Source: Cointelegraph Original: "{title}"

The U.S. spot Bitcoin exchange-traded fund (ETF) ended a five-week trend of net outflows during the trading week ending March 21.

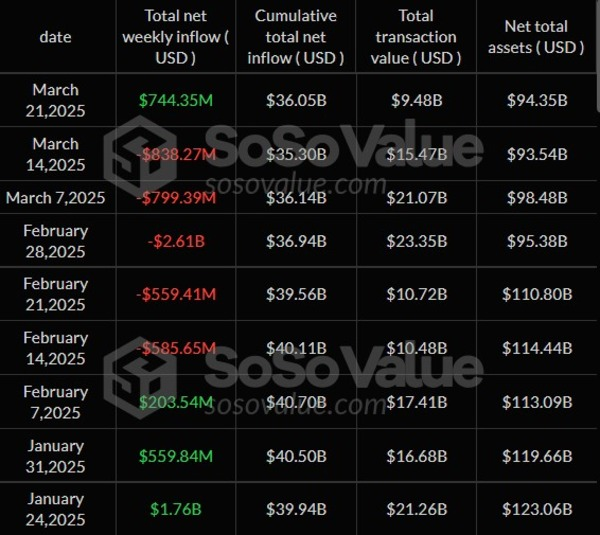

According to SoSoValue data, Bitcoin ETFs recorded a net inflow of $744.4 million—marking the highest level in eight weeks—extending their daily inflows for six consecutive days.

U.S. spot Bitcoin ETF net flows are back on track. Source: SoSoValue

Five funds contributed to these inflows, with the majority coming from BlackRock's iShares Bitcoin Trust (IBIT), which saw an inflow of $537.5 million. Fidelity's Wise Origin Bitcoin Fund (FBTC) followed closely with $136.5 million.

This renewed inflow occurred after the cryptocurrency market and the broader global economy entered a bearish phase, during which trade tensions escalated and recession fears grew.

Weeks prior to this date, Bitcoin ETFs recorded the largest net inflow of 2025: $1.96 billion for the week ending January 17, followed by $1.76 billion the next week. Bitcoin surged to a historic high of $109,000 on January 20—U.S. President Donald Trump's inauguration day.

In the broader market correction, Bitcoin fell to the $78,000 range. According to CoinGecko data, with the strongest inflows since January, Bitcoin's price rebounded to $87,343 at the time of writing.

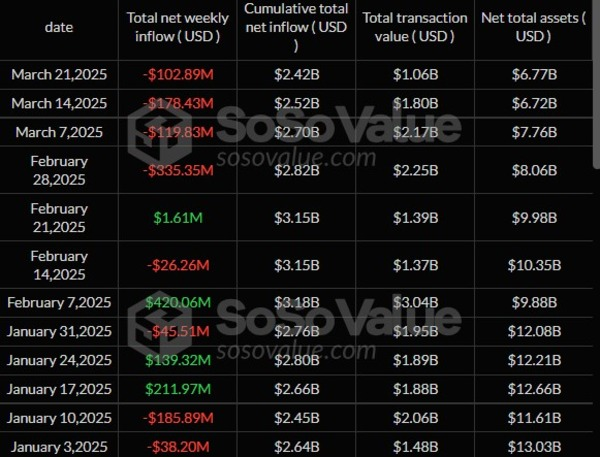

The situation for Ethereum (ETH) ETFs is different, continuing a trend of net outflows for four consecutive weeks.

Ethereum ETF net inflows continue to decline. Source: SoSoValue

For the week ending March 21, Ethereum ETFs saw a net outflow of $102.89 million, with BlackRock's iShares Ethereum Trust ETF (ETHA) accounting for $74 million of the total.

Ethereum was trading at $2,090 at the time of writing, recovering slightly from below $2,000—marking the first time it had fallen below that level in over a year.

Despite this, Ethereum still has bright spots, as institutions continue to deepen their exposure to the asset.

According to Token Terminal data, BlackRock's BUIDL fund—primarily investing in tokenized real-world assets (RWA)—now holds a record $1.145 billion worth of Ethereum, up from about $990 million just a week ago. This new injection indicates that the world's largest asset management company has an increasingly strong belief in Ethereum's role as a leading infrastructure for tokenizing real-world assets.

Cryptocurrency market sentiment has improved since last week, with the crypto fear and greed index rising from 32 points to 45 points.

However, Singapore investment firm QCP Capital advises caution regarding the potential for continued breakthroughs.

"The tariff escalation scheduled for April 2 may again put pressure on risk assets," QCP Cap stated in its market analysis on March 24.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。