Market Overview

Overall Market Situation

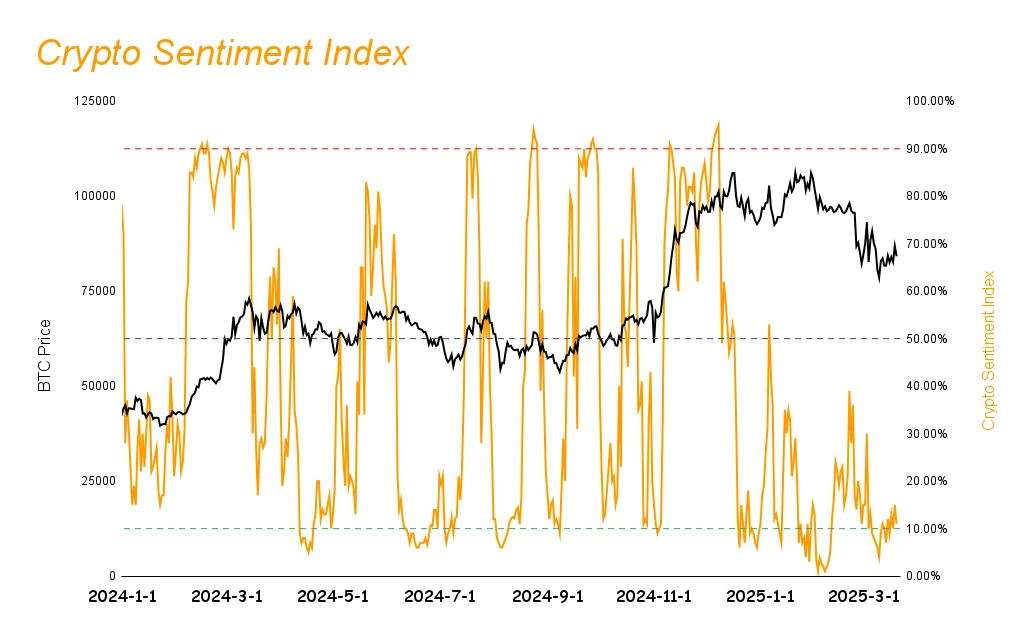

This week, the cryptocurrency market is in a trend of fluctuating upward, with the market sentiment index rising from 8% to 11%. The market capitalization of stablecoins has continued to grow (USDT reached $143.7 billion, USDC reached $59.2 billion, with increases of 0.18% and 1.39% respectively), indicating that institutional funds are still entering the market during the downturn, maintaining a growth trend for nearly three weeks, primarily driven by the increase in US funds (USDC). After experiencing a decline over the past few weeks, American investors have continued to enter the market at a high speed following last week; the market rebounded mid-week mainly due to the limited 30-day ceasefire agreement reached in the Russia-Ukraine war, as well as the Federal Reserve maintaining the current interest rate as expected and reducing the scale of QT from $25 billion/month to $5 billion/month, stating that the U.S. economy is not in recession, which has alleviated market sentiment to some extent, leading to a generally strong performance of Altcoins against the benchmark index.

Next Week's Predictions

Bullish Targets: UNI, BNB, EUL

UNI: $165.5 million ecological grant and the reshaping of DeFi leadership

Strategic Funding Empowerment

The Uniswap community has provided ample funding support for Uniswap v4 and Unichain through a historic $165.5 million grant, with $45 million specifically allocated for liquidity incentives and $95.4 million for developer ecosystem construction. This decisive investment will significantly enhance the protocol's competitiveness and create a solid foundation for token value.

Token Economic Model Innovation

The potential implementation of a "fee switch" mechanism will fundamentally change the UNI token economic model, allowing token holders to directly share in protocol revenue. Meanwhile, Unichain has committed to distributing 65% of on-chain net income to validators and stakers, enhancing this revenue attribute to attract more long-term investors. Notably, Uniswap's annual revenue has already exceeded $90 million, and if 65% of that is allocated, it could provide $58.5 million in profits to validators and stakers.

Technological Innovation and Ecological Expansion

Uniswap v4 has significantly lowered the development threshold through its innovative "hook" system, attracting over 1,000 developers to create more than 150 prototypes. The Unichain, optimized for DeFi, will provide efficient infrastructure for the ecosystem, solidifying Uniswap's core position in the DeFi space.

Governance Structure Optimization

Uniswap is actively promoting governance autonomy, planning to introduce a "core contributors" program and legal entities to reduce reliance on a single entity, while committing to enhance transparency and establish a representative council to oversee execution. This governance upgrade will bring a more sustainable development model and stronger community cohesion to the protocol.

BNB: The Rise of the BNB Chain Ecosystem and Value Reconstruction

On-chain Data Continues to Grow

The TVL of the BSC chain increased by 12.95% within a week, reaching $5.448 billion, demonstrating substantial traffic growth and value accumulation brought by the Meme wave for the BNB Chain.

Successful Marketing Strategy

Binance has accurately seized investment opportunities from UAE sovereign funds, creating a Middle Eastern cultural Meme narrative. The executive team has personally engaged in community interactions, building a "official meme - community engagement - token monetization" model, transforming personal influence into market momentum.

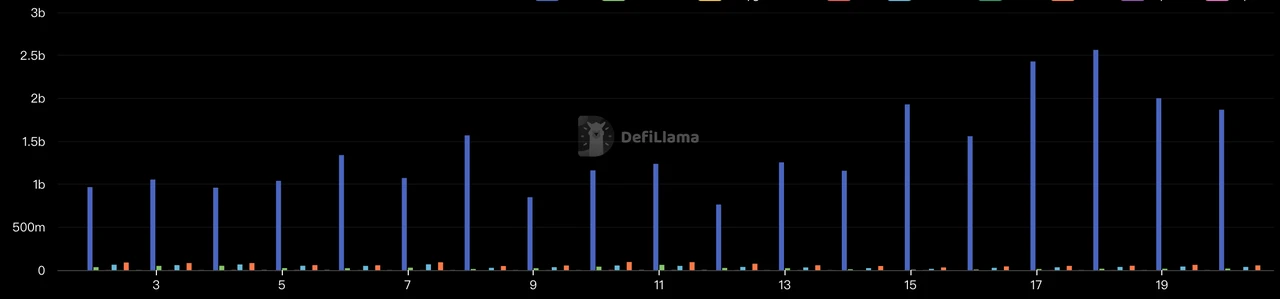

Pancakeswap Trading Volume

Recently, Pancakeswap's trading volume has significantly increased, peaking at $3.15 billion in daily trading. As the largest DEX on the BNB Chain, it reflects the ecological situation on the BNB Chain.

Technological Policy Innovation

The introduction of zero-fee trading, "anti-slippage compensation" mechanisms, and Alpha sections are among the technological innovations that simplify the BEP20 token issuance process, constructing a "exchange + public chain" dual-driven model to create a low-threshold, high-liquidity Meme ecosystem for the BNB Chain.

Strategic Transformation Path

Binance is achieving a strategic transformation from an exchange token to a value-capturing tool for Web3 infrastructure, learning from Solana's experiences, and guiding Meme users to DeFi projects through high APY strategies to retain user value.

Regulatory Environment Improvement

With the SEC dropping its appeal against Ripple, the likelihood of Binance reaching a final settlement with the SEC has increased, and the reduction of regulatory risks provides a clearer development outlook for BNB.

Pancakeswap Daily Trading Volume

EUL: TVL Hits All-Time High, Cross-Chain Expansion and 54% High Yield Drive New DeFi Growth

Rapid TVL Growth

Euler's TVL increased by 30.56% this week, reaching $501 million, setting a new all-time high, mainly benefiting from ecological expansion, improved capital utilization, and optimized yield strategies.

Providing High-Yield Products

Euler offers users high-yield lending pools, with the stablecoin pool sUSDC/USDC providing a maximum net asset yield of 54.77%, and the depth continues to increase, exceeding $31 million, making it very attractive for users holding stablecoins.

Strategic Ecological Expansion and Cooperation

Euler is actively collaborating with other ecosystems. This week, Euler announced a partnership with Berachain and launched a reward of $150,000 in BERA tokens. On the second day of entering the Berachain ecosystem, it added $25 million in TVL.

Providing User Incentive Mechanisms

Euler continues to launch incentive programs, including the latest $300,000 incentive measure, encouraging users to provide WETH or USDC to earn rEUL. The incentive mechanism can effectively attract new users, retain existing users, and enhance platform liquidity, forming a virtuous cycle of ecosystem growth.

Bearish Targets: ALT, NFP, EDU

ALT: Altlayer Faces Cooling Market and Large Unlocking

Market Heat Cooling

As a RaaS project positioned in the modular and Layer 2 track, Altlayer is facing severe challenges in the market environment. The overall performance of the Ethereum ecosystem has not met expectations during this bull market, especially as Layer 2 projects are viewed negatively by the market as "bloodsucking Ethereum." This shift in market sentiment has led to a significant loss of investor attention and capital inflow in the modular and Layer 2 tracks, causing related projects, including Altlayer, to lose heat and fall into obscurity.

ALT Token Unlocking Pressure

Altlayer will unlock 195 million ALT tokens on March 25, accounting for 1.95% of the total locked amount. This unlocking is substantial, and the recipients are mainly early investment institutions and project team members. Against the backdrop of declining project heat, these investment institutions are likely to choose to sell tokens to recoup funds, which will exert significant selling pressure on the ALT token price.

NFP: NFPrompt Faces Declining Market Heat and Large Unlocking Next Week

NFT and AI Tracks Both Losing Favor

NFPrompt, an art creation trading platform that integrates artificial intelligence and NFTs, is facing severe market environment challenges. Since the last bull market ended, the NFT track has remained sluggish, and in this market cycle, it has been replaced by the Meme coin craze. Meanwhile, the recent overall market decline has led to a rapid cooling of the AI track, with most AI-related projects experiencing declines of over 50%. This dual cooling of the NFT and AI tracks has significantly reduced NFPrompt's heat in the current market, making it difficult to attract investor attention.

Large Token Unlocking May Intensify Selling Risks

NFPrompt will unlock 14.51 million NFP tokens on March 26, accounting for 1.45% of the total locked amount. Considering that NFP currently has only a 41% circulation rate, this unlocking is relatively large, and the recipients are mainly project team members. Given the significant decline in project heat, the project team is likely to choose to sell tokens to realize project profits, which will exert significant selling pressure on the NFP token price, further exacerbating the project's market predicament.

EDU: Stratis Market Heat is Low, Token Unlocking May Trigger Selling Pressure

Open Campus is a decentralized education solution that has not received market attention since its launch. Its token EDU will have 19.07 million tokens unlocked on March 28, accounting for 1.91% of the total locked amount. This unlocking is substantial, and the project's current circulation rate is 47%. Additionally, since the main recipients of this unlocking are early investment institutions, in the absence of renewed market attention, they are likely to sell, which is expected to impact the EDU token price.

Market Sentiment Index Analysis

The market sentiment index has risen from 8% last week to 11%, with overall changes being minor, still fluctuating at an extreme fear level.

Hot Tracks

BNB Chain Reignites the Meme Craze

Current Situation

In the first quarter of 2025, the Meme ecosystem on the BNB Chain has shown explosive growth. Starting with a test token TST from a tutorial video, under CZ's "unofficial but tacit" attitude, its market value skyrocketed 100 times to $500 million within three days, marking the beginning of the "TST token experiment" explosion. Recently, after Binance secured a $2 billion investment from the UAE sovereign fund MGX, CZ's post included the term Mubarak, igniting a wave of Memes on the BNB Chain. Coupled with Binance's launch of zero-fee trading on Binance Wallet, the "anti-slippage full compensation + 24-hour guarantee" policy, and the addition of an Alpha section on the main Binance site to facilitate user purchases, the Meme wave on the BNB Chain has reached a climax, drawing nearly all attention and funds to the BNB Chain overnight.

Specific Analysis

Reasons for the BNB Chain Meme Craze

Before 2025, the BNB Chain was relatively lukewarm, underperforming Ethereum in the DeFi space and Solana in the Meme space. Therefore, for the BNB Chain to break through, it had to choose a direction for breakthrough, and given the current trend in the Crypto industry dominated by attention economics, the BNB Chain chose the Meme track for its breakthrough.

Marketing Reasons

Binance has successfully attracted attention and funds to the BNB Chain through a series of marketing strategies and wealth creation effects. Firstly, Binance seized the opportunity of the UAE sovereign fund MGX investing $2 billion in Binance, actively creating a Middle Eastern cultural narrative by transforming Arabic elements such as "mubarak" and "Mashallah" into Meme tokens. CZ even changed his profile picture to one wearing a Muslim robe, creating a new cultural symbol system and investment logic. Secondly, the Binance executive team actively participated in Meme hype, with CZ personally buying mubarak and TST tokens and announcing it on Twitter, while He Yi interacted with users in a humorous and self-deprecating manner, even joining Meme coin WeChat groups to discuss projects, giving users the feeling of Crypto celebrities purchasing the same tokens, successfully transforming personal influence into market momentum. Thirdly, Binance designed a model of "official meme - community engagement - token monetization," stimulating user participation through blank marketing and community co-creation activities, achieving broader dissemination effects. Finally, through self-deprecating humor, meme play, and deep interaction, Binance enhanced users' sense of equal participation and community belonging. These strategies have driven the formation of a Binance-centered community culture, providing sustained momentum for the Meme craze.

Technical Policy Reasons

After learning from Solana's successful experience, Binance launched a series of innovative technologies and policies to build a low-threshold, high-liquidity Meme token ecosystem for the BNB Chain. Firstly, it introduced a zero-fee strategy, sub-second block confirmation, and "anti-slippage compensation" mechanisms, significantly reducing user transaction costs and enhancing security, creating a user-friendly trading environment. Secondly, Binance has innovated through the Alpha section and direct purchase functions on the main site, bridging on-chain and off-chain funding channels, bringing direct liquidity to the chain. Thirdly, by simplifying the BEP20 token issuance process, providing detailed development tutorials, and establishing the "BNB Goodwill Alliance," Binance effectively lowered the development threshold, encouraging developers to respond quickly to market demands and achieve rapid token issuance. Finally, leveraging Binance's large user base and traffic advantages, it further constructed an ecological closed loop, attracting liquidity accumulation and fund inflow into the BNB ecosystem, achieving coordinated development between the exchange and public chain.

Advantages and Disadvantages of BNB Chain Compared to Solana

For BNB Chain to make a mark in the Meme space, its most direct competitor is Solana. As the initiator of the previous Meme wave, Solana is a mountain that all challengers in the Meme space cannot bypass, and both the market and users will compare BNB Chain with Solana.

Advantages

Firstly, BNB Chain relies on Binance, and its "exchange + public chain" mutual traffic model provides ample liquidity for BNB Chain, combined with mechanisms like the Alpha section to build an ecological closed loop. Secondly, the implemented zero-fee, rapid confirmation, and "anti-slippage compensation" features optimize the user trading experience and lower participation thresholds. Thirdly, Binance executives can enhance community cohesion and attract traffic through interactive methods. Finally, BNB Chain attracts more developers by simplifying the BEP20 token issuance process and supporting plans.

Disadvantages

Firstly, Solana's chain performance is superior, capable of processing 65,000 transactions per second, and has demonstrated its efficient transaction processing capabilities during events like TRUMP, making it difficult for BNB Chain to compete in terms of performance. Secondly, Solana has a more advanced programming model and richer development tools, with technological innovation significantly surpassing BNB Chain, which relies more on simplified technologies. Thirdly, as Solana is an American chain, it enjoys higher recognition in the U.S., where the main users in the Crypto industry are located. Finally, the Four.Meme incident shows that BNB Chain has security flaws, while Solana's Pump.fun has undergone more market tests without experiencing security crises, making it easier to gain trust from on-chain users.

Future Development Direction of BNB Chain

Solana represents the Meme wave, and its ecosystem has flourished under the influence of the Meme wave, but it failed to effectively convert Meme traffic, leading to significant impacts on its ecosystem when the Meme wave receded. Regardless of how large the Meme wave is, it will eventually recede. Therefore, BNB Chain's future development strategy should focus on using Meme as a traffic growth point, converting Meme traffic into value accumulation in AI + DeFi. This involves building user conversion, technology conversion, and capital conversion. After attracting new users through Meme, it is essential to effectively guide them into AI data platforms like Alaya and DeFi protocols like PancakeSwap, ensuring a higher retention of valuable users. Additionally, BNB Chain should extend the efficient trading infrastructure designed for Meme tokens to more complex financial scenarios, such as derivatives trading.

BNB Chain should create a complete value cycle ecosystem of "Meme traffic - supporting infrastructure - enhancing commercial applications," thereby achieving a strategic upgrade from an exchange-affiliated public chain to a globally leading Web3 infrastructure.

Overall Market Overview

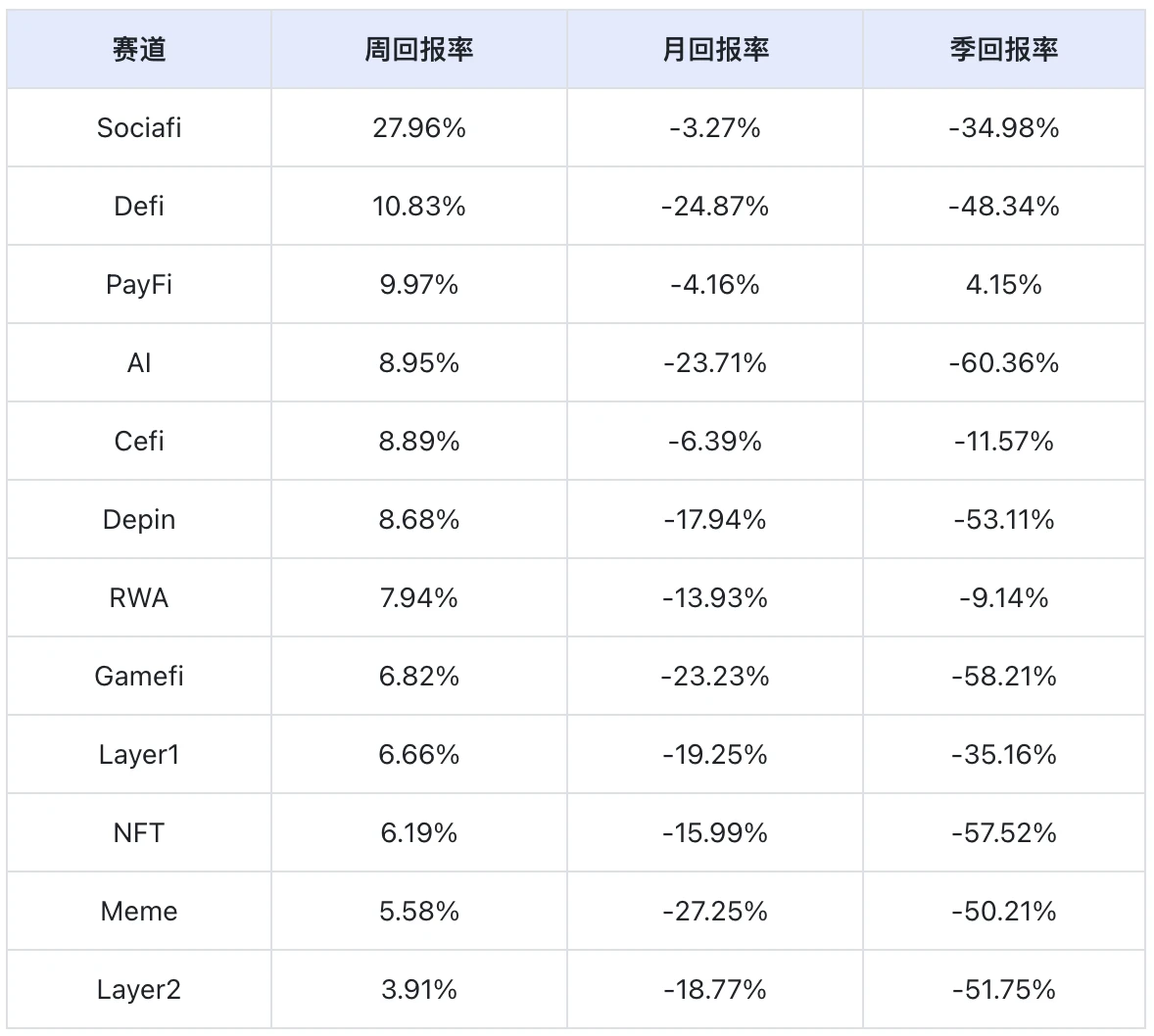

Data Source: SoSoValue

According to weekly return statistics, the Sociafi track performed the best, while the Layer2 track performed the worst.

Sociafi Track: In the Sociafi track, TON and CHZ account for a large proportion, totaling 95.31%, with weekly increases of 29.51% and 6.21% respectively. Among them, TON has the largest share and the highest increase, making the Sociafi track perform the best.

Layer2 Track: In the Layer2 track, MNT, POL, TIA, ARB, and OP account for a large proportion, totaling 72.04%, with weekly fluctuations of 7.12%, -1.67%, -6.36%, 6.98%, and 3.31% respectively, leading to the overall Layer2 track index performing the worst.

Next Week's Major Crypto Events

Monday (March 24) GMove Cooper: Movement’s APAC Tour 2025 - Chengdu Station

Tuesday (March 25) Mining Disrupt Conference & Expo 2025

Friday (March 28) U.S. February Core PCE Price Index Year-on-Year

Summary

In summary, the cryptocurrency market this week is generally in a trend of fluctuating upward, with the market sentiment index rising from 8% to 11%. Although it remains in the extreme fear zone, there are signs of easing. The continuous growth of stablecoin market capitalization, especially the 1.39% increase in USDC, indicates that American investors are continuously entering the market during the downturn, providing solid support for the market. The limited 30-day ceasefire agreement reached in the Russia-Ukraine conflict, along with the Federal Reserve maintaining interest rates and significantly reducing the scale of QT, have become the main catalysts for this week's market rebound, leading to most Altcoins outperforming the benchmark index.

From the performance of the tracks, SocialFi leads the market due to the strong performance of TON, with a weekly return rate of 27.96%. The DeFi track also performed well with a weekly return rate of 10.83%, reflecting a trend of value return. Meanwhile, the BNB Chain ecosystem became the biggest highlight of the week, successfully triggering a new round of Meme craze through precise marketing and innovative technical policies.

Next week, investors should be cautious of the potential selling pressure risks from projects like ALT, NFP, and EDU that face large unlockings, while also paying attention to potential opportunities from fundamentals improving in UNI, BNB, and EUL. As market sentiment gradually stabilizes and stablecoin funds continue to flow in, the market may welcome more positive factors, but caution is still necessary, closely monitoring changes in macroeconomic data and geopolitical situations to formulate more prudent investment strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。