Author: Weilin, PANews

On March 20, the American financial institution Canary Capital submitted an application for the Canary PENGU ETF to the U.S. Securities and Exchange Commission (SEC), planning to launch an ETF that simultaneously holds Pudgy Penguins NFTs and $PENGU tokens. According to the submitted plan, the ETF fund aims to hold 80-95% of $PENGU tokens and 5-15% of Pudgy Penguins NFTs. This news sparked widespread discussion within the Pudgy Penguins community and the broader crypto market, with even Canary's social media avatar being a Pudgy Penguins NFT.

Founded just six months ago, Canary Capital has intensively submitted multiple altcoin ETF applications. However, this approach has also raised many questions about the actual demand for these altcoin ETFs. Or is this more of a gimmick and marketing tactic?

PENGU ETF news drives price up then back down, will traditional investors enter the market?

After the announcement of the PENGU ETF, the price of $PENGU initially soared to $0.0075, an increase of nearly 10%, reflecting the market's short-term optimism about the news. However, as of 7:30 PM on March 21, its price had fallen back to $0.0062, an overall decline of 8.63% over 24 hours, indicating that the market's enthusiasm for the news could not be sustained long-term. Although there was a noticeable increase in capital inflow after the announcement, with a 24-hour trading volume reaching $135 million, the price trend failed to maintain strength.

The submission of the PENGU ETF has sparked some controversial voices within the Pudgy Penguins community. For example, community user @beast_ico stated that the $PENGU ETF might be the most ridiculous thing he has seen recently. "We don't even need an ETF for 'ghost chains', let alone a memecoin that's not even six months old. If those 'Boomers' (traditional investors) aren't even interested in ETH (let alone SOL), why would they touch something called PENGU?"

However, digital artist @Tuteth_ expressed, "We're really going to be doomed, guys. I see all this hype about the $PENGU and Pudgy Penguin ETF, and it's just garbage opinions. Some of them are even my friends. But you don't even realize that you're fostering 'tall poppy syndrome' (jealousy of successful people, suppressing leaders). Bitcoin was also mocked as the dumbest thing in the world back in the day. The reason we stay in this circle is to enjoy these seemingly absurd possibilities that ultimately come true because we've witnessed them happen. We've come this far, and now we see this ETF and say, 'Hey, this crosses the line'? Think about it, your avatar is an animal, and you chat about cryptocurrency with friends online every day. This is all absurd to the extreme—yet you choose to draw the line here, it's hilarious."

It is evident that there are differing attitudes within the Pudgy Penguins community regarding this ETF application, with opponents viewing it as absurd hype and supporters seeing it as a necessary step in the evolution of NFT culture.

Low threshold for S-1 filing? Canary Capital continuously applies for altcoin ETFs

PANews previously introduced Canary Capital, a crypto investment company, in October 2024, when it had only been established for a month. The founder and CEO of Canary Capital is Steven McClurg, who is also a co-founder of Valkyrie Funds. Notably, Sun Yuchen is also an investor in Valkyrie, which was approved in October 2021 to launch the first Bitcoin futures ETF in the U.S. Steven McClurg left Valkyrie Funds in August 2024 and established the crypto investment company Canary Capital in September. On October 1, Canary Capital announced the launch of the first HBAR trust in the U.S. Subsequently, Canary has applied for SUI ETF, an ETF tracking Axelar (AXL) prices, Litecoin (LTC) ETF, AXL Trust, Solana ETF, and XRP ETF.

Some analysts point out that the low cost of submitting S-1 documents may be one reason for the recent surge in altcoin ETF applications. According to analyst Chen Jian (Jason) in his interpretation on March 7, "S-1 is the first step in registering an ETF, and what are the hard thresholds for submitting an ETF's S-1? There are two hard thresholds: first, it needs to be a U.S.-registered company that includes asset management and financial services; second, it requires about $100,000 to cover the costs of drafting the S-1 document."

Previously, on March 6, it was reported that Canary Capital had applied to the SEC to launch an ETF tracking the cross-chain protocol Axelar. At that time, Chen Jian pointed out, "After Canary submitted the S-1 for the AXL ETF, AXL also saw a price increase. I know about the AXL project; I've written two long articles about it, and its fundamentals are decent, but it completely fails to meet the qualifications for an ETF, it's far from it. And the company submitting the materials, Canary, was only established in September 2024, not even six months ago. So, a small company that has been established for half a year submits a coin that clearly does not meet ETF requirements, and major media outlets rush to report it. Can you believe there's nothing fishy about this?"

Crypto KOL @qinbafrank recently expressed a similar view to Chen Jian: "Aside from the three largest mutual fund companies—BlackRock, Franklin Templeton, and Fidelity—along with Bitwise, Grayscale, Ark, and other early approved BTC ETF fund companies, if we see some unknown fund companies announcing that they have submitted inexplicable altcoin ETFs to the SEC, there is no doubt that these fund companies are likely receiving advertising fees, and the main players behind them may be looking to take advantage of this to pump and dump."

Weak demand on the first day of SOL futures listing, small-cap coins may struggle to maintain high demand

Meanwhile, Solana futures began trading for the first time on March 17 at the Chicago Mercantile Exchange (CME) Group's U.S. derivatives exchange, which is considered a key step in applying for a SOL spot ETF and a test of market demand.

However, according to preliminary data from the CME website, on March 17, the first trading day of the contract, approximately 98,250 SOL (about $12 million) in nominal value of SOL futures changed hands on the exchange. This performance was poor compared to major cryptocurrencies like Bitcoin and Ethereum.

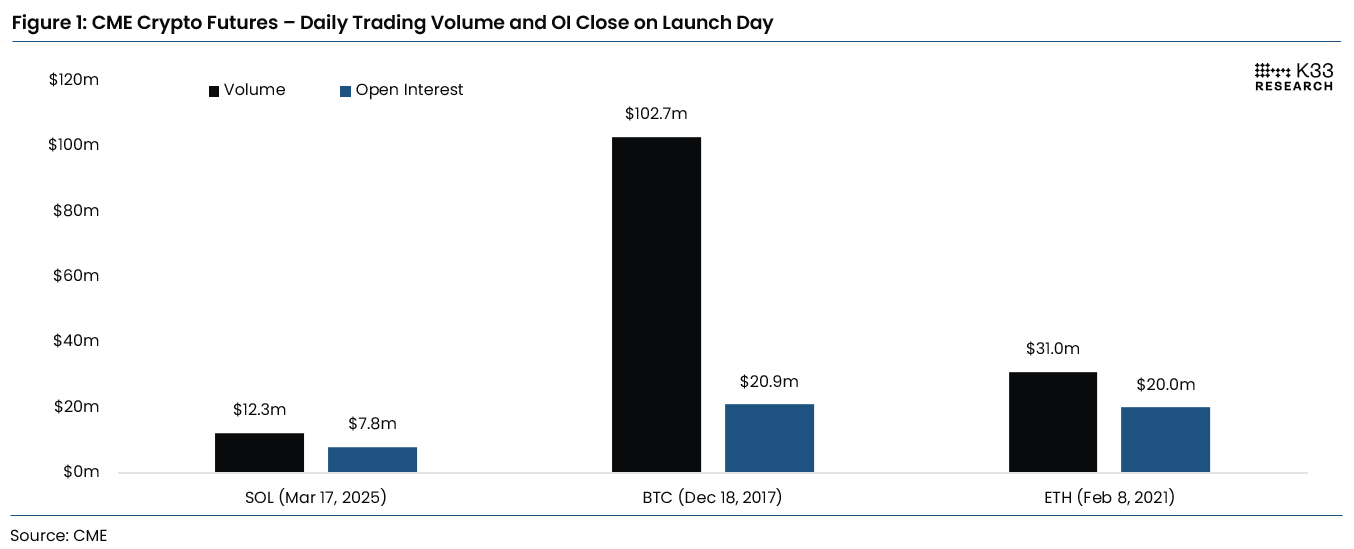

According to a report from research firm K33, the total trading volume for Solana futures on the first day was $12.3 million, with open interest at $7.8 million. This stands in stark contrast to Bitcoin futures, which attracted $102.7 million in trading volume and $20.9 million in open interest when they debuted at the Chicago Mercantile Exchange in December 2017. Ethereum also performed better, with its futures launching in February 2021, achieving a trading volume of $31 million and open interest of $20 million.

K33 analysts Vetle Lunde and David Zimmerman attributed the lackluster performance to broader market conditions, noting that Solana's launch occurred during a period of low risk appetite, without the benefits of a strong bull market or altcoin rebound. The K33 report stated, "Although Solana's performance seems more reasonable after market cap adjustment, its absolute numbers are far below previous futures listings."

Analysts added that despite the weak start, the listing does align with the typical pattern associated with the eventual approval of spot ETFs. However, they warned that compared to the price surge triggered by the approval of Bitcoin spot ETFs in early 2024, Solana's lower trading activity suggests that any future ETF related to this token may have a more muted impact on prices.

Overall, the discussion around the PENGU ETF reflects a collision between NFT, memecoin culture, and traditional finance, with community users holding diverse opinions. Whether Canary Capital's frequent applications for altcoin ETFs represent innovative attempts or mere marketing tactics remains to be seen, as the future of altcoin ETFs awaits answers from the crypto market, users, and regulatory bodies in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。