Today's homework is a bit tangled. Previously, it was always said that the market has never won against the Federal Reserve, and this time is no different. In fact, if the market had won this time, it would definitely be good for the risk market. With three rate cuts and a pause in balance sheet reduction, Bitcoin could have possibly returned to $90,000 today, but in reality, the market's gamble has once again failed.

Nick already stated in his post tonight that the Federal Reserve has no plans to cut rates before the fourth quarter, so two cuts are highly probable, and the dot plot also indicates two cuts. The number of rate cuts for 2026 remains unchanged at two, which is somewhat hawkish. However, the Federal Reserve has indeed taken a step back on balance sheet reduction, decreasing from $25 billion per month to $5 billion.

Powell's answer is that the choice to reduce the balance sheet is to maintain a longer balance sheet reduction cycle. In simpler terms, if they hadn't reduced it before, it might have been nearly done in six months. Now, with the reduction, it can last about 15 months, which has a deterrent effect on the market. Therefore, they chose not to pause or stop, as they do not want to send the wrong signals to the market.

Overall, the market's reaction seems to be optimistic. After all, the possibility of increasing rate cuts under the banner of tariffs is indeed low. If it really increases significantly, one would have to worry about a recession. The Federal Reserve's stance indicates that there is no expectation of a recession in the U.S. economy, which is a silver lining in bad news. Additionally, reducing the balance sheet is equivalent to reducing the withdrawal of liquidity from the market, which is somewhat acceptable.

However, on the monetary policy front, today's Federal Reserve did not show any signs of easing. There was no concession on rate cuts or balance sheet reduction, inflation is being blamed on tariffs, and they continue to watch the data. Overall, it is quite neutral, but I personally feel it leans a bit hawkish. Next, we will see how the market plays its hand.

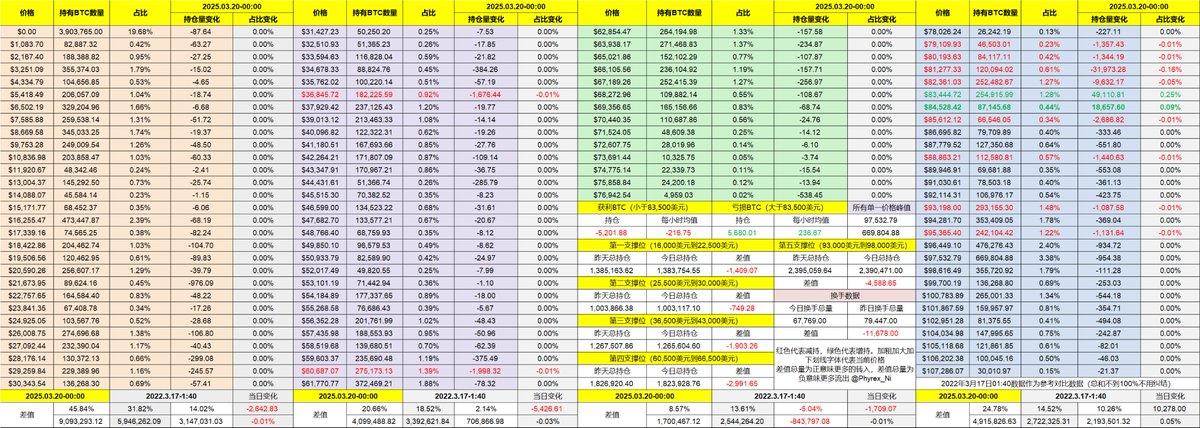

Looking back at the #Bitcoin data, the turnover in the last 24 hours has not only increased but has actually decreased. This should align with yesterday's expectations, as many investors are waiting for today's gamble and are not in a hurry to participate in the turnover. Therefore, even short-term investors are maintaining relative restraint, but this restraint may not last too long.

Although the current market shows good rises in U.S. stocks and cryptocurrencies, this interest rate meeting still hasn't changed the trend from "rebound" to "reversal." The tariff issue continues to trouble the Federal Reserve, and the slow economic growth is acknowledged by the Fed. Powell has clearly stated that there is no rush to cut rates, so this is still insufficient to meet the conditions for a reversal.

April may be a major test. Tariffs and GDP are both in April.

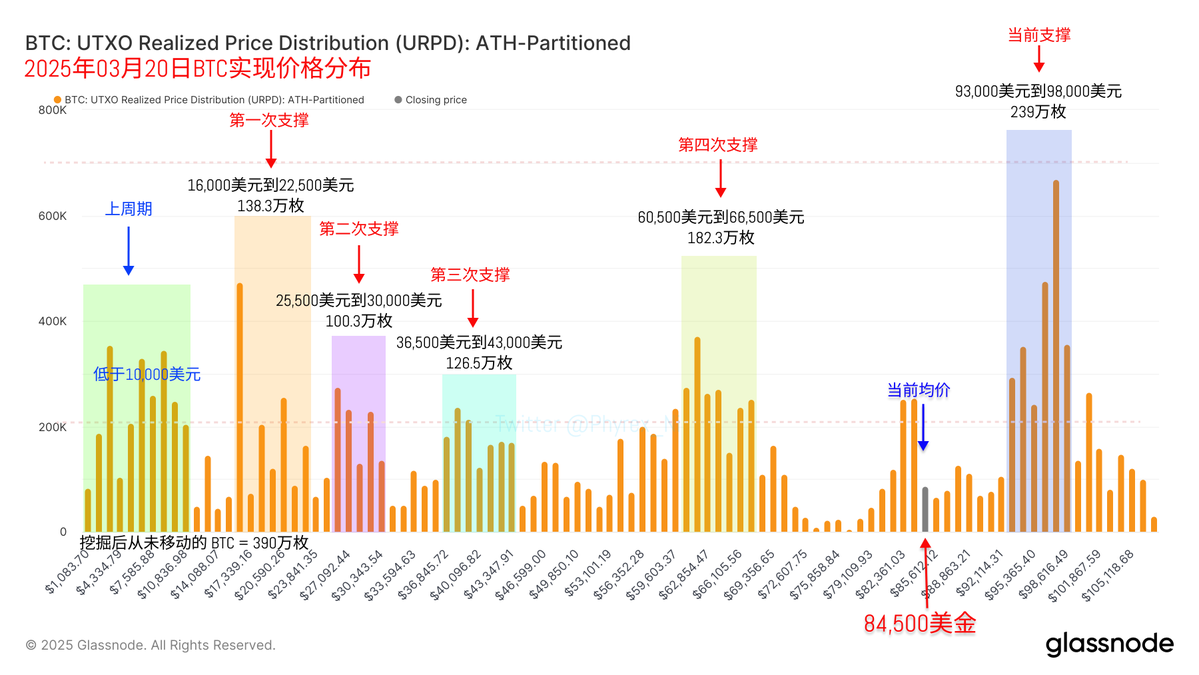

Due to the low turnover, there is still no threat to the dense chips between $93,000 and $98,000. The emotions of loss-making investors are very stable; let's first see how far this rebound can go.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。