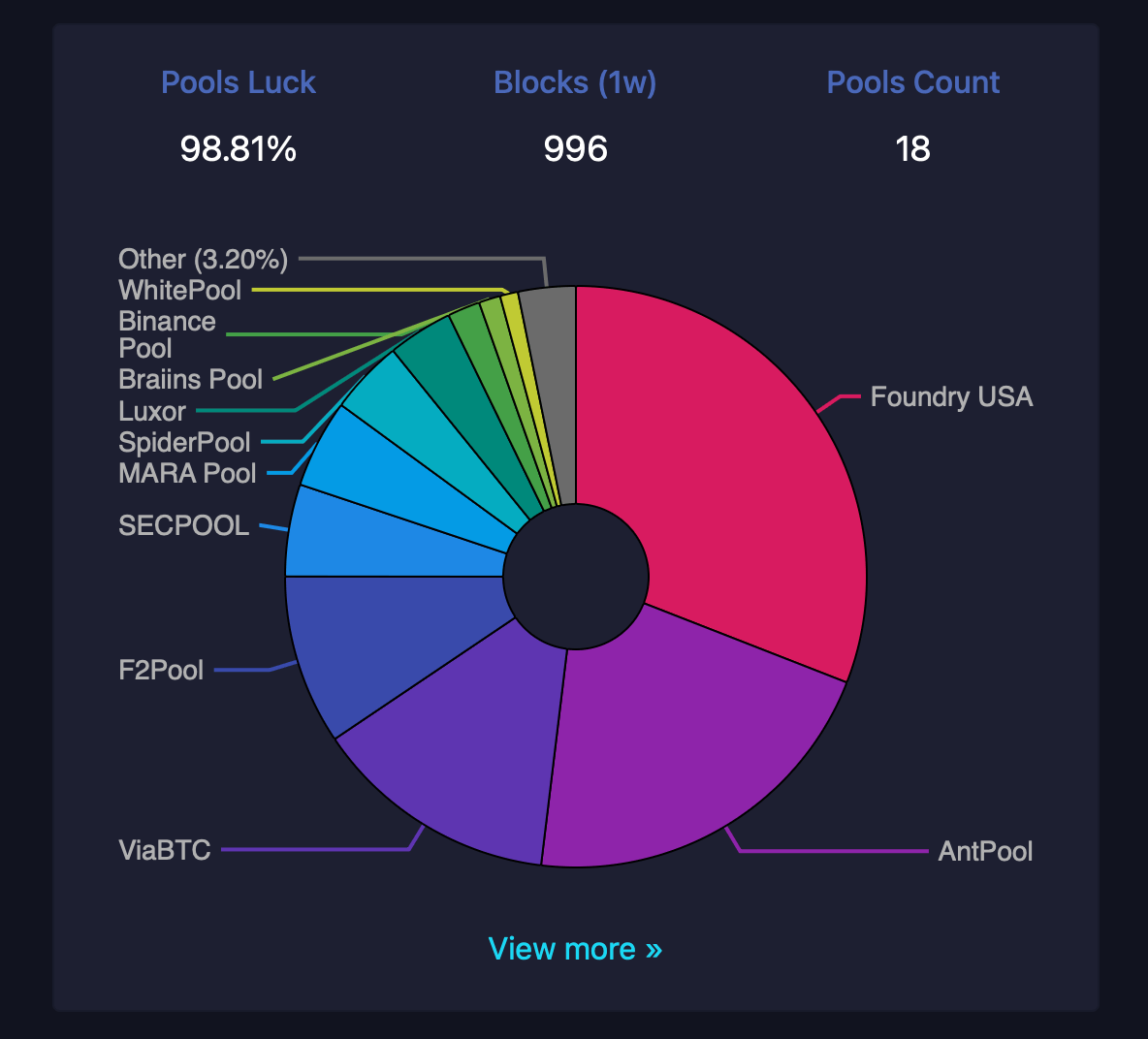

Collaborative mining pools aggregate computational resources from individual miners to enhance block discovery odds, distributing rewards based on contributed hashpower. As of March 20, 2025, Bitcoin’s total network hash rate measures 809.65 EH/s. Leading this sector are Foundry USA (246 EH/s), Antpool (173 EH/s), and Viabtc (111 EH/s), together representing roughly 65.5% of global hashpower, according to mempool.space stats.

Their expansive infrastructure attracts miners prioritizing steady returns, perpetuating a significant feedback loop where dominant pools expand while smaller competitors face mounting pressure.

Foundry USA

Foundry USA currently holds the top position, steering nearly 30% of Bitcoin’s total hashrate. The pool’s appeal reportedly stems from stringent security protocols—such as KYC/AML adherence, address whitelisting, and SOC 2 certifications—coupled with a zero-fee Full Pay Per Share (FPPS) payout structure, ensuring consistent revenue streams for institutional participants. Its “Donate” initiative further distinguishes it, enabling miners to allocate a portion of earnings to Bitcoin development, with the goal of fostering goodwill within the ecosystem.

Foundry’s U.S.-based operations claim to offer regulatory predictability, a key draw for miners wary of geopolitical volatility. Presumably, the publicly-listed miners Bitfarms, Hut 8, and Cipher Mining mine with Foundry’s dedicated pool. Out of the last 998 blocks, Foundry discovered 310.

Antpool

Antpool, ranking second with 173 EH/s, leverages its affiliation with Bitmain Technologies (established in 2013) to deliver reliability and trust. The pool employs a Pay Per Last N Shares (PPLNS) model with no fees, optimizing miner profitability. Its merged mining functionality allows simultaneous participation in multiple blockchains, broadening income potential without added costs.

Antpool’s geographically dispersed node network—spanning the U.S., Germany, and China—minimizes downtime, while low payout thresholds and a strong reputation cement its popularity. It has been said that Bitfufu and Bitdeer dedicate hashrate toward Antpool’s collective computational power. Over the last 998 Bitcoin blocks, Antpool’s hashrate has managed to obtain 209 blocks.

Viabtc

Viabtc, third with 111 EH/s, prioritizes earnings via its proprietary PPS+ payout system, engineered to boost miner returns. The platform enhances appeal through integrated financial tools, such as crypto-backed loans and hedging strategies, alongside real-time Telegram notifications for hashrate shifts. Viabtc’s adaptable payout options make it a compelling choice for miners. The pool provides PPS+, PPLNS, and SOLO payment methods, catering to different mining preferences.

Notably, PPS+ is Viabtc’s exclusive system, designed to maximize profitability—an advantage highlighted by an Ultramining Review. Supporting merged mining for litecoin ( LTC) and bitcoin cash ( BCH), Viabtc is said to offer several diversification opportunities. Reportedly miners flock to this specific pool for its intuitive interface, mobile app, and global user base. Out of 998 blocks mined, Viabtc’s pool managed to capture 136 of them.

Miners increasingly favor large pools like Foundry, Antpool, and Viabtc for their reliability and steady reward distribution. These entities mitigate operational risks through advanced infrastructure, dedicated support, and cost-efficient fee structures—advantages smaller pools struggle to replicate.

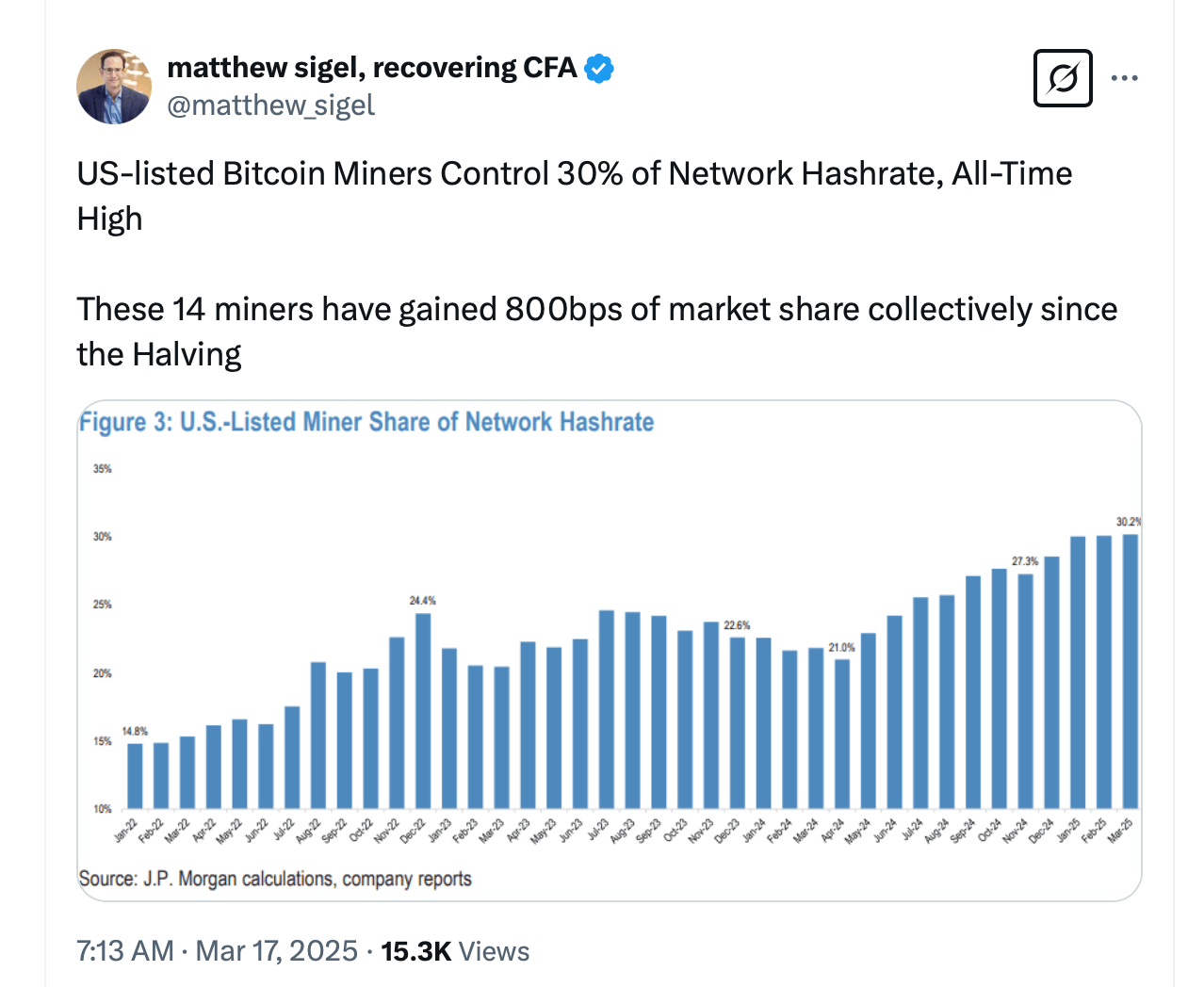

The resulting centralization, however, sparks debates about Bitcoin’s foundational ethos, as concentrated hashpower could theoretically expose the network to coordinated vulnerabilities. These debates have resurfaced on many occasions but nothing has truly curbed the centralization to this day. As of March 2025, the trio’s 65% hashrate share reflects a continued trajectory toward heightened centralization, unless things change.

While miners benefit from stability and efficiency, this consolidation challenges Bitcoin’s decentralized ideals. For instance, in the future people speculate that specific entities and transfers could be blocked if centralization continues unabated. Economic pragmatism continues to drive this trend, suggesting centralization may intensify absent shifts in miner priorities or technological breakthroughs. The ongoing tension between operational practicality and philosophical principles remains a defining dynamic for Bitcoin’s evolution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。