Author: Stacy Muur, Crypto Researcher

Translation: DeepSeek

Editor's Note: The article summarizes that within 30 days, 89 projects across 9 blockchains achieved over 2 million gasless transactions through ERC-4337 smart wallets, saving approximately $117,000 in gas fees, demonstrating the significant potential of the Paymaster payment model to enhance on-chain activity. However, the surge in transaction volume may obscure genuine user demand, as one-time activities like NFT minting and airdrops lead to a short-term increase in wallet numbers but low retention rates, while a few games, DeFi, and infrastructure applications show deeper levels of reuse. Data indicates that while gas sponsorship can attract users, sustained engagement relies on appealing applications. ERC-4337 has promoted the popularity of gasless transactions but faces challenges of technical complexity and costs, with future EIP-7702 expected to further simplify and accelerate its adoption.

The following is the original content (reorganized for readability):

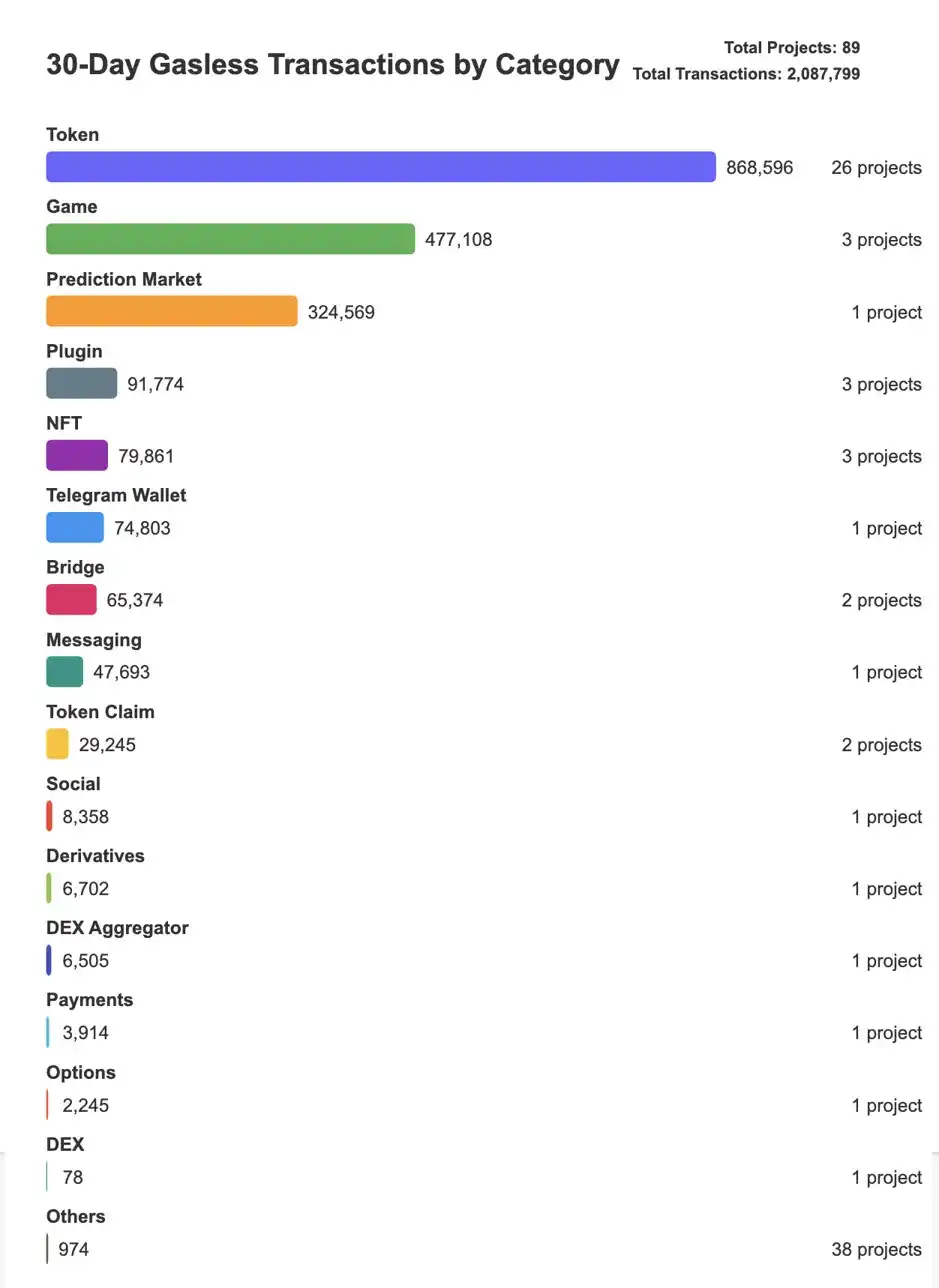

In just 30 days, 89 projects across 9 blockchains supported over 2 million gasless transactions, saving up to $117,000 in gas fees.

The wave of gasless transactions across multiple chains indicates that solutions like the Paymaster fee payment in ERC-4337 smart wallets can rapidly enhance on-chain activity.

Paymaster-driven usage may obscure genuine user demand

The surge in transaction volume does not necessarily reflect true user interest, especially when a small number of wallets (such as traders and bots) repeatedly call contracts.

One-time airdrops, free minting, or claiming activities may lead to a short-term spike in wallet numbers, but subsequent usage rates are extremely low.

The number of new wallets for NFT, gaming, and token projects has surged, but many wallets are only used for one-time operations (like minting or claiming rewards) rather than ongoing participation.

On the other hand, a small number of applications demonstrate deeper, repeated usage, often driven by more engaging game loops, repetitive DeFi operations, or infrastructure-level services.

These findings suggest that ERC-4337 smart wallets are reshaping on-chain activity, showcasing both the power of gas sponsorship to attract users and the need for appealing, reusable applications to maintain user engagement.

@0xKofi has built an authoritative dashboard to track this explosive growth, with data provided by @base.

Key Metrics

- 89 independent applications/protocols

- Approximately 724,000 active smart wallets

- Approximately $117,000 in gas fees waived

- Approximately 2,087,799 gasless transactions

Development of ERC-4337

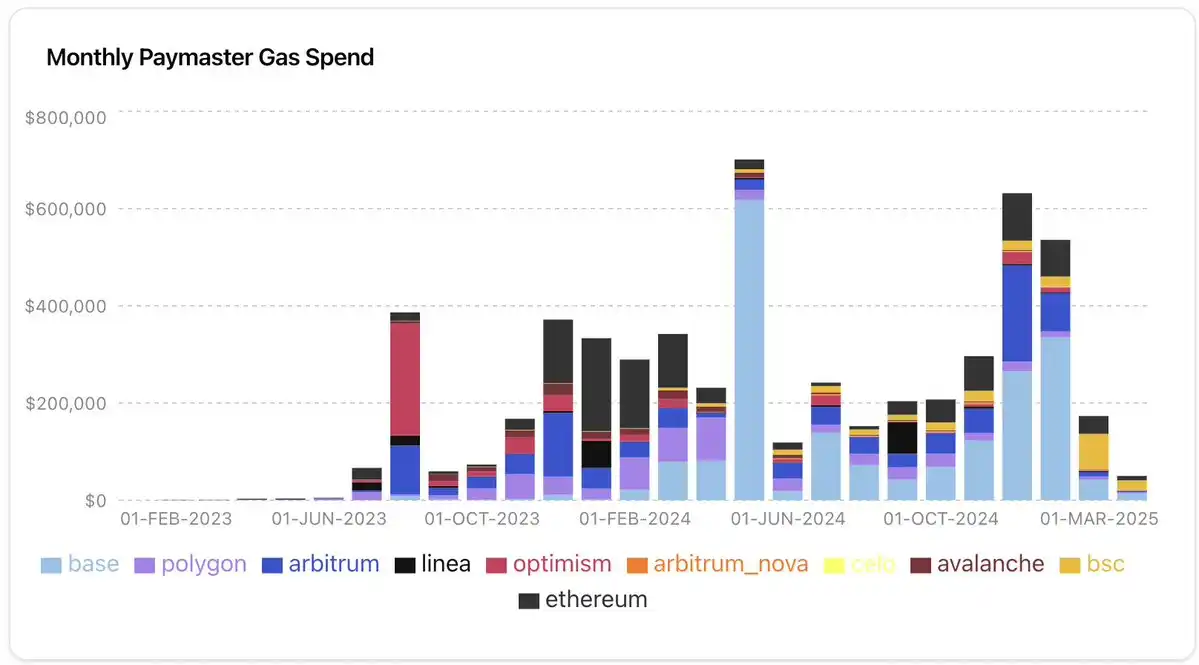

The rapid growth of gasless transactions is part of a larger trend. In 2024, ERC-4337 accounts executed over 103 million user operations (UserOps), more than 10 times that of 2023 (8.3 million). Of these, 87% of transactions were paid for by the Paymaster, achieving a gasless experience.

From the monthly Paymaster gas expenditure chart, we can see the following evolution:

- Early Adoption (2023): Very little expenditure before mid-2023, with Optimism leading early adoption.

- Growth Phase (End of 2023): By October 2023, monthly expenditure steadily grew to about $400,000.

- Peak Activity (April 2024): Expenditure surged to about $700,000, primarily driven by Base.

- Recent Trends (Late 2024 to Early 2025): After reaching a new high (about $630,000) in November to December 2024, monthly gas expenditure significantly dropped in early 2025, falling to about $150,000 in February.

Through Paymaster, applications and users spent over $3.4 million on UserOp fees, with major providers including @biconomy, @pimlicoHQ, @coinbase, and @Alchemy. Despite market contraction, overall expenditure showed a downward trend in Q1 2025, but @base ($391,117), @ethereum ($121,053), and @BNBCHAIN (approximately $112,493) remained dominant.

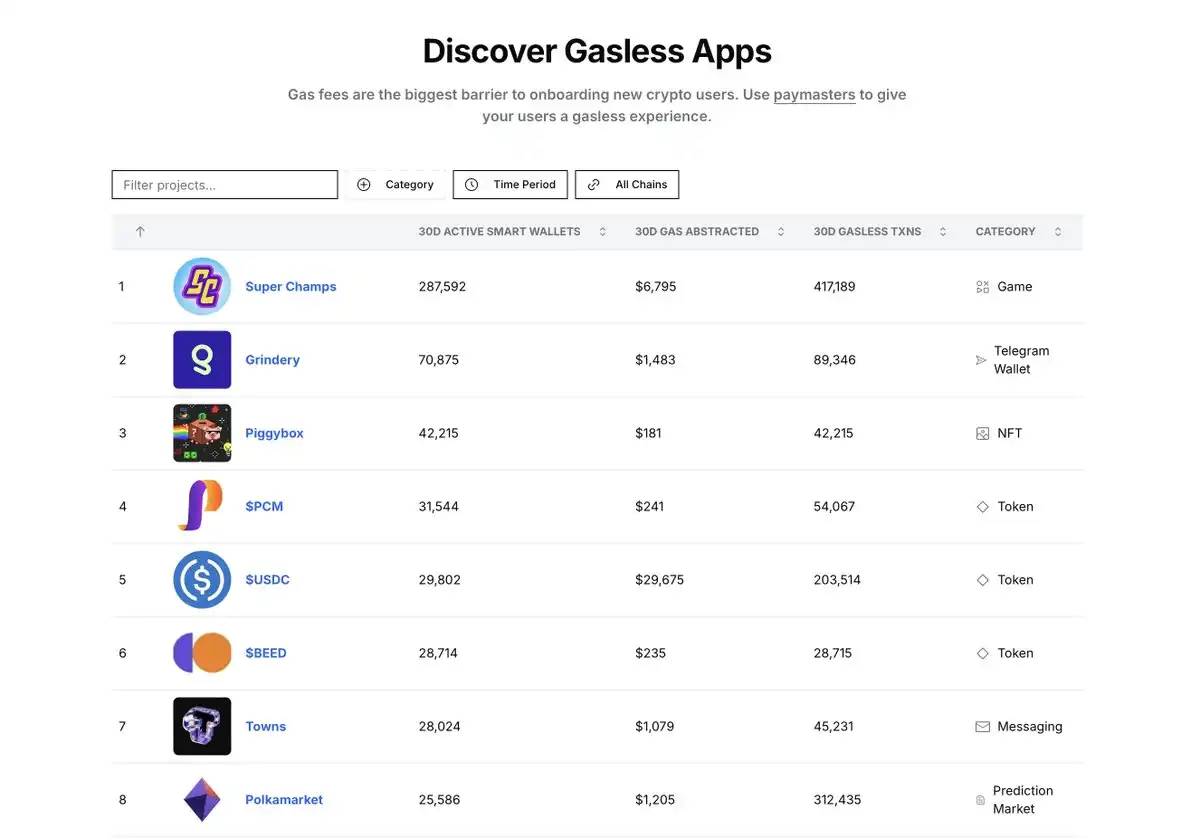

Ranking by On-chain Activity

- Base (43.2%): Entertainment and social hub—dominates the gaming sector (76.8%).

- Polygon (21.4%): Community engagement layer—NFTs (50.7%) and Telegram wallets (42.3%).

- Optimism (8.5%): Security-focused—emphasizes recovery infrastructure.

- Celo (7.4%): Niche experts—prediction markets.

- BSC (4.2%): Value transfer layer—token-focused, with the highest gas costs.

Data Analysis

Before delving into data analysis, it is crucial to understand two key metrics:

- Tx/Wallet (transactions per wallet)—measures the average number of transactions completed per wallet. A low value (e.g., ~1.0) indicates one-time use (e.g., minting NFTs or claiming airdrops). A high value (e.g., ~25) indicates repeated engagement (e.g., active trading, gaming, or bot operations).

- Cost/Tx (cost per transaction)—represents the average cost per transaction. In a gasless system, it reflects the waived fees per transaction rather than the fees paid by users.

1. NFT Projects: Many wallets often = one-time accounts

- Piggybox: → Approximately 1 tx/wallet, ~$0.004/transaction.

- Somon Badge: → Approximately 1.4 tx/wallet, ~$0.007/transaction.

Interpretation: A 1:1 ratio of wallets to transactions (Piggybox) strongly indicates minting or claiming activities. Piggybox is an NFT obtained when registering for EARN'M, along with a possible lottery box for earning EARNM tokens.

One-time surge: Many wallets only perform one transaction (initial minting/claiming) and do not return, resulting in a nearly perfect 1:1 ratio.

Ranking: Due to many new wallets minting, Piggybox ranks high overall. However, if one-time wallets are filtered out, it may drop from the top five, with very low retention rates.

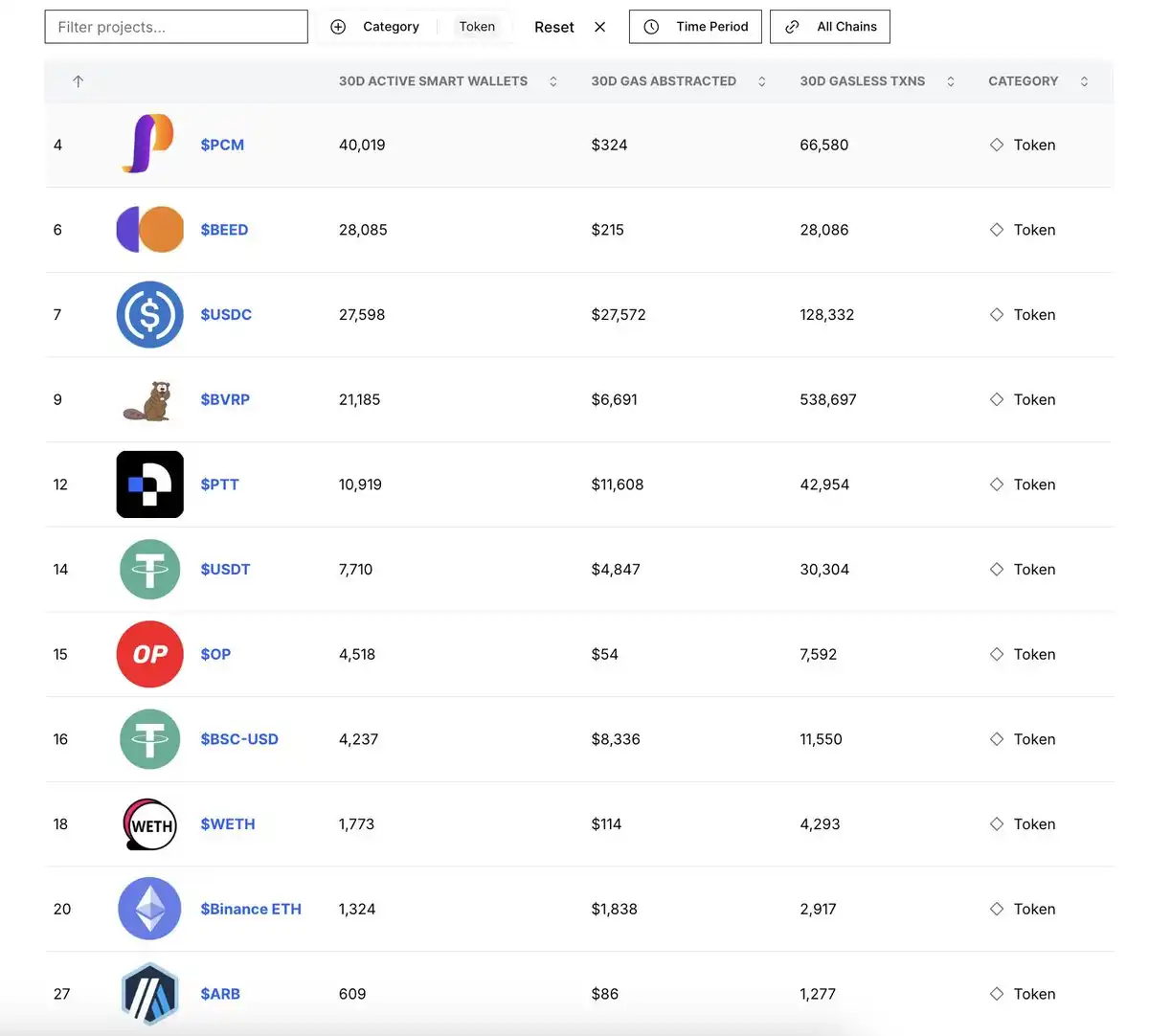

2. Tokens: Concentrated in a few projects

There are 26 token projects on the list, far exceeding other categories. Among them, 2 tokens, $BVRP and $USDC, accounted for over 667k transactions, dominating the transaction volume.

- $BVRP: → ~25 tx/wallet at $0.012/tx.

- $USDC: → ~4.6 tx/wallet at $0.21/tx.

Interpretation:

- This concentration indicates that not all "token" projects are equally active, but rather a few heavyweight projects drive the total volume.

- $BVRP shows high trading activity relative to the number of wallets, indicating high user engagement on these platforms with frequent automated or repeated trading.

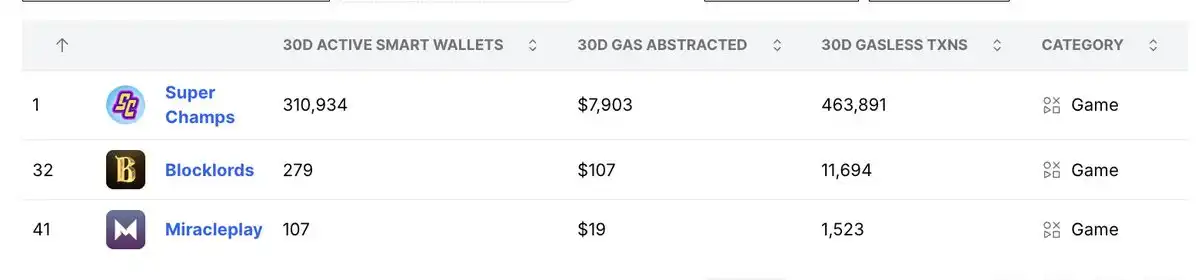

3. Gaming: A "hit," but attention needed on wallet/transaction ratio

- @SuperChampsHQ: → Approximately 1.49 tx/wallet, ~$0.017/transaction.

- @BLOCKLORDS: → Approximately 42 tx/wallet, ~$0.009/transaction.

- @miracleplay_cn: → Approximately 14 tx/wallet, ~$0.012/transaction.

Interpretation:

- Super Champs dominates total gaming usage (463k vs. ~13k total for other projects), but each wallet only performs about 1-2 transactions.

- Blocklords has fewer wallets but an extremely high transaction ratio per wallet (~42). This is often related to bot-driven repetitive operations, as Blocklords' David Johansson stated: "They are fighting against bots."

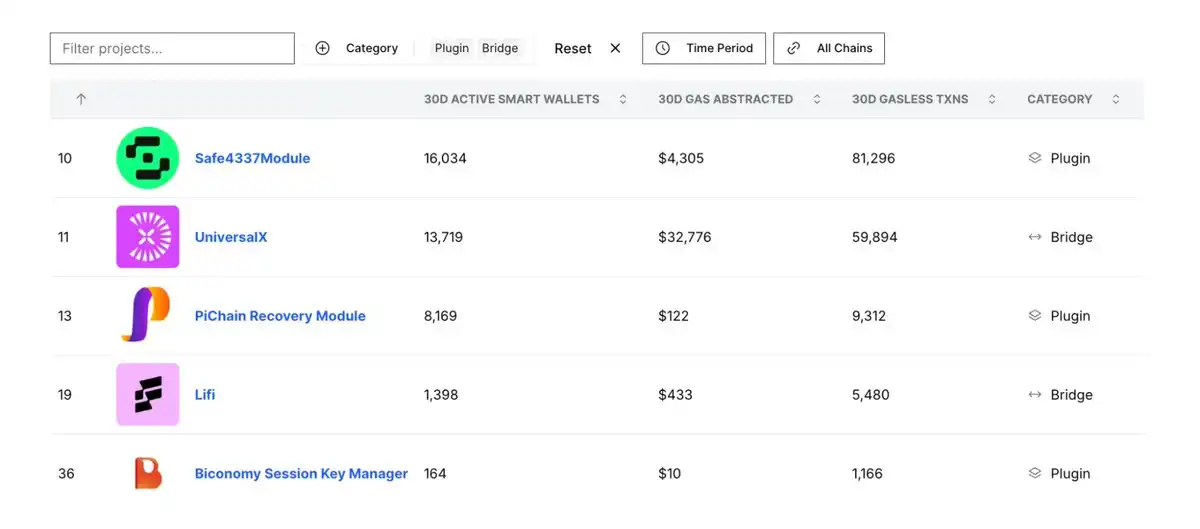

4. Bridging and Plugins: Moderate but stable usage, higher gas costs

- UniversalX: → Approximately 4.4 tx/wallet, ~$0.55/transaction.

- Safe4337Module: → Approximately 5.1 tx/wallet, ~$0.053/transaction.

Interpretation:

- Behind-the-scenes tools: Bridging and plugins do not have "headline" transaction volumes like tokens or games, but they maintain stable usage due to reliance from multiple dApps.

- Ecosystem health indicator: Moderate usage of infrastructure services indicates their real utility rather than a hype-driven surge.

5. Chain specialization is forming

- @base: 99.5% of gaming wallet activity (310,934 out of 312,361 wallets).

- @0xPolygon: Dominates NFT/social activity (87% of ecosystem NFT wallets).

- @BNBCHAIN: Leads in high-value bridging transactions (accounting for 23.2% of all gas-exempt transactions).

- @Celo: Performs strongly in prediction markets (25,574 wallets, 12.7 tx/wallet).

6. Cross-chain cost differences

The 100-fold cost differences between different chains drive the concentration of specific application categories on specific chains:

- Ethereum: $2.41 per gasless transaction (highest).

- BSC: $0.50 per gasless transaction.

- Base: $0.02 per gasless transaction (lowest among major chains).

- Polygon: $0.03 per gasless transaction. Argument: The 100-fold cost structure differences between chains will drive specific application categories to concentrate on specific chains, regardless of technical similarities. Gaming and social applications are economically unfeasible on high-cost chains.

Overall Situation

- NFT adoption may show tens of thousands of wallets performing a one-time minting (like Piggybox), but the reuse rate is extremely low.

- Infrastructure (bridging, plugins) maintains stable, moderate transaction volumes, usually with higher costs per transaction (bridging) or stable behind-the-scenes usage (plugins).

- The differences in transactions per wallet across all categories highlight different usage patterns: some are highly repetitive, while others are purely one-time operations.

- Finally, the participation of a large number of projects is close to zero, indicating that free gas alone is insufficient to generate demand; dApps need a genuine value proposition to retain users.

Summary

Account abstraction and gas sponsorship can indeed boost transaction volumes and user registrations, but the real test is repeated participation. Combining wallet numbers, waived gas fees, and gasless transaction volumes, the data highlights the phenomenon of concentrated usage within each category, often coming from just one or two star dApps or large-scale one-time claiming activities. Projects like Piggybox demonstrate how a near 1:1 ratio of wallets to transactions can push NFT projects to the top of the rankings, but may quickly fall once one-time accounts are filtered out. Meanwhile, bridging and plugin solutions show more stable moderate transaction volumes, reflecting the real demand of the ecosystem rather than fleeting hype.

The Role of ERC-4337 Smart Wallets

All these trends—gasless gaming, seamless DeFi, chain specialization—are driven by ERC-4337 smart wallets.

Unlike traditional EOAs (Externally Owned Accounts), smart wallets introduce automation, security, and flexibility, significantly enhancing the user experience.

What is an ERC-4337 Smart Wallet?

A smart contract wallet or smart wallet is a programmable Ethereum account that enhances the user experience through the following features:

Batch transactions—users can combine multiple operations (like approving + swapping on a DEX) into a single transaction.

Gas fee abstraction—users do not need to hold ETH to pay gas fees; fees can be paid by sponsors or in other tokens.

Security—users can authenticate via passwords, social recovery, or multi-factor authentication instead of using high-risk seed phrases.

How do gasless transactions work?

When a user initiates a transaction, the Paymaster (a special smart contract) can intervene to pay the gas fees or allow the user to pay with any held ERC-20 tokens. This significantly lowers the entry barrier for new users, making blockchain applications as seamless as Web2 applications.

However, ERC-4337 also faces significant adoption challenges, and the aforementioned retention issues may directly stem from several key limitations:

- Technical barriers: Complex components like UserOperations, Bundlers, and EntryPoint contracts present a steep learning curve for average users and developers.

- Cost issues: While gasless transactions are helpful for users, implementing a full stack can be costly, and the profitability of Bundlers is unstable during gas fluctuations.

- Reliability issues: Network congestion can lead to transaction delays, and complex validation logic introduces potential security vulnerabilities.

- User experience gaps: Multi-chain fragmentation leads to inconsistent wallet experiences, hindering seamless cross-chain management.

Summary

Account abstraction and gas sponsorship have successfully increased transaction volumes and new wallet registrations, but the real challenge is sustained participation. The data shows:

- Many dApps experience one-time usage spikes (like NFT minting, airdrops) rather than long-term retention.

- A few projects drive most of the activity, while many others struggle to attract genuine user demand.

- Bridging and infrastructure solutions show more stable usage rates, highlighting real utility rather than hype.

While ERC-4337 has enabled gasless transactions and improved user experience, its complexity and cost barriers limit mainstream adoption. EIP-7702 addresses these issues by:

- Allowing EOAs to perform account abstraction: The core issue of ERC-4337 is that it excludes EOAs, requiring users to switch to smart contract wallets. EIP-7702 resolves this by allowing EOAs to temporarily adopt smart contract code, thus accessing gas sponsorship (paying fees with ERC-20 tokens) and batch transactions (like approving and spending ERC-20 tokens in one transaction).

- Simplifying complexity and costs: Allowing EOAs to temporarily adopt smart contract features reduces the need for permanent wallet contracts, lowering gas overhead and reliance on EntryPoint or Bundlers.

- Increasing efficiency: Introducing transaction type 0x04 for batch EOA operations provides a more streamlined alternative to ERC-4337's UserOps.

- Simplifying infrastructure: Limiting smart contract code to transaction execution reduces reliance on alternative memory pools and Bundlers.

- Empowering developers: Integrating with ERC-4337 while providing a flexible, low-friction upgrade path.

ERC-4337 lays the foundation, but EIP-7702 will make smart wallets cheaper, simpler, and more accessible, accelerating the next wave of Web3 adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。