Source: Cointelegraph Original: "{title}"

Some market analysts suggest that Bitcoin may first reach a historical high of $110,000 before experiencing a significant pullback. They believe that easing inflation and rising global liquidity are key factors supporting the price increase.

TradingView data shows that Bitcoin (BTC) has risen for two consecutive weeks, achieving a bullish weekly close above $86,000 on March 23.

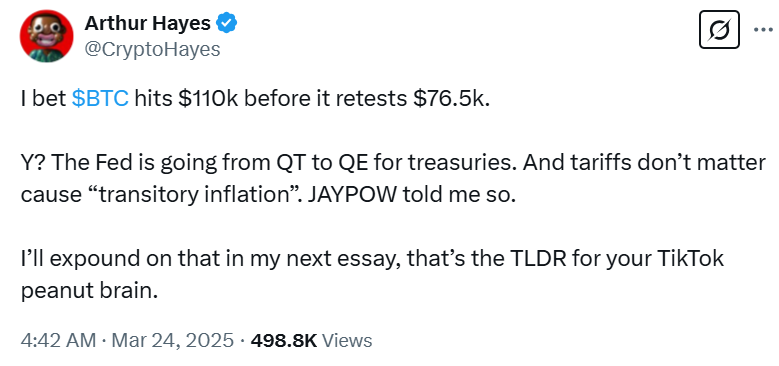

Arthur Hayes, co-founder of BitMEX and Chief Investment Officer of Maelstrom, stated that the combination of easing inflation concerns could pave the way for Bitcoin to rebound to its historical high of $110,000.

BTC/USD Weekly Chart. Source: Cointelegraph/TradingView

In a post on X on March 24, Hayes wrote, "I bet BTC will hit $110,000 before retesting $76,500. Why? The Fed is shifting from QT (Quantitative Tightening) to QE (Quantitative Easing) to support Treasury bonds. And tariffs are irrelevant because inflation is 'transitory.' JAYPOW (Powell) told me."

Source: Arthur Hayes

"I mean, the price is more likely to reach $110,000 next rather than $76,500. If we hit $110,000, it’s yacht time, and we won’t look back until $250,000," Hayes added in a follow-up post on X.

Quantitative Tightening (QT) refers to the Fed reducing its balance sheet by selling bonds or allowing bonds to mature without reinvesting the proceeds, while Quantitative Easing (QE) means the Fed buys bonds and injects money into the economy to lower interest rates and encourage spending in difficult financial environments.

Other analysts pointed out that while the Fed has slowed down QT, it has not fully shifted to an easing policy.

"QT is not 'basically over' on April 1. They still have $35 billion in mortgage-backed securities maturing each month. They are just slowing QT from $60 billion a month to $40 billion," said Benjamin Cowen, founder and CEO of IntoTheCryptoVerse.

Meanwhile, market participants are awaiting the anticipated shift to Quantitative Easing by the Fed, which has historically been favorable for Bitcoin prices.

BTC/USD Weekly Chart, 2020-2021. Source: Cointelegraph/TradingView

The last round of QE in 2020 led to a more than 1000% increase in Bitcoin's price, rising from about $6,000 in March 2020 to a historical high of $69,000 in November 2021. Analysts believe a similar situation could occur again.

Enmanuel Cardozo, a market analyst at the real-world asset (RWA) tokenization platform Brikken, stated that Bitcoin's recovery to above $85,000 after last week's Federal Open Market Committee (FOMC) meeting is a bullish signal for investor sentiment, potentially indicating more room for upward movement.

The analyst told Cointelegraph that the macroeconomic environment also "supports" Bitcoin rising to $110,000.

"Global liquidity has increased, and discussions around the U.S. Bitcoin strategic reserve may drive Bitcoin towards the $110,000 target, as the available BTC liquidity on exchanges continues to decline, leading to a tightening supply situation," he said.

"However, a pullback to $76,500 aligns with Bitcoin's historical volatility, typically triggered by profit-taking or unexpected market shifts," he added.

Other analysts also believe that Hayes' prediction is likely to come true.

"Given that Bitcoin recently closed above the 21-day and 200-day moving averages, this bullish momentum aligns with his view. However, the resistance at $88,000 remains a key hurdle," said Ryan Lee, chief analyst at Bitget Research, to Cointelegraph.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。