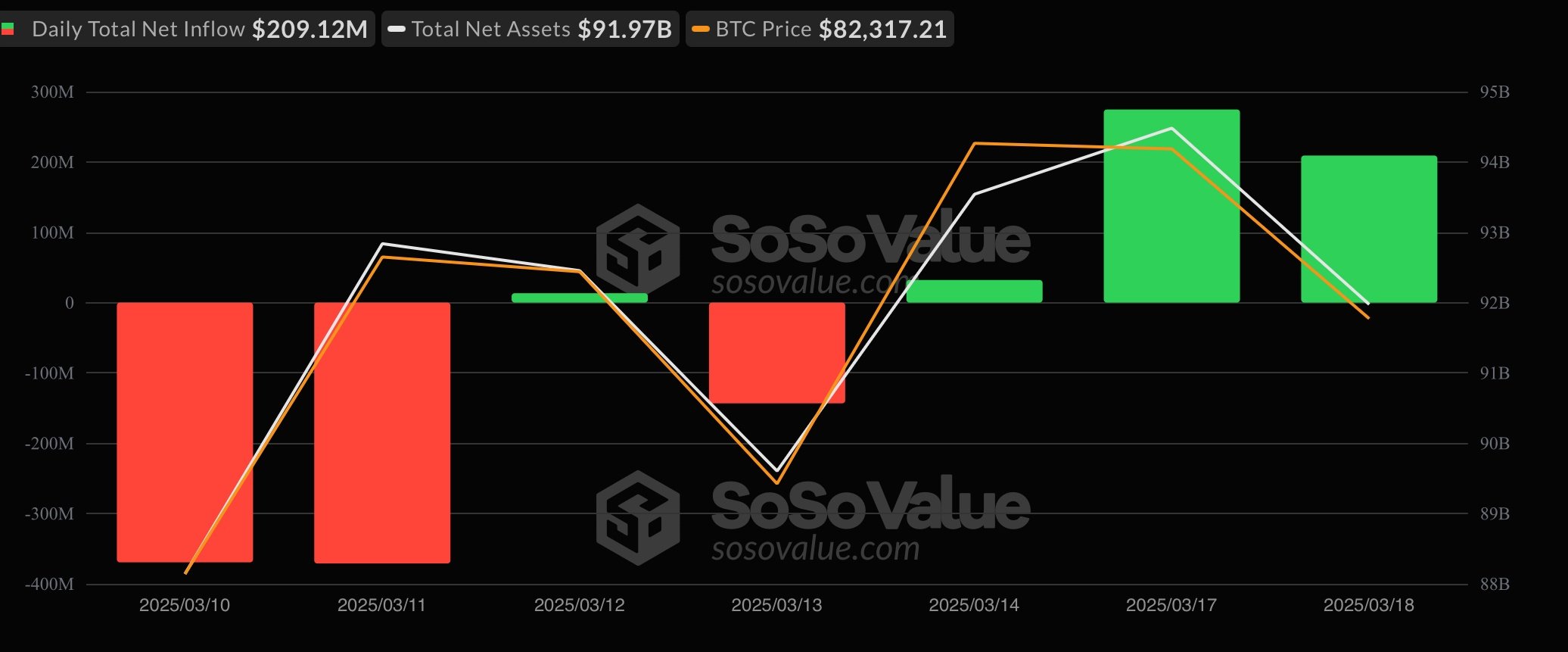

The positive inflows for bitcoin exchange-traded funds (ETFs) continued on Tuesday, March 18, attracting $209.12 million in new capital. This marks the second consecutive day of inflows for bitcoin ETFs, signaling a strong recovery of investor confidence with over $400 million of inflows over the past two days.

In contrast, ether ETFs experienced a net outflow of $52.82 million, extending their streak of withdrawals to ten consecutive days.

The day’s inflows for bitcoin ETFs were predominantly driven by Blackrock’s IBIT, which saw an impressive addition of $218.12 million. This substantial investment highlights the fund’s strong position in the market. Conversely, ARK 21shares’ ARKB experienced a minor outflow of $9 million, a slight deviation that did not significantly impact the overall positive trend. The remaining ten bitcoin ETFs reported no net flows, maintaining stability across the board.

For ether ETFs, challenges continued, with significant outflows recorded across major funds. Blackrock’s ETHA led the downturn with a $40.17 million withdrawal. Grayscale’s ETH and Fidelity’s FETH also reported outflows of $9.33 million and $3.32 million, respectively.

These consistent outflows reduced the total net assets for ether ETFs to $6.56 billion, reflecting a $200 million decline from the previous day’s close.

The returning inflows into bitcoin ETFs suggest that investor confidence is growing again, possibly influenced by recent market dynamics and positive sentiment. On the other hand, the continued outflows from ether ETFs indicate a cautious approach among investors, potentially due to ETH’s declining price action.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。