Regulation, technology, and sovereignty struggles are reshaping the power landscape of the crypto world.

Written by: Lawrence

On March 21, 2025, the first cryptocurrency roundtable meeting held by the U.S. Securities and Exchange Commission (SEC) was charged with tension. When former enforcement official John Reed Stark bluntly stated that "crypto investors receive death threats," the debate over the "securities nature" had escalated beyond a legal framework dispute to an ultimate struggle for the survival rights of the crypto industry. Meanwhile, Bitcoin ETFs ended a five-week bloodletting cycle with a weekly inflow of $744 million, while Ethereum's on-chain activity plunged to historical lows—this dual shift in regulation and market is reshaping the power landscape of the crypto world.

The SEC's "War of Definition": Regulatory Rifts Behind Death Threats

Panel members of the first SEC cryptocurrency roundtable meeting

At the first SEC cryptocurrency roundtable meeting on March 21, 2025, John Reed Stark's remarks detonated a deep-seated regulatory cold war in the crypto world that has lasted for a decade—"Whenever I advocate for stronger regulation in public, I receive death threats from crypto investors." This stark accusation not only reveals the bloody opposition between regulators and the crypto community but also pushes the ultimate game over the "securities nature" to a critical point.

The fuse for this war has long been planted. Since the SEC initiated a series of lawsuits against Coinbase and Binance in 2022, the confrontation between regulators and crypto companies has spread from the courtroom to the streets. Records from SEC Chairman Gary Gensler's office show that he received over 200 death threat emails from around the world between 2023 and 2024, including one anonymous letter from Australia that even included a photo of a bullet, stating "Crypto freedom must not be tarnished." Behind these extreme actions is the desperate resistance of crypto fundamentalists against the SEC's "comprehensive securitization" strategy—if 90% of tokens are included in the securities regulatory framework, the survival space for decentralized finance (DeFi) will be completely strangled.

However, the SEC's regulatory iron fist is not an isolated action. The newly constituted SEC committee, led by the Republican Party, is attempting to reconstruct the power landscape of the crypto world: the resignation of former chairman Gary Gensler and the establishment of the Crypto Task Force signify that the Trump administration is dismantling the policy legacy of the Democratic era through "regulatory power redistribution." Acting Chairman Mark Uyeda revealed in a closed-door meeting that the SEC may open exemption channels for NFTs and utility tokens through "non-securitization statements," a policy shift that could disrupt the compliance cost structure of exchanges like Coinbase and Kraken.

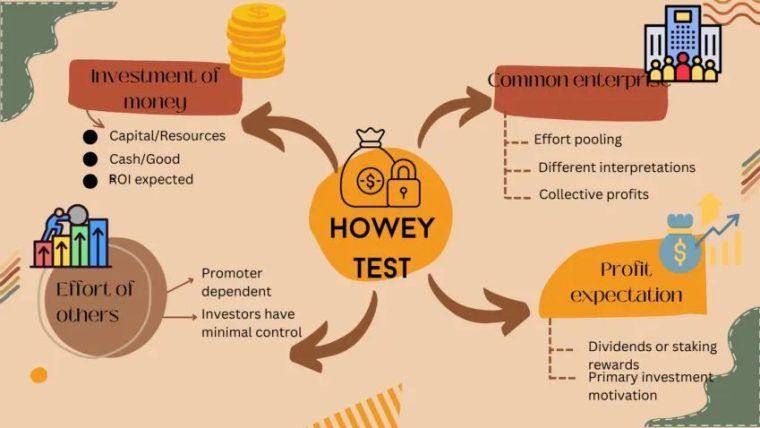

The Howey Test is a legal test used to determine whether certain crypto assets are securities.

The essence of this struggle for definition is the direct collision between the Howey Test from the 1930s and the Fourth Industrial Revolution. BakerHostetler partner Teresa Goody Guillen sharply pointed out at the roundtable: "As distributed ledger technology (DLT) reconstructs global business forms, the SEC is trying to use the rusty key of 'investment contracts' to unlock the regulatory chains of the digital age." This contradiction is particularly evident in the NFT space—while the SEC tacitly allows leading projects like BAYC and CryptoPunks to be classified as non-securities, it simultaneously launches a series of lawsuits against social tokens and fan economy NFTs, exposing the fragmentation and opportunism of regulatory logic.

The "Ice and Fire Reversal" of Bitcoin ETFs: $744 Million Weekly Inflow Hides Secrets

As regulators become mired in the quagmire of definition, capital is rewriting market narratives with real money.

From March 17 to 21, U.S. Bitcoin ETFs ended five consecutive weeks of outflows with a net inflow of $744 million, with BlackRock's IBIT attracting $105 million in a single day, bringing total net inflows to over $36 billion.

However, behind this round of "institutional bottom-fishing," a hidden arbitrage game is unfolding: the premium rate for Bitcoin futures on the Chicago Mercantile Exchange (CME) has continued to narrow to below 2%, eliminating the arbitrage space between spot ETFs and futures contracts, with nearly 40% of the inflow confirmed to be unrelated to "real demand."

More concerning is the divergence in market consensus. Although Bitcoin's price has been trading sideways in the $83,000 to $85,500 range, on-chain data tells a starkly different story: Glassnode has detected that long-term holders (LTH) have accumulated 250,000 BTC over the past 45 days, worth about $21 billion, while the Bitcoin reserves on centralized exchanges have dropped to their lowest level since 2021. This divergence between "institutional hoarding" and "retail exit" suggests that the market is gearing up for a new round of volatility.

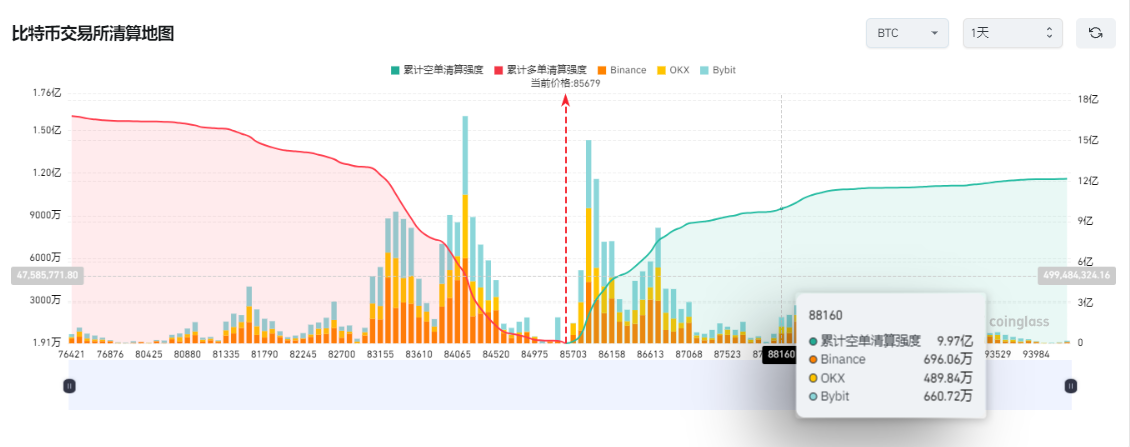

According to Coinglass liquidation data, if Bitcoin's price breaks above $88,000, it is expected to trigger liquidations of short positions worth $1 billion.

Ethereum's "Darkest Hour": The Ecological Collapse Behind Layer 2 Prosperity

As Bitcoin ETFs regain capital favor, the Ethereum ecosystem is experiencing an unprecedented winter.

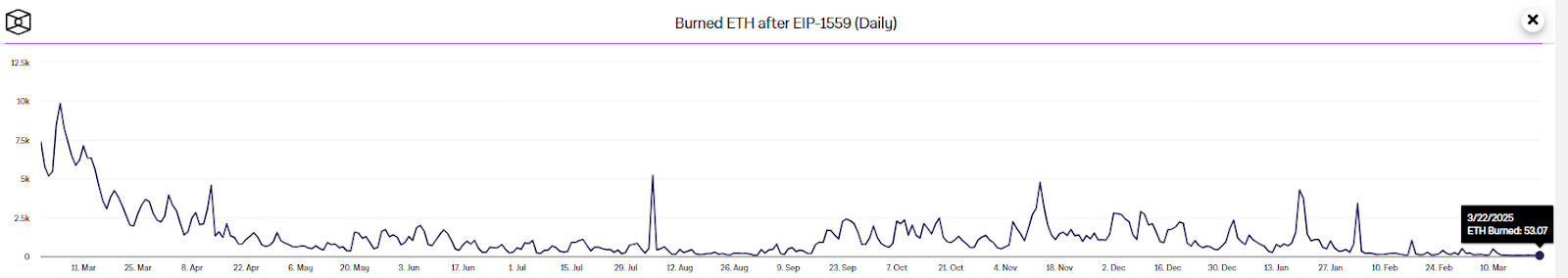

Data from The Block shows that on March 22, the daily burn rate of Ethereum dropped to 53.07 ETH (about $106,000), shrinking by 99% from the peak in 2024, with on-chain transaction volume, active addresses, and gas fees all plummeting to historical lows.

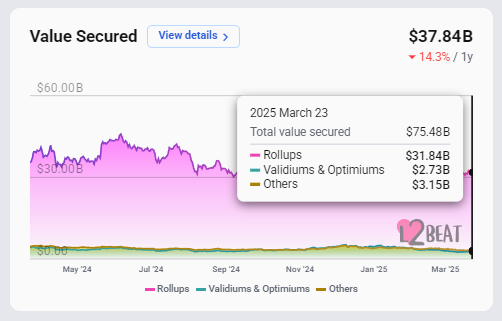

At the same time, the total locked value (TVL) of Layer 2 has risen to $37.8 billion, yet leading networks like Base and Arbitrum account for 80% of DEX trading volume—this paradox of "mainnet hollowing" and "Layer 2 hegemony" exposes fundamental flaws in Ethereum's economic model.

Standard Chartered's forecast has intensified market concerns. The institution slashed its 2025 target price for Ethereum from $10,000 to $4,000, pointing to the "siphoning effect" of Layer 2 on the mainnet's value: "Layer 2s like Base capture 80% of ecological value added but only return less than 20% of fee income to the mainnet." This unsustainable revenue-sharing mechanism has caused the ETH/BTC exchange rate to drop to a historical low of 0.023, even underperforming tokens from competing public chains like Solana.

The far-reaching impact comes from regulatory pressure. The SEC has defined a safe zone for POW assets like Dogecoin in its "Meme Coin Statement," yet remains silent on Ethereum and Layer 2 tokens.

This uncertainty has forced funds like Grayscale's ETHE to experience a weekly outflow of $102 million, with cumulative outflows exceeding $730 million over four weeks, shaking the foundation of Ethereum as an "institutional asset."

Path to Resolution: Regulatory Arbitrage, Technological Revolution, and Sovereignty Struggles

In this multifaceted crisis, three variables will determine the ultimate direction of the crypto market:

1. The End and Reconstruction of Regulatory Arbitrage

The SEC's crackdown on "securitized tokens" has extended from exchanges to Layer 2 protocols. In March 2025, Coinbase announced its acquisition of the Deribit exchange and takeover of a Dubai license, marking that U.S. companies are circumventing regulatory risks through offshore structures. However, the "Stablecoin Act" being pushed by the Trump administration shows that sovereign nations will not allow a regulatory vacuum—this act requires stablecoin issuers to hold 1:1 cash reserves and prohibits tech companies from entering the field, a "precise strike" that could reshape the $120 billion stablecoin market.

2. The Paradox and Breakthrough of Technological Revolution

Ethereum developers have postponed the Prague upgrade for the 153rd time, exposing the fatigue of technological iteration. In contrast, the Bitcoin ecosystem is experiencing an explosion: the Ordinals protocol has driven on-chain NFT trading volume to exceed $1 billion, and the Rune protocol has led to a 300% monthly increase in BTCFi locked value. As "Bitcoin programmability" moves from concept to reality, this self-revolution of the "ancient blockchain" may overturn the survival logic of "Ethereum killers."

3. The Rise and Struggle of Sovereign Digital Assets

Putin's declaration that "no one can ban Bitcoin" resonates with Trump's crypto-friendly policies. Russia plans to build a compliant Bitcoin trading system based on the Moscow Exchange (MOEX), while India's digital rupee pilot has attracted 15% of offshore crypto funds back—this "sovereign digitalization race" is dismantling the hegemony of dollar stablecoins and may give rise to a new geopolitical financial order.

Conclusion: Seeking Certainty Amidst Order Reconstruction

In 2025, the crypto world stands at the fault line where traditional finance collides with decentralized ideals. The SEC's regulatory game, the institutional narrative of Bitcoin ETFs, and Ethereum's ecological dilemma collectively outline a tension-filled industrial landscape. When death threats and trillion-dollar capital flow into the same battlefield, and when the Howey Test from 89 years ago encounters the Fourth Industrial Revolution, this transformation has long transcended the technical realm, becoming an epic experiment in humanity's reconfiguration of the value exchange system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。