid Out AI Earlier, Lacks Competitiveness?

Infrastructure Issues of BNBCHAIN

1. Introduction to Representative Tokens

2. Characteristics of BNBCHAIN's MEME

Abstract

BNB Chain is a Layer 1 blockchain supported by Binance, launched in September 2020 as Binance Smart Chain (BSC) and renamed BNB Chain in February 2022 to emphasize its evolution as an independent ecosystem. Its native token BNB surged at the end of 2020 due to the DeFi boom, leading the market to reprice it as a top Layer 1 token. The ecosystem encompasses DeFi (such as PancakeSwap), GameFi (such as CryptoBlades), NFTs (such as BakerySwap), social media (such as Friend 3), data storage (such as BNB Greenfield), and AI (such as MyShell), benefiting greatly from Binance's support, but many projects have declined due to a lack of sustainability. The TVL peaked at $20 billion in 2021, then fell to over $2 billion, and is expected to rebound to $5 billion in 2024 (a growth of 58.2%), but has decreased by 29% when measured in BNB, with a 17.7% increase in addresses (reaching 486 million) not translating into substantial gains. The AI layout began in May 2024 through opBNB (high TPS) and BNB Greenfield (data storage), but due to insufficient infrastructure (MEV attacks, transaction delays) and a lack of wealth effect, it lags behind Solana. The meme ecosystem is primarily themed around dogs and cats (such as FLOKI, Baby Doge Coin), with a strong but monotonous background, while Solana's memes are more diverse and vibrant. Choosing BNB Chain memes requires attention to the yellow logo, endorsements from influencers, and stable trends, but the effect of launching has weakened, and risks must be approached cautiously. BNB Chain needs innovation and infrastructure upgrades to regain competitiveness.

Ecosystem Overview

BNB Chain is a Layer 1 blockchain supported by the leading cryptocurrency exchange Binance, backed by its native token BNB. The origin of BNB Chain can be traced back to September 2020, when it was known as Binance Smart Chain (BSC), launched by the cryptocurrency exchange Binance. In February 2022, it was renamed BNB Chain to reflect its evolution as an independent blockchain ecosystem.

Figure 1 BNBCHAIN Official Website Main Image

Data Source: bnbchain.org/

1. Ecosystem Project Categories

Decentralized Finance (DeFi)

BNB Chain is a popular choice in the DeFi ecosystem, featuring several well-known decentralized exchanges, lending platforms, and yield farming projects. The following are representative projects:

PancakeSwap: A decentralized exchange that offers instant token swaps and liquidity farming.

Venus Protocol: A lending and borrowing platform that allows users to earn interest or borrow assets.

Alpaca Finance: A platform focused on yield farming, where users can earn additional returns by providing liquidity.

Tranchess: A risk management and yield optimization platform that offers various DeFi tools.

Mdexswap: Another decentralized exchange that supports cross-chain trading.

GameFi

BNB Chain supports various blockchain games, particularly focusing on the "Play-to-Earn" model, attracting a large number of players. Representative projects include:

CryptoBlades: A role-based "Play-to-Earn" game where players can earn cryptocurrency through gameplay.

Faraland: A multiplayer role-playing game (RPG) where players can own unique NFT warriors.

Monsterra: A multi-chain "Play-to-Earn" game that supports BNB Chain and other blockchains.

Alien Worlds: A sci-fi fantasy game where players earn tokens by completing tasks.

NFTs (Non-Fungible Tokens)

BNB Chain is an active platform in the NFT market, supporting the creation, purchase, and sale of unique digital assets. Representative projects include:

BakerySwap: A decentralized exchange that integrates an NFT marketplace.

NFTb: An NFT lending platform that allows users to collateralize NFTs for loans.

Phantasma Chain: A platform focused on NFTs and blockchain, supporting the creation and trading of digital assets.

BNB Chain NFT Marketplace: The official NFT marketplace of BNB Chain, facilitating user transactions of digital collectibles.

Social Media

There are a few social media projects on BNB Chain that emphasize decentralization and user data control. Representative projects include:

Friend 3: A social media platform that provides a passive income mechanism, allowing users and creators to earn rewards through social interactions.

Data Storage and Management

BNB Chain supports decentralized data storage through its infrastructure, enhancing data ownership and privacy. Representative projects include:

BNB Greenfield: A decentralized storage solution that allows users and dApps to create, store, and exchange data.

Blockchain and Artificial Intelligence (AI) Integration

In recent years, BNB Chain has emphasized an "AI-first" strategy, supporting multiple AI-driven projects. Representative projects include:

MyShell: A decentralized platform that innovates the creation, sharing, and monetization of AI applications.

NFP: An AI-driven project that may involve various industries.

ChainGPT: A tool that combines AI and blockchain to enhance smart contract development.

Gata: An AI-related project on BNB Chain, with specific functions to be explored further.

Alaya: An AI project focused on AI innovation within the blockchain ecosystem.

MEET 48: An AI-driven project with specific application scenarios including social or data processing.

Conclusion: BNBCHAIN has come a long way since the DeFi boom in August 2020, nearing five years of development. Undoubtedly, the explosive price of the BNB token at the end of 2020 was closely related to the then-BSC, as users discovered that Binance was not just a centralized exchange, but that the BNB token was also a core token of a top Layer 1 blockchain. This led the market to reprice the BNB token. Over the years, like other public chains, BNB has also focused on GameFi, DeFi, NFTs, and AI, giving rise to many projects launched on Binance, closely related to Binance's strong support. These projects achieved good results at times, but most have faded and been delisted by Binance. Ultimately, the performance of a valuable project is still related to its sustainability.

- Overview of BNBCHAIN Ecosystem Data

When we measure a chain with data, we inevitably consider metrics such as TVL, transaction volume, interaction numbers, and the number of developers.

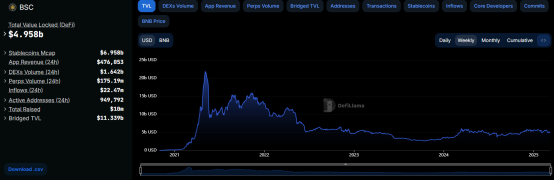

Like other financial markets, the cryptocurrency market is liquidity-driven, known as TVL. The explosion of BNBCHAIN's TVL was concentrated in early 2021, when all DeFi innovations on the Ethereum chain were replicated on the BSC chain. The advantage of BSC is its higher TPS, faster confirmation speed, and lower transaction fees. This advantage attracted countless users, even though the projects on the BSC chain were merely copies. In May 2021, the TVL peaked at $20 billion, then fell to over $2 billion. Even with the recent market recovery, CZ's calls for action have only doubled the TVL to $5 billion. This makes the narrative of non-innovative public chains appear like a bubble scheme; once the bubble bursts, no matter how hard one tries, each rebound feels like a dead cat bounce. In 2021, Binance's support was not as strong as today; not only was He Yi personally involved, but CZ also took the unprecedented step of actively promoting projects.

Figure 2 Changes in BNBCHAIN's TVL Source: defillama

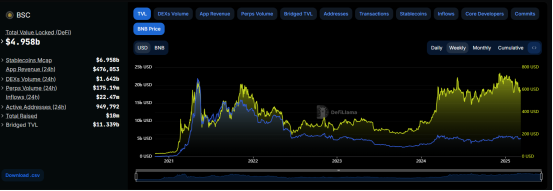

Interestingly, when we compare the TVL trend of BNBCHAIN with the price of the BNB token, we find:

Figure 3 Comparison of BNBCHAIN's TVL and BNB Token Price Trends Source: defillama

After the bubble burst, the BNB token has embarked on a new journey, even reaching new highs. This proves that the logic of centralized exchanges (CEX) is enduring, sticky for users, and genuinely in demand. A Layer 1 public chain requires new innovations and new gameplay to rejuvenate the chain. All CEXs can list all tokens from all chains, which does not create a significant competitive barrier. When the market is good, if CEX A is performing well, it also means that CEX B is doing well. The competition lies in service, security, liquidity, and so on. The competition among public chains is brutal; the prosperity of other public chains not only brings no benefits to one's own chain but can even attract its limited liquidity away. "The growth of the ecosystem is reflected in a 58.2% increase in Total Value Locked (TVL) and a 17.7% increase in unique addresses, with opBNB achieving 4.7 million daily active users (DAU)." The above statement is excerpted from BNBCHAIN's 2024 annual report, which considers the key growth indicators to be rather trivial from a user perspective. This is because everyone knows that the key point of a chain's TVL is the value of its native token. This accounts for the majority, so the 58% increase in TVL in 2024 is actually attributed to the rise in the BNB token. When we measure the TVL of this chain in terms of the number of BNB, we can find that in 2024, the total TVL of the chain actually decreased from 11 million BNB to 7.8 million BNB, a decline of 29%.

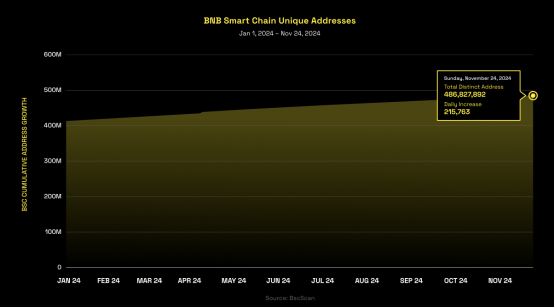

Another point is the increase in the number of addresses. The report shows, "In 2024, the total number of unique addresses on BSC increased by 17.7%, reaching over 486 million. This growth is consistent with the steady expansion of the previous few quarters." Based on daily calculations, this means an increase of 210,000 addresses per day.

Figure 4 BNBCHAIN 2024 Address Growth Status Source: 2024 BNBCHAIN Ecosystem Report

From a data perspective, we actually do not see any growth in BNBCHAIN, which means that apart from a portion of the tax-collecting class (such as BNB nodes), the remaining ecological niches are basically unable to gain any benefits. This implies that it is very difficult for users to expect simple holding of project tokens within the ecosystem to generate returns.

BNBCHAIN's AI

Before discussing BNBCHAIN's AI, we need to review the development of BNBCHAIN over the years. Many people do not understand what BNBCHAIN's AI is about; in this market cycle, the AI sector has been led by Solana. Many naturally assume that BNBCHAIN is just trying to catch up at the last minute, bringing out some half-finished products to fish in troubled waters.

- Major Events in BNBCHAIN

September 2020: BNB Smart Chain officially launched, introducing the PoSA consensus mechanism, supporting smart contracts, and attracting early developers.

2021: The DeFi and NFT boom, with projects like PancakeSwap driving growth in TVL and trading volume.

February 2022: Brand renaming, merging Binance Smart Chain and Binance Chain into BNB Chain, enhancing the community-driven image.

2023: Regulatory controversies, with Binance facing SEC charges that could affect public trust, but technological development continues to advance.

2024: Launch of opBNB and BNB Greenfield, enhancing scalability and data storage capabilities. According to the BNB Chain Blog: 2024 Annual Report, opBNB reached 4.7 million daily active users by the end of 2024, with BSC's TVL growing by 58.2%.

2025: AI-first strategy, supporting AI-driven projects like MyShell and ChainGPT, further expanding the ecosystem.

2. BNBCHAIN's AI Layout

This is a list of major events in BNBCHAIN's ecosystem related to AI. The specific projects are actually DeFi, NFT, and AI; DeFi and NFT are already in the past. Therefore, the core focus for BNBCHAIN moving forward is actually AI. When discussing BNBCHAIN's AI, the key events to note are the launch of opBNB and BNB Greenfield in 2024. Why launch these two things? We can find the answer in BNBCHAIN's official report.

Figure 5 Why Build AI on BNB Chain? Source: BNBCHAIN Official Report

In the May 2024 report "Why Build AI on BNB Chain?," it mentions, "The BNB Chain ecosystem has a robust infrastructure and multi-chain architecture, including BNB Smart Chain (BSC), opBNB, and BNB Greenfield, specifically tailored for AI integration."

These three chains merge into a unified solution called "One BNB." This structure provides a seamless and efficient environment for AI projects, allowing developers to leverage the unique features of each chain:

BSC: The first-layer platform, providing strong EVM compatibility and a proof-of-stake authority consensus model. This significantly improves transaction speed and reduces costs.

opBNB: A second-layer solution built using the OP Stack. It has high performance, processing 5-10K TPS, and utilizes optimistic rollup technology to further expand throughput and reduce transaction costs, making it suitable for high-performance AI applications that require fast processing and low latency.

BNB Greenfield: A decentralized data storage solution focused on enhancing privacy and security, providing a solid foundation for AI applications that manage large amounts of data.

In simple terms: opBNB and BNB Greenfield provide strong support for AI applications. The low latency and high throughput of opBNB (up to 10,000 TPS) and extremely low gas fees make it very suitable for AI use cases that require rapid data processing and response, such as vehicle motion recognition and chatbots, ensuring quick transaction confirmations and a smooth user experience; its integration with BSC maintains data integrity and security through the BNB token and Layer-1 network, meeting real-time AI demands. On the other hand, BNB Greenfield offers a decentralized and secure data storage platform, supporting fine-grained data access control and data markets, allowing users to control and monetize personal data, providing high-quality datasets for AI training, while creating new opportunities through DataFi applications, collectively driving AI innovation and deployment. Therefore, BNBCHAIN has actually been actively laying out the AI sector for quite some time, not just developing ecosystem projects but also building the infrastructure of the ecosystem. At that time, on May 1, 2024, many projects had already been born. So why did the AI sector only explode on the Solana chain in October 2024? This relates to the underlying operational logic of the cryptocurrency market; cryptocurrency users value the wealth effect rather than true cognition and foresight. It is liquidity, not project quality.

Figure 6 BNBCHAIN AI Layout Source: BNBCHAIN Official Report

In this image, we can see many familiar projects, such as MyShell, ChatGPT, Sleepless AI, HOLOworld AI, and so on. Among them, the most noteworthy is HOLOworld AI. I first saw this project in November 2024. I learned about it through the Avaai project, which is an AI agent project on the Solana chain. I only discovered while writing this report that HOLOworld AI was originally a BNBCHAIN project. The project saw the AI agent market on Solana explode and quickly went to the Solana chain to issue tokens. However, because the project was supported by BNBCHAIN, it could not directly issue its project token on the Solana chain and could only send an AI agent over. But the crazy market conditions caused this AI agent project to reach a market cap of over $300 million at one point. Coincidentally, the virtual token was actually launched earlier than GOAT, back in May 2024 on the Base chain. Unfortunately, no one paid attention. Fortunately, later the project team urgently released their AI agent virtual idol Luna, and with the official hype from Base and the breakout of AIXBT, it created the myth of Virtual.

3. Why Did BNBCHAIN, Which Laid Out AI Earlier, Lack Competitiveness?

Returning to BNBCHAIN, why has it failed to capture significant value despite its early layout? On one hand, it is due to the lack of infrastructure in BNBCHAIN, which currently faces issues like MEV attacks, with these traps running rampant. For instance, during high concurrency, the chain can become congested, preventing users from trading for extended periods. Additionally, the absence of support from Telegram bots and trading bots has led to low trading volumes and activity. On the other hand, CZ and He Yi believe that the community should not be guided but should be allowed to develop on its own. This is in stark contrast to the ideas of Raj and Toly from the Solana chain. Particularly, CZ believes that excessive hype around memes is inappropriate, leading to a lack of wealth effect.

Returning to the earlier question of why the infrastructure on the Solana chain is so much more complete than that of BNBCHAIN—was Solana born this way? Certainly not. Although the Solana team has consistently supported DeFi and GameFi projects, it is undeniable that memes were key to the resurgence of the Solana ecosystem after the FTX collapse in 2022.

The BONK token is a hero of the ecosystem. BONK introduced many EVM chain users to the Solana ecosystem for the first time. The meme market at the end of 2023, including projects like Myro, Wif, and Silly, helped Solana chain give birth to a batch of Telegram bots and trading bots.

BNBCHAIN's Infrastructure Issues

To digress a bit, why do mainstream Chinese media tirelessly support the game "Black Myth: Wukong" after its birth? Why is "Nezha 2" trending everywhere during this year's Spring Festival? Because the upgrade of the industry (infrastructure) relies on these miracles. These miracles show everyone the hope in this area and encourage more people to invest in the industry. The development of "Black Myth: Wukong" will stimulate the market demand for graphics cards and chips, and this upstream and downstream demand can promote chip companies to conduct research, providing them with ample opportunities for trial and error. The explosive success of "Nezha 2" can also promote the development of China's special effects industry and cultural industry, spreading Chinese culture worldwide. Therefore, national-level support is necessary and essential.

Figure 7 Black Myth: Wukong

Source: Steam

Why do so many people flock to the Solana ecosystem? Because Wif is such a miracle, and Bome is also such a miracle. Coupled with the slogan "only possible on Solana," it continuously occupies users' minds, making the wealth effect of the Solana chain increasingly strong. Supporting a particular industry should not simply mean supporting that industry or the projects within it. Because a single source of official funding can easily lead to projects in the industry defrauding subsidies and working behind closed doors, ultimately resulting in a futile effort. The same principle applies to public chains; what can truly help the ecosystem thrive is good projects. Memes are actually a crucial part of this. The KOLs with significant influence in this round have all emerged from Solana memes, earning money from the ecosystem and naturally speaking for it. An interesting fact is that Solana's price dropped from a high of $295 to $125, a decline of 57%, which is more than a halving, yet the user sentiment in the ecosystem remains positive, with no one complaining about Solana's official stance. In fact, such a significant pullback must have resulted in many stakeholders selling off a lot of their holdings.

Rome wasn't built in a day. In December 2023, when this market cycle just started, there was a representative token called Zero. This project adopted a new asset issuance method, where users continuously sent SOL to randomly verify and distribute assets. The project team added all liquidity to the pool. At this point, the first thick pool was born, a case of adding liquidity for all tokens. This project attracted a lot of community attention as soon as it came out. However, the token's price increase lasted a long time. One reason was that the project's pool was thick, and small amounts of capital could not drive the token's price up. The other reason was that people didn't know how to buy it. The project's pool was on Meteora, and everyone learned about this DEX for the first time, but trades always failed, and at that time, there was no OKX. People would ask about Jupiter, but unfortunately, Jupiter didn't support it either. Eventually, everyone discovered that Birdeye could trade, which led to a massive influx of funds, creating the first "god pool." The prosperity of the chain relies on millions of real users and the infrastructure that can support millions of real user interactions.

BNBCHAIN's MEME

1. Introduction to Representative Tokens

The meme aspect of BNBCHAIN is also an important component of its ecosystem, with top projects having reached market capitalizations of billions of dollars and hundreds of thousands of token holders.

Baby Doge Coin

Introduction: Baby Doge Coin was launched in April 2021 as a dog-themed meme token, aiming to be more sustainable than its predecessors, emphasizing community involvement and animal welfare. According to CoinMarketCap: Baby Doge Coin, it has a mission to help save dogs, donating over 81,000 pounds of dog food and holding a world record.

Token Economics: The total supply is 100,000,000,000,000 tokens, with a current circulating supply of approximately 163,712,257.10 billion tokens according to BscScan: Baby Doge Coin Token Tracker. (The tax has been canceled.)

Community: The community is active, with high social media engagement, supporting animal welfare charitable activities, such as donating over $1.5 million in collaboration with multiple animal rescue organizations.

Market Cap: $200 million

FLOKI

Project Introduction: FLOKI is inspired by Elon Musk's dog Floki, launched in July 2021, and quickly gained popularity due to its meme attributes and community support. According to the Floki Official Website, it supports the Valhalla NFT game and FlokiFi decentralized financial products.

Token Economics: The total supply is 10,000,000,000,000 tokens, with 432,586 holders according to BscScan: FLOKI Token Tracker.

Community: The community is strong, focusing on charitable and community-driven activities, such as locking assets through FlokiFi Locker to support the ecosystem. According to CoinDesk: BNB Chain’s Venus to Accept Floki Tokens, FLOKI can be used as collateral for lending on the Venus protocol.

Market Cap: $600 million

Simon's Cat (CAT)

Description: Simon's Cat (CAT) was launched on the BNB Chain in August 2024, based on the popular animated series "Simon's Cat," aiming to bring traditional brands into the Web3 space. According to CoinMarketCap: Simon's Cat Price, it attracts users by airdropping to FLOKI holders.

Token Economics: The total supply is 9,000,000,000,000 tokens, with 268,145 holders according to BscScan: Simon's Cat Token Tracker.

Community: Leveraging the large online fan base of the animated series, it attracts millions of users. According to Binance: Simon's Cat Token Surges, the CAT price rose over 26% after Binance launched its derivatives on October 21, 2024.

Market Cap: $60 million

Cheems

Project Introduction: Cheems Token (CHEEMS) is a meme token based on the internet meme "Cheems," featuring Shiba Inu dogs, known for its humor and community-driven characteristics.

Token Economics: Cheems Token is unique in its transparent and community-driven model. According to the Cheems Token Official Website, it has no team reserves, trading taxes, or revenue sources, fully committed to the market, emphasizing "Cheems is the ruler of memes," aiming to generate more wealth through community power. Its community remains active through social media and events like meme contests and charitable activities (such as supporting animal welfare), attracting a large following.

Market Cap: $170 million

2. Characteristics of BNBCHAIN's Meme

These are some of the most representative meme tokens on the BNB chain, and undoubtedly, these projects have attracted a large number of users to BNBCHAIN. Meme coins on BNB Chain are often based on popular internet memes, such as dogs and cats, with representative tokens including Floki, Baby Doge Coin, and Cheems. They are driven by active communities, with some attempting to increase utility through NFT platforms or charitable activities (such as animal welfare). The high performance of BNB Chain (fast transactions and low fees) is suitable for trading these speculative assets. Floki and Baby Doge Coin have higher market capitalizations.

BNBCHAIN's memes often have strong backing and funding from the outset. Everyone can intuitively see the background of the project and its growth journey. In contrast, meme coins without backing generally lack any special randomness. They are almost 100% likely to end up at zero. These projects have a very clear growth path from the beginning. Particularly, the TST token that emerged in February this year was entirely supported by CZ and Binance officials.

3. Differences from Memes on Solana

Memes born on the Solana chain are more diverse, covering many types.

Source: PANews

In this collection of wealth-creating meme coins for 2024, the vast majority are Solana memes, which can be categorized as follows:

- Animal memes: Wif, Silly, Wen, Mew, etc.

- Lifestyle and spirit: Giga, Chad

- Political memes: Trump, Tremp, Pnut

- Secondary creation memes: Peng, Fwog

- Derivative memes: Andy, Mumu

- Hot event memes: Moodeng, Luigi

- Celebrity memes: Mother

- Religious memes: Luce

- Art memes: Mundi, Ban

- Emoji memes: Hehe, Michi

- AI memes: Ai16z, Goat, Ava

- DeSci memes: Rif, Uro

The range covered is extensive, and Solana's memes can attract various types of people with their diverse forms. In contrast, BNBCHAIN's memes are much more monotonous. This is closely related to the differences in the foundational infrastructure of the two. Of course, this is not just a problem for BNBCHAIN; other public chains also face this issue aside from the Solana ecosystem.

4. How to Choose Meme Coins on BNBCHAIN

Meme coins are generally issued directly, and then market-making or operations are conducted based on market reactions. Most community users, aside from conspiracy groups, are unaware of the conditions before the coin issuance. If a meme is overly conspiratorial, it often means that the quality of the project itself is secondary. It is essential to understand that the purpose of the memes on the BNB chain is to get listed on Binance, nothing more. They themselves do not believe they can create a great community or an interesting culture. However, they only need to be better than other memes on BNBCHAIN, as Binance will ultimately support its own projects. Therefore, when choosing memes on BNBCHAIN, consider the following points:

- Logos with yellow or black-yellow color schemes, which essentially serve as a token of loyalty to Binance. These are projects of the trusted type. For example, Cheems was originally a project on ZKSync, and the dog Cheems itself is pure yellow. However, after moving to BNBCHAIN, it became a dog in a black suit with a black-yellow color scheme. I don't believe this is coincidental.

Figure 9 Cheems Project Logo

- Many well-known figures or influencers endorse the project, as the project itself lacks significant meme quality or interesting culture to attract users. Therefore, its core competitive advantage relies on authoritative endorsements. Since the quality of everyone's memes is similar, Binance will certainly choose the ones with louder voices. This also reflects the will of the people. For example, KOMA and Cheems have always been the subjects of endorsements from major influencers in the Chinese community, and eventually, KOMA was listed on Binance contracts, while Cheems was listed on Binance spot. However, the effect of Binance listings has weakened significantly, and related risks should be noted.

- The project's token shows stable trends and a long-term upward trajectory.

Conclusion: The rise of BNBCHAIN relies on DeFi innovation, Binance's endorsement, and the low gas fees and high TPS of its chain. However, currently, aside from Binance's endorsement still being effective, the DeFi track has lost its dividends, and there are more powerful competitors for low gas fees and high TPS. At this stage, BNBCHAIN is primarily developing its AI ecosystem, investing substantial resources to support track projects and build the necessary infrastructure. Users can prioritize projects on the bnbchain.org website when exploring projects on the BNBCHAIN chain, as well as the MVB (Most Valuable Builder) that Binance has consistently certified and supported.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。