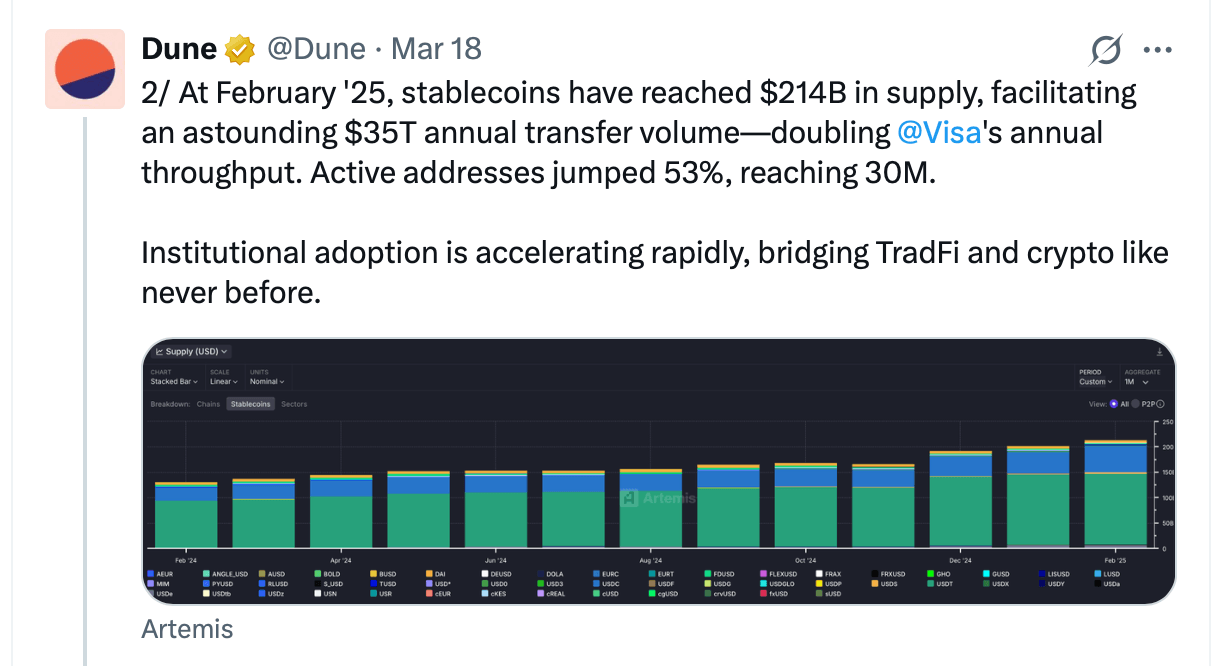

The stablecoin market has experienced significant growth in 2024, with total supply reaching $214 billion and transfer volume hitting $35 trillion, according to a report by Dune and Artemis. Stablecoins, which are pegged 1:1 to assets like the U.S. dollar, have become a critical bridge between traditional finance and the crypto economy, facilitating cross-border payments and enhancing liquidity in digital asset markets.

Institutional adoption has accelerated, with asset managers and payment providers increasingly integrating stablecoins into their operations. Despite this growth, stablecoins remain a fraction of traditional fiat liquidity, with the U.S. M1 money supply at $18.4 trillion. However, in transaction volume, stablecoins have surpassed major payment networks like Visa and Mastercard, processing $35 trillion in transfers compared to Visa’s $15.7 trillion and Mastercard’s $9 trillion in Q4 2024.

USDC has emerged as the leader in transfer volume, accounting for 66% of total stablecoin transfers, while USDT remains dominant in peer-to-peer transactions, particularly on the Tron network. Meanwhile, decentralized stablecoins like Ethena’s USDe have gained traction, with USDe’s market cap reaching $6.2 billion within a year of its launch.

Ethereum and Tron continue to dominate stablecoin activity, but Solana and Base have seen significant growth, driven by memecoin trading and DeFi activity. Base, in particular, has become a hub for regional stablecoins like EURC and BRZ, expanding financial inclusion by offering low-cost, on-chain alternatives for fiat transactions.

The report highlights the growing role of stablecoins in both decentralized and traditional finance, with DeFi applications driving the majority of transfer volume. As regulatory frameworks evolve, stablecoins are poised to play an even larger role in global financial infrastructure, according to the Dune and Artemis study.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。