The U.S. Securities and Exchange Commission (SEC) hosted its first-ever crypto roundtable on Friday, pitting critics and proponents of digital assets in a sometimes-contentious debate focused on how to best determine whether or not a crypto asset is a security.

President Donald Trump’s landslide victory in November set the stage for the country’s first crypto-friendly administration. One of Trump’s campaign promises was to fire then-SEC Chairman Gary Gensler, perhaps crypto’s most vocal detractor, but Gensler, seeing the writing on the wall, resigned in January and will now teach “financial technology” at MIT.

(Former SEC Chairman Gary Gensler in an undated photo)

Trump’s election and Gensler’s subsequent resignation sparked a shakeup at the SEC, with acting Chairman Mark T. Uyeda announcing a new crypto task force just a day after Gensler’s departure. One of the first notable activities carried out by the task force was establishing a series of roundtable discussions exploring some of crypto’s thorniest issues, and what better topic to kick things off than Friday’s “what makes a crypto asset a security?”

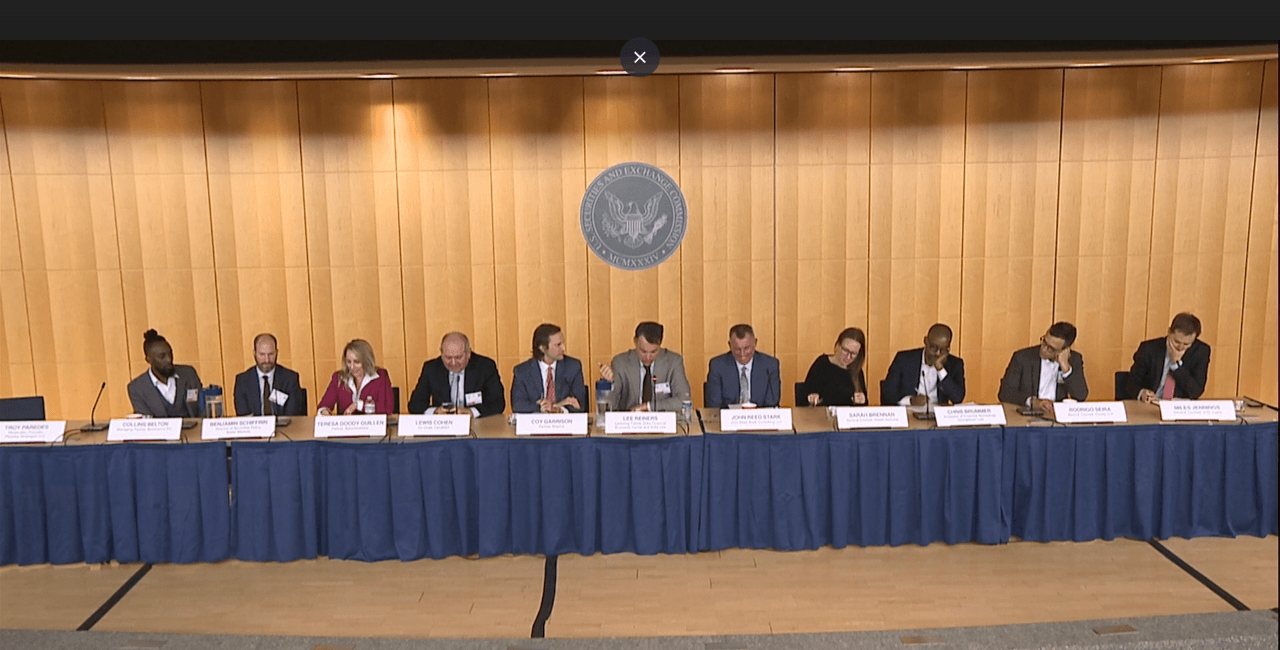

Uyeda and SEC Commissioners Hester Peirce and Caroline Crenshaw delivered opening remarks before Troy Paredes, Founder of Paredes Strategies moderated a panel of eleven legal experts all opining on the intersection of crypto and securities regulation for nearly four hours.

(Panelists at the first-ever SEC Crypto Roundtable / sec.gov)

But even the opening remarks revealed a hidden tension between skeptics and advocates of crypto. While Uyeda and Peirce were generally more lighthearted and positive, Crenshaw, a Biden appointee, issued a warning.

“Modifying the law to facilitate the success of a chosen product category is fraught with risk,” Crenshaw said. “We cannot poke holes in the foundation without expecting the walls may crack,” she added.

The real fun started when an 18-year veteran of the SEC’s Enforcement Division and now president of John Reed Stark Consulting, John Reed Stark, took the gloves off.

“The people buying crypto are not collectors. We all know that they’re investors, and the mission of the SEC is to protect investors,” Stark explained. “And how do I know they’re investors? Because whenever I go around and talk about this stuff…I get death threats afterwards because I’m talking about crypto and that it should be regulated,” he added.

(John Reed Stark claims he has received death threats for advocating for crypto regulation / johnreedstark.com)

Stark also said he read all the briefs from law firms that had legal battles with the SEC and each time, he concluded that the assets involved were all securities.

Benjamin Schiffrin, director of securities policy at Better Markets, a non-profit that advocates for the financial industry, agreed with Stark.

“I went yesterday to look at the websites of some large brokers…and on the web pages of a lot of them, there’s always a tab of products that they offer: stocks, bonds, mutual funds, ETFs, crypto,” Schiffrin explained. “I struggle with the idea that only four out of five are securities, and not all five.”

Lee Reiners, lecturing fellow at Duke Financial Economic Center and Duke Law, completed the “anti-crypto trio.” Much like Stark and Schiffrin, Reiners echoed the general sentiment that almost all crypto, except for bitcoin and non-fungible tokens (NFTs), falls into the investment contract bucket.

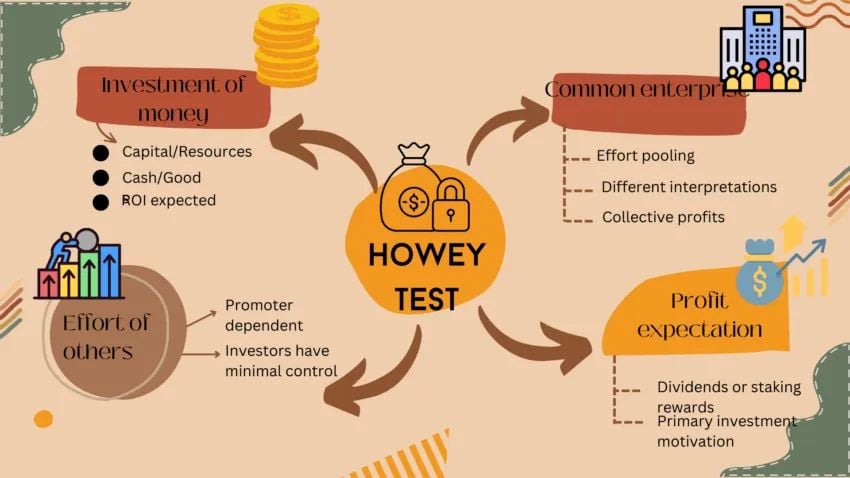

(The Howey Test is a legal test used to determine whether or not certain crypto assets are securities / Kyrian Alex on Medium)

“In over hundreds of cases, judges have applied Howey’s three or four prongs…to the offering of digital asset transactions and found that in fact, there was a presence of an investment contract,” Reiners explained.

Despite being outnumbered three to eight, the crypto critics appeared more vocal than their more open-minded counterparts, but the pro-crypto lawyers also managed to make some compelling points.

Coy Garrison, partner at Steptoe One LLP and Rodrigo Seira, special counsel at Cooley LLP discussed so-called “regulatory humility,” meaning the SEC should not see itself as the be-all and end-all entity when it comes to regulating crypto. The Commodity Futures Trading Commission (CFTC), the states, and even Congress all play key roles in regulating digital assets.

Garrison praised the SEC for finally yielding to calls for clarity and guidance as evidenced by the release of the SEC’s Statement on Meme Coins and its Statement on Certain Proof-of-Work Mining Activities, both of which clarify assets and activities that don’t fall within SEC jurisdiction.

“I applaud the work with the meme coin statement and the mining statement,” Garrison said.

Collins Belton, managing partner at Brookwood P.C. reminded the panel about the second order effects of classifying digital assets as securities and urged attendees not to get too bogged down with the investment contract question.

“There are so many other elements of industry that are affected by this downstream, taxonomical question that get lost in this discussion,” Belton cautioned.

But Perhaps Teresa Goody Guillen, partner at BakerHostetler offered the most contrarian view of them all: What if the Howey Test isn’t the appropriate legal tool to determine the regulatory status of crypto assets?

(Teresa Goody Guillen suggested that perhaps the Howey Test is not appropriate for crypto / bakerlaw.com)

“Howey is the definition of an investment contract,” Guillen explained. “And if you think about these [distributed ledger technology] DLT networks, not as just some basic technology, but more as the fourth industrial revolution, as like a new business form, a new way of doing things, a new way of allocating resources, it becomes much bigger than that.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。