Arcium is a crypto supercomputer designed to resolve the conflict between data privacy and computational efficiency through cryptographic technology.

Written by: 1912212.eth, Foresight News

At 1 AM Beijing time on March 24, the community round public offering of Arcium officially launched on the CoinList platform, continuing until 1 AM on April 2. The minimum purchase amount for this public offering is $100, with a maximum limit of $250,000, and payment methods support USDC or USDT. The tokens from this public offering will be 100% unlocked at the TGE in the third quarter of this year, allowing participants to obtain fully liquid tokens without waiting for a long lock-up period.

CoinList has previously brought substantial returns to many investors during this round with projects like Neon and RWA leader Ondo Finance. Additionally, the recently listed nillion on Binance Launchpool had also conducted a public offering on CoinList, bringing it back into the community's focus. So, is the newly launched Arcium worth paying attention to?

Crypto Supercomputer

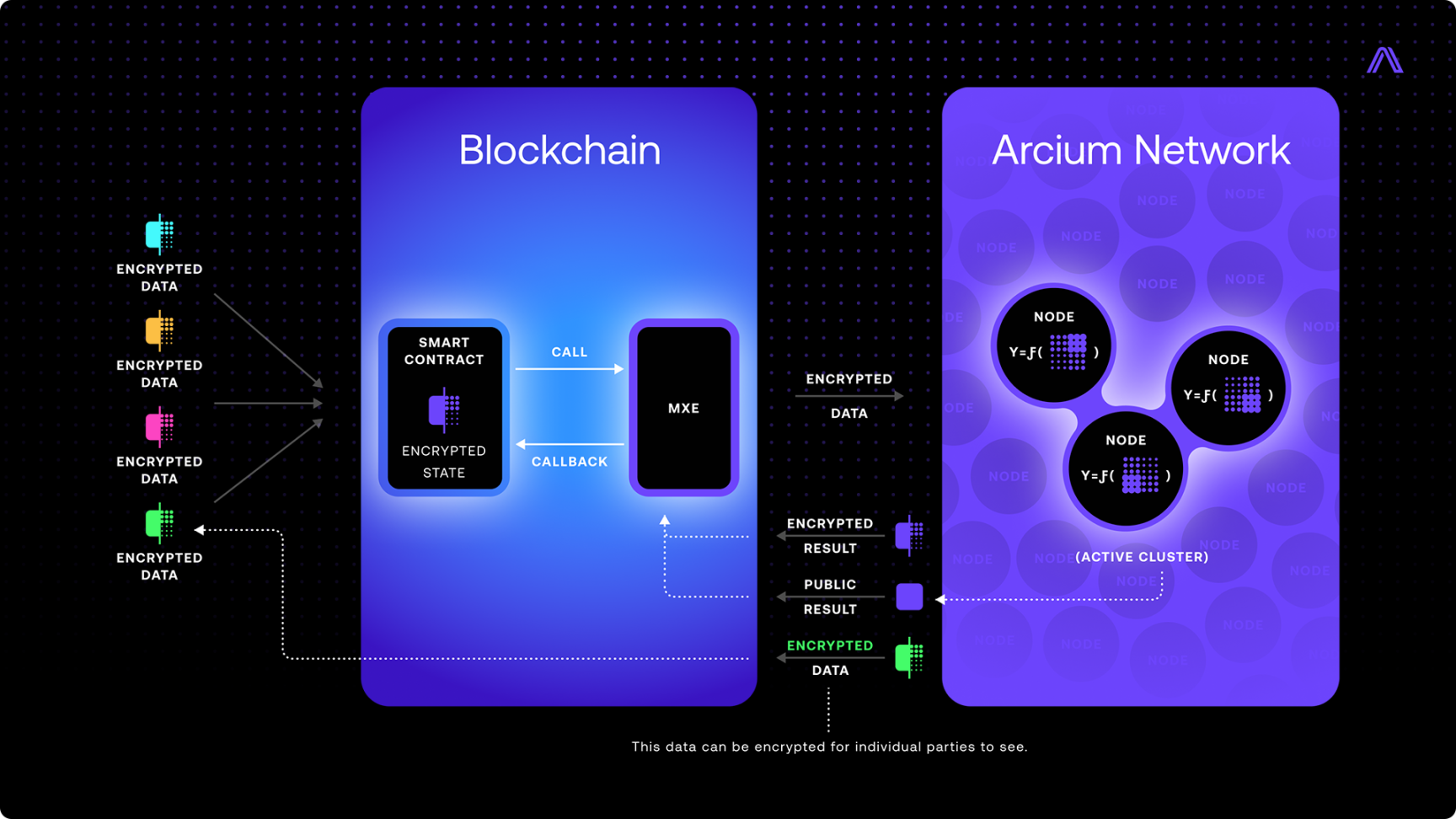

Arcium is defined as a crypto supercomputer aimed at resolving the conflict between data privacy and computational efficiency through cryptographic technology. Traditional internet data processing often requires exposing the data itself, which not only erodes privacy but also limits innovation and poses potential security risks. Arcium addresses this by constructing a decentralized, verifiable, and high-performance cryptographic computing framework that allows data to be fully utilized while remaining completely encrypted.

Specifically, each node in the Arcium network acts like a processor in a traditional computing stack, collectively forming a powerful cryptographic computing system. Users can process sensitive data through this network without worrying about data leakage.

This ability to "understand the book without seeing the text" makes Arcium a missing piece in internet privacy protection. Currently, Arcium has launched a private testnet and plans to open a public testnet on April 30. The project team consists of 20 experts, including PhDs in applied cryptography, machine learning, and mathematics, as well as technical backbones from Web2 giants like JPMorgan and Amazon, showcasing formidable strength.

According to information on the official website, Arcium has made breakthroughs in securely and efficiently computing encrypted data using Multi-Party Computation (MPC), with its decentralized architecture being 10,000 times faster than Fully Homomorphic Encryption (FHE), and comes with intuitive developer tools to ensure readiness for adoption.

Token Economics

The Arcium token is based on the SPL standard token of the Solana blockchain, with a total supply of 1 billion tokens. This CoinList community round will sell at a price of $0.20 per token, with an initial fully diluted valuation (FDV) of $200 million.

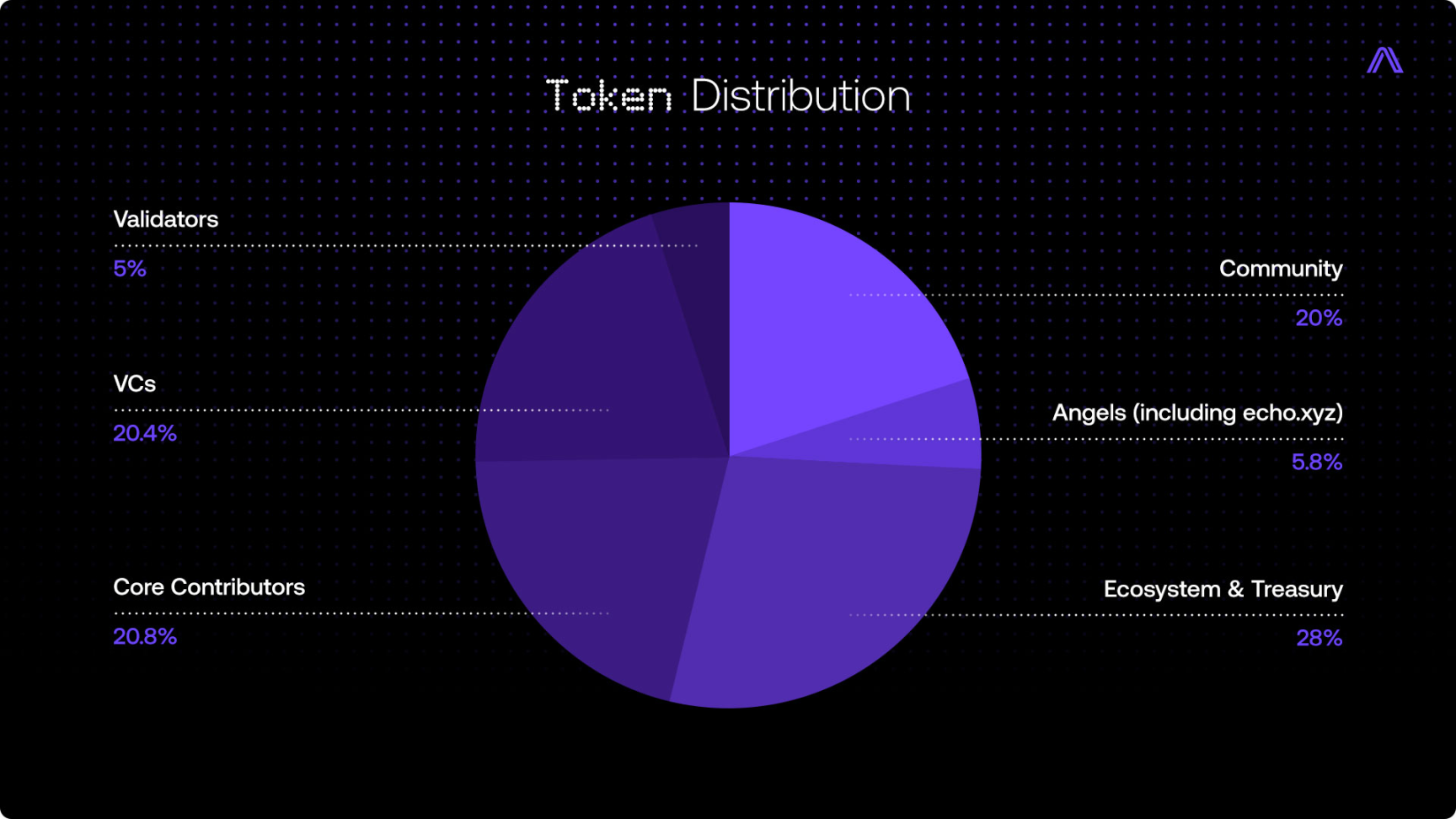

Details of token distribution: 20% for community allocation (with a target allocation of 2% for CoinList), 5.8% for angel investors (including Echo sales), 5% for validators, 20.8% for core contributors, 20.4% for venture capital firms, and 28% for ecosystem and treasury reserves.

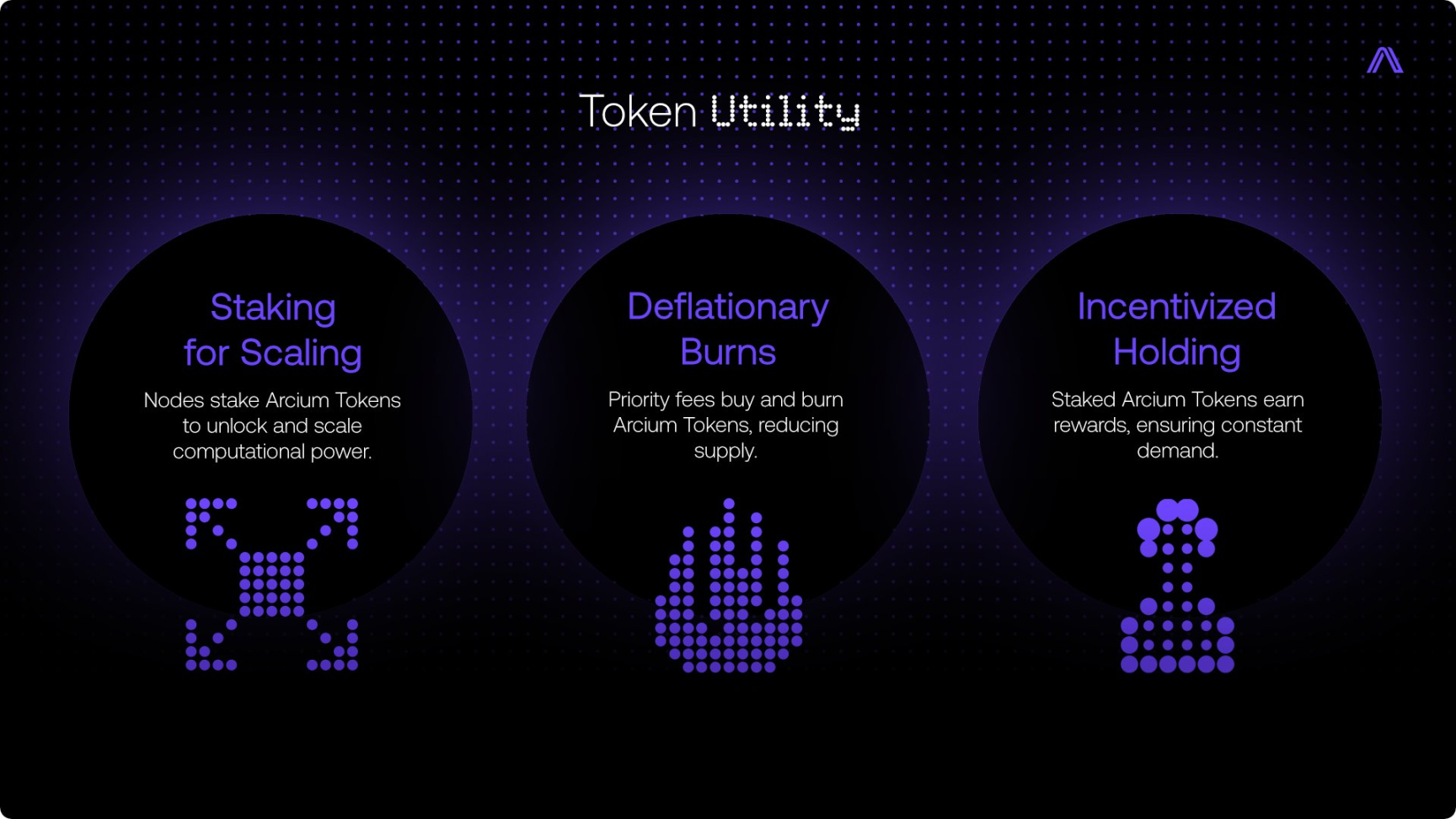

Tokens play multiple roles in the network: first, to activate nodes and ensure decentralized operation; second, for network security and staking, incentivizing node operators' participation; third, as a core tool for staking and delegation, regulating token supply and demand. It is worth mentioning that only fully unlocked tokens are eligible for staking to ensure fairness and transparency.

The Arcium token economic model has designed a dynamic supply mechanism to adapt to changes in network demand. When task volume is low, the system compensates node operators through a reward mechanism; when demand surges, tokens will be deflated through a burn mechanism, enhancing scarcity. This design aims to ensure the long-term economic sustainability of the network and allow token holders to benefit from the growth in computational demand.

Additionally, the strategy of 100% unlocking tokens in this community round may alleviate the traditional "low liquidity, high FDV" dilemma.

Luxurious Investment Lineup

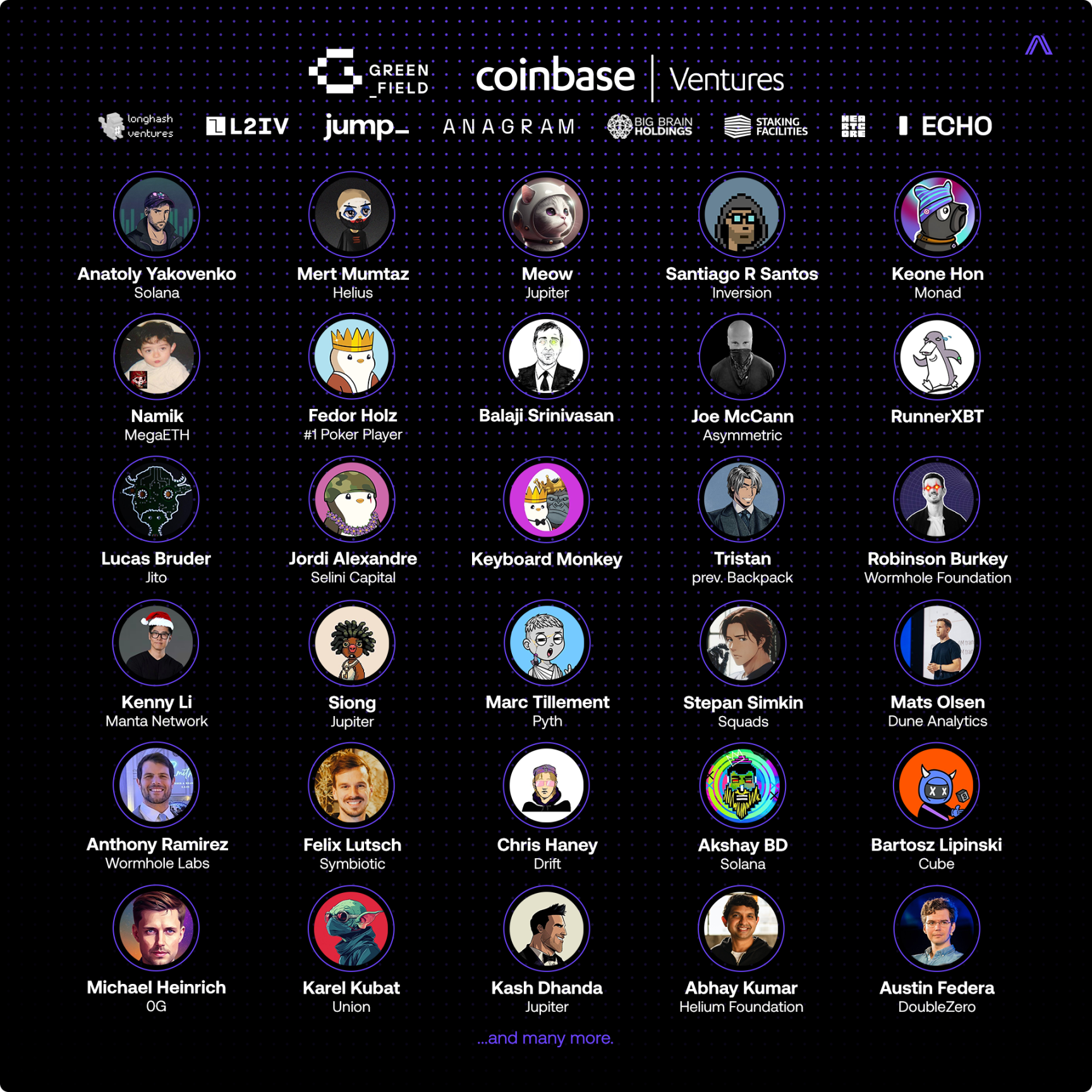

Behind Arcium is a gathering of luxurious investment institutions and individuals in the crypto industry, with a strategic financing of $5.5 million in May 2024, led by Greenfield Capital, along with co-founders from Coinbase, Solana, Monad, Jupiter, Wormhole, and renowned angel investor Balaji.

Arcium has garnered the favor of well-known project co-founders from the Solana community. Recently, Arcium acquired its largest Web2 competitor, Inpher—a company that previously provided cryptographic computing technology for banks, healthcare, and government—enhancing Arcium's technical strength and opening doors for collaboration in the Web2 market.

Summary

As one of the well-known token issuance platforms in the crypto field, CoinList has been recognized for screening quality projects and providing high returns for early investors. Since its establishment in 2017, CoinList has helped several blue-chip projects successfully launch, such as Solana, Filecoin, Algorand, Ondo, and Flow. In 2024, CoinList launched 14 token sale projects, raising an average of about $7.51 million per transaction, with an average of over 10,000 participating investors, of which 13 projects were oversubscribed. The token holding rate among CoinList users is also impressive. Data shows that 70% of public offering participants still held their tokens within 30 days after distribution, a rate significantly higher than that of typical airdrop projects (where usually 60%-90% of participants quickly sell off). This indicates that CoinList's investor group is more inclined towards long-term holding rather than short-term speculation.

Although some projects launched on CoinList during this round have faltered, for risk-tolerant investors, Arcium may still be a worthwhile opportunity to participate in, especially considering its low initial valuation ($200 million FDV) and strong ecosystem support. However, for conservative investors, it is advisable to closely monitor its testnet and mainnet progress before making a decision. Regardless, it is essential to conduct thorough research before participating and to invest cautiously based on one's risk tolerance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。