February 21, 2025 Cryptocurrency Market Dynamic Analysis and Trading Reference

BTC On-Chain Dynamics

Binance trading volume surges: During the plummet of the Turkish Lira, BTC/TRY trading volume reached 93 BTC in one hour, reflecting panic buying in the local market. U.S. policy expectations: If the bill passes, government purchasing behavior may trigger large on-chain transfers and a wave of withdrawals from exchanges, necessitating monitoring of wallet address changes.

ETH On-Chain Activity

Application scenario expansion: The tokenization of real estate in Dubai may enhance ETH's usage in on-chain physical assets, but current on-chain data has not shown significant changes. EU payment demand: 70% of cryptocurrency payments in the EU are for retail and food and beverage, and ETH, as one of the payment networks, may benefit from the growth in practical applications.

In the long-term trend for BTC, this round has maintained above $80,000. In the short term, unless something unexpected occurs, there will not be a significant drop, and it can be said that the downward pressure is relatively limited. As previously discussed, the current cost price for BTC miners is around $80,000. To maintain normal operations and prevent the entire crypto market from collapsing, BTC's price will not be much lower than $80,000. The strategies for spot BTC and ETH that I shared earlier are still valid; just follow the approach to enter the market.

For intraday contracts

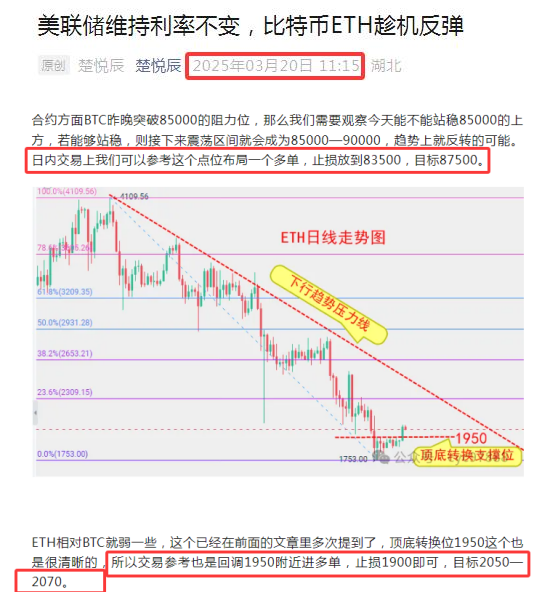

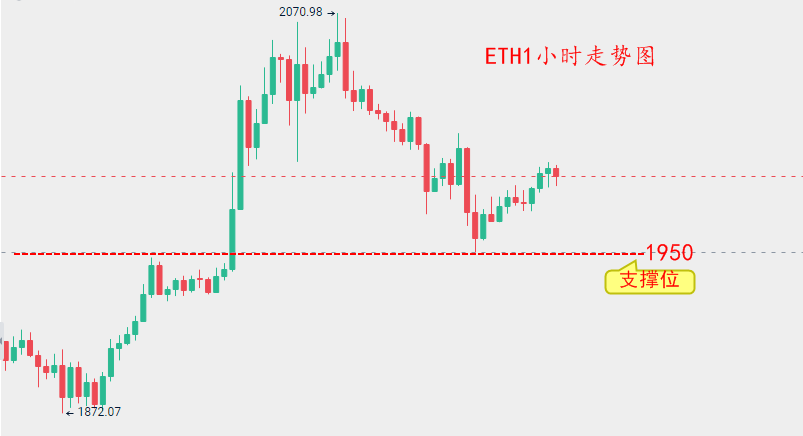

On the BTC hourly chart, short-term price support is around 83,500. I suggested entering a long position when the price retraced to around 85,000 yesterday morning. In the evening, when the price rebounded to around 86,500, I also indicated that a profit of over 1,000 points could be taken at 86,200. For ETH, we provided a short position at 2,070 in the article two days ago and a long position at 1,950 yesterday. You can check these two points on the hourly chart; yesterday's market reached both levels, which were very standard. Therefore, whether you were shorting or going long yesterday, as long as you followed these two points, you would have made a profit.

Today's contract trading strategy remains to treat it as a range-bound market. Recent fluctuations have not been large, so do not look too far in your operations; take profits when short-term targets are reached. For BTC, consider entering a long position around 83,500, with a stop loss at 82,000 and a target of 86,500.

For ETH, continue to set a long position at 1,950, with a stop loss at 1,900 and a target of 2,070.

Market conditions change in real-time, and there may be delays in article publication. The strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are your own responsibility. For daily real-time market analysis, there is also an experience exchange group and a practical discussion group. Feel free to get real-time guidance. Live broadcasts explaining real-time market conditions will be held at irregular times in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。