Translation: Yuliya, PANews

Stablecoins are reshaping the global financial system at an unprecedented pace. According to the "2025 Stablecoin Status" report jointly released by Dune and Artemis, the stablecoin market has seen significant growth over the past year, with accelerated institutional adoption, the rise of decentralized stablecoins, and continued increases in on-chain trading activity.

Market Size and Growth Trends

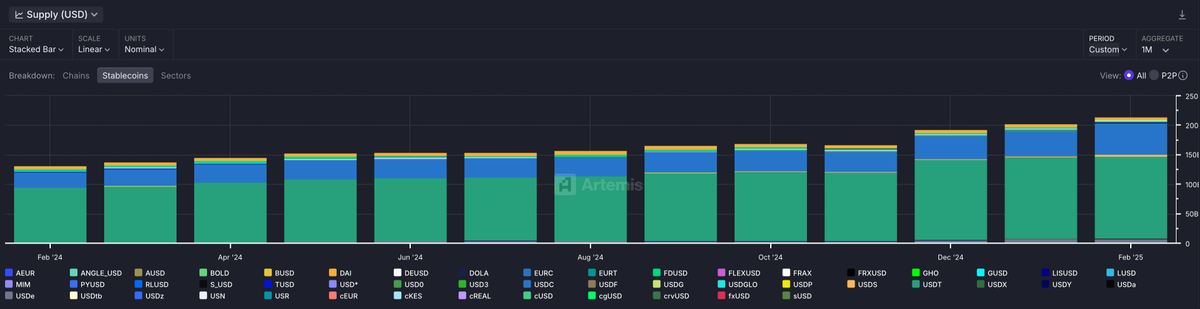

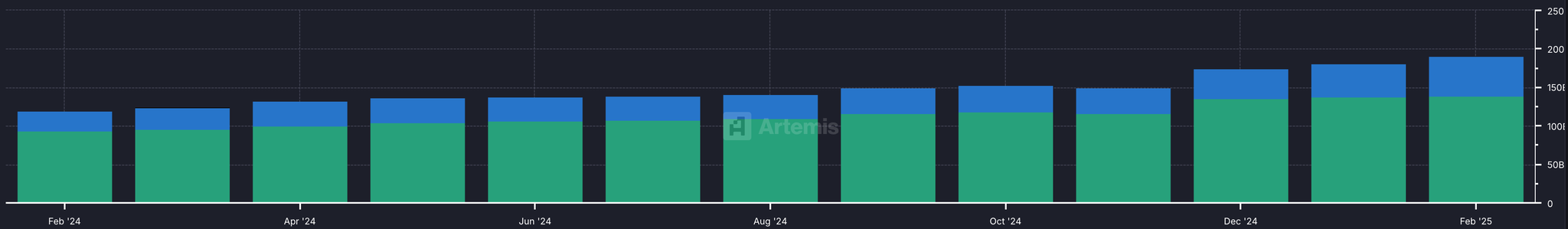

As of February 2025, the supply of stablecoins has reached $214 billion, with an annual trading volume of $35 trillion, double that of Visa's annual trading volume. Market activity has also risen, with the number of active addresses on-chain increasing by 53%, surpassing 30 million. Institutional funds are flowing in on a large scale, driving the deep integration of traditional finance (TradFi) and the crypto market.

Changes in the Dominance of USDC and USDT

Driven by the process of compliance and market strategies, USDC and USDT still hold dominant positions, but there are subtle changes in market share.

- USDC's market capitalization has doubled to $56 billion, mainly due to the approval of MiCA and DIFC regulations, the addition of important strategic partners like Stripe and MoneyGram, and the rapid expansion of the global market.

- USDT's total market capitalization has grown to $146 billion, remaining the largest stablecoin by market cap, but its market share has declined, with a decrease in institutional adoption and a gradual shift towards the P2P remittance market, solidifying its position in the global payment sector.

The Rise of Decentralized Stablecoins

In the decentralized finance (DeFi) ecosystem, the influence of decentralized stablecoins has significantly increased, with several emerging projects achieving breakthrough growth.

- USDe (Ethena Labs): Its market capitalization skyrocketed from $146 million to $6.2 billion, making it the third-largest stablecoin in the market, with growth driven by its innovative yield strategy and Delta-neutral hedging mechanism.

- USDS (MakerDAO): MakerDAO has rebranded to Sky and launched the compliance-friendly USDS, with a market cap reaching $2.6 billion by February 2025. This adjustment has enhanced its competitiveness in the decentralized stablecoin market.

Capital Flows and Industry Distribution

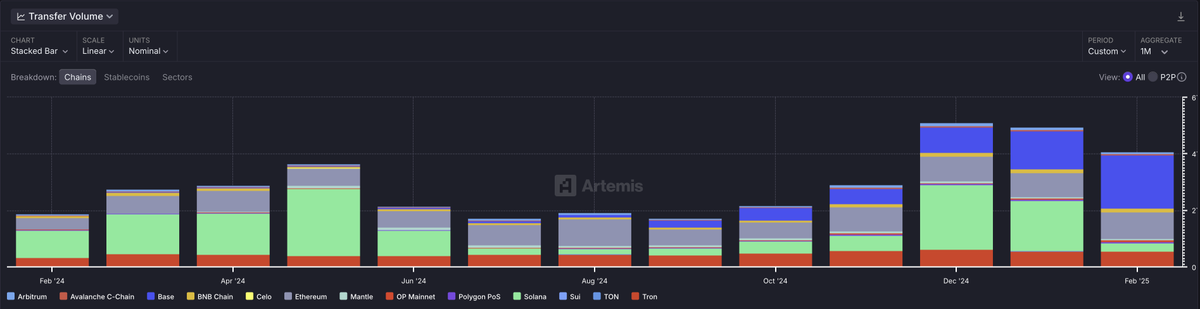

The flow trends of stablecoins reflect the positioning and competitiveness of different public chains in the market:

- Ethereum remains the primary issuance platform for stablecoins, holding 55% of the supply share.

- Base and Solana have seen rapid growth in trading volume, driven by the DeFi and meme coin markets, becoming important on-chain ecosystems for stablecoin capital flow.

- TRON continues to occupy a core position in the global P2P payment and cross-border remittance markets, especially in emerging markets, where stablecoins are widely used for payments and savings.

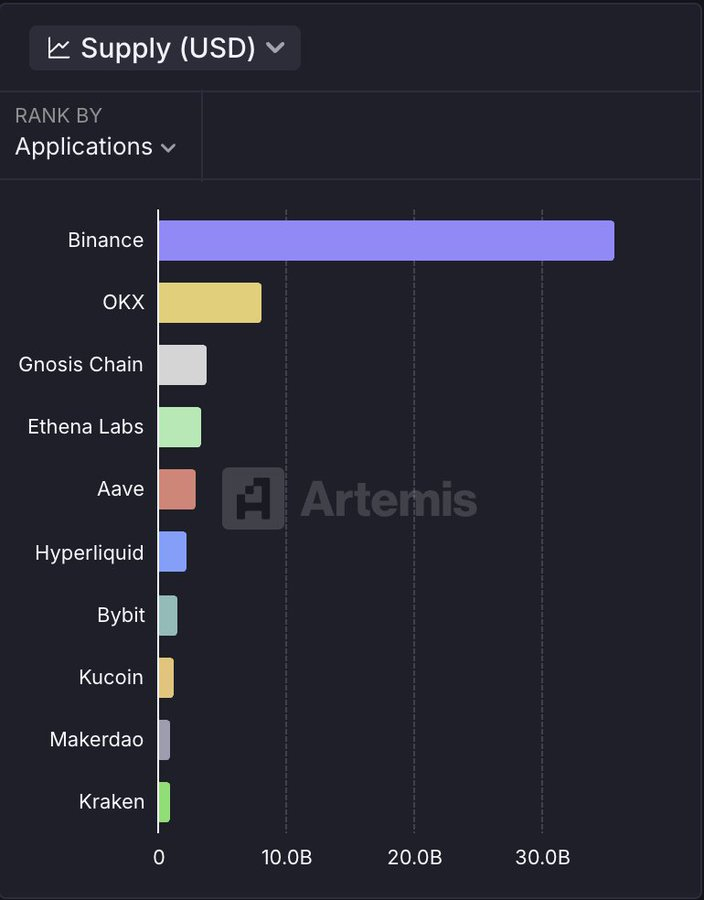

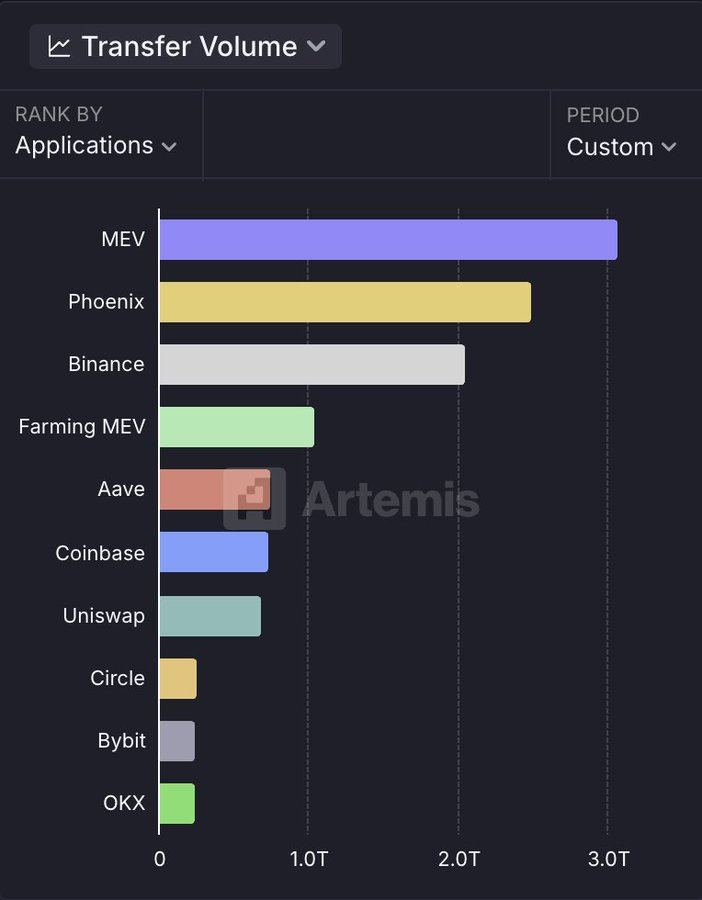

Most stablecoin liquidity is primarily concentrated in centralized exchanges (CEX), with trading volume mainly driven by DeFi (DEX, lending, yield farming), reflecting efficient capital circulation and innovation.

Core Role and Future Development

Stablecoins have become a key infrastructure in the crypto market while also driving innovation in the traditional financial sector. Industry experts are optimistic about the future development of stablecoins:

"Stablecoins are the lifeline of the crypto market and the superconductor of the financial system. They open up new markets and financial opportunities, driving innovations that were previously hard to reach."

——Dragonfly General Partner Rob Hadick

"The advantages of stablecoins in cross-border payments are significant. I hope Base supports more local currency stablecoins, allowing global users to trade on-chain with familiar currencies, increasing the adoption of blockchain technology."

——Base Product Head Neodaoist

"The next generation of stablecoins must possess market resilience. The core of USDe is a yield-supported stability mechanism, ensuring users have a reliable dollar alternative."

——Ethena Labs Research Head Conor Ryder

"The flow of stablecoins depends on the quality of infrastructure—low costs, fast transactions, and market demand. In Solana, meme coin trading has a high demand for liquidity and instant settlement, making stablecoins an indispensable part."

——Herd Founder and Data Analyst Andrew Hong

"TRON has become the preferred blockchain for stablecoin trading, with daily trading volumes reaching billions of dollars. USDT on TRON has driven real economic activity, especially in emerging markets, where it has become a key tool for payments and savings."

——TRON DAO Community Spokesperson Sam Elfarra

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。