Always keep in mind the core concept of "not only maximizing earnings but also earning points for free."

Written by: Azuma

This column aims to cover relatively low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market, to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Base Interest Rate

Note from Odaily: The base interest rate currently covers single-coin financial products from mainstream CEXs, as well as deposits and market-making solutions from mainstream DeFi, including lending, DEX LP, and RWA.

This week, I want to highlight two main points regarding the base interest rate.

One is the CeFi side's Binance LaunchPad/LaunchPool (including Binance Wallet's new offerings). Recently, Binance has shown significant activity; last week, LaunchPool featured Nillion (NIL), and the Wallet also introduced Bedrock (BR). Considering the current market sentiment has somewhat recovered, ideally, the estimated annualized yield for this period's LaunchPool USDC pool (with FDUSD pool being higher) could exceed 15% (based on a $1 billion FDV calculation; since NIL has not yet launched, specific data may fluctuate); the new offering from the Wallet also yielded over 100 U. These are all must-have small gains, just go for it.

The other point is about Meteora. Last week, the Meteora team officially announced two governance proposals regarding the MET token.

The first governance proposal is to increase the token reward share for liquidity providers (LPs) from 10% of the total supply to 15%; additionally, they will provide an extra 3% of the total supply in tokens for participants in Launch Pools and Launch Pads.

The second governance proposal suggests allocating 20% of the total supply in tokens to the team, locked for 6 years; additionally, 2% will be taken from the team’s share to be distributed to M3M3 stakeholders.

The community trust that was once lost can only be restored through a broader perspective; I am inclined to trust it once more. In terms of specific strategies, consider the FDUSD-USDC pool currently incentivized with FDUSD (7.32% APY, simultaneously earning Meteora points).

Pendle Section

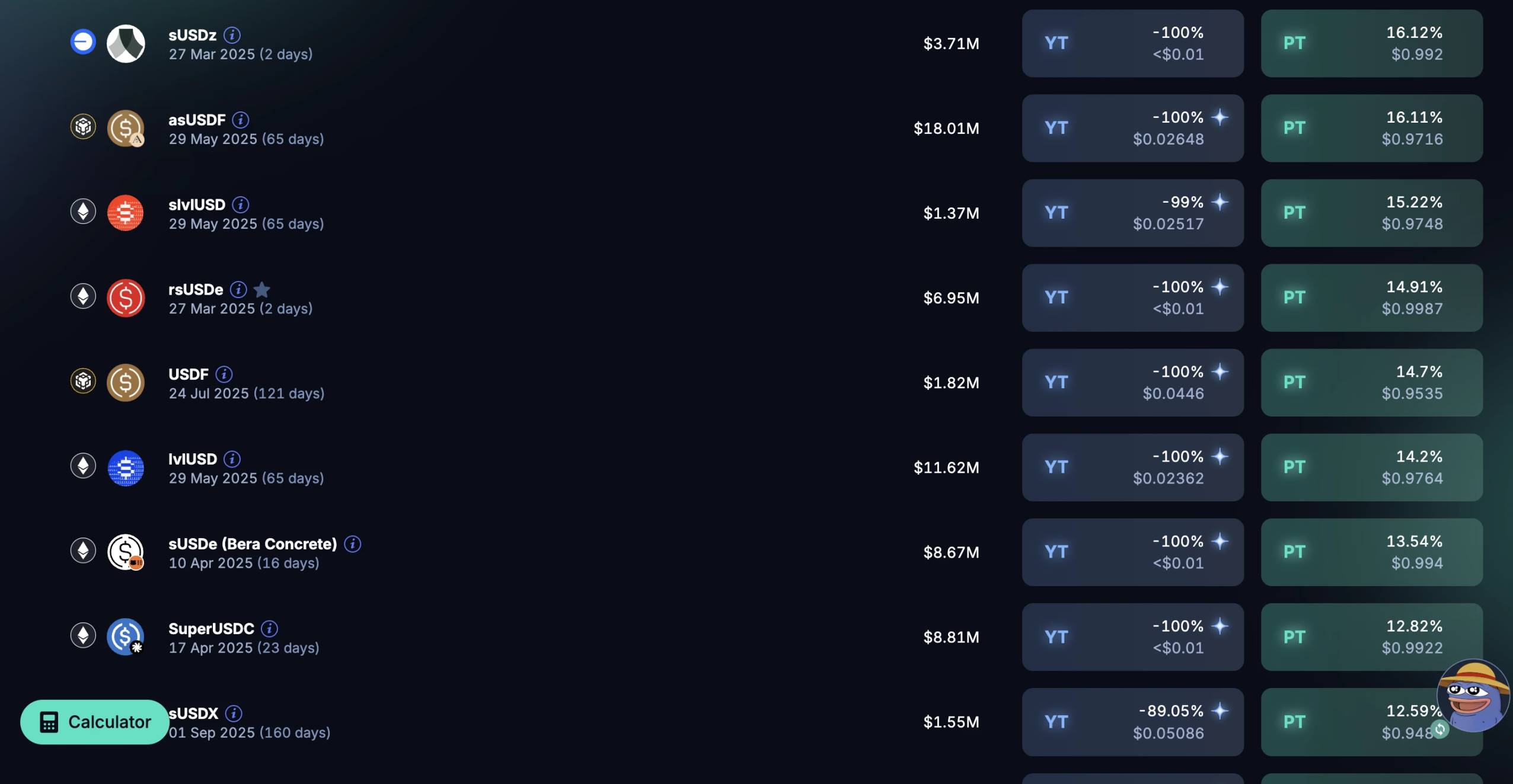

First, regarding fixed income, the real-time ranking of PT yields from various stablecoin pools within the mainstream ecosystems (Ethereum mainnet, Base, Arbitrum, BNB Chain) on Pendle is as follows.

On the LP side, the most important news this week is that the Ethena Season 3 event has ended (airdrop queries will open in the first week of April), but the Ethena team has simultaneously launched a 6-month Season 4 event, with the current incentive pools remaining unchanged. From a pure points efficiency perspective, consider the USDe pool expiring on July 31 (up to 10.83% APY, 60 times Ethena points increase) and the eUSDe pool expiring on May 29 (up to 7.59% APY, 50 times Ethena points increase and 1.6 times Ethreal points increase).

Additionally, other LP pools to consider include the recently completed financing round for the Level lvlUSD pool (which will be detailed below) and the Astherus USDF (up to 16.82% APY, 35 times points increase) and asUSDF pool (up to 13.19% APY, 25 times points increase) that CZ interacted with over the weekend on X.

Always remember, the significance of storing Pendle LP is "not only to earn yields but also to earn points for free." The value of points depends on the potential of the project itself, so look for projects with a stronger narrative angle.

Other Opportunities

Continuing from the previous mention of Level, this project just completed a $2.6 million financing round led by Dragonfly, with participation from Polychain and others.

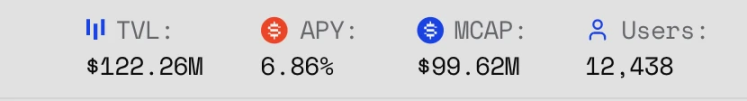

Currently, Level has launched a points program, where holding, staking (6.86%), and market-making on platforms like Pendle (lvlUSD pool up to 13.79% APY, 40 times points increase) can all accumulate points. As of the time of writing, the total user count is only 12,438 — with excellent backers and less competition, it has preliminary potential for significant growth.

Another project to watch is Perena, founded by Anna Yuan, the former stablecoin head at the Solana Foundation (pool invitation code available: GRLJKL). This project opened a new season (Pre-Season) points activity last week, with three main ways to accumulate points (Petals):

Trading (limited to 5 transactions per day): not recommended to force, just use it daily;

LP within the protocol, with different increases based on deposit duration (up to 3 times, requiring 60 days), LP yield is relatively low;

LP in RateX and Exponent, which can be understood as the Solana version of Pendle, with relatively higher LP yields, though the increase is currently unknown.

Personally, I would recommend the third path, as RateX and Exponent also have certain airdrop expectations.

Finally, Backpack also launched a points program last week. If you have a stablecoin exchange need, you can use this channel in addition to Perena. Those willing to try hedging strategies might also consider using SOL to participate in Meteora's JITOSOL-SOL pool (9.64%) or Fragmetric staking (8.05%), while simultaneously shorting SOL on Backpack to earn points across multiple platforms while maintaining a certain yield.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。