Is there still a season for altcoins in cryptocurrency?

Yes, I believe that altcoins will inevitably emerge. However, the timing of their emergence should be directly related to liquidity.

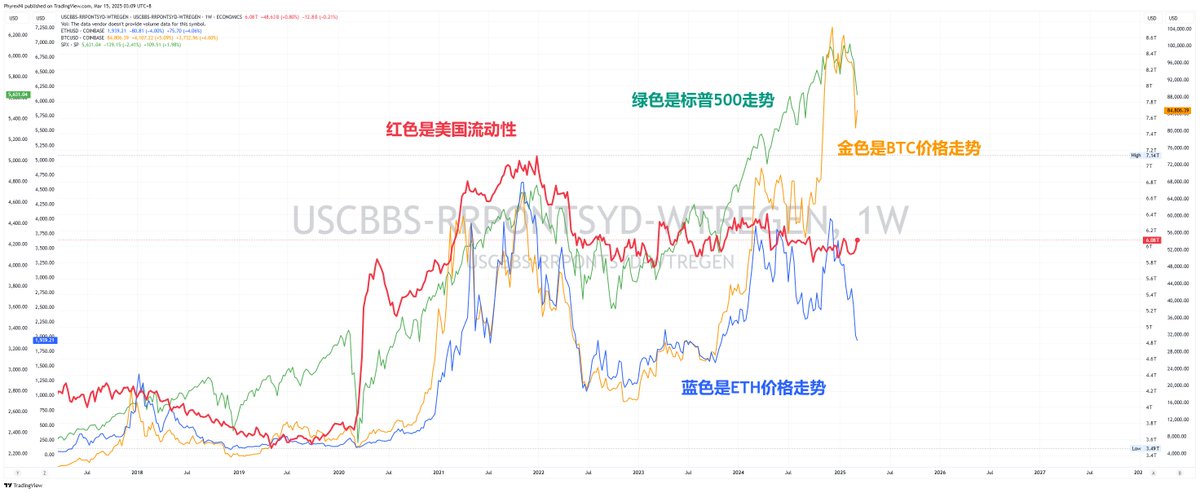

The emergence of altcoin seasons is often accompanied by an increase in liquidity. From the chart, it can be seen that if ETH is considered the largest altcoin, its correlation with U.S. liquidity is very high. When liquidity rises, it first transmits to large-scale assets, such as the S&P 500, then to medium-sized assets, like $Bitcoin, and finally to altcoin assets, such as $ETH.

Thus, we can also see that during times of liquidity shortage, large-scale assets are affected the least, while medium and small-scale assets are impacted more significantly. This means that ETH, being the second-largest cryptocurrency after BTC, shows data that can still be closely aligned. If we switch to other altcoins, the changes influenced by liquidity would be even more pronounced.

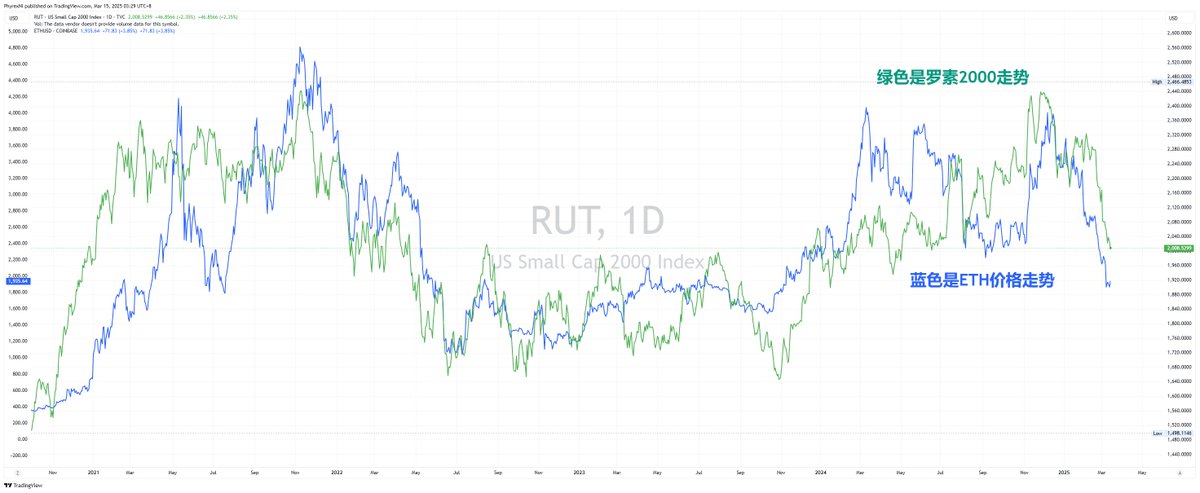

In other words, during liquidity peaks, the rise will be more vigorous, while during liquidity troughs, the decline will be very harsh. Therefore, in the current situation where liquidity has not significantly increased, the possibility of an altcoin season appearing is indeed lower. Altcoins are somewhat like the Russell 2000 in the U.S. stock market.

From the chart, it can be seen that the Russell 2000 is severely affected by liquidity. Even if there is a short-term breakthrough in the trend of rising liquidity, it can easily experience a significant drop. This is quite different from major assets that have "external forces," such as the AI industry in U.S. stocks, which has attracted a large amount of capital due to being in the spotlight. Naturally, during times of poor liquidity, it will "siphon" from small-cap stocks.

The same principle applies to cryptocurrencies, except that BTC has seen an increase in liquidity due to the emergence of spot ETFs, stimulating both on-exchange and off-exchange buying of BTC. However, since overall liquidity has not improved, it essentially means that it is siphoning from other assets.

From the comparison chart, the trends on both sides are very similar, both influenced by U.S. liquidity. Especially when liquidity is insufficient, while the rise may seem manageable, once a decline occurs, non-quality assets are the first to be liquidated and the last to be bottomed out. This indicates that the S&P 500 and BTC often experience the least decline and the fastest rise during market fluctuations.

Ultimately, it is indeed true that an altcoin season will occur, but it will inevitably be accompanied by a rebound in liquidity. The rebound in liquidity, from the current perspective, requires monetary policy to continue moving towards easing to enhance investors' risk appetite. Additionally, there needs to be direct liquidity stimulation to increase funds in the market, such as halting balance sheet reduction, canceling SLR, or implementing QE.

Therefore, without the injection of liquidity, the situation for altcoins will at most be characterized by short-term surges and drops, making it difficult to sustain for a longer period and form an altcoin season.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。